by

Hmida Atmani

Economiste de pêche, INRH

Casablanca, Maroc

1. INTRODUCTION

The opening of the Southern ports and the subsequent transfer of the pelagic fisheries far away from traditional processing centres; the obligation of the high seas fleet to unload its catch in the national ports instead of Las Palmas where it has been based since its creation; and recently the withdrawal of the European fleet from the national waters, were the most outstanding events in the Moroccan fishery in the last decade.

These events have not only reshaped the landing map, but were also the major forces behind the changes that marketing and distribution and trade sectors are undergoing. The contribution of these fisheries to the national economy is important as source of foreign exchange and income to fishermen, but its contribution to the national food security is very modest in relation to the importance of the overall landings and their variety on one hand, and the deficit in the sources of protein needed to improve the diet of the population on the other hand.

The national consumption of fish per capita is still very low, although one of the main objectives of fisheries development is to contribute to improve the nutritional status of the population.

In this paper, the main characteristics of the Moroccan fisheries with regards to access to resources, the importance of landings and their main uses, will be presented. Particular attention will be given to the structure of the national fish consumption and to the evolution of fish exports and the resulting national benefits. This will allow an estimate of the contribution of fisheries to national food security, and to explore the potential margin to optimise this supply within a framework of sustainable development of fisheries and the conservation of the resource base as the main prerequisite.

2. FISHERIES SECTOR

2.1 Background Information

Moroccan coasts are fringed in the North by the Mediterranean Sea and the West by the Atlantic Ocean. The continental shelf is characterised by the presence of up-welling, which makes the coastal waters extremely rich in nutritive salts and high biological productivity; and by the wind driving water away from the coasts so that it may be replaced by richer waters from deeper down. The rich feeding grounds create potential for fishing stress and competition is the area for both pelagic and demersal resources.

The objectives assigned to the fishery sector were (1) to contribute to nutritional status of the population by increasing the fish consumption, (2) to improve the balance of payments by fish exports for hard currencies and (3) to provide employment. In this framework, investments have been made to set up new infrastructure, to survey new markets, to train the workforce and to institute reforms.

The fishery sector is playing an increasingly important role in the Moroccan economy, realizing a gross value of fishery outputs 7 761 Million DH, employing about 200 000 people and supplying about 25 percent of animal protein intake in the country. The sector contributes approximately two percent of the GDP and has a leading rank in exports.

2.2 State of the Fisheries

The recent evolution of the fishery sector has been marked by three interesting phenomena.

1) The 1980s witnessed the opening of the ports of Tan Tan and Laayoun in the South, which gave a new breath to the fisheries, mostly the pelagic fishery, providing abundant resources for the processing industry.

2) The 1990s were characterised by the repatriation of the national high seas fleet and the obligation to unload the catches in the national ports instead of Las Palmas, where it had been based for two decades. Consequently the cephalopod fishery, the most important activity of this fleet, is enjoying growth.

3) The withdrawal of the European fleet from the national waters, which gave the country more freedom to manage these fisheries within a framework of optimising the national benefits from their exploitation.

Fishing in Morocco is based on nearly 65 species of fish, cephalopods and crustaceans. These species are generally divided into the following groups: merlucccidae: 2 species, sparids: 15 species, cephalopds: 5 species, other ground fish: 20 species, shrimp: 3 species, crustaceans: 5 species, and finally sardine and other pelagics: 4 species.

Landings in 2001 were 117 075 tonnes of ground fish, 870 134 tonnes of pelagics and 104 795 tonnes of cephalopods. About 78 percent of these landings consist of five pelagic species and nearly 70 percent are made up of one species, the sardine, which constitutes the mainstay of fish industry in Morocco. Some 70 percent are used as raw materials processed products. In terms of value, cephalopod fishery produced most income because of the high value of this product when exported.

Four main fishing areas can be distinguished: the Mediterranean area, the North Atlantic area, the Centre South Atlantic area and the South Atlantic area. Each harvest area exhibits different characteristics of production and distribution.

2.3 DOMESTIC PRODUCTION

Fleet Structure

The fleet can be divided into three categories: the coastal fleet, the small-scale fleet and the high seas fleet.

1) The coastal Fleet consists of about 2 500 vessels of which 1 814 were operational in 2001. The purseiners dominate in landings, because of the importance of the canning industry and the abundance of the sardine resource in the national waters. The average age, gross tonnage and power are respectively of 20 years, 54 GRT and 260 CV. The structure of the fleet with regard to age and GRT shows that the vessels built in the seventies are the largest and the most equipped, owing to the benefit of the investment incentives offered by the government, which may reach 35 percent of the purchasing price of the vessel.

In terms of value, however, the trawlers and the long-liners contribute more substantially as they produce more high value species. Their number increased during the last decade at least by 30 percent and their GRT by 40 percent.

2) Data on small-scale fisheries are not precise, but it is generally believed that the number of canoes is steadily increasing because of their low investment. Surveys have estimated their number at about 5 000 units operated by some 45 000 subsidence fishermen.

3) The trend in the active high seas fleet is impressive. From 235 units of a total capacity of 76 636 GRT in 1987, the number increased to 446 units with the production capacity almost doubled (144 369 GRT). This was the result mainly of

(i) the significant public financial assistance to investors in this fishery,

(ii) an abundant resource and

(iii) a very good ex-vessel price.

In fact, the expansion of the market along with the promise of an extremely productive fishing area made the investment response the private sector greater than expected. It is to be noted that this fleet is highly capital intensive.

Landings

The marine fisheries of Morocco consists of two distinguished sectors, i.e., (i) the high seas fishery which is oriented mostly towards fishing and exporting high value species and (ii) coastal fishery whose products are destined to the fresh consumption and for supplying an important processing industry. Altogether they catch over one million tonnes yearly. Table 1 summarizes the composition of domestic landings over recent years.

TABLE 1: Quantity and Value of Landings, 1996-2001

|

OVERALL LANDINGS (tonnes) |

||||||

|

|

1996 |

1997 |

1998 |

1999 |

2000 |

2001 |

|

|

|

|

|

|

|

|

|

Coastal Fishery |

525 022 |

661 646 |

607 129 |

622 160 |

765 241 |

978 519 |

|

Demersal |

73 933 |

78 040 |

88 419 |

107 026 |

138 300 |

117 075 |

|

Pelagics |

451 089 |

583 606 |

518 710 |

515 134 |

626 941 |

861 444 |

|

|

|

|

|

|

|

|

|

high seas fishery |

90 915 |

111 493 |

92 038 |

125 007 |

133 510 |

122 485 |

|

cephalopods and white fish |

72 625 |

68 127 |

80 995 |

93 028 |

121 614 |

104 795 |

|

Shrimp |

5 010 |

5 188 |

7 050 |

8 561 |

8 606 |

8 690 |

|

pelagics |

8 240 |

34 157 |

|

19 958 |

0 |

9 000 |

|

refrigerated fish |

5 040 |

4 021 |

3 993 |

3 460 |

3 290 |

|

|

|

|

|

|

|

|

|

|

Activities |

9 318 |

10 051 |

9 914 |

10 892 |

14 588 |

10 494 |

|

Seaweed |

7 625 |

8 094 |

7 049 |

8 525 |

12 068 |

7 000 |

|

Aquaculture |

1 241 |

1 183 |

969 |

1 160 |

870 |

787 |

|

Coral |

4 |

3 |

2 |

5 |

8 |

7 |

|

Tuna |

448 |

771 |

1 894 |

1 202 |

1 642 |

2 700 |

|

|

|

|

|

|

|

|

|

Total: |

625 255 |

783 190 |

709 081 |

758 059 |

913 339 |

1 111 498 |

|

OVERALL LANDINGS (million DH) |

||||||

|

|

|

|

|

|

|

|

|

|

1996 |

1997 |

1998 |

1999 |

2000 |

2001 |

|

Coastal Fishery |

1 547 |

1 755 |

1 680 |

1 818 |

2 078 |

2 545 |

|

Demersal |

843 |

905 |

887 |

968 |

1 160 |

1 412 |

|

Pelagics |

704 |

850 |

793 |

850 |

918 |

1 133 |

|

|

|

|

|

|

|

|

|

High seas fishery |

3 292 |

2 917 |

2 942 |

2 888 |

4 603 |

4 859 |

|

Cephalopods and white fish |

2 857 |

2 441 |

2 579 |

2 492 |

4 129 |

4 401 |

|

Shrimp |

284 |

274 |

298 |

280 |

401 |

452 |

|

Pelagics |

59 |

131 |

0 |

48 |

0 |

6 |

|

Refrigerated fish |

92 |

71 |

65 |

68 |

73 |

0 |

|

Littoral activities |

203 |

193 |

186 |

178 |

258 |

357 |

|

Seaweed |

79 |

62 |

62 |

82 |

113 |

63 |

|

Aquaculture |

88 |

65 |

52 |

43 |

41 |

25 |

|

Coral |

4 |

4 |

2 |

3 |

6 |

5 |

|

Tuna |

32 |

62 |

70 |

50 |

98 |

264 |

|

Total: |

5 042 |

4 865 |

4 808 |

4 884 |

6 939 |

7 761 |

The High Seas Fishery

The high seas fishery has developed largely as a result of the establishment of the EEZ. It has enjoyed unprecedented growth and prosperity during the last three decades to become by far the most important type of fishery in terms of value. In fact, the success of this fishery may be ascribed to three factors:

i) an abundant resource generated by the over-exploitation of the sparid species freeing the carrying capacity for the blooming of cephalopod species;

ii) the adoption of sophisticated gear, freezing equipment and larger vessels capable of ranging the Exclusive Economic Zone; and

iii) the high exports the fishery is enjoying.

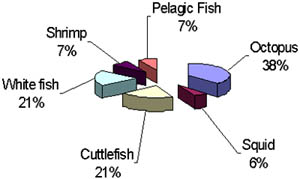

The production, with an average of about 100 000 tonnes per year, stood at 122 485 tonnes in 2001, a small decrease of 10 percent under the 133 510 produced one year before but a 34 percent over the 91 438 tons landed in 1998. These landings consist mostly of cephalopods (octopus, cuttlefish and squid), sparids, (85 percent) and pelagics (eight percent). The crustaceans represent only eight percent in volume, but almost 10 percent in value.

Because of the size of the vessels and fishing areas located in the south, the entire production is landed in Agadir and Tan Tan - ports well equipped to receive this type of vessels. Since fishing trips last generally about 60 days, the product is chilled on board.

Figure 1: STRUCTURE OF THE HIGH SEAS CATCH 2001

The Coastal Fishery

The harvest of this fishery beats the record in 2001, attaining for the first time more than one million tonnes. The overall volume has been stable over the last decade. The opening of the southern ports was the main factor behind the take off the fishery. The pelagic species comprise more than 85 percent of the total coastal landings.

The major species harvested in 2001 were sardine (763 689 tonnes), mackerel (25 890 tonnes), horse mackerel (12 268 tonnes) which with anchovy (47 393 tonnes), account for almost 83 percent of the overall landing in quantity. In value, however, these species represent only 39 percent of the total for the same year, because of their low price.

Landings of white fish have remained relatively stable over the last years. The inability to expand is partially explained by the fact that the stocks are heavily fished. Demersals comprise a wide range of species, consisting of merlucidae, sea bream, red mullet sole, turbot, ray, etc. They are high priced species, which do not constitute a major proportion of domestic fish supply.

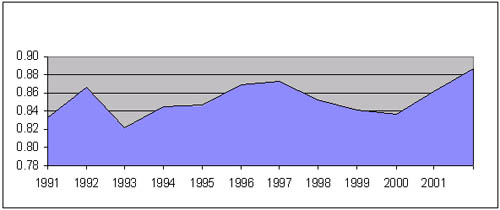

Figure 2: SHARE OF SARDINE IN PELAGIC LANDINGS

Spatial and Temporal Distribution of Landings

The most important catches are currently landed in Laayoun. This is due to pelagics migrating southward. This port and Tan Tan, receive around 80 percent of the total national landings and their importance is steadily increasing.

The fishing area from Safi to Agadir, which supported the largest fishery until the seventies, witnessed a severe drop in resource abundance, which occurred in the early eighties. Consequently, the coastal fleet transferred its activity southward, and the production in the area has been on the decline for nearly 10 years. The downward trend over the last decade made the supply of the canning industry in the area a real issue.

The overall landings off the Moroccan coast have showed a big dynamism mostly in the Southern ports and the landings in the South alleviate the shortfall of supply in the North. The problem of supplying the canneries in the North has been resolved by imports from the Southern ports of Tan Tan and Layoun, replacing shortfalls in local supply, but at increased prices due to the extra costs of transportation. In the Northern Atlantic and the Mediterranean areas, the landings are almost stable.

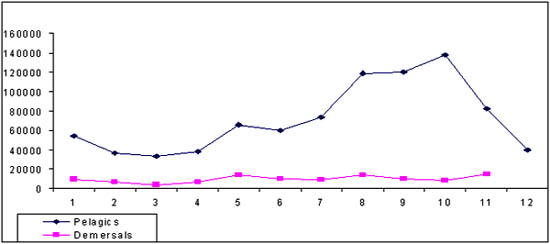

Moreover, the pattern of landings is also characterised by seasonality, more than 70 percent of the production occurs between July and December (Figure 3).

Figure 3: MONTHLY PELAGICS AND DEMERSALS LANDINGS 2001

2.4 Resource Potentials and Future Prospects

The main demersal fisheries are fully exploited and are therefore producing catches that have reached or are very close to their maximum limit, with no room expected for further expansion. Moreover, there is an increasing likelihood that catches might decrease if remedial action is not undertaken to reduce or suppress over-fishing, particularly in the Mediterranean Sea. However, the pull out of the foreign fleet from the national waters may improve the performance of this fishery, but in short term a redeployment of the fleet along with the investment in bigger trawlers may enable the exploitation of the further fishing grounds still under-exploited, and the development of new fisheries in the South.

The stocks of pelagics species are distributed all along the coast of Morocco and their availability is important, especially in Tan Tan and the Southern areas. Two serious problems are now facing the industry: 1) the misallocation of the fishing grounds and canneries and 2) the old age of the fleet and the lack of repairs. That being so, substantial investments are needed for modernisation.

Concerning Cephalopod resources, it is estimated that the resource has reached its maximum yield level. Consequently, a series of management measures have been implemented in order to rebuild the stock. The most important measures are two months closed season, corresponding to the spawning season, with the prospect of extending it to three months and a legal minimum size restriction. The pull out of the European fleet from the national waters, has reduced considerably the fishing stress on these resources.

2.5 Markets and Facilities

Fish Halls

The most important outlet for demersal fish is provided through auctions. The fish auctions are held daily in the 22 fish halls according to the local conditions of each port, but generally in early morning. Virtually, all the ports are equipped with such facilities. The fish hall is a public institution empowered to enforce compulsory auction at all locations considered as fish wholesale markets. The auction is carried out at stipulated times according to the local conditions of each port.

The floor price for bidding is determined by the auctioneer himself. An ad valorem commission of 4 percent is generally charged for each transaction. An intersectional comparison of the first sale pattern shows a difference in the system of auction in the Mediterranean and the Atlantic ports. In the Atlantic ports, the tradition is that fish is sold at the highest offer according to the system of increasing bidding, while it is the opposite in the Mediterranean ports where it is the high price which constitutes the basis for the auction.

There are, however, some exceptions to this rule:

1) On the beach sites where small-scale fleet is landing, the transaction between the fishermen and the fishmonger may be an outright sale.

2) Frozen fish is not sold at the auction. After some time in the freezing facilities or on board of vessels, the dealers sell fish to their clients.

3) The pelagics destined for processing industry. As it will be seen later in more details, these species landed in the Southern ports are sold through the CAPI.

The CAPI

The CAPI is the public body entitled to organise the first sale of pelagic species destined for the processing industry. It is the major means of exchange between the pelagic catching and processing sectors. Sales are based on samples. Prices depend on the fish quality. Good quality is usually processed into canned products while the poor quality moves to fishmeal.

The sale of the sardine represents an exception to the normal process whereby prices are determined by auction. Under this arrangement, sardines destined to the processing industry are determined at the outset of the fishing season. The price of sardines destined to reduction may be subject to seasonal adjustments. As regards to the other pelagic species, the law fixes the floor price, which represents the basis for auction bidding.

Ports and shore equipment

Catches are landed in 28 ports and more than 170 landing sites for small-scale fishery along the coast. The most important ports are Tan Tan, Laayoun, Agadir, Safi of the Atlantic coast and Nador Tangier Hoceima on the Mediterranean cost.

As a result of the developments of the fisheries in the last two decades, the ports South of Agadir have drawn a particular attention to prepare them to receive the oceanic fleet, which was operating from Las Palmas for at least two decades. These ports have a dredged depth of six meters and are suitable for large fishing vessels. Other facilities available are well equipped workshops, ice plants and cold stores.

3. FISH MARKETING AND CONSUMPTION

3.1 Market Supply and Demand

With the repatriation of the high seas fleet, the cephalopods emerged as the leading Moroccan fishery with respect to value. Since the catch is entirely exported, these landings are not dealt with in this section. The evolution and structure of these landings will however be analysed in detail as an important component of the international trade.

In relative terms, the structure of the utilization of coastal production has remained almost stable over the last decade, indicating the importance of the processing activities, which absorbed about 70 percent of the total production. Over the last years, the use of the production has been as follows; the demersal species are generally sold as fresh mostly in the national market. An export market is however expanding, competing with the domestic demand. The outstanding species are sea bass, sea bream, mullet and hake.

Besides constituting an important component of fresh consumption, the pelagic species are processed primarily into three major product forms, namely

i) chilled or frozen,

ii) canned,

iii) fishmeal.

Annually more than 80 percent of the total pelagic landings undergo some form of industrial treatment. This rate knows a great difference from the Mediterranean and the north Atlantic coasts where almost all the landings are destined for fresh consumption. In the south, the bulk of catch is destined for processing industry.

The patterns vary also with respect to the species composition. If the sardine continues to constitute the mainstay of fish processing, other species such as anchovy and mackerel are now highly demanded for fresh consumption and therefore, give higher returns. Furthermore, due to problems in knowing the final destination of fish bought by traders in Tan Tan, the figures should be treated with caution. In fact, this portion for a large part is sold not to final consumption as indicated by the official statistics, but to the canning industry in the North for processing.

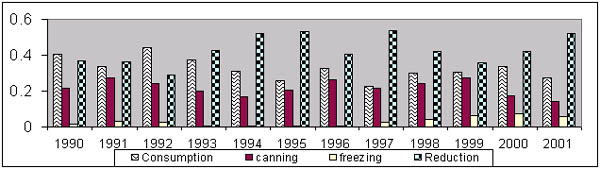

Allocation of Coastal landings 1990-2001

The utilization structure of pelagic species differs even within the group of Southern ports, well known for their processing infrastructure. In the ports of traditional areas like Safi, Essaouira and Agadir, the demand comes chiefly from the canning sector and it is characterised by the high employment and value added provided and by the good ex-vessel price obtained by the fishermen.

3.2 Handling and Transportation Patterns

The handling of fish after capture and before processing influences greatly the quality of final product. The pelagic fish is transported in bulk without ice. However, since the distance between fishing grounds and landing places is only a few hours, the raw material generally arrives in a suitable form for canning. When fish is destined for reduction, the pumping system from the vessel to the truck is generally used. Fish destined for canning is transported in wooden or plastic boxes. The portion destined to fresh consumption receives better handling and it is boxed and iced immediately after landing.

The canning industry is considering assisting fleet owners to introduce refrigeration on board of sardine fishing vessels. In fact, the modernisation of the fishing fleet needs investments and so does the restructuring of the present system of fishing and marketing. Generally, demersals are iced on board at sea to preserve their freshness. Re-icing is done on shore at collection centres, where fish is sorted and packed in wooden boxes, lined with plastic film to keep the ice intact. Buyers ice fish, using 3 to 3.5 kg of ice for a box of 150 kg of fish.

The mode of transport varies with respect to species and distance involved. Trucks carrying 8 to 10 tonnes are the most common mode of distribution used. Trucks hauling refrigerated vans of carrying capacity of 20 to 30 tonnes were also recently introduced. Trucking offers the flexible and relatively cheap solution for getting fish to markets over short and even longer distances. The export trade of products by air becomes an important business. However, since the airfreight costs are very high, the volume of fish to be exported is limited to high value species such as shrimp and lobster.

3.3 Consumer Preferences and Consumption Habits

Landings that were not exported or transformed, and which were assumed to be destined to the national market, amounted to 267 739 tonnes in 2001. Judging by this data, the local market for fish has grown steadily in the last decade from 183 022 tonnes in 1992, to 250 000 tonnes in 2001 - an increase at an average of five percent per year. It accounts for 27 percent of the total coastal fishery landings.

These figures do not include the part of the production, which was landed on the beach sites by small scale fishery and sold directly to the final consumers. This amount is unknown but it constitutes a considerable quantity. A good estimate of this part could be 10 percent of the total consumption. Moreover, an important part of white fish landed in the Moroccan ports, is reckoned as destined for fresh consumption, but in fact it is exported.

Allowing these variations the national consumption may be calculated at about 260 000 tonnes as follows:

|

Pelagic species: |

150 664 tonnes |

|

Demersal species: |

94 480 tonnes |

|

Others: |

1 000 tonnes |

|

Total: |

250 000 tonnes (rounded) |

Landings destined for fresh consumption, are made up of almost the entire landings in the Mediterranean area and the North of the Atlantic coasts. The south Atlantic coast, where the pelagics are destined for canning and fishmeal industry, only 25-30 percent of landings account for the part sent to fresh consumption. This portion is however, growing for the following reasons.

1) The high price of the white fish; the consumption of the pelagics is developing as a substitute.

2) Fresh consumption provides generally higher prices than the processing industry so that in spite of the official fixed prices, fishermen sell their catch dearer to the fresh fish traders, especially in the season of short fish supply. Moreover the price of fish destined to fresh consumption formed by auction, is very elastic to the supply, playing in favour of the fishermen compared to fish destined to the processing industry whose price is fixed in advance of the fishing season.

With an estimated population of 29 million inhabitants, the derived annual per capita consumption is then 8.6 kg, compared to 14 kg of meat and five kg of poultry. Approximately half of this quantity refers to pelagics, and the rest mainly to demersals. Although relatively low, this figure conveys the considerable progress in fish consumption and the change in the eating habits of the population.

From 1991 to 2001, the per capita consumption of fish has grown at an average of 3.7 percent. The evolution of the per capita consumption of fish is the result of the combination of several factors, mostly; increased urbanisation, development of appropriate transportation means and refrigerating facilities, progressive monetarization of the economy; development of a middle class with higher purchasing power; and the steady increase in the price of red meat.

Fish consumption patterns vary throughout the country due to the traditional eating habits influenced, in turn, by history and geography. Fish is a very popular meal in the Mediterranean area and Northern Atlantic area where the production is entirely used for human consumption. Very often, the local catch is not sufficient and fish is brought from the Southern ports to fill the supply gap. Moreover, consumption is higher in the great cities where there is greater purchasing power. The low consumption in the countryside is due also to structural obstacles that are sometimes discouraging, including inadequate road infrastructures and refrigerated facilities. The preference of the consumer goes primarily towards fresh fish. The experience of the marketing of frozen fish in inland areas did not have the expected success.

3.4 Packaging/Labelling

Packaging is one of the major problems the processing industry is facing. It not only accounts for a very high percentage in the cost structure, but also the consuming centres are changing their regulations and requirements related to the materials used.

The canned products are packed in three-piece can and in the two piece ring pull. Several other sizes are used, with ¼ club 30 of 125 grams as the most popular. Labelling of product should include the following information: date of production, trade name and standard number of product, net weight, ingredients, storage condition and expiry date.

3.5 Retailing / Wholesaling/ Catering

Wholesalers buy their fish at the auction and perform the services of assembling and storage before distributing it by lorry or van to their customers, the retailers. They are also supplying selected customers such as hotels and restaurants, or exporting it. Large quantities are also sent to the auction hall of Casablanca.

The traders are usually small enterprises working for themselves or as representatives of wholesalers located in Casablanca. They generally purchase fish for resale, without further processing beyond sorting grading or re-icing. A few dealers bypass the wholesalers and sell directly at the retail level. Products may change ownership many times before reaching the final consumer. To feed their plants in raw material, the processors acquire their fish through the CAPI and ensure its transportation to the processing facilities.

The fish retailers at the end of the chain are private enterprises. They are normally working every day, generally in the morning. Owing to the development of the conservation system, fish of adequate quality is now accessible to urban population on a regular basis.

Generally, all the cities and the villages on the coastal areas have their own fish market. Furthermore, the remote districts are served by special shops. In the inland, markets serve villages once a week. Some markets may exclusively sell fish, but the normal practice is that the fish sale point is integrated in large grocery markets.

There were some experiences on distribution of frozen fish. Some companies with sophisticated equipment, such as ASMAK and PROGEL, are specialized in this business. These companies have their own stalls throughout the country, 120 retail outlets were open in 1988. Their experience did not seem to have met the expected success, although the distribution vans facilitated the marketing of frozen fish. PROGEL was the last company active in this field reducing its activities to big cities. The lack of sufficient supply on a regular basis, rather than potential demand, obliged the company to end its activities

With regard to the catering fish market, the most important customers are hospitals, the military and schools. At least one fishmeal per week is served in these institutions. The restaurants are divided among those, which offers fish as a variety in their menus and those, which are specialised in fish exclusively. In the coastal areas, the better restaurants offer a range of fish dishes in their menus. The most important varieties are demersals and crustaceans. The demand of these varieties is growing in line with the development of tourism.

3.6 Fish Processing and Value Added

The canning industry

Structure of the processing capacities

The canning industry for fish products goes back many years. The sector has gone through three periods of increased activity. The industry began developing in the thirties and expanded progressively after World War II. The number of plants in activity was 200 units in the early fifties. The concentration began in the sixties, the number shrinking to 84 units with a total installed capacity of 1 500 tonnes per day, or 375 000 tonnes per year of 250 days. Only 39 of these are currently operational. With very few exceptions where some companies are at the same time ship-owners and canneries representatives, the canning industry is neither vertically nor horizontally integrated.

The plants are clustered in the Moroccan Centre Atlantic and are heavily concentrated in the Safi - Agadir area, where most of the purseseine fleet unloaded sardine until the eighties. Average plant capacity is 40 tonnes per day, ranging from 70 tonnes in the Southern ports to 20 tonnes per day in the northern ports. This segment of the fishery is characterised by a high employment and added value content in the production process.

Processing capacity and effective production

The present production capacity is in excess of real landings suitable for canning. The industry is said to work at 30 percent of its full capacity. The under-utilization of the production capacity may be attributed to the following major factors:

Fluctuations in fish daily landings. When the raw material is at a low level, the canning plants work on a rotation basis as during the low season; when there is glut of landings, a considerable part of the catch goes to fishmeal.

Poor raw material quality. The fish is transported in bulk, which affects the freshness of the product; the loss rate is very high.

Misallocation of processing industry capacity as compared to the spatial distribution of landings. Until 1982, the area Safi-Agadir, where almost the entire processing capacity is located, was the major producing zone for pelagic species. With the opening of the port of Tan Tan in 1982 and later that of Laayoun, the fleet transferred the major part of its effort southward, landing their catch far away from the processing centres. Conversely, in Tan Tan and Laayoun few processing plants are installed, and fishing effort increased and so did the landings. Therefore, supplying the canning plants of the Safi- Agadir becomes a real issue.

International economic environment. The canned product market did not expand in recent years. In fact the demand from Europe, the main client, has been sluggish. A decrease in the price by the Moroccan export did not have the expected results. Demand from African countries is less remunerative and less stable. Furthermore, the problem of liquidity limits the development of these markets. The American and the Middle East markets are developing, but very slowly.

Costs of production

Besides the problem of raw material supply, the industry is facing increasing costs.

Price of raw materials. Increase in the official price of fish forced the industry to compete with the market for fresh fish.

Higher wages. The increase of labour costs, for a great part would be offset by increased productivity.

Transportation rates. Landings far away from the ports where the canning industry is located complicated supply of these plants. The problem has been partially solved by transporting sardine from the Southern ports Tan Tan and Laayoun (respectively at 300 and 600 km), but this constitutes extra costs.

The weight of the depreciation and replacement. The industry had modernised its equipment to improve its product quality, in order to meet the EEC requirements. This happened during a devaluation of the national currency, which made the cost of the investment in imported equipment very expensive.

The cost of tin plate. This is the major burden on the canned fish producers and increased costs endangered the profitability of processing activities. Tin makes up one third of the total product cost, while the cost of fish itself accounts for roughly 20 percent of the overall processing costs.

Other costs include filling materials, energy, labour, administration and overheads.

TABLE 2: CANNING COST STRUCTURE

|

|

|

Unit cost |

Total cost |

percent |

|

Sardines |

24 kg |

1.4 |

33.6 |

17.08 |

|

Ice |

|

0.1 |

2.4 |

1.22 |

|

Transport |

|

0.25 |

6 |

3.05 |

|

Oil |

3.80kg |

6.48 |

24.624 |

12.52 |

|

Labour |

3 hours |

9 |

27 |

13.73 |

|

Salt |

5 kg |

0.27 |

1.35 |

0.68 |

|

Energy |

|

|

6 |

3.05 |

|

Tins |

100 boxes |

0.92 |

92 |

46.79 |

|

Packaging |

1 |

3.7 |

3.7 |

1.88 |

Prospects of the canning industry

Increasing costs of the raw material and of other inputs coupled with fierce competition in the European market required an improvement of quality. Several plants are engaged in expansion and modernisation programs. They have introduced new technologies to improve quality and reduce costs to be up to the international standards. The modernisation offers considerable advantages, but represents no small investment.

According to a recent report of the canning industry federation, 250 million DH were invested to install highly mechanised canning lines in order to offer the advantage of a better quality product and high productivity, compared to the traditional practices. Furthermore, credits were given to the ship-owners to modernise handling on board of their vessels. All this may increase output above the present level and could also improve marketing conditions.

4. FISHMEAL INDUSTRY

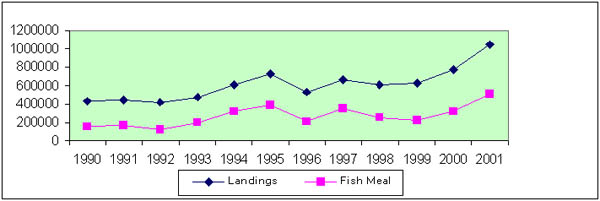

Fish catches moving into production of fishmeal, are estimated to be more than 0.5 million tonnes representing about 60 percent of the total pelagic landings. Fishmeal is largely based on the reduction of four species of pelagic fish: sardine, mackerel, horse mackerel and anchovy. It is also derived from the scraps remaining after whole fish have been sent for other uses, and from whole fish that is not marketable for human consumption or canning.

The fishmeal industry is considered a surplus industry, which depends to a large extent on the capacity of the canning industry. It constitutes, some times, the sole outlet for landings especially in the following circumstances:

i) excess of supply over the canning capacity;

ii) lack of sufficient freezing and refrigeration facilities,

iii) bad quality of fish due to improper handling and transportation on board, and

iv) insufficient canning structures as in the case of Laayoun where more than 70 percent of the production are destined for reduction though being of good quality.

The industry was, until recently, concentrated in the Safi-Agadir area. Only with the considerable landing in Tan Tan and Laayoun, located in the south, a real expansion has taken place in this area - near these new landing centres - over the last decade.

Traditionally fishmeal was exported to the European countries. This export has been suspended due to the sharply growing demand in the domestic market, particularly for the formula used as chicken feed. The fishmeal consumed in Morocco is used as a high protein supplement in animal feed, particularly for poultry. The draught the country has known these last years in that the livestock is fed fishmeal instead of maize, also enhances demand for the fishmeal. A dozen of firms are now specialised in the animal feed and can absorb the entire national production.

The produced fishmeal varies in protein content. Three grades are recognised: the top grade with 65 percent protein; second grade with over 50 percent protein and third grade over 45 percent. The price varies consequently. Two factors are identified as being the main causes off these differences, mainly factory conditions and raw material composition. In fact, the small plants use simple technology and produce low quality meal, while the largest are equipped with modern technology capable of getting higher meal. As for specific composition of the raw material, the fishmeal obtained from the sardines is more appreciated than that derived from other species.

Conversely, the canning industry, where the cost of raw material represents less than 20 percent of the overall costs, fish is the most important component in the cost structure to produce fishmeal, accounting for more than 60 percent of the total production costs.

FIGURE 5: FISH ALLOCATED TO REDUCTION 1990-2001

5. OTHER PROCESSING FORMS

The salting industry is located in the north of the country - 32 plants are recorded. The production level depends on the anchovy landings. This species is currently highly demanded in the domestic market in fresh form, which posed a problem for feeding the salting plants. The tendency is to fill the shortage by imports.

6. FISH TRADE

6.1 Import

Morocco, being an important fish producer, imports very little. The imports are limited to very luxurious products, such as smoked products and very valuable species.

6.2 Export

Fish export has been steadily expanding in the last years to exceed the billion DH in 2000. Over the last three years, foreign exchange earnings from marine products export have shown a remarkable growth, increasing by 32 percent in volume and 54 percent in value as against the Moroccan total exports.

Records from the OC estimated the total gross weight of fish (all species mixed up) exported in 2000 from Morocco amounted to 318 652 tonnes for a value of more than one billion DH. A slight drop occurred, however, in 2001 both in volume and value.

The structure of fish exports have changed substantially over the past two decades, indicating a growing share of the crustaceans and molluscs, and a diminishing role of fishmeal and oil, while the export of canned products witnessed a remarkable stagnation.

|

TABLE 3: AVEARGE PRICE BY PRODUCT BY REGION |

|||||||

|

|

Frozen |

Canned |

Fishmeal |

Fresh |

Oil |

Salted |

Semi |

|

CEU |

37.77 |

24.27 |

5.34 |

31.69 |

21.16 |

25.78 |

45.32 |

|

OEC |

19.56 |

22.60 |

5.28 |

113.18 |

12.88 |

|

55.21 |

|

Asia |

40.49 |

26.54 |

9.49 |

103.92 |

|

146.50 |

83.00 |

|

M east |

7.59 |

19.88 |

5.41 |

8.28 |

|

|

70.00 |

|

America |

10.44 |

26.45 |

|

24.80 |

|

96.75 |

57.39 |

|

Africa |

6.93 |

19.24 |

8.81 |

7.14 |

2.36 |

|

12.00 |

|

Magreb |

13.30 |

15.77 |

|

|

|

|

|

|

Oceania |

|

19.26 |

|

|

|

|

51.73 |

Crustaceans and molluscs

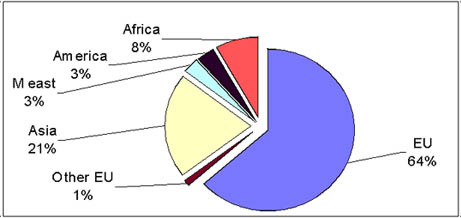

Crustaceans and molluscs emerged as the main exported commodities. Their share dominates in the export trade of marine products in volume and value, and are accounting for about 63 percent in terms of value of the overall marine product exports.

Octopus and cuttlefish from the high seas are destined almost entirely to the external market, with Japan as the leading market. As for squid, about 48 percent are exported to Japan; the remaining is exported to the European countries. Generally Spain constitutes the main outlet for squid landed by the coastal fleet, and Japan for that landed by the high seas fleet. Together these two countries absorbed more than 80 percent of these species landings.

Cephalopod prices vary according to the size and fluctuate in relation to the supply, and demand for any particular size range at given time. There are 12 size rages for octopus, three for cuttlefish and three for squid.

Fresh and frozen fish

Fresh fish recorded also a slight increase compared to the previous year. Spain remains the principal market for these species followed by France and Italy for frozen fish. Fish destined are washed, cleaned and graded for size. Generally, no heading is carried out and only the larger fish is eviscerated. After cleaning, most of the fish is packed in coated corrugated cardboard cartons of polyester boxes, which provide some insulation. These varieties do not meet any problem for their marketing.

Processed fish

The pelagic fish industry is virtually completely geared towards exports. Only 10-15 percent of the national production is sent to the domestic market.

During the campaign, the industry packed cartoons of canned sardines using several sizes with the most popular is ¼ club 30 of 125 grams. This corresponds to 69 277 tonnes of final products in 2000 which, in turn is the equivalent of almost 100 thousand tonnes of processed fish. It should be noted that over this period exports of canned fish have evolved in a margin of 10 percent. In 2000, 69 277 tonnes were exported.

Morocco’s canning exports depend heavily on the trade in canned sardine, directed chiefly towards European countries, Africa, Middle East, America and Oceania, with the European as the leading import market. The European countries accounted for more than 40 percent of the total canned product exports. This market is definitely the largest and most lucrative one. Among these countries, France has remained the most important buyer of Moroccan products, next came Africa which bought 37 percent in volume, but only 32 percent worth of the total exports value.

The importance of fishmeal has dropped during the 1990s because of the development of the domestic demand, supporting a growing poultry industry. The trend is completely reversed the last three years and the exports of the commodity are steadily growing to become the third after the canning and the frozen fish in volume.

FIGURE 6: STRUCTURE OF MOROCCAN FISH EXPORT BY REGION

7. CONCLUSION

Fishery landings more than doubled in 10 years. The growth is, however, mainly limited to low-value species, highly variable stocks of pelagic fish, whereas the general demersal species have been fairly stable, if not in decline over the years.

Although all the factors affecting the consumption level such as the price of meat and the urbanisation of the society, the development in consuming habits are developing in the sense to increase the consumption of fish in Morocco, the national consumption per capita is still very low. The growing demand is hindered by a limited demersal supply and an increasing and lucrative export sector, particularly of crustaceans and molluscs. Consequently, fresh consumption is switching to low value pelagic fish for want of availability of white fish at a reasonable price, and therefore providing tough competition for the processing industry for the same raw material.

The international markets offer good prospects. The foreign demand for fresh and frozen fish and shellfish is increasing because of the high disposable income in developed countries.

Cephalopods are not a popular consumption item among Moroccans. The domestic demand accounts for only a very negligible proportion as the products are more expensive than ground fish. The prospective growth of the national production market depends on the evolution of these export markets, but also on the state of the resources.

Hence, international trade is a benefit and a drawback. If it is hindering an important contribution of the fishery industry to the national food security, it helps however and in large measure, a large population of fishermen and people involved in the industry to prosper. On the macro-economic level, the fish exports improve the balance of trade.

Main prerequisites for optimising the contribution of the fishery to the national food security are:

Management of the resource in order to ensure a sustainable harvest and supply for food for domestic consumption and for earning of foreign exchange.

The global vision of the marketing of the fishery. Investments should be done in storing, transporting processing and financing and the quality of fish and consequently the net return from its exploitation depend on all these links on the same equal footing.

Restructuring of the processing industry and modernisation of the industrial fleet.