FAO Cereal Supply and Demand Brief

The Cereal Supply and Demand Brief provides an up-to-date perspective of the world cereal market. The monthly brief is supplemented by a detailed assessment of cereal production as well as supply and demand conditions by country/region in the quarterly Crop Prospects and Food Situation. More in-depth analyses of world markets for cereals, as well as other major food commodities, are published biannually in Food Outlook.

Monthly release dates for 2024 (tentative): 2 February, 8 March, 5 April, 3 May, 7 June, 5 July, 6 September, 4 October, 8 November, 6 December.

Supply situation comfortable as 2023/24 marketing season draws to close; 2024 wheat outlook remains favourable, but adverse weather dents maize yields prospects in southern hemisphere

Release date: 03/05/2024

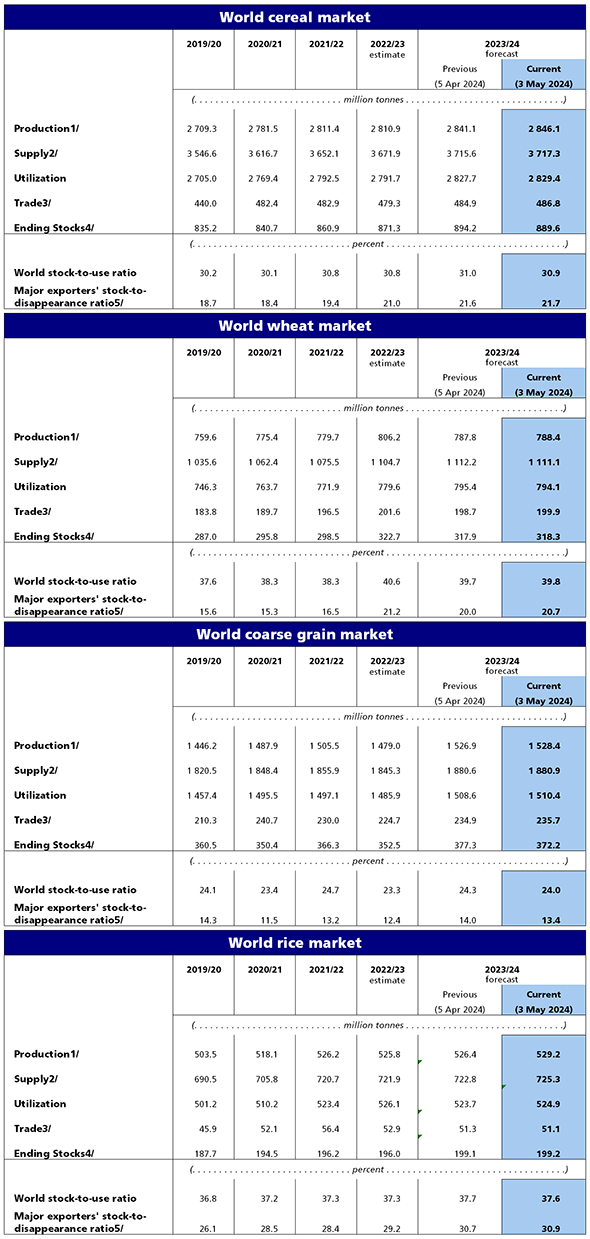

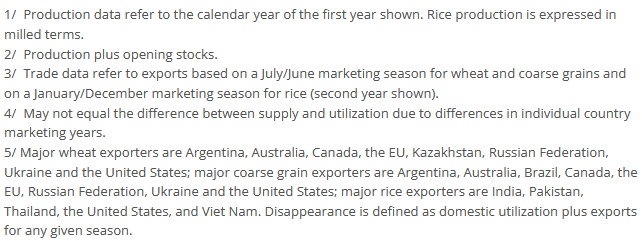

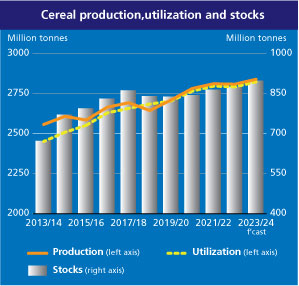

FAO’s forecast for world cereal production in 2023/24 has been raised by 5 million tonnes and now stands at 2 846 million tonnes, up 1.2 percent (35.1 million tonnes) from the previous year’s level. This upward revision mostly rests on adjustments to global rice production, which has been raised by 2.9 million tonnes since April. This follows revisions to historical production figures for Myanmar and the release of official assessments in Pakistan pointing to a more pronounced production rebound than earlier estimated. As a result, global rice production in 2023/24 is expected to reach a new record of 529.2 million tonnes (milled basis), 0.7 percent above the 2022/23 estimate. Furthermore, modest upward revisions were made to the forecasts for global maize and wheat production.

Pegged at 2 829 million tonnes, the forecast for world cereal utilization for 2023/24 is up 1.7 million tonnes from last month and 37.7 million tonnes (1.4 percent) above the 2022/23 level. Global coarse grain utilization in 2023/24 is forecast at 1 510 million tonnes, up 1.8 million tonnes from the previous month and 1.6 percent from the 2022/23 level. This increase largely reflects higher than previously anticipated feed use of maize (especially in Canada and the United States of America) and barley (in China). By contrast, the global wheat utilization forecast for 2023/24 was revised downward by 1.3 million tonnes, mostly on account of lower expected feed use in Brazil and the United States of America. However, the 2023/24 global wheat utilization is still set to increase by 1.9 percent above the 2022/23 level, to 794 million tonnes, driven predominantly by robust growth in the feed use of wheat mostly in China and the European in Union. FAO has raised its April forecast of world rice utilization in 2023/24 by 1.2 million tonnes to 525.0 million tonnes, following upward revisions to expected uses by a number of, mostly Asian, countries, which more than offset a forecast cut namely for China. Despite the upward revision, global rice utilization remains forecast to fall 1.2 million tonnes below the 2022/23 estimate.

Despite a downward revision of 4.6 million tonnes from the previous month, FAO’s forecast for world cereal stocks ending in 2024 is now pegged at 890 million tonnes, still 2.1 percent above their opening levels. This downward revision is mostly attributed to anticipated declines in maize inventories in Brazil and the United States of America and, to a lesser extent, barley stocks in Kazakhstan. The world cereal stocks-to-use ratio in 2023/24 is forecast at a comfortable level of 30.9 percent, almost unchanged from the level of 30.8 percent in 2022/23. Pegged at 372 million tonnes, global coarse grain stocks are still predicted to rise above their opening levels, by 5.6 percent. At 318 million tonnes, the global wheat stocks forecast is 1.4 percent below opening levels and nearly unchanged this month, as upward revisions to wheat inventories in the European Union and the United States of America, on account of larger imports and lower utilization, respectively, have offset downward revisions to wheat stocks elsewhere. Global rice stocks at the close of 2023/24 marketing seasons are forecast to rise by 1.6 percent above their opening levels to an all-time high of 199.2 million tonnes. This level is little changed from April, as upward revisions to inventories held by Pakistan, Myanmar and a few other countries were largely offset by downscaled expectations for stocks namely in Cambodia, Japan and the Republic of Korea.

The forecast for world trade in cereals has been lifted by 1.9 million tonnes in 2023/24 to 487 million tonnes, pointing to a 7.5 million tonnes (1.6 percent) increase above the 2022/23 level. The forecast for global trade in coarse grains in 2023/24 (July/June) has been raised by 0.8 million tonnes, mostly driven by greater anticipated barley and sorghum imports by China, bringing the forecast to 236 million tonnes, 4.9 percent above the 2022/23 level. Global wheat trade in 2023/24 (July/June) was also lifted by 1.2 million tonnes, attributed mostly to larger than anticipated exports from traditionally minor exporters of wheat products, along with higher imports by Afghanistan, Egypt and the European Union. Despite the upward revision, global wheat trade in 2023/24 (July/June) is still anticipated to decline by 0.8 percent from the 2022/23 level to 200 million tonnes. International trade in rice in 2024 (January-December) is forecast at 51.1 million tonnes, down marginally from April, and 3.4 percent below the already reduced 2023 level.

Production outlook for 2024 crops

FAO’s forecast for global wheat production in 2024 has been lowered to 791 million tonnes. At this level, the 2024 world wheat outturn is still anticipated to exceed the 2023 output, albeit by a smaller margin of nearly 0.5 percent. The recent downgrade reflects the latest official data from the European Union, indicating a larger drop in wheat plantings than previously foreseen; however, weather conditions generally improved in March and early April, helping to firm yield prospects. Overall wheat production is pegged at 128.4 million tonnes in 2024, about 4 percent down year on year. Compared to the preliminary outlook, a downward revision was also made to the wheat production forecast for Australia, based on the latest projections from the country indicating more restrained growth in 2024, following the dry weather affected harvest in 2023. A recent lack of rainfall in the Russian Federation has led to some dryness in key producing southern areas, prompting a small cut to the production forecast to 93 million tonnes, although this outturn would still exceed the five-year average. In Ukraine, amid generally conducive weather conditions, wheat production is still foreseen to fall to a well below-average level of 20.2 million tonnes, reflecting the destructive effects of the war, now in its third year, on productive capacities, as well as weaker profit margins for wheat. In the United States of America, notwithstanding slight downgrades to winter wheat crop conditions in parts of the southern Plains, the overall wheat production outlook remains favourable and an aggregate output of close to 52 million tonnes is expected. In Canada, assuming a return to trend yields after the lows of 2023, production is seen to rise to 34.6 million tonnes in 2024. In Asia, conducive weather conditions continued to prevail, underpinning expectations of near-record wheat outturns in India and Pakistan and bolstering favourable production outlooks in Near East Asian countries. In North Africa, recent localized rainfall arrived too late to materially improve crop conditions following widespread seasonal rainfall shortages since late 2023, and wheat yield prospects still remain poor.

For the 2024 coarse grain crops, the main harvest period is beginning soon in southern hemisphere countries, where recent adverse weather conditions have curbed yield prospects in leading producers. In Brazil, less-than-favourable weather conditions, notably in the main producing southern and central-western areas, have diminished yield prospects and lowered the country’s maize production forecast to 111 million tonnes, albeit still remaining slightly above the past five-year average. In South Africa, hot and dry weather conditions since February have curtailed yield expectations, and maize production is now forecast to fall 10 percent below the five-year average. Significant maize yield reductions are also expected in most Southern African countries in 2024, similarly driven by intense rainfall deficits.

Summary Tables