S. Mbabaali

Commodity Specialist, Basic Foodstuffs Service, FAO

The structure of international rice trade renders it susceptible to the effects of even small supply fluctuations in any of the major exporting and/or importing countries. Most of the rice produced in the world is consumed near its point of production, and only 4 to 5 percent of global production is traded internationally. The bulk of rice production, consumption and trade is concentrated in Asian countries, particularly China, India, Indonesia, Bangladesh, Viet Nam, Thailand and the Philippines, and the Islamic Republic of Iran. In any given year, the volume of trade in countries of the Northern Hemisphere depends largely on the preceding year's production, while for countries in the Southern Hemisphere trade is dependent on the current year's production. Although global rice output was at an all-time high in 1997, there was a significant production decline in several major importing countries, such as Indonesia, the Philippines and Brazil, precipitated by weather problems associated with the El Niño phenomenon.

In Indonesia, the El Niño weather phenomenon affected most parts of the country, including the island of Java, where most of the rice is grown. Over 400 000 ha of the 1997 second-season crop was reportedly damaged by heat and drought, resulting in a 3 percent fall in the country's 1997 paddy production to about 49 million tonnes. The lingering drought also delayed the planting of Indonesia's 1998 main-season crop (by up to ten weeks in some places) owing to lack of moisture in many of the traditional rainfed rice areas which, together with lower planted area, brought about a further 2 percent decline in the country's 1998 paddy output.

Similarly, in the Philippines, drought caused a 13 percent decline in the 1997 second-season crop, which fell to about 4.2 million tonnes, reflecting reduced planted area owing to a lack of adequate water for irrigation. Overall, paddy production in 1997 declined by almost 11 percent from the previous year, to about 10 million tonnes.

Paddy production for major exporters and importers1 | ||||

1995 |

1996 |

1997 |

1998 | |

(million tonnes) | ||||

Bangladesh |

26.5 |

28.3 |

28.3 |

26.7 |

Brazil |

11.2 |

10.0 |

9.5 |

8.5 |

China2 |

187.3 |

197.0 |

202.8 |

193.1 |

India |

115.6 |

122.1 |

123.6 |

126.8 |

Indonesia |

49.7 |

51.1 |

49.4 |

48.5 |

Iran, Islamic Republic |

2.7 |

2.6 |

2.6 |

2.9 |

Japan |

13.4 |

12.9 |

12.5 |

11.2 |

Pakistan |

5.9 |

6.5 |

6.5 |

7.1 |

Philippines |

11.2 |

11.2 |

10.0 |

10.2 |

Thailand |

22.0 |

22.4 |

22.6 |

21.4 |

United States |

7.9 |

7.8 |

8.3 |

8.5 |

Viet Nam |

26.8 |

27.3 |

28.4 |

28.0 |

World total |

26.8 |

27.3 |

28.4 |

28.0 |

1 Production refers to the calendar year in which the harvest or bulk of the harvest took place. | ||||

Adverse weather conditions during planting and harvesting in several countries in South America had a negative impact on the region's 1998 paddy crop season. In particular, output in Brazil, the largest producer and consumer in the region, fell to 8.5 million tonnes, the lowest in eight years. This decrease was a reflection of abnormally wet conditions at planting time, especially in the largest rice-producing state of Rio Grande do Sul, and heavy rains during most of March, which delayed harvesting progress.

FIGURE 1: Rice production and imports, Indonesia

Conditions in Bangladesh also influenced international rice trade significantly in 1998. This was the result of floods that affected over 50 percent of the country's 64 districts during the period July to September, especially in the northern and central regions. Harvesting of the boro crop had already been completed before the floods, but part of the ahu crop, especially the late-planted sections, was affected and output was down by 16 percent, compared with 1997, to about 1.6 million tonnes. Planting operations for the aman (main-season) crop were affected by torrential rains, and nurseries or transplanted rice were damaged in several areas. Based on the FAO/World Food Programme (WFP) crop and food supply assessment mission, which was sent to the field during the latter part of 1998, total 1998 paddy output is estimated at slightly more than 26 million tonnes, a decline of 2 million tonnes from the previous season.

Several Asian countries suffered a contraction of their real gross domestic product (GDP) in 1998. The crisis led to reduced import demand for some agricultural commodities, caused by the sharp income contraction in the region and the large depreciation of several of its currencies. However, the currency depreciation was also responsible for increased export competitiveness in some countries.

As far as international rice trade was concerned, the Asian economic crisis had only a minimal impact, largely owing to the fact that rice is the main staple food in most of the countries affected and trade takes place largely among themselves. Thailand and Indonesia were the countries most affected by the financial crisis. Thailand is the world's leading rice exporter and generally sets the prices on the international rice market. A depreciation in the Thai baht made its exports cheaper and more competitive, to the benefit of Indonesia which was the world's leading importer during 1998, although some of its imports were made under special arrangements, particularly those from Japan.

World trade in rice in 1998 is estimated to have climbed to an all-time peak of 27.6 million tonnes, about 8.6 million tonnes more than in 1997 and over 6 million tonnes above the previous high of 1995. This record trade was the combined result of reduced harvests in 1997 and/or 1998 in a number of the major importing countries, attributed to El Niño-related weather problems, and of simultaneous bumper crops in some of the major exporting countries which made it possible to increase exports to satisfy the exceptionally large demand on the international market.

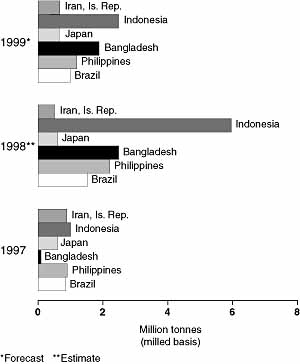

FIGURE 2: Major rice importers

Indonesia was the largest importer during the calendar year 1998, with estimated record purchases of

6 million tonnes despite the economic difficulties that the country was undergoing. In comparison, Indonesia imported about 1 million tonnes of rice in 1997. The record imports were brought about by two consecutive years of reduced domestic output. It should, however, be noted that some of the country's import needs were supplied on special terms, particularly by Japan through rice loans to be returned, at a future date, in kind or in cash. Japan also provided financial assistance that enabled Indonesia to purchase additional rice from the international market. In addition to the 600 000 tonnes of food aid committed earlier in the year, in October 1998, Japan announced an extra 400 000 tonnes of rice aid to Indonesia. The package included a long-term rice loan of 200 000 tonnes and another loan in yen for purchasing 200 000 tonnes of rice from the international market. Shipments into Bangladesh are estimated at 2.5 million tonnes in 1998, compared with less than 50 000 tonnes in 1997. In 1998, the other major importers included the Philippines and Brazil, with estimated volumes of 2.2 million tonnes and 1.5 million tonnes, respectively. A greater share of Brazil's import shipments was from sources other than Argentina and Uruguay, its traditional suppliers and Southern Common Market (MERCOSUR) partners, since adverse weather conditions in those countries limited their ability to export. Purchases by the Islamic Republic of Iran, which was the world's leading importer prior to 1994, were estimated at 500 000 tonnes, more than 40 percent down from the previous year owing to three consecutive years of good paddy output. Imports by African countries totalled about 4 million tonnes, similar to 1997, with South Africa, Côte d'Ivoire, Senegal and Nigeria as the major importing countries.

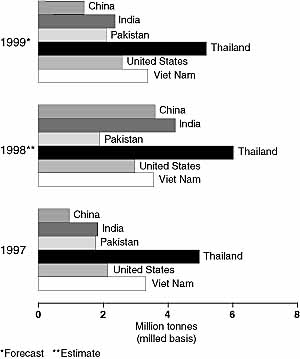

FIGURE 3: Major rice exporters

On the export side, a number of countries were able to increase shipments to help satisfy the rise in international import demand. This was made possible by the bumper crops harvested in several of the major exporting countries in 1997. Exports from Thailand in 1998 are estimated at 6.4 million tonnes, up by over

20 percent from 1997. India shipped close to 4 million tonnes of rice in 1998, compared with about 2 million tonnes in the previous year. Other major exporters included Viet Nam, China (mainland) and the United States, with volumes of 3.8 million, 3.7 million and 3.1 million tonnes, respectively.

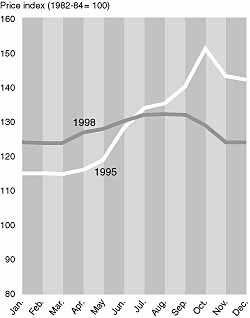

International prices of rice from most origins were on an upward trend during most of 1998, sustained by record global import demand along with concerns about the availability of export supplies. Such concerns increased when Viet Nam, the world's number two rice exporter, decided to control the pace of export shipments during 1998 with the aim of ensuring domestic food security. This was done by using temporary bans on new export sales and a tax on exports. Further upward pressure on prices was exerted during the third quarter of the year, when floods destroyed rice crops in some exporting and importing countries. However, prices eased towards the end of 1998, mostly as a consequence of the arrival of new crop supplies on the market and reduced new import demand. The fluctuations are illustrated by movements in the FAO Rice Export Price Index (1982-84=100), which reached a yearly high of 132 points between July and September before declining to 124 points in November and December. Overall, the index averaged 127 points during 1998, similar to the 1997 average.

FIGURE 4: FAO total export price index for rice, 1995 and 1998

In light of the record import demand, prices could have edged higher during the course of the year, had it not been for the bumper harvests in several exporting countries, including Thailand, China (mainland) and India, which led to increased shipments. The other factor that prevented a price rise comparable to the levels established in 1995, when the previous peak in international rice trade was set, is the devaluation of the baht in Thailand, the world's leading rice exporter.

For 1999, global rice trade is provisionally forecast to decline by about 20 percent from the 1998 estimated record. This forecast is based on improved production performance in 1998 and/or the expectation of higher production in 1999 in many of the major importing countries that were largely responsible for driving the 1998 trade to a record level. If realized, however, the trade volume would still be the second highest on record. Increased production, and therefore lower imports, are expected in Indonesia, the Philippines, Bangladesh and Brazil, four of the leading importers in 1998. On the other hand, export supplies in most of the major exporting countries are abundant and, given the reduced import demand, the result so far has been a weakening of international rice prices in the year. For these reasons, international rice prices are expected to remain subdued during the rest of the year, barring any unforeseen demand and/or supply shocks in the major importing and/or exporting countries.

Commerce international du riz: bilan de 1998 et perspectives pour 1999

On estime que le commerce mondial du riz s'est établi en 1998 à son plus haut niveau historique, avec plus de 27 millions de tonnes, soit environ 6 millions de tonnes de plus que le précédent record établi en 1995. Ce niveau exceptionnel s'explique par les récoltes réduites de 1997, voire de 1998, dans plusieurs grands pays importateurs, dues aux mauvaises conditions météorologiques liées au phénomène El Niño, alors que certains des principaux pays exportateurs engrangeaient des récoltes records, ce qui a permis d'accroître les exportations pour répondre à la demande exceptionnellement forte sur le marché international. Au cours de l'année, les cours du riz de pratiquement toutes origines n'ont cessé de monter, soutenus par une demande mondiale d'importations exceptionnelle accompagnée d'inquiétudes quant aux disponibilités exportables. Ces préoccupations se sont aggravées lorsque le Viet Nam, deuxième exportateur mondial de riz, a décidé de contrôler le rythme de ses expéditions de riz en 1998 dans le but d'assurer sa sécurité alimentaire intérieure. Les prix ont subi une autre pression à la hausse au cours du troisième trimestre, après que des inondations eurent détruit les récoltes dans certains pays exportateurs et importateurs. Les prix se sont ensuite stabilisés vers la fin de 1998, du fait essentiellement de l'arrivée de nouvelles récoltes sur le marché et du ralentissement de la demande d'importation.

Pour 1999, on prévoit à titre provisoire une baisse d'environ 20 pour cent du commerce mondial de riz par rapport au niveau record de 1998. Cette prévision est fondée sur de meilleurs résultats de production en 1998 et/ou sur l'espoir d'une production plus abondante en 1999 dans de nombreux pays importateurs qui avaient été largement responsables du niveau record du commerce du riz atteint en 1998. Si cet espoir devait se confirmer, le volume du commerce se maintiendrait, toutefois, juste en dessous du volume record de l'an dernier. La combinaison d'une demande d'importation en baisse et d'amples disponibilités exportables dans la plupart des grands pays exportateurs a affaibli les cours internationaux du riz jusqu'à présent. Ces cours ne devraient plus augmenter pendant le reste de l'année 1999, sauf demande imprévue et/ou difficultés d'approvisionnement dans les principaux pays importateurs et/ou exportateurs.

Comercio internacional del arroz: reseña de 1998 y perspectivas para 1999

Se estima que el comercio mundial del arroz en 1998 ha marcado una cota máxima jamás registrada antes de más de 27 millones de toneladas, unos 6 millones de toneladas por encima de la producción máxima anterior que se alcanzó en 1995. Dicho comercio sin precedentes fue el resultado conjunto de una reducción de las cosechas en 1997

y/o 1998 en varios grandes países importadores, reducción atribuida a problemas meteorológicos relacionados con el fenómeno de

El Niño, y de la simultaneidad de varias cosechas excelentes en algunos de los principales países exportadores, lo que permitió incrementar las exportaciones para satisfacer la demanda excepcionalmente grande del mercado internacional. Durante el año, los precios internacionales del arroz de casi todos los orígenes registraron una tendencia al alza, sostenida por una demanda récord mundial de importaciones, que estuvo acompañada de la inquietud que la existencia de disponibilidades para la exportación suscitaba. Esas preocupaciones sobre los suministros exportables se agravaron cuando Viet Nam, segundo país exportador del mundo, decidió controlar el ritmo de los envíos de exportación durante 1998 con la finalidad de garantizar la seguridad alimentaria nacional. Hubo una nueva presión al alza de los precios en el tercer trimestre, cuando las inundaciones destruyeron los cultivos arroceros en algunos países exportadores e importadores. Sin embargo, hacia finales de 1998 bajaron los precios, debido sobre todo a la llegada de nuevas disponibilidades al mercado y al descenso de la nueva demanda de importación.

Para 1999, según los pronósticos provisionales, el comercio mundial del arroz bajará en un 20 por ciento aproximadamente respecto de la cota récord estimada de 1998. Estos pronósticos se basan en una mejora del rendimiento de la producción en 1998 y/o en la expectativa de una mayor producción en 1999 en muchos de los principales países importadores, que fueron en gran parte los que impulsaron el comercio de 1998 hasta un nivel sin precedentes. Ahora bien, si esto se materializase, el volumen del comercio seguiría siendo el segundo mayor jamás registrado. La conjunción de una menor demanda de importación y de un amplio suministro de exportación en la mayoría de los principales países exportadores ha dado lugar hasta ahora a un debilitamiento de los precios internacionales del arroz a lo largo del año. Las previsiones son que dichos precios se mantendrán bajos durante el resto de 1999, impidiendo así cualquier altibajo imprevisto de la oferta o de la demanda en los principales países importadores y/o exportadores.