A site is assumed to have a local institution staffed and equipped to run a watershed project.

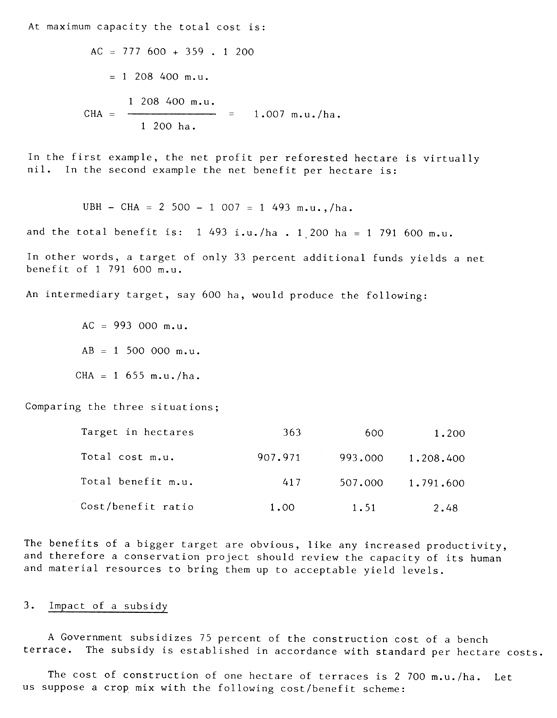

The institution has a fixed annual cost (FC) for staff and facilities equal to 777 600 m.u./yr*. The major watershed project job is reforestation at a direct cost (DC) of 359 m.u./ha. Figures are calculated in terms of economic value. The updated benefits per hectare (also in terms of economic value) are as high as 2 500 m.u./ha. (UBH).

* m.u. = Monetary units

Costs: 250 m.u./ha/yr

Benefits: 350 m.u./ha/yr

A bench terrace thus cropped has an estimated useful life of fifteen years.

The subsidy is returned the year following construction and during the year of construction the terrace cannot be used.

Table1 shows cost and income in a situation with and without subsidy. The table also clearly shows the effects of the subsidy:

At 10 percent interest, the unsubsidized terraced crop shows an updated negative net

benefit of -1559.09 m.u./ha, i.e. a net loss, and an internal rate of return of -0.02.

With the subsidy, the updated net benefit is positive at 145.46 m.u./ha and the internal

rate of return is 12 percent.

In this case, the incentive turns a non-lucrative activity into a lucrative one, i.e.,

without subsidies, the peasant will not build the terrace.

|

GROSS INCOME |

NET INCOME |

||||

| YEAR | COSTS | WITHOUT SUBSIDY | WITH SUBSIDY | WITHOUT SUBSIDY | WITH SUBSIDY |

| 0 | 2700.00 | 0.00 | 0.00 | -2700.00 | -2700.00 |

| 1 | 200.00 | 350.00 | 2375.00 | 150.00 | 2025.00 |

| 2 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 3 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 4 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 5 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 6 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 7 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 8 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 9 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 10 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 11 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 12 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 13 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 14 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| 15 | 200.00 | 350.00 | 350.00 | 150.00 | 150.00 |

| PRESENT NET VALUE 10% 0.10 |

3488.61 | 2662.13 | 4503.04 | -1559.09 | 145.46 |

| INTERNAL RATE OF RETURN | -0.02 | 0.12 | |||

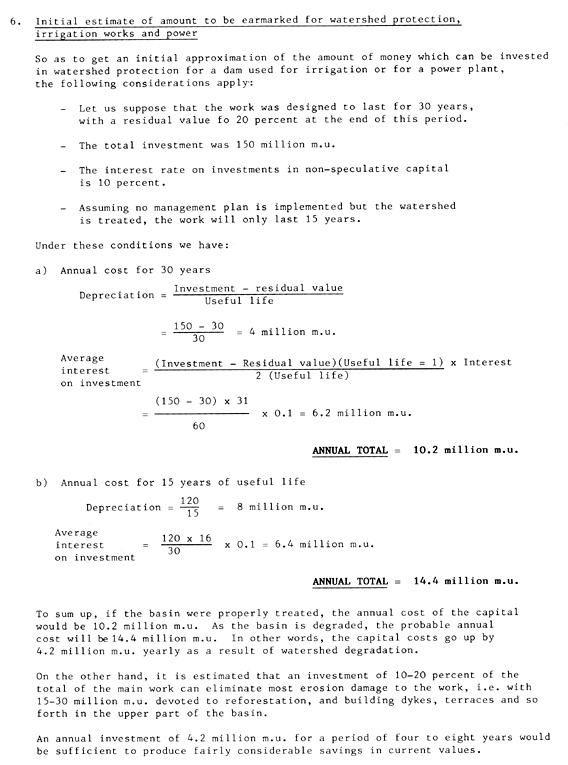

Let us assume that the State wishes to interest small and medium landowners in reforesting for fuelwood and to protect a watershed where a power plant is operating. The State therefore wishes to analyzed the impact of various loan terms on financial profitability.

Costs

Cost of reforestation 1 900 m.u./ha.

Cost of annual maintenance 80 m.u./ha/yr

Income

Growth: 15 m³/ha/yr

Year 10, 150 m³

Thinning 30 percent of volume

at 60 m.u./m³ standing timber 2 700 m.u. at year 10

Year 15, 225 m³ minus 45 m³ for thinning, leaving 180 m³ at

60 m.u. for m³ standing timber 10 800 m.u. at year 15

Table 2 shows that without loans, reforestation has a net actual benefit of 1 137 m.u. and a financial rate of 13 percent.

a) The first type of loan had the following terms:

- Loan covers total cost of reforestation

- Interest rate 7 percent

- First payment of accumulated interest in the year trees are thinned

- Payment of loan and remaining interests in the year following the harvest

The first interest payment falls on year 10

1900 (1.07)11 - 1900 = 2 099 m.u.

The payment of the loan and remaining interests is:

1900 (1.07)5 = 2 665 m.u.

The costs in the tenth year also include 80 m.u. of plantation maintenance, the table accordingly shows a cost of 2 179 m.u.

A net present benefit under these conditions goes up to 1 647 m.u. and the IRR is 27 percent.

There are attractive terms because the landowner does not have to pay anything at the time the trees are planted, nor before the tenth year when the first income is generated.

| WITH LOAN | WITHOUT LOAN | |||||

| YEAR | COSTS | INCOME | NET BALANCE | COSTS | INCOME | NET BALANCE |

| 0 | 1900.00 | 0.00 | -1900.00 | 0.00 | 0.00 | 0.00 |

| 1 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 2 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 3 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 4 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 5 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 6 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 7 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 8 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 9 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 10 | 80.00 | 2700.00 | 2620.00 | 2179.00 | 2700.00 | 521.00 |

| 11 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 12 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 13 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 14 | 80.00 | 0.00 | -80.00 | 80.00 | 0.00 | -80.00 |

| 15 | 0.00 | 10800.00 | 10800.00 | 0.00 | 10800.00 | 10800.00 |

| 16 | 0.00 | 0.00 | 0.00 | 2665.00 | 0.00 | -2665.00 |

| NET VALUE 0.10 |

2489.33 | 3626.40 | 1137.07 | 1978,57 | 3626.40 | 1647.83 |

| IRR | 0.13 | 0.27 | ||||

| NET VALUE 10% LOAN AT 3% INTEREST |

1350.22 | 3626.40 | 2276.18 | |||

| NET VALUE 10% LOAN WITH | 0.33 | |||||

| INTEREST SUBSIDIZED AT 100% | 1002.83 | 3626.40 | 2623.57 0.36 |

|||

b) The second kind of loan has the same terms as the first except that the interest rate is 3 percent. The net present benefit is 2276.18 m.u. and the IRR 33 percent.

These are also very attractive terms because there is no initial payment and by year 10 the peasant receives:

| Value of the wood | 2 700 m.u. |

| Maintenance | -80 m.u. |

| Interest | -730 m.u. |

| 1900 (1.03)11 - 1900 | |

| Net sum received at year 10 | 1 890 m.u. |

Nearly the equivalent value of one new hectare of plantation.

c) The third type of loan. The State subsidizes all interest to be paid so that the peasant needs only pay the loan principal at year 16.

In this case, the net present benefit goes up to 2 624 m.u. and the IRR 36 percent.

Under these terms, the State, since reforestation is highly valuable in terms of protecting the hydroelectric structures, decides to adopt the following approach:

- Selection of the second type of loan for medium sized landowners, with the proviso that at year It an additional hectare is planted with the net value received and the same again at year 16.

- The third type of loan is chosen for small landowners, with the same proviso as above.

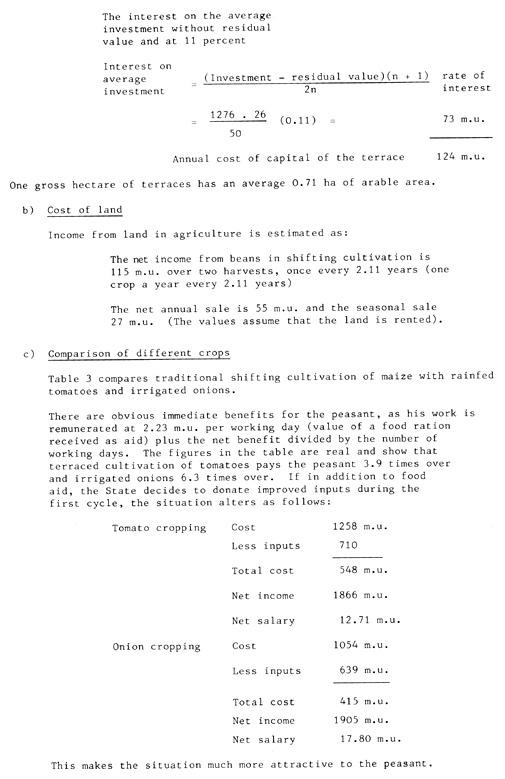

Bench terraces are built as part of a watershed project on steeply sloping land. The project organization has prepared cost standards and yield from shifting cultivation and from improved crops on bench terraces for the purpose of arousing peasant interest in the work to be done.

a) Annual costs of terraces

To construct a terrace requires:

570 working days paid for by food rations valued at 2.23 m.u. = 1.271 m.u.

The terraces are estimated to have a useful life of 25 years after which they must be completely rebuilt

Depreciation = 1275÷25 = 51 m.u.

|

COST FACTORS AND INCOME

|

HILLSIDE MAIZE CROPPING | RAINFED TOMATOES ON BENCH TERRACES | IRRIGATED ONIONS ON TERRACE | |||

| Work | 66HD x 2.23 m.u. | 147 | 178HD x 2.23 m.u. | 397 | 107HD x 2.23 m.u. | 239 |

| Inputs | Seeds | 46 | 1000 m.u. x 0.71 | 710 | 900 m.u. x 0.71 | 639 |

| Lease of land | - | 21 | - | 27 | - | 27 |

| Bench terrace | - | - | - | 124 | - | 124 |

| Irrigation | - | - | - | - | - | 25 |

| Total | 220 | 1258 | 1054 | |||

| Yield | 17qq/ha x 13 m.u. | 221 | 17Ton. x 0.71 x 200 | 2414 | 9.9 Ton.x 0.7l x 200 | 2320 |

| Net income | 1156 | 11256 | ||||

| Real net salary per working day | Salary + (Net income÷work) |

2.23

I |

8.72 | 14.06 | ||

Under these circumstances, a watershed conservation and reforestation project can be formulated for 16-32 million m.u. which would lower the kilowatt cost of energy per capital expenditure. Maintenance costs for the work would also be lower and direct benefits from the conservation works on the upstream rural population greater.

A community has succeeded in establishing a revolving fund of 50 000 m.u. The cost of cultivating one hectare in the first year is 1 000 m.u. The average rate of inflation is estimated at a cumulative annual 20 percent. Furthermore, the revolving fund does not charge interest on its short-term loans. The fund operation is described in Table 4 under these terms. As can be seen, the fund remains at a constant 50 000 m.u. but given the rising cost of cultivation due to inflation, the original 50 hectares capacity at year 1 has dropped to only 10 ha. at the end of 10 years in real terms and therefore the revolving fund is worth only 20 percent of its original value.

This simple example prompts the recommendation that the returns from revolving funds in small communities be calculated in kind in accordance with the community's facilities for marketing products and that a reasonable rate of interest also be charged so that the fund can grow.

| YEAR | REVOLVING FUND | CULTIVATION COSTS ON 1 ha. |

CAPACITY |

| 1 | 50.000 | 1.000 | 50 ha |

| 2 | 50.000 | 1.200 | 42 ha |

| 3 | 50.000 | 1.440 | 35 ha |

| 4 | 50.000 | 1.728 | 29 ha |

| 5 | 50.000 | 2.074 | 24 ha |

| 6 | 50.000 | 2.488 | 20 ha |

| 7 | 50.000 | 2.986 | 17 ha |

| 8 | 50.000 | 3.583 | 14 ha |

| 9 | 50.000 | 4.300 | 12 ha |

| 10 | 50.000 | 5.160 | 10 ha |

*The revolving fund makes loans for the crop and collects at harvest time at zero

interest