Objective:

To help people prepare a cash flow budget. This is the most important and most useful part of any business plan. It is the most important tool for anyone wanting to manage money better.

Method:

1. Use the forms provided to help the person produce time plans for the production and marketing of their new product or service.

2. Then help him/her complete a cash flow budget following the guidelines given below.

Copies of the forms can be found at the end of this section.

Hint: USE A PENCIL AND HAVE AN ERASER HANDY!

Completion notes:

a. Decide on the best time frame for the time plans and budget - how many weeks or months are going to be planned and what the starting point is. Write in the names of the months on the forms you are going to use. Keep reminding the person as you work that you are talking about this real period of time so if they say something will happen in May, it really should be expected to happen in May.

b. Start with the time plan for production. Fill in the tasks that must be done in each month of the plan period - some may be blank. Then discuss what must be bought in each month and the expected price of the items. Fill this information in.

c. Now complete the time plan for sales. First, work out the expected output from the new enterprise. There may be just one new product, e.g., bean seed or there may be two or three products, e.g., different types of vegetables or tree seedlings. Work out total production, e.g., in kg, expected in the plan period, how much might be kept and how much will be sold. If it is a processing activity, work out how much will be processed each week and month. Finally work out the monthly pattern of sales, entering the quantities to be sold and the price expected per kg or item. Check that the monthly quantities add up in total to the same amount you estimated would be sold in the plan period.

Now you can move on to the main cash flow.

Start with money coming in:

d. Identify and note all the sources of income the person or household has in the left hand column. These should be the same as those entered on the business plan form. Include the new income-generating project.

e. Gradually, month by month, fill in what cash inflow the person expects from each source. Remember you are only concerned with cash and when it will be received. For traded goods, you can arrive at the estimated cash inflow by multiplying the estimated quantity to be sold by an estimated price. Otherwise just guess the amount. Use the time plan for sales to estimate the income from the new activity.

f. Be realistic! Prepare or refer to a cash flow tree or seasonal pattern diagram of income and expenditure if it helps.

g. Total the money coming in each month.

Now do money going out:

h. Take each income-generating activity in turn and identify the inputs that have to be bought, listing them under business inputs in the left hand column.

i. Then list any capital items - machinery, equipment or buildings - that are to be purchased during the budget period.

j. Gradually, as you did for income, fill in the money to be spent on each item in the month when the transaction will occur. You will normally arrive at the figure required by estimating quantities needed and multiplying by an estimated price. This information for the new activity is on the time plan for production.

k. When you reach the space for home and personal expenditure, it is important to include a realistic estimate of the amount of money that is required for such spending each month. You must get the person to guess a figure and remember to include school fees and other occasional amounts. It may be worth stopping to work out a list of items that are bought each day or each week and trying to build up a more accurate figure. It is very easy to underestimate this item.

l. Total the money going out each month.

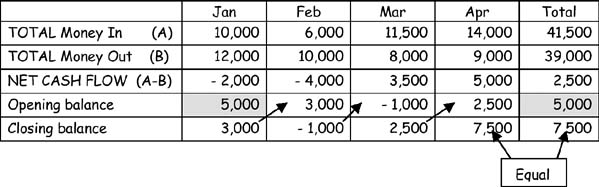

m. The next step is to work out the net cash flow for each time period in the budget by subtracting the total money going out from the total money coming in. It may be a negative or positive figure.

n. The final step is to enter the opening cash balance that the person expects to have on the day the cash flow plan starts. Tell them that a business person always has something in hand! It may only be Br50 but it must be entered.

o. Then calculate the closing balance for the first month by subtracting the net cash flow from the opening balance. Take care when working with a mixture of positive and negative figures.

p. Transfer the closing balance for the first month to the opening balance of the second month and subtract the net cash flow from it to get the next closing balance.

q. Repeat this process across the budget.

r. In the total column you must once again enter the opening balance that you did at the start of the plan. (See shaded figures below.) When you subtract the total net cash flow from this you should arrive at the same closing balance as at the end of the last month.

This is how the calculations of opening and closing balances are done:

Remember when you are helping someone prepare a cash flow, you must do it in constant discussion with the individual or family concerned. All points should be explained and if necessary the information should be displayed on a large sheet of paper. The intention is that the people involved can prepare their own cash flow budget one day.

You should never take the budget away with you without making a copy that will remain with the person or family. It is their budget, not yours.

Discussion points:

The pattern of net cash flow and closing balances should be reviewed. If there is a negative closing balance in any month, something has to be done about it as it is not possible to have negative savings! The family will have to plan to get extra income in that period, e.g., by doing casual work or selling livestock, or they may decide they have to borrow money to cover the deficit. Another strategy is to change the pattern of input purchase. After discussing all this, modify the budget to include the extra income or loan or changed buying pattern.

If the closing balance is increasing, point out that this means they will be building up savings and they will need to decide if they are going to keep the money or use it.

Ask “what if?” questions, e.g., what if the price is lower than you expect or what if the yields are lower than anticipated? The whole point of planning is to be prepared to deal with changes and problems if they arise. Do they know how they would cope?

If they want to apply for a loan, work out what amount would be necessary to help them execute their plan successfully. Thus, if there is a maximum closing balance deficit of say Birr 980, then a loan of this amount should make the plan workable. Check this by entering the amount in the loan section of the required month and recalculate the closing balances.

If a loan is to be considered, it is necessary to work out when repayment is possible and if interest charges and fees can be met. You can do this by looking at the closing balances each month and deciding when there is a sufficient positive balance to enable repayment in total or in part. Write proposed repayments in the relevant months of the loan section and recalculate the closing balances to see if the plan is still OK.

Help the person complete a loan application form if appropriate.

INCOME-GENERATING PROJECTS

|

TIME PLAN FOR PRODUCTION INPUTS |

Plan period: from _____________ |

to _____________ |

List expected tasks in each month

|

Month: |

Month: |

Month: |

Month: |

Month: |

Month: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List input requirements for each month:

|

Item |

Price / unit |

Item |

Price / unit |

Item |

Price / unit |

Item |

Price / unit |

Item |

Price / unit |

Item |

Price / unit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List expected tasks in each month

|

Month: |

Month: |

Month: |

Month: |

Month: |

Month: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List input requirements for each month:

|

Item |

Price / unit |

Item |

Price / unit |

Item |

Price / unit |

Item |

Price / unit |

Item |

Price / unit |

Item |

Price / unit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIME PLAN FOR SALES |

Plan period: from _______________ |

to ______________ |

OUTPUT INFORMATION

Seed production, crop production, sheep, poultry, tree nursery, etc.

|

Product ® |

|

|

|

|

Estimated total production during this plan period |

|

|

|

|

Amount(s) retained for next production cycle if any, e.g., as seed |

|

|

|

|

Amount to be sold |

|

|

|

Processing activities, e.g., grinding mill, oil press

|

|

Each week |

Each month |

In which months? |

|

Quantity that will be processed |

|

|

|

List amounts to be sold each month of the plan period and expected price that month. Remember that prices may change through the year.

|

Month: |

Month: |

Month: |

Month: |

Month: |

Month: |

||||||

|

Amount |

Price / unit |

Amount |

Price / unit |

Amount |

Price / unit |

Amount |

Price / unit |

Amount |

Price / unit |

Amount |

Price / unit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month: |

Month: |

Month: |

Month: |

Month: |

Month: |

||||||

|

Amount |

Price / unit |

Amount |

Price / unit |

Amount |

Price / unit |

Amount |

Price / unit |

Amount |

Price / unit |

Amount |

Price / unit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: ______________________________ |

CASH FLOW BUDGET |

Year: ___________________ |

|

MONEY COMING IN |

Month: |

Month: |

Month: |

Month: |

Month: |

Month: |

Total |

|

Sales of: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Wages |

|

|

|

|

|

|

|

|

Other sources: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

MONEY GOING OUT |

|

|

|

|

|

|

|

|

Business inputs: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Capital items: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Home / Personal items |

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

NET CASH FLOW |

|

|

|

|

|

|

|

|

Opening balance |

|

|

|

|

|

|

|

|

Closing balance |

|

|

|

|

|

|

|

|

+ Loan |

|

|

|

|

|

|

|

|

- Loan deposit / fees |

|

|

|

|

|

|

|

|

- Loan / interest repayment |

|

|

|

|

|

|

|

|

New Closing balance |

|

|

|

|

|

|

|