Looking into the medium-term future, the biofuels "gold rush" could be one of the major factors affecting agricultural commodity prices and rural incomes in Asia. This section discusses recent developments in the trends and stability of commodity prices; the status of biofuels development in the region; the possible effects of biofuels on national incomes, energy security and the environment; and whether and how biofuels production should be subsidized. The subsequent section examines the potential effects of biofuels demand on household food security in Asia.

Recent trends in commodity prices

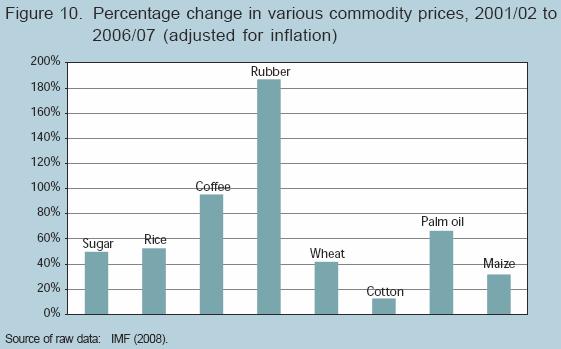

Commodity prices have increased sharply during the past few years (see Figure 10). It is important to realize, however, that not all of the recent increases in commodity prices over the past few years are because of the demand for biofuels. First, higher oil prices lead to higher costs of food production (fertilizer and machinery), which in turn lead to higher food prices even in the absence of a demand for biofuels.

Second, demand for maize is increasing independently of its use as a feedstock for ethanol. As consumers in China, India and other rapidly developing countries gain more income, they shift diets away from cereals toward livestock products that use substantial quantities of maize as feed. Because it requires several calories of grain to produce just one calorie of meat, an increased demand for meat means a substantially increased demand for grain.

Third, some of the increases in commodity prices are a result of exchange rate movements, specifically the weakening of the US dollar. A weak US dollar leads to increased commodity demand (at any given US dollar price) from countries whose currencies have appreciated (e.g. the Indian rupee, the Thai baht), because it is cheaper in domestic currency terms to buy the commodity. A weak US dollar also leads to an inward shift of the supply curve as farmers in countries whose currencies have appreciated now receive fewer units of domestic currency (again, at any given US dollar price) per unit produced. The shift in both demand and supply leads to higher commodity prices (as measured in US dollars). This theory is borne out by historical experience. For example, the weak US dollar in the mid to late 1980s led to increased commodity prices at that time.

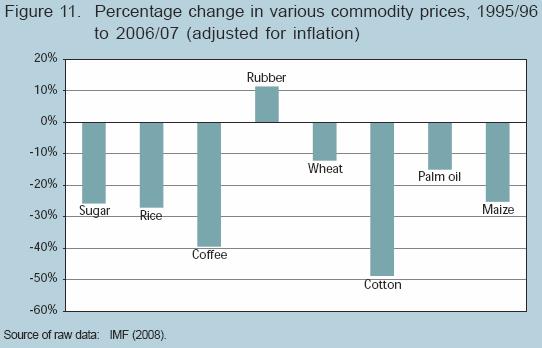

Fourth, some of the recent increases in commodity prices are just the recovery from low prices in the past. Low prices in the first years of this decade discouraged farmers from planting, and this negative feedback on production has contributed to higher prices at present. Indeed, commodity prices in 2006/07, after adjusting for inflation, were still lower than they were during the previous peak in 1995/96 for most commodities (see Figure 11). In turn, the relatively high prices of the past few years have contributed to higher cereal production; FAO (2007c) estimated that world production of coarse grains and rice both hit record highs in 2007, although wheat production remained below the levels in 2004 and 2005.

Although the factors discussed above are medium to longer term in nature, some of the recent price increases may be a result of very short-term considerations. For example, despite the development of improved inventory management techniques during the past decade, the current low level of cereal stocks may create more uncertainty and make the markets more susceptible to very short-term supply shocks. This tendency may be exacerbated by increased participation of speculative investors (e.g. hedge funds) in commodity markets. Such trends should not lead to permanently higher prices, although they can lead to increased price volatility.

Finally, the demand for biofuels has also contributed to the upward pressure on commodity prices. More than half of the 2007 increase in world corn production, for example, will be utilized for higher ethanol production, limiting the ability of the increased supplies to help contain international prices (IMF, 2007). This leads to an obvious question: what will be the impact of increased biofuels production on international commodity prices in the future?

Future trends in commodity prices

Long-term projections are notoriously difficult to make. Ex-post validation often shows large deviations between projected prices and actual prices. Commodity price variability from year to year complicates such validation; for example an incorrect projection for 2025 may be correct in 2035. Finally, those who make projections emphasize that projections are different from forecasts, and are simply estimates of what prices would be if the structure of their model is correct (a distinction often lost on many users of the projections). Despite these difficulties, such projections are still useful, and several research institutes make such projections.

The International Food Policy Research Institute (IFPRI, 2007), using its IMPACT model, has constructed two scenarios for possible future biofuel development. One scenario is based on the actual biofuel investment plans for countries that have such plans, as well as assuming that high-potential countries will also develop this sector in the near future. Under this scenario, maize prices are expected to be 26 percent higher in 2020 relative to a baseline scenario, whereas oilseed prices would be 18 percent higher. Under a more aggressive biofuel development scenario, where biofuels production levels are double those in the first scenario, maize prices would increase 72 percent relative to the baseline, whereas oilseed prices would increase 44 percent. Calorie consumption in Asia would be reduced by approximately 2 to 4 percent under the two scenarios and this would constitute a substantial reduction for the poor. Thus, biofuel development will have potentially large effects on food security (see the next section for more discussion).

Naylor, Liska et al. (2007) list several other long-term price projections, and note that the estimates from the various studies are quite variable. Projections for corn prices, for example, range from a 2.5 percent increase (by 2014) to a 65 percent increase (by 2016). The ultimate realization is very difficult to predict and will depend on many factors, including the development of technologies that can profitably use lignocellulosic feedstocks, the fate of Conservation Reserve Program (CRP) land in the USA and set-aside land in Europe, the time path of oil prices, and many other factors.

How will biofuels demand affect price stability on international markets?

As pointed out by Schmidhuber (2007), an increased demand for biofuels is likely to create closer integration between energy and food markets. If oil prices are relatively stable, then the links between these markets may create long-term stability in food markets. For example, if agricultural commodity prices rise, these rising feedstock prices will eventually make biofuels production unprofitable because feedstock costs are an important component of biofuels production costs. The contraction of demand for biofuels feedstock will then help to place a ceiling on agricultural prices. Conversely, if agricultural commodity prices decline, the rising profitability of biofuels production will increase demand and help to provide a price floor. This price corridor will narrow the range of volatility of agricultural commodity prices in the long term, although it will be less relevant in the short term because of transaction costs and time lags in expanding or contracting biofuels production capacity.

The scenario is quite different, however, if oil prices are themselves unstable. A look at the empirical evidence shows that oil prices have exhibited greater volatility than cereal prices at both monthly and annual frequencies (Table 1). The relative lack of integration between oil markets and agricultural commodity markets in years past meant that fluctuations in oil prices had relatively little effect on food price instability. Now, however, even if a demand for biofuels creates a price corridor for agricultural prices, this corridor will itself be fluctuating as oil prices fluctuate. In this case, the greater integration between oil prices and agricultural commodity prices is likely to result in more pronounced price instability for cereal grains.

Table 1. Volatility of real (inflation-adjusted) commodity prices, 1990 to 2007 (percent)

Commodity |

Annual |

Monthly | ||

CV |

DLMA |

CV |

DLMA | |

| Petroleum | 47 |

21 |

46 |

19 |

| Sugar | 29 |

20 |

33 |

19 |

| Rice | 24 |

14 |

25 |

11 |

| Wheat | 21 |

15 |

24 |

14 |

| Maize | 22 |

14 |

24 |

13 |

| Palm oil | 28 |

25 |

30 |

20 |

| Soybean oil | 21 |

16 |

22 |

14 |

| Sunflower oil | 24 |

21 |

24 |

17 |

| Sorghum | 19 |

13 |

22 |

13 |

| Rubber | 37 |

26 |

36 |

19 |

| Note: CV is the coefficient of variation. DLMA is the average absolute value (over time) of the percentage change in the annual or monthly price from a two-year lagged moving average. Source of raw data is IMF (2008). | ||||

Over the last five years many Asian nations have started establishing national biofuels plans and strategies in order to provide a strategic and regulatory framework for the development of their biofuels industries. China and India, with their increasing influence on the international energy market, are in part responsible for driving the transformation of the global energy system by their sheer size and growing share in the fossil fuel trade. Based on current policies and trends, almost half of the growth in world energy needs from now until 2030 would be attributable to these two countries alone (IEA, 2007). Thus, biofuels developments in Asia could have an important impact on world energy and agricultural commodity markets.

China imports 45 percent of its crude oil from foreign sources, and it is expected to become the world's largest energy consumer after 2010. Its demand for transport fuel is expected to quadruple by 2030 as a result of an anticipated sevenfold expansion of the vehicle fleet (IEA, 2007). With this large demand in mind, China plans to produce about 6 million tonnes of ethanol by 2010 and 15 million tonnes by 2020, as well as 5 million tonnes of biodiesel (China Daily, 2007). But food security is also an important concern, and as of 2007 the government will not allow any expansion of ethanol production that uses staple grains such as maize. Sugarcane, sweet sorghum, cassava and rapeseed are being considered as alternative feedstocks. China is also looking at the possibility of investing in feedstock production in other countries in Southeast Asia, such as cassava in Lao PDR (Naylor, Liska et al., 2007).

India's net oil imports are projected to be as high as 6 million barrels per day in 2030, which would make it the world's third largest importer of oil (IEA, 2007). Concerned about this growing dependence on imported fuels, India's evolving strategy for the promotion and production of biofuel use is based on promoting the use of ethanol derived from sugar molasses for blending with petrol as well as the use of non-edible oils for blending with diesel. In 2006 the government mandated 5 percent blending of ethanol with petrol, subject to commercial viability, in 20 states and seven union territories. This would entail 550 million litres of ethanol use. In the third phase, when the policy applies to all states, the blend ratio is set to be raised to 10 percent. Sugar mills are also able to get subsidized loans for the construction of ethanol plants (USDA, 2007a).

Biodiesel policy in India is based primarily on promoting plantations of jatropha on wastelands. The Planning Commission has earmarked 11.2 million hectares of wasteland to be planted with jatropha by 2012 in order to produce sufficient biodiesel to blend at 20 percent with petrodiesel. In 2005 the government announced a biodiesel purchase policy and price (currently Rs. 26.5 per litre); it is insufficient to cover the cost of production, however, and so has not attracted any sales yet. Even though the central government has exempted biodiesel from the central excise tax, the state governments do not provide any exemptions for biodiesel or biodiesel blends.

Indonesia adopted a National Energy Policy in 2006 that stipulates blending guidelines of 2 percent biofuel mix from 2005 to 2010, increasing to 5 percent by 2016. Some 3 million hectares of palm oil plantations and 1.5 million hectares each for jatropha and cassava have been allocated in support of the new policy (Kleffman Research Pacific, 2007). These plans are supported by incentives to develop biofuels from palm oil and by January 2007 as many as 59 corporations had concluded agreements for the manufacture of biofuels. However, food security is of concern, and sharp increases in cooking oil prices led the government to implement a progressive export tax on crude palm oil that can reach as high as 10 percent (Commodity Online, 2007). Plans are also being considered to reserve a minimum quantity for the domestic market (Naylor, Liska et al., 2007).

Malaysia, which has large oil palm resources, has adopted a National Biofuel Policy to promote the use of B5 (5 percent biofuel content) for the transport and industrial sectors. By August 2007, some 92 biodiesel plants had been licensed with a capacity of 10.29 million tonnes, but only seven plants were in operation because of increases in the price of crude palm oil. Some 120 000 tonnes of biodiesel were exported between August 2006 and July 2007, mainly to the European Union and the USA.

Thailand has also assigned priority to biofuels development because of its dependence on fossil fuel imports and its significant agricultural resources. It has mandated use of B2 in 2008 and is aiming for use of B5 by 2011, using palm oil as the source of biodiesel. The government has also reduced fuel taxes (and thus retail prices) for gasohol (E5, 5 percent ethanol content) in order to encourage consumers to substitute away from premium gasoline. Sugarcane, molasses and cassava are the feedstocks for ethanol production. As of the middle of 2007, there were seven ethanol plants in operation producing about 545 000 litres per day (operating at about 60 percent capacity utilization). Six of these plants use molasses as feedstock, with the other also using sugarcane. However, several plants using cassava as feedstock are now operational, or are expected to be so by the end of 2008 (USDA, 2007b). The Royal Thai Government is conducting research on improved cassava varieties that have higher starch content and/or shorter duration (so that cassava can fit into a rice-cassava rotation). The government is also supporting extension projects to help farmers learn more about the possibilities of growing cassava for ethanol production.

The Philippines' plans for biofuels are based on its major coconut plantations. The Biofuels Act of 2006 mandates a gradual increase in the use of biofuels from 1 percent in 2006 to 2 percent in 2008, rising to 5 percent in 2010 and 10 percent from 2012 onwards. The government also plans to plant jatropha on 700 000 hectares, most of it in the poor Mindanao region. The recent opening by Ford of the first flexible fuel engine manufacturing plant in Southeast Asia may contribute to the use of biofuels in the country. However, a review of the Biofuels Act and its mandates is being undertaken in light of recent research casting doubt on the positive climate change contributions of biofuels (see below).

The key commodities affected by the biofuels movement in Asia are palm oil, maize, sugarcane, soybean, cassava and coconut oil, and it is clear that the Asian region has tremendous potential for increased biofuels production, especially biodiesel. It seems politically likely that biofuels production will continue to grow given the existing investments in plant and equipment.

National incomes

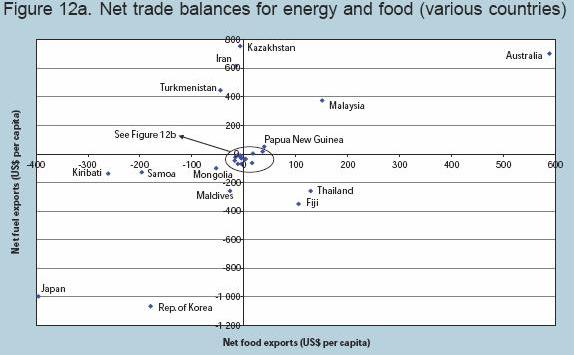

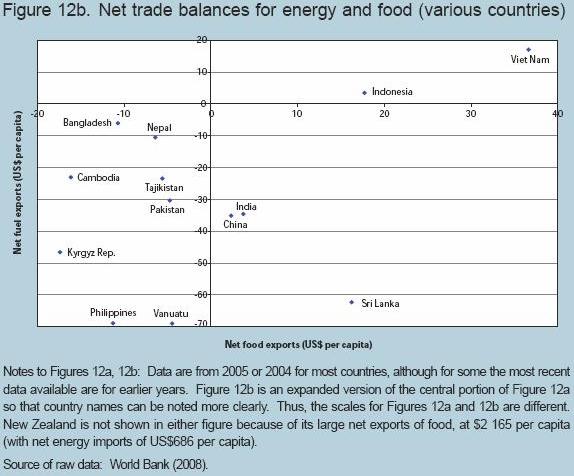

Schmidhuber (2007) simulated the net trade status for energy and agriculture at various levels of the oil price and plotted the trade in US$ per capita on scatter diagrams. In that spirit, Figures 12a and 12b show the actual (not simulated) net trade status for energy and food in per capita terms using the most recent trade data available. Several countries in the region are net exporters of food and energy. Australia and Malaysia are large net exporters of both, whereas Indonesia, Papua New Guinea and Viet Nam are minor net exporters of both. These countries stand to benefit the most in terms of national income from the biofuels boom.

Half of the countries in the region are net importers of both food and energy, with Japan and the Republic of Korea having the largest import bills per capita. But these two countries are relatively wealthy, and will have an easier adjustment than many of the other countries that import both food and energy. Some of the region's poorest countries, such as Bangladesh, Cambodia, Nepal, and Pakistan, fall into this category. The remaining countries export either food or fuel, but not both. Whether they gain or lose will depend on the relative size of their food and energy trade balances.

Energy security

Perhaps the main motivation of many governments for pursuing biofuels production is the potential for enhanced energy security. Given the importance of oil in energy consumption, the fact that three-fourths of the world's proven oil reserves are in just seven countries, namely Iran, Iraq, Kuwait, Russia, Saudi Arabia, United Arab Emirates and Venezuela (Naylor, Liska et al., 2007), and the persistent volatility of world market oil prices, concerns over the reliability of future supplies are well founded.

Given the size of the world energy market, further development of biofuels is unlikely to make many energy importers self-sufficient in energy unless they are already close to self-sufficiency. For example, Rajagopal and Zilberman (2007) calculate that even if 25 percent of the world's current annual production of sugarcane, maize, wheat, sorghum, sugar beet and cassava was used for ethanol production, it would still account for just 21 percent of petrol demand (which is in turn just a fraction of total energy demand). Future energy self-sufficiency will be even more difficult to achieve because energy demand grows rapidly with income and is growing more rapidly than production of these major crops. It is also not clear that it would be politically feasible for many countries to shift such a large share of domestic food production into biofuels.

Increased energy security will be especially difficult to achieve for countries that are both net food importers and net energy importers. If a country is already importing food and diverts domestic food supplies to biofuels production, then it will simply be a matter of replacing oil imports with more food imports. This could be advantageous, however, to the extent that world food markets are more stable than world petroleum markets.

There is no denying however, that at the margin, increased biofuels production can improve energy security for many countries, and this is a goal worth pursuing. Even if energy self-sufficiency is not achieved, a diversification of energy sources will be helpful. There are, however, potential costs in terms of the environment and household food security that should be considered before pursuing improved energy security.

Environment

Initially, biofuels were widely seen as having the potential to reduce greenhouse gas (GHG) emissions relative to the combustion of fossil fuels. Given the concerns over global warming, this is an important benefit. Subsequent research, however, has cast doubt on the magnitude of these benefits. Life cycle analysis that considers not only the direct emissions from burning of the fuel but also the indirect emissions coming from the use of fertilizer, irrigation water and other inputs used in the production of the biofuel feedstock have found that the net reduction in CO2 emissions is much less than previously thought. Furthermore, recent research suggests that the N2O (a greenhouse gas that is more potent than CO2) emissions from the cultivation of certain biofuel feedstock crops (e.g. bioethanol from maize, biodiesel from rapeseed) may contribute more to global warming than the cooling achieved by reduced combustion of fossil fuels (Crutzen et al., 2007). Thus, it is not clear whether biofuels will reduce or exacerbate global warming. What is clear is that different crops will have markedly different impacts.

However, changes in GHG emissions are not the only effect of biofuels on the environment. One of the most serious concerns in the Asian context is that biofuels production will lead to further deforestation, which will release sequestered carbon into the atmosphere and cause loss of biodiversity because of habitat destruction. Depletion of water resources will be of concern whenever new land uses increase evapotranspiration. Agrochemical pollution is a concern when biofuels feedstock is grown under input intensive conditions, as is often the case today. Even if production shifts to more marginal lands, there will still be potential problems with soil erosion, although in some cases cultivation on marginal lands might regenerate vegetative cover (e.g. jatropha). Finally, the burning of supposedly clean bioethanol may cause problems for human health (e.g. respiratory problems) even if GHG emissions are reduced (Rajagopal and Zilberman, 2007). Scharlemann and Laurence (2008) cite a recent Swiss study by Zah et al. which estimated that the total environmental impact of using almost any biofuel produced from crops was worse than the environmental impact of low sulphur petrol.

More research is clearly needed so that we can better understand the complex environmental effects of increased biofuels production. Unfortunately, much of this research will need to be location specific since agricultural production occurs within a very heterogeneous set of environments (e.g. irrigated versus rainfed, different intensities of fertilizer use). This fact will make the research agenda substantially more challenging.

Second-generation biofuels that use lignocellulosic feedstock seem likely to have much fewer adverse environmental impacts, but such technology seems unlikely to be in wide commercial use for at least the next ten years (Naylor, Liska et al., 2007).

Some Asian farmers, when first exposed to semi-dwarf modern rice varieties, were not convinced that higher yields would be forthcoming because the plants were so short. After all, they reasoned, how could a short plant yield more than a tall plant? (The farmers were unaware that the short stature of the plants was a structural advantage that enabled them to hold more grain without falling over). Other Asian farmers, when first introduced to nitrogen fertilizer, were happy to receive free fertilizer because they could put the free sack to good use (many of them simply discarded the urea inside). In situations like these, legitimate arguments can be made for the temporary use of subsidies or price supports to overcome incomplete information. Furthermore, the very first modern rice varieties were quite susceptible to pests and diseases, entailing more risk for farmers who planted them (although these problems have been overcome and modern varieties now have more stable yields than traditional varieties). Again, there is a rationale for using subsidies when financial markets are imperfect, as was the case in nearly all Asian rural areas 40 years ago.

In terms of producing biofuels feedstock, however, it is hard to make similar arguments today because biofuels production from sugarcane, maize, cassava or palm oil does not depend on fundamentally new crops or varieties. One key exception might be jatropha, but even here many farmers are familiar with it as a fencing material, a source of lighting oil or as a medicinal plant. Even if it does make sense to distribute jatropha seeds widely and at low cost, it is important to note that providing such subsidies is only sensible if the costs of growing jatropha will eventually be less than the benefits when the subsidies are withdrawn, with the assessment being made in farmers' fields and not on experimental stations. If the costs will always be more than the benefits on the farm, then the money spent on subsidies could be better used elsewhere, e.g. for improving education or infrastructure. It is also difficult to argue for subsidies for large factories that produce biofuels since these investors should be well aware of relevant information and the risks involved.

There may be a role for government intervention in establishing the necessary infrastructure to transport biofuels from production points to retail distribution outlets, e.g. petrol stations. A recent study found that, in the USA it cost $0.13 to $0.18 to transport a gallon of ethanol fuel from refinery to service station, compared to just $0.03 to $0.05 per gallon of petroleum fuel (Kleffman Research Pacific, 2007). Construction of such infrastructure can arguably be left to the private sector, which is being increasingly relied upon for building roads and telecommunications networks. But there may be some role for government to set standards in terms of mandatory blending ratios to overcome coordination problems and help ensure that a viable market will exist in the future, thus providing incentives to the private sector to construct the required infrastructure. Again, however, the advisability of such interventions is contingent upon biofuels production being competitive and profitable at realistic levels of oil prices and feedstock prices.

Environmental benefits that are not priced in the market (externalities) also provide a potential rationale for government subsidies. However, once externalities other than GHG emissions are taken into consideration (e.g. deforestation, soil erosion), it is not clear that the net environmental benefits of biofuels are positive, so subsidies for environmental reasons may be difficult to justify at present. Energy security is also a potential rationale for subsidies or protection, although it is difficult to quantify this benefit.

Developing countries may want to consider postponing the use of subsidies in order to wait and learn more about developments in the commercial viability of biofuels production from lignocellulosic feedstock (second-generation biofuels), which could be substantially more efficient and will utilize different feedstocks such as switchgrass and miscanthus. Such a strategy could reduce the risks of getting locked into a technology that might soon be obsolete, or of producing a new crop such as jatropha that takes several years to mature but might then turn out not to be competitive as a source of energy.

However desirable biofuels may be in terms of energy security, consideration must be given to the adverse effects on food security for the poor (see the section below). The best way to avoid hurting the poor is to increase investment and productivity in agriculture in order to reduce production costs per tonne of food produced, thus lowering prices for consumers and increasing profits for farmers (Dawe, 2007). For example, government investments in agricultural research can create flood or drought resistant seeds that will buffer farmers against the risks inherent in unfavourable environments, helping to increase productivity. New seeds for favourable environments are also important, as it will be difficult to feed growing urban populations and the rural landless without increased productivity in these areas that provide most of Asia's food supply. Government investment in rural infrastructure can increase farmer access to key inputs such as land, water, fertilizer and credit, and simultaneously increase the opportunities for selling into new markets, again helping farmers to increase productivity. Rural education will help future generations of farmers to take advantage of new technologies and markets. These investments in public goods are more likely to reduce poverty and increase national income than are subsidies for biofuels production.

In some respects, poor consumers and the emerging biofuel industry are competitors, and the profits of the latter may come at the expense of food security for the former. Yet these two groups both have a vested interest in low food prices. Feedstock costs are one of the largest cost components of biofuels production and already the USA ethanol industry and the Malaysian biodiesel industry are under pressure from higher maize and palm oil prices. For many poor consumers, higher food prices are a matter of life and death. Thus, both of these groups will benefit from increased investment and productivity in agriculture. Such investment will create a win-win situation for all whereas the failure to fund such investment will hurt the most vulnerable members of society.