No.3  July 2009 July 2009 | ||

|

Crop Prospects and Food Situation | |

|

Regional reviews

In North Africa, harvesting of the winter grains (mainly wheat and barley), which make up the bulk of the subregion's cereal crop, is underway and a good harvest is expected after two consecutive years of below average production. FAO's latest forecasts of the subregion's aggregate output of wheat (the main crop) is about 18.6 million tonnes, some 30 percent up from the previous year's level, while that of barley is put at some 5.5 million tonnes, about 138 percent up from 2008 and well above average. The outlook is particularly good in Morocco where a bumper crop is expected following exceptionally favourable weather throughout the winter cropping season. The wheat harvest is forecast at 6.5 million tonnes, 74 percent over last year's level and more than four times the poor crop harvested in 2007. The outlook is also favourable in Egypt, the largest cereal producer of the subregion, where wheat and maize output is expected to be similar to last year's average level. By contrast, a strong recovery in wheat production is not expected in Tunisia, in spite of government incentives to increase domestic production to mitigate the negative impact of high international prices on consumers. This is mainly a consequence of insufficient soil moisture at planting time, causing an area reduction. Although rainfall increased significantly at the end of the cropping season boosting yields, wheat output is provisionally estimated at about 1.19 million tonnes, some 8.5 percent below the average of the previous five years. The barley crop outlook is better with an above-average crop anticipated. The generally favourable crop prospects for 2009 combined with a significant decline in international commodity prices have been favourable in helping to reduce inflation and improve access to food in the subregion. In Egypt, the most affected country, where the year-on-year rate of inflation in urban areas reached 23.6 percent in August 2008 (up from 6.9 percent in December 2007), a downward movement was observed from September with inflation dropping steeply to 11.7 in April 2009. Inflation is driven mainly by price changes in the food sector where the year-on-year rate of inflation dropped from 30.9 percent in August 2008 to 13.8 percent in April 2009.

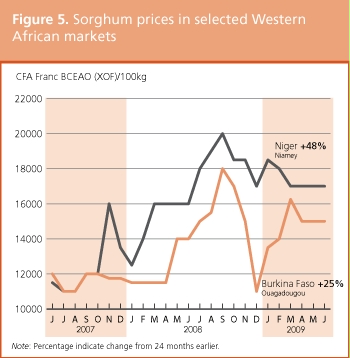

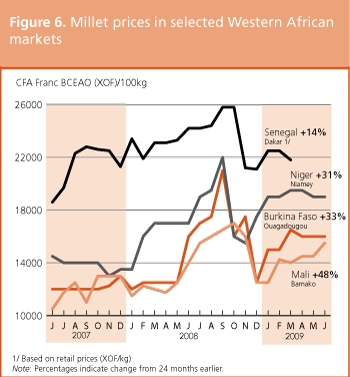

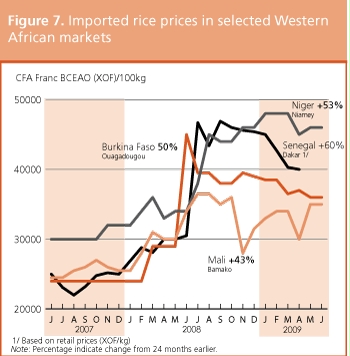

In Western Africa, the cropping season has been slow to start with erratic rains in several parts of the Sahel including Guinea-Bissau, southern Niger and Burkina Faso, northern Nigeria and southern Chad. Satellite imagery indicates that Northern Nigeria experienced the highest rainfall deficit which may have affected area planted and potential yield in that area. By contrast, in the southern part of coastal countries of the Gulf of Guinea, rains have been regular and widespread since the beginning of the main season in April and prospects for the first maize crop, to be harvested from August, are good in most countries, except in western Côte d'Ivoire where significant rainfall deficits have been reported. These trends are in line with the 2009 annual climate prediction exercise carried out by the African Centre of Meteorological Applications for Development (ACMAD) and the Agrhymet Centre in May. According to their forecast, there is an increased probability this year of normal to below-normal rainfall for the Sahelian region which receives about 80 percent of its annual precipitation in the July-September period. Specifically, the western part of the subregion including Mauritania, Senegal, the Gambia, Guinea-Bissau and parts of Guinea are expected to receive below-average rains in 2009. Coarse grains prices have shown signs of stabilising over the past few months but remained above the levels of a year earlier by June 2009 in most countries in spite of the good cereal crop gathered in the subregion in 2008. For example, in spite of a significant decline from their peak of August-September 2008, wholesale prices of millet in markets of Mali (Bamako) and Niger (Niamey) in June 2009 were still 11 and 12 percent respectively higher than in June 2008. By contrast, retail prices of millet in Senegal (Dakar) during the first quarter of 2009 were slightly lower than their year-ago levels. The different trends between the western and eastern parts of the subregion suggest that demand from the Nigerian food processing and poultry sector may be contributing to market tension in the east. In Ghana (Accra), the retail price of maize in June was 17 percent higher than one year earlier. A contributing factor for the price strength in the eastern part of the region is the demand from Nigerian food processing and poultry sector. Prices of imported rice, a major staple, also remain very high in most countries in spite of the fall in international prices. In Senegal prices of imported rice in April 2009 were still 33 percent higher than a year earlier in spite of the downward movement observed since the beginning of the year. In Ghana and Niger they were 23 percent and 35 percent higher respectively in June 2009 than a year earlier. By comparison, the export price of broken Thai rice in May 2009 was 59 percent lower than its year-earlier level. Rice price inflation in Western Africa has been fuelled to some extent by the steady depreciation of national currencies in response to the impact of the global economic crisis. Most currencies including the CFA (francophone countries), the cedi (Ghana) and the Naira (Nigeria) have depreciated substantially in recent months. These developments are likely to translate into continuously high rice consumer prices with negative impact on access to food, notably in import-dependent countries of the western part of the subregion.

In Cameroon and the Central African Republic, planting of the main maize crop for harvesting from July 2009 has been completed in the South. Satellite-based rainfall estimates indicate that the crops benefited from adequate rains, and early prospects are favourable provided normal weather conditions persist. By contrast, in the northern part of these countries, precipitation has been erratic and below average since the beginning of the season (in May normally), which may have affected land preparation and plantings of cereal crops. Moreover, in the Central African Republic agricultural recovery continues to be hampered by persistent civil unrest and inadequate availability of agricultural inputs, notably in northern parts where nearly 300 000 people have reportedly been uprooted from their homes over the past two years. Continuing insecurity in both Chad and Sudan (Darfur region) threaten to further destabilize the situation in northern parts of the country.

The harvesting of the main season's crops is underway in the United Republic of Tanzania and Uganda, while it is scheduled to commence in August in Kenya and Somalia. The secondary "belg" crops in Ethiopia are currently being harvested, while Sudan's wheat crop was harvested last April. Late and below average rains persisted throughout much of Eastern Africa during the beginning of the main rainy season (March-June), raising the prospects of a below-average harvest if poor rains continue through July. Much of the pastoral areas, including central and north-east Somalia, south-east lowlands and coastal regions of Kenya, inland areas of Djibouti and south-eastern and northern regions in Ethiopia have received below-average rainfall from March to May. The limited water access and availability has lead to worsening livestock conditions and an increase in the mortality rate, particularly affecting poor households with smaller herd sizes. A combination of above-average cereal prices and unfavourable livestock conditions will have a negative impact on food security as a result of the deterioration in the terms of trade of pastoralists, although the seasonal increase in livestock prices might help somewhat. The north-east regions of the United Republic of Tanzania continued to receive below-average rainfall for the duration of the main "masika" season (March-June), with harvesting currently underway. By contrast, average precipitation in unimodal regions from April to May improved production prospects, with harvesting of the "msimu" main crops well underway and scheduled to finish in August in the southern highland zone. However, limited input utilization, due to the high fertiliser costs, is likely to lead to lower yields. Furthermore, in the south-east, poor localised rains in Lindi and Mtwara is expected to reduce the cereal harvest. An FAO-coordinated programme succeeded in containing Red Locust infestations through treating 10 000 ha with bio-pesticide, preventing further production losses. In Kenya, insufficient rainfall during the initial stage of the main cropping season (March-April) is likely to have impeded crop growth, increasing the probability of yet another poor harvest. By contrast, production estimates are favourable in western maize growing regions, bordering Lake Victoria, which received near normal rainfall from March to June. Preliminary forecasts from the Ministry of Agriculture estimate maize production at 2.4 million tonnes for the long rains season, 16 percent below the average of the past five years. Harvesting is scheduled to begin in August. Kenya has imported approximately 1.1 million tonnes of white and yellow maize between November 2008 and mid-June 2009 in efforts to maintain domestic cereal supplies, following low production levels in 2008. Harvesting of the "belg" crop in Ethiopia, which accounts for approximately 10 percent of national cereal production, is currently underway. Low rainfall from March to June and a reduction in the area planted, particularly in the Amhara region and southern Tigray, are expected to result in a lower belg production in 2009. Poor precipitation levels in central Ethiopia during June, which normally marks the start of the main "meher" cropping season, may negatively impact crop germination. However, in the western maize growing regions, the meher season has progressed well. In Somalia, below-average rains during April and May have had a detrimental impact in northern and north-western pastoral areas, creating unfavourable conditions for livestock. However, favourable crop conditions prevail in the southern regions - Bay (sorghum) and Shabelle (maize) - where rains have been near normal from April to mid-June, raising prospects of an improved harvest. By contrast, in central regions, particularly Galgadud and Mudug, the continuation of drought conditions have impeded crop growth and lead to water deficits. In Sudan, the recently harvested wheat crop was above average owing to an increase in the area planted and favourable weather conditions. Preliminary estimates indicate a harvest of around 700 000 tonnes compared to the 642 000 tonnes gathered last year. Prospects for the main coarse grain crop planted in April are mixed. Below-average rains between May and mid-June, in southern regions has led to moisture deficit and has raised concerns about the output of the main season's crops. However, improved rainfall in the border region with the Central African Republic has improved crop conditions in the south west. Late rains in north-east Uganda delayed planting activities, increasing concerns that the main season's harvest will be below average. In the bimodal areas, July marks the start of the dry period, with harvesting expected to commence in the same month. Poorly distributed rains across the bimodal areas resulted in variation in the development of the main crop, but overall average rains were recorded throughout most parts of the country, with the exception of western and central regions, which received below normal rains during April and May. In Eritrea, sowing for the main "kremti" season is underway. However, low cumulative rainfall from March to May, prior to the planting period, has raised concerns that conditions are not suitable for long cycle crops.

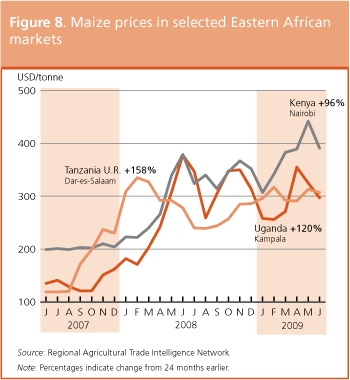

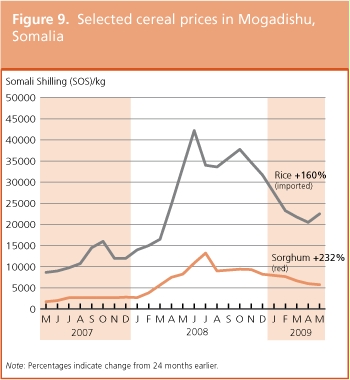

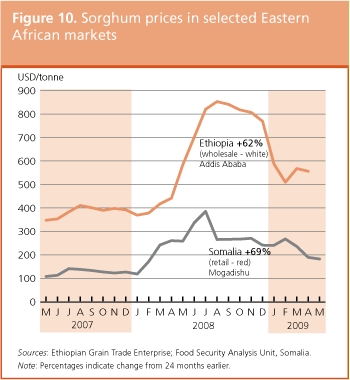

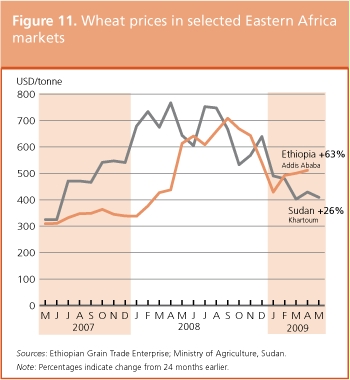

National cereal prices have stabilized and are following normal seasonal trends, with a gradual modest increase prior to the main harvest period from June to August, in contrast to the rapid price increases that occurred in 2008. However, the region continues to experience above-average cereal prices, specifically compared to the pre-crisis level of June 2007, with prices of the region's main staple crops more than double. In particular, sorghum prices in Sudan and Somalia are approximately 190 and 230 percent higher in May 2009, relative to pre-crisis levels. In the United Republic of Tanzania, maize prices have remained relatively stable in 2009; however, prices in Dar es Salam in June were 10 percent higher than last year's prices, at the equivalent of USD 307 per tonne. A surplus maize crop in Malawi is expected to lead to improved market availability and lower prices in southern Tanzania. Despite the import duty waiver on maize (which has been extended until December 2009) in Kenya, prices in Nairobi increased by 27 percent between January and June 2009 and remain 4 percent higher, at USD 391 per tonne, compared to a year earlier. The persistent high prices of maize in 2008/09 in Kenya can be explained by the decline in the national maize production in 2008, by 12 percent and 16 percent, compared to 2007 and the average of the previous five years respectively. The average share of maize imports to domestic production in the previous five years (2003/04-2007/08) was 18 percent. In 2008/09, this grew to more than 45 percent (starting from late last year when world prices were still high), with an estimated 1.1 million tonnes of maize imported between November 2008 and June 2009, predominantly from South Africa. The United Republic of Tanzania, one of the major suppliers to Kenyan markets imposed an export ban on maize. This large volume of imported maize through Mombassa port has lead to congestion and consequently an increase in demurrage costs for importers. Government initiatives in Ethiopia, including export bans, price controls and elimination of domestic taxes on selected items have contributed to reducing the annual food inflation rate to 52.6 percent in May 2009, down from a peak of 61.1 percent in February 2009. Nationally, cereal prices (whose weight is about 23 percent of national CPI) have declined and stabilized since reaching record levels in September 2008. In Addis Ababa, the price of maize, the most widely consumed cereal, decreased by 5 percent over 12 month period April 2008-April 2009 to USD 309 per tonne. Conversely, in Uganda (Kampala), the price of maize in - the country's main staple food - increased sharply in April 2009 to USD 355 per tonne, reportedly as a consequence of large scale purchases for schools, relief aid and institutional requirements. Prices have since decreased to USD 297 per tonne in June 2009 and were 21 percent lower than the high prices recorded during the same month last year.  In Ethiopia, the price of sorghum (white) in Addis Ababa, a main staple in most of the lowland areas of the country, declined marginally between January and April 2009 to USD 556 per tonne, though prices were 26 percent higher than the same month in 2008. In Somalia, the retail price of sorghum (red) in Mogadishu has decreased by 30 percent in May 2009, compared to prices recorded in the same period in 2008. The price of other important staple food commodities has also declined during the first half of 2009. For instance, the price of rice (imported) was 33 percent lower in May 2009 compared with the same period in the previous year, reflecting lower international rice prices.   In Sudan, the price of wheat in Khartoum in May 2009 was down by about 36 percent at USD 409 compared to the same period in 2008. The fall in international wheat prices, as well as improved domestic market supplies have contributed to this decline. However, the depreciation of the Sudanese Pound (which fell 17 percent against the USD during the period indicated) has meant that domestic prices have not decreased by as much, but still declined by 25 percent in May 2009 to SDG 978 per tonne, compared to SDG 1 311 a year earlier. By contrast, in Ethiopia (Addis Ababa), the retail price of wheat (which is predominantly consumed in urban centres) was 17 percent higher in April 2009, at USD 511 per tonne, compared to the same period last year.

The region's aggregate 2009 cereal production (including forecasts for small amounts of wheat from the secondary season currently underway in a few countries) is estimated at 30.1 million tonnes, up by about 3 percent from 2008, which already was the highest level since 2000 . Regarding maize, the main staple crop in the subregion, aggregate output is estimated at 21.8 million tonnes, 4 percent higher than last year's bumper outcome (Table 8). In general the region experienced well distributed rainfall during the main cropping season from November 2008 to April 2009. Similarly, seed and fertilizer distribution programmes in Malawi, Zambia, Angola and Madagascar contributed to this result. Increase in the aggregate production is primarily due to a boost in the harvest in Zimbabwe, Namibia, Malawi, Zambia, Swaziland, Mozambique and Botswana. Regional production increased in spite of a drop in the estimated production of maize and total cereals in South Africa, Angola, and Lesotho. No significant change in total cereal production is estimated for Madagascar.

Planting of the 2009 wheat crop in South Africa, which accounts for about 90 percent of the region's total wheat production, has been carried out in May-June in southern and central growing areas. Early estimates put the area planted down by about 14 percent from the previous year, continuing the long term negative trend which started in mid-1980s. A consequent decline in production later this year is forecast. This year's reduction in intended plantings is probably due to the significant drop in the international wheat prices in recent months. Wheat production in Zambia, although currently less than 10 percent of the regional output, is on the rise, reflecting the recent development of irrigation facilities in that country.

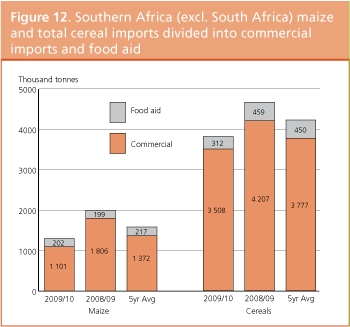

Thanks to the bumper crop in several countries in the region, FAO estimates a lower cereal import requirement for the region as a whole in the 2009/10 marketing year (mostly April/March). However, given the forecast for poor wheat crop later in the year in South Africa and a consequent increase in total cereal import requirement there, the decrease in import requirements for the rest of southern Africa (excluding South Africa) is even more pronounced (Table 9 and Figure 12). As a result of the increased production even at the small scale communal farm household level, the aggregate imported cereal food aid import requirement, calculated as a residual uncovered cereal deficit over and above the forecast commercial imports, is estimated to be lower than the actual food aid imports in the recent past. The country-by-country estimates for 2009/10 in comparison with 2008/09 and the average of the previous five years are given in Table 9 and shown in Figure 12

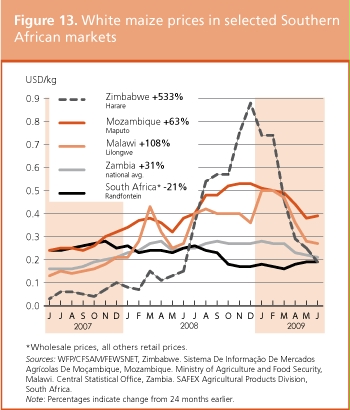

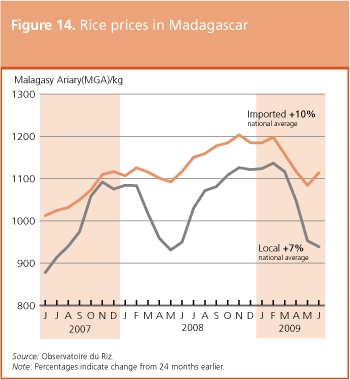

The nominal prices of maize are now coming down seasonally during this post-harvest period but are still higher in most cases than the corresponding months in 2007, which was before the soaring price crisis. In some cases, prices remain higher than a year ago. While the price increases over the 24 month period are fairly high, in most cases the increases in nominal prices over the past 12 months are less than the rate of consumer price inflation, implying some reduction in real prices from the peak levels of 2008. The maize surplus countries such as South Africa and Zambia in general have lower local prices than the deficit countries. Maize price in South Africa owing to another bumper harvest this year (although slightly below last year's record output) and high carry over stocks has declined and remained low. Namibian market prices, dependent on South Africa and tied to its currency at one-to-one ratio, follow South African market fairly closely. However, price spikes do occur depending on the timing of imports. Zimbabwe went from a position of having the lowest maize prices in the region, mostly on account of government controls, to the extreme price hikes (even in US Dollar terms) due to reduced domestic production and imports during the hyperinflationary period. With the recent economic reforms, such as the abandonment of the Zimbabwe dollar and adoption of the US Dollar and South African Rand as legal currencies, removal of import restrictions on food, allowing private trade, etc., and a relatively good harvest, prices have come down drastically and are now more in line with the import parity levels. Retail prices of maize in Maputo in southern Mozambique, the main cereal deficit area, are among the highest in the region. This reflects the high cost of moving grain from the surplus north of the country or of imports from South Africa. In Madagascar, the rice price is following the usual seasonal movement and currently is at about the same level as the corresponding months last year, but slightly up from two years back. This price movement is more or less consistent with the estimated level of national paddy harvest for 2009/10. The price of imported rice being influenced by international and domestic prices, has followed similar but less pronounced pattern.

The overall food security in southern Africa subregion has improved during this post-harvest period and is expected to be much better this year than last few years as majority of the countries in the region have gathered good harvests. In aggregate there is more than enough supply of white maize than the import requirement in the region, which amount to about 1.3 million tonnes (excluding South Africa). South Africa alone is expected to have more than 2 million tonnes of exportable maize surplus. In addition, based on official estimates, Malawi and Zambia are also expected to have surplus maize this year. In the midst of this, however, pockets of vulnerability and food insecurity exist in southern Africa notably in Zimbabwe, Lesotho and Swaziland.

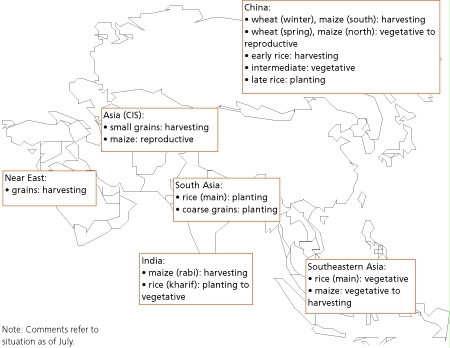

Harvesting of the 2008/09 winter wheat and of first season 2009 rice crops is almost complete throughout the subregion, while land preparation and planting of the main rice and coarse grain crops are well advanced. In China (Mainland), harvesting of the winter wheat crop, which accounts for about 95 percent of China's annual wheat production, has virtually been completed in the major wheat-producing provinces. Despite the severe winter drought in the early stage of the season, a bumper output is estimated because of timely rainfalls and increased irrigation supplies supported by the government during late February and March. The country's 2009 aggregate wheat output, which includes some expected 6 million tonnes of spring wheat yet to be harvested, is tentatively forecast at a record 113.2 million tonnes, 0.74 million tonnes above the previous high set last year. Harvesting of the 2009 wheat crop in India is also almost complete and output is preliminarily estimated at 77.6 million tonnes, which is below the previous record set last year (78.4 million tonnes), but much higher compared to the five-year average (72.85 million tonnes). Similarly, in Pakistan a bumper 2009 wheat crop has just been harvested, reflecting the favourable rains and strong government support in maintaining the minimum guaranteed producer price. Harvesting of the winter wheat crop in Islamic Republic of Iran is currently underway. In the northwest region - the main wheat growing area - favourable rainfall was recorded during the growing season, with well-above rains received in April. Wheat production is expected to increase by 38 percent relative to last year's poor harvest, reaching 13.5 million tonnes in total, while barley production is forecast at 2.2 million tonnes.

In India, sowing of the main Kharif coarse grains and rice crops for harvest in September is underway. The early outlook is unfavourable because of the delayed arrival of the southwest monsoon in some major producing regions. By 2 July, all India-area weighted cumulative rainfall since the start of monsoon season (1 June) is 46 percent below the average. However, the final outcome of Kharif season will depend greatly on the development of southwest monsoon rains in July and August. Harvesting of the boro rice crop in Bangladesh was completed in May and a bumper crop is reported. The southwest monsoon is currently active over Bangladesh and this is an indication of a good start for the Aman season crops. In Sri Lanka, the main 2009 maha rice crop, planted in October-November 2008, has been harvested. Total paddy production (Maha and Yala) in 2009 is estimated at 3.6 million tonnes, only slightly below the record of the previous year. Similarly, a record main rice crop is also reported in Indonesia.

Several countries have new policies to encourage grain exports and support 2009 food grain production. In view of the expected bumper crops and sufficient cereal supply in 2009/10, China has eliminated export taxes on some grains, including wheat (3 percent), rice (3 percent), and soybeans (5 percent), effective 1 July. China also eliminated special export taxes on some fertilizers. The Government of India has reportedly allowed the export of 650 000 tonnes of wheat following the state procurement of cereal in 2009 of over 24 million tonnes, much higher than in the previous year. The Government is reportedly planning to ease non-basmati rice exports if there will be a marketable rice surplus after meeting the requirements for the country's safety net programme. The Government of Thailand has set the farmers guaranteed price for second-crop paddy at THB 11 800 (USD 332) per tonne under a new intervention scheme starting on March 16 and running through July. The second-crop intervention program has reportedly led to the procurement of 4.1 million tonnes of paddy, valued at THB 46 million (USD 1.4 billion). The Prime Minister of Vietnam reportedly instructed state-owned companies to buy as much as 2 million tonnes of rice to support the production of the second season paddy rice crop. In the first half of this year, the country exported 3.8 million tonnes of rice, up 25 percent over the same period in the previous year.

Food staple prices have continued to decline in some countries in the second quarter of the year. But they remain significantly higher in comparison to the pre-2008 food-crises levels. The price impact on overall food consumption of the vulnerable population is still substantial. In Sri Lanka, the retail price of rice in Colombo was 62.3 Rupee/kg in June 2009, only some 6 percent down from the same month in 2008, but 74 percent over that of the same month two years ago. In Pakistan, the retail price of wheat flour in Karachi was 29.21 rupee/kg in May 2009, 15 percent below the peak in October 2008, but still 90 percent higher compared to that in May 2007. In the Philippines, the national average retail rice (Regular Milled Rice or RMR) price was 31.46 peso/kg in May 2009, 12 percent below that the peak level in June 2008, but still 43 percent above that in May 2007.

Despite an overall satisfactory food supply situation in the subregion, vulnerable populations in a number of Asian countries are still affected by serious food supply difficulties. More than two million people in Nepal face a precautious food situation as a result of crop failure due to the 2008/09 winter drought. Crop yields in some districts in Mid- and Far-Western Nepal - which received less than 50 percent of average rainfall during the period from November 2008 to February 2009 - have dropped by more than half based on the recent MOAC, WFP and FAO joint crop assessment report. Cyclone Aila struck the southwestern coast of Bangladesh on 25 May, causing widespread devastation. Over 240 000 homes have been completely destroyed and 370 000 homes partly destroyed, causing food insecurity for over 4 million people. Some 3 million people in Pakistan's northwest region have been reportedly displaced and faced food shortages due to the recent civil conflict.In Sri Lanka, following the cessation of the conflict between the Liberation Tamil Tigers of Eelam (LTTE) and the Government in May 2009, over 300 000 people were displaced and have since been housed in government-run camps. In Myanmar, agricultural and food assistance continues to be needed for the summer season and the current monsoon season to help small farmers recover their production and livelihoods in the areas affected by cyclone Nargis last year. The food situation of more than 6 million vulnerable people in the Democratic People's Republic of Korea is expected to worsen during the lean growing season before the November harvest because of reductions in aid. The World Food Programme has received only 15 percent of the USD 504 million it needs to fulfil its planned emergency assistance needs.

Across the subregion, harvesting of the 2009 winter crops is almost complete, with most countries experiencing seasonably dry weather in June. During May, average rainfall across much of Turkey maintained mostly favourable soil moisture for the reproductive to filling stage of the winter wheat and barley crops. Estimates indicate improved cereal production, forecast at about 67 million tonnes, compared to last year's output of 56.5 million tonnes, when extreme drought conditions decimated crops. In Turkey, dry weather during June favoured an early harvest in most growing areas. Barley production is expected to increase by approximately 27 percent, relative to last year's harvest, to 7.5 million tonnes, owing to favourable rainfall. Wheat production is forecast at 20 million tonnes, an average crop, and 12 percent above the previous year. Similarly, Syrian Arab Republic received normal rainfall during the cropping season, with dry spells in June during the harvest period. The winter wheat harvest is expected to be the second lowest of the current decade, even though wheat production is forecast to increase by 53 percent, to 3.2 million tonnes, compared to last year. In spite of this, grain imports will continue to be required to meet domestic needs. Harvesting of the winter barley crop is complete, with production forecast at 700 000 tonnes. In Iraq, accumulated rainfall from September 2008 to April 2009 averaged between 25 and 65 percent of normal levels in the principal wheat growing regions. The below-average rainfall hindered winter crop development, particularly in the northern region, with wheat production expected to increase compared to last year to 2 million tonnes. To stabilise domestic cereal supplies another year of above-average cereal imports will be required in 2009/10. Cereal production in Israel is forecast at 88 000 tonnes, well below average, but about 30 percent up over last year's exceptionally low cereal production. Despite poor rains during the initial stages of the cropping season in Afghanistan, rainfall improved between February and May 2009. Higher wheat prices encouraged farmers to increase the sown area for wheat, with production forecast at 3.5 million tonnes. Harvesting of the winter crops is scheduled to conclude in August. In Lebanon and Jordan, cereal production is forecast to increase compared to a year earlier, with harvesting of the winter crop scheduled to finish in July.

In Asian CIS countries, sowing of spring cereals has been completed and harvesting of winter cereals has started, except in Kazakhstan where the harvest season starts in September. Good rainfalls during the spring season have maintained adequate soil moisture levels raising the prospects for a good cereal harvest in the region. Reflecting an increase of the land sown to grains, Azerbaijan is expected to produce an above-average grain output of over 2 million tonnes, with more optimistic forecast, close to 2.5 million tonnes. If those forecasts are confirmed, wheat imports will be significantly reduced in the 2009/10 marketing year. In Georgia, the wheat harvest is forecast to be as good as last year, after two consecutive poor harvests in 2007 and 2006. In Tajikistan, the situation is mixed as heavy rains have damaged spring sown crops, such as cotton and coarse grains, while the winter wheat harvest is expected to partly recover from last year poor output. In Kazakhstan, the area sown to wheat is estimated to have increased to 13.8 million hectares compared to 12.9 million hectares of last year. Provided normal weather conditions prevail during the summer season, the 2009 wheat output could increase to 14 million tonnes from 12.5 million tonnes in 2008. Wheat exports in the current 2008/09 marketing year are estimated to reach 5.5 million tonnes or approximately 30 percent less than the previous year. In view of the large wheat harvest anticipated for this year, export availabilities in 2009/10 could be substantially higher.

Dry weather conditions have favoured rapid maturation and harvesting of the 2009 main winter wheat crop in Mexico's key producing states of Sonora, Guanajuato, Baja California and Michoacán. Seasonal output is tentatively estimated at a record 3.9 million tonnes, mainly due to a substantial increase in planted area that reached 725 000 hectares, exceeding official planting intentions by about 10 percent or some 75 000 hectares.

Planting of the 2009 first season (mainly rain-fed) coarse grain and bean crops is underway in all Central American countries. In Mexico, after few weeks of dryness, beneficial rains in June in eastern and central sections of the southern plateau, boosted soil moisture for 2009 summer maize and sorghum crops in key growing states of Guanajuato, Jalisco and Michoacán. Plantings are expected to be close to the good levels achieved in 2008, with 6.9 million hectares of summer maize and 1.1 million hectares of sorghum anticipated. In the Caribbean, planting is underway in Cuba, while harvesting has already started in Haiti and the Dominican Republic where production prospects are favourable following well-distributed precipitation throughout the whole growing season. In aggregate subregional coarse grain area is expected to reach the record level of 12.4 million hectares in 2009, slightly above the previous record set last year and continuing the expanding trend started in 2005. Planting of the 2009 main summer season paddy crop is underway throughout the subregion and planting intentions point to a record area of about 710 000 hectares, with an increase of about 20 000 hectares compared to 2008, mainly in Cuba, Haiti and Dominican Republic. Based on the results of harvests already underway and assuming normal conditions and average yields for the crops just being sown, the subregion's aggregate cereal production is tentatively forecast at 41.3 million tonnes, 1.4 million tonnes less than 2008 record output but still 6 percent above the average of the past five years.

Since August 2008 wholesale prices of white maize (used to prepared tortillas) and rice in Mexico, have stabilized at high levels of 4 000 and 11 500 pesos per tonne, respectively. On the contrary, wholesale prices of beans have continued to skyrocket: from January 2008 to June 2009, they passed from 7 700 to more than 17 000 pesos per tonne, severely affecting the access of local consumers to this important source of proteins. In all other Central American countries, except Nicaragua, prices of cereals are either stable or declining from the peaks achieved in mid-2008. Since many countries are in the hunger season, which will last until the arrival on markets of first season production in August, prices are expected to go up again, with negative impact on food security of most vulnerable people, especially in poor urban areas. In Haiti, the population with food insecurity is officially estimated to have declined to 2.1 million from 2.8 million at the beginning of the year. This reflects the very good production of 2008 winter staple foods, the gradual reduction in market prices and the implementation of safety net programs based on donor or government-financed labour-intensive works. However, food assistance continues to be required by most food vulnerable groups in poorest urban slums as well as in the departments of North-West, Artibonite, South-East, Nippes, South and the Grand'Anse.

Cereal production in 2009 is early forecast at 124.6 million tonnes; some 14 percent less than the 2008 record output and 4 million tonnes below the average of the last five years. This is mainly due to the significant reduction in summer maize crop production, whose harvest is almost completed throughout the subregion, and the unfavourable prospects for winter wheat crop that is still at planting stage. Harvesting of 2009 maize crop will be completed in July/August and aggregate production is estimated to drop by almost 20 percent from last year's record of 91.7 million tonnes to 74.5 million tonnes as a consequence of the drought throughout the growing season that affected all major producing areas. In addition, unattractive domestic prices coupled with high costs of inputs and low access to credit have induced farmers to reduce planted area and the application of fertilizers with negative effects on yields. Aggregate production of 2009 wheat crop is early forecast to be very similar to or even lower than the 2008 low level of 17 million tonnes because of the severe dry weather conditions and cold temperatures that are hampering planting operations in Argentina, one of the top five global wheat supplier in recent years and the lead producer of the subregion. Here estimates of planted area have been continuously revised downward in the last few weeks, with only 3 million hectares now expected, the lowest level of last 100 years and some 30 percent below last year's level. However, a different scenario for 2009 wheat crop is reported in Brazil and Uruguay. In Brazil, planted area is early forecast at about 2.3 million tonnes, similar to the 2008 good acreage and, assuming favourable weather conditions persist during the season, an above-average production of 5.7 million tonnes is tentatively forecast. In Uruguay, official planting intentions for wheat point to some 500 000 hectares, about 9 percent above 2008 record acreage and double of the last five year average. This renewed interest for wheat crop is partially due to the increasing investments by Argentinian farmers that prefer to move to Uruguay because of a series of local factors, such as higher domestic prices, better export conditions and access to credit, and cheaper land rent.

The subregion aggregate production for paddy, whose harvest is virtually completed, is estimated at a record level of 24.7 million tonnes, about 3 percent above the good 2008 crop. Large productions are reported in some Andean countries, such as Bolivia, Peru and Venezuela, as well as in Brazil and Uruguay. In Bolivia, 2009 paddy production is officially set at the record level of 457 000 tonnes, 20 percent more than in 2008, as a consequence of record plantings in the oriental plains of 200 000 hectares. In Peru, harvesting of 2009 irrigated paddy crop will be completed in July/August. Attractive producer prices at the beginning of the season and adequate water reservoir levels in major northern producing areas have led farmers to plant some 370 000 hectares, an acreage very similar to previous year's record. Assuming average yields, 2009 paddy production is early estimated at the near-record level of 2.7 million tonnes. In Brazil and Uruguay, favourable climatic conditions throughout the growing season have resulted in record yields and to above average productions.

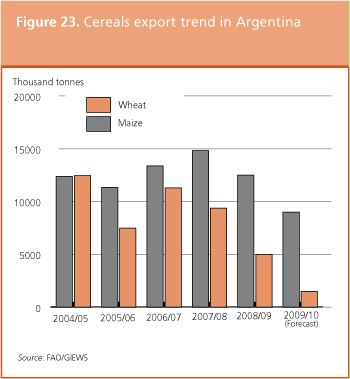

The expected shortfall in wheat and maize crop production in Argentina is a major new issue in the subregion. Cereal exports of Argentina are forecast at record low 12 million tonnes in marketing year (July/June) 2009/10, well below the last five year average of almost 20 million tonnes. In particular, exports of maize are forecast at a low of 9 million tonnes, while exports of wheat may only reach 1.5 million tonnes. This situation is opening trade opportunities for other exporting Mercosur countries, such as Brazil for maize and Uruguay and Paraguay for both maize and wheat, but also forcing important wheat importers such as Brazil to look for alternative suppliers outside the subregion such as the Russian Federation and Canada.

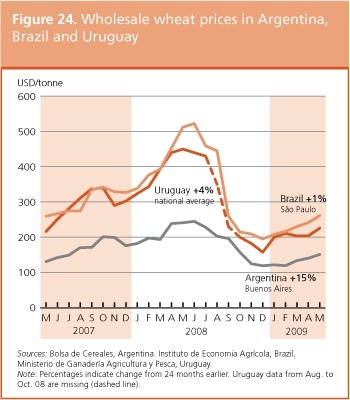

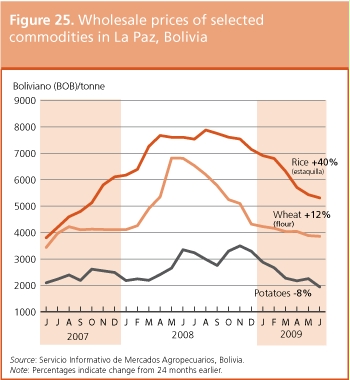

In Andean countries, prices of main staple food are declining with the arrival on markets of the new production. In La Paz (Bolivia), compared to one year ago, wholesale nominal prices of rice, potatoes and wheat flour in June were lower by about 28, 40 and 41 percent, respectively. In Peru, the average wholesale price of rice has continued to decline from the peak registered in October 2008 and this trend is expected to continue due to the good prospects for 2009 paddy production. The price of potatoes has also dropped by about 25 per cent from the record level of January 2009, but it is still 21 percent above the price of 12 months earlier. On the contrary, in Lima, the retail price of wheat flour has remained practically unchanged from the record level of June 2008. After a steady decline from record levels reached in April/May 2008, wholesale wheat prices have started to climb again since the beginning of 2009 in key producing countries such as Argentina, Brazil Paraguay and Uruguay, mainly reflecting the poor prospects for Argentina's production.

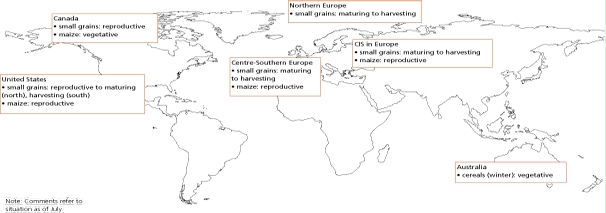

In the United States, after a slow start, winter wheat harvesting was well underway in the southern states as of late June. The latest official forecast puts the winter wheat output at some 40.6 million tonnes, about 20 percent down from the previous year. The area sown decreased by 6 percent and lower yields are expected in some parts, especially in Texas and Oklahoma where crops were damaged by adverse weather. Latest indications also continue to point to a smaller spring wheat harvest despite the generally good condition of crops. Any improvements in yields expected compared to last year are unlikely to compensate for the decline in area planted, which is officially estimated to be down by about 3 percent from 2008. Aggregate wheat output is now forecast at 54.9 million tonnes, slightly below earlier expectations and about 19 percent down from last year. Regarding coarse grains, latest official reports estimate that despite wet weather during planting in some parts, the bulk of the maize crop was planted by early June and the total area amounts to about 35.2 million hectares, 1 percent up from the previous year and the second largest area in more than 60 years. Assuming average yields, maize output in 2009 is currently forecast at 303 million tonnes, close to last year's level; but much will still depend on weather conditions in the coming months. In Canada, prospects for the 2009 wheat crop have deteriorated slightly in the past weeks reflecting sowing delays in some parts because of wet weather and unseasonably cold weather that slowed emergence. Although the final area sown to wheat may turn out similar to last year's, which is more than had been expected from farmers' planting intentions earlier in the year, yields are expected to be lower than last year's relatively good levels and the wheat output in 2009 is now forecast at 25 million tonnes, 13 percent down from 2008.

Although previous forecasts already pointed to lower cereal output this year in the region because of reduced plantings, latest information indicates that reduced yield prospects in some countries could lead to a smaller harvest than earlier expected. In the EU, weather conditions in recent weeks have been generally favourable but reports from some countries indicate that earlier dry weather caused irreversible damage and reduced yield potential. This was particularly the case in Romania and Hungary. The aggregate wheat output of the EU in 2009 is now forecast at about 135 million tonnes, some 10 percent down from last year, while coarse grains output, forecast at 150 million tonnes, would be about 8 percent down from 2008. In European CIS countries, planting of the spring cereals has been completed and harvesting of winter cereals has recently started. Unusual cold and dry whether during the month of April has delayed the spring cereals planting campaign; however warmer temperatures and good precipitations during May and June have promoted spring cereal emergence and improved winter cereal conditions. The outlook for the aggregate cereal production in 2009 is good, with early forecast for the region set at 144.2 million tonnes, 15 percent below the bumper harvest of last year, but still 10 percent above the average of the past five years. The aggregate area sown to cereals for the 2009 harvest is estimated to similar levels, if not slightly above, to those of last year. Yields, however, are expected to be lower than in 2008, reflecting dry and cold weather at the beginning of the spring season. In the Russian Federation, the outlook for the 2009 cereal harvest is good and output could reach its second highest level, after last year's record of 106.2 million tonnes. The aggregate cereal planted area is expected to reach some 46.6 million hectares, about one million hectares more than the previous year. Assuming normal weather until harvest, cereal output in 2009 is tentatively forecast at some 95 million tonnes, including 59 million tonnes of wheat compared to 63.8 million tonnes in 2008. Cereal exports in the new marketing year are anticipated to decline by about 3 to 5 million tonnes from a record 22.9 million tonnes estimated for the 2008/09 marketing year, reflecting increased competition expected in world grain markets. In Ukraine, the outlook for the 2009 cereal harvest is satisfactory, with the early forecast put at some 39.6 million tonnes, approximately 24 percent less than last year's record, but still 3 percent above the past five-year average. Wheat output is forecast to decrease by 6.4 million tonnes to 19.5 million tonnes, as both wheat area and yield will be lower than in 2008. Barley output is also forecast to decrease, from 12.6 to 10.0 million tonnes, despite a larger area sown as yields of spring barley (main crop) are anticipated to be significantly lower than in 2008, reflecting delayed plantings. As a result of the removal of export restrictions, Ukrainian cereal exports in 2008/09 marketing year are estimated to increase to a record 25 million tonnes, about 10 percent of world cereal exports. In marketing year 2009/10 cereal exports from Ukraine are forecast to decline significantly, due to a lower domestic cereal production in 2009 and a weaker demand for wheat from importing countries. In the Republic of Moldova, unfavourable weather has dimmed prospects for the cereal harvest in 2009. A combination of drier-than-normal and unseasonable cold temperatures have affected winter grain development and delayed spring crop planting. Early estimates put 2009 wheat output at 750 thousand tonnes, approximately 45 percent less that the previous bumper year and 14 percent below the past five-year average. Maize output is estimated to decrease by 200 000 tonnes to some 1 million tonnes in 2009. Aggregate cereal production in 2009 may decrease by around 30 percent in comparison to the previous year and 15 percent below the past five-year average.

As of late June, prospects for Australia's main winter grain crops (mostly wheat and barley) remained generally favourable. Adequate moisture for planting was reported in most of the main growing areas and the overall area sown is now estimated to be close to last year's level. Based on the conditions as of late June, the winter crop output could potentially match last year's relatively good levels of some 21 million tonnes of wheat and about 7 million tonnes of barley, assuming sufficient rainfall during the coming months. However, concern is currently rising over the outlook for rainfall during the current crop season in the country as there is growing evidence of a developing El Niño event. El Niño events are usually (but not always) associated with below-normal rainfall in the second half of the year (from July) across large parts of southern and inland eastern Australia. Should this phenomenon materialize, this could seriously affect cereal yields and production. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GIEWS | global information and early warning system on food and agriculture |