At central level the government evidently retains control as to how collected revenues are applied in the economy, and this is examined briefly in this section. Revenues collected at decentralized levels are all applied at the village (Zanzibar) or district (mainland) according to the priorities of local administrations.

The Fisheries Department has been allowed by the Ministry of Finance to operate a "Retention Scheme" whereby a percentage of collected revenue can be retained by the sector for use in development of the sector, effectively pre-consigning revenue to the sector of origin. During budgeting, projection is made of revenue to be collected, and the department's annual budget then developed on the basis of the retention of a percentage of that revenue. Should revenue collection exceed the projection, surplus funds are taken into the treasury's consolidated funds, and not retained in fisheries. In practice the Fisheries Department does not itself operate the retention scheme, any and all collected revenue is deposited with the Ministry of Finance which in turn transfers funds (according to the department's budget) directly to the MNRT's current account. Under the terms of the retention scheme the MNRT is in turn permitted to take up to 6 percent of retained revenues for administrative purposes, and the remaining 94 percent is then the Fisheries Department's annual budget.

In principle, retention schemes are short-term (3 years) arrangements whose objective is to facilitate the reinvestment of funds in the sector from which revenue is collected, with the specific aim of generating further revenues from that same sector. Should a sector operating a retention scheme show improved revenue generation, the arrangement can be extended. In the case of fisheries, the scheme started in 1997 and revenues and degree of retention are such that the Fisheries Department receives no further budget allocation from consolidated treasury funds.

Table 8 - Collection and retention by fiscal year (mainland) - In US$ millions

|

|

1998/99 |

1999/00 |

2000/01 |

2001/02 |

|

Total revenue collected by MNRT |

16.79 |

16.74 |

21.85 |

22.92 |

|

|

4.32 |

6.47 |

6.76 |

7.36 |

|

|

1998/99 |

1999/00 |

2000/01 |

2001/02 |

|

Total revenue retained by MNRT |

8.33 |

7.88 |

12.54 |

12.35 |

|

|

3.17 |

2.71 |

3.91 |

4.00 |

|

Agreed rate of retention |

100% |

100% |

91% |

85% |

|

Actual rate of retention |

73% |

42% |

58% |

54% |

Source: Ministry of Finance

Note that actual rates of retention are consistently below projected (agreed) rates of retention for the sector. This may be due to a combination of i. the Fisheries Department collecting more revenue than they projected (any surplus is retained by Finances), and ii. The Ministry of Finance not allowing all of projected retention due to other priorities in the economy.

Annual expenditure by the Fisheries Department (excluding donor support) is shown in Table 9. The difference between that which the department spends and that which was sent back to the sector by the Ministry of Finance via the retention scheme is presumed the margin taken by the MNRT. This amounted to 25 percent and 11 percent of retained revenue in 1999/2000 and 2001/2002 respectively, considerably above the agreed margin of 6 percent.

Table 9 - Fisheries Department annual expenditure (mainland) - In US$ millions

|

|

1996/97 |

1997/98 |

1998/99 |

1999/00 |

2000/01 |

2001/02 |

|

Fisheries expenditure |

1.29 |

0.49 |

no data |

2.05 |

no data |

3.57 |

Source: FD

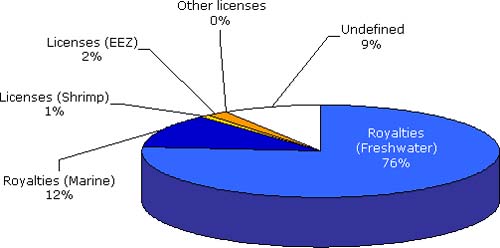

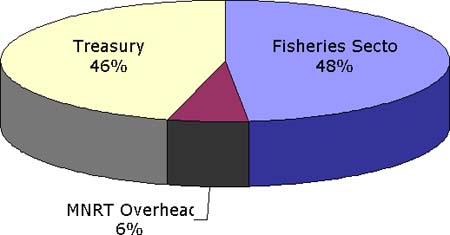

For 2001/2 the Ministry of Finance received US$7.36 millions from the fisheries sector. The sources of revenue and its allocation can be summarised as illustrated in Figure 7.

Figure 7 - Central government revenue sources and allocation, 2001/2 (mainland)

Sources of revenue

Allocation

Zanzibar also operates a retention scheme for revenues from the fisheries sector, but it was only introduced in 2003 and the fundamental modalities of operation (such as degree of retention) are yet to be established. Before the introduction of the retention scheme, all revenue accruing to central government via the Fisheries Department was remitted to the treasury and the department relied on normal budget finding via the Ministry of Agriculture. Annual expenditure by the Zanzibar Fisheries Department is shown in Table 10.

Table 10 - Fisheries Department annual expenditure (Zanzibar) - In US$ millions

|

|

1999/00 |

2000/01 |

2001/02 |

|

Fisheries expenditure |

no data |

0.078 |

0.095 |

Source: FDZ

For 2001/2, expenditure was 17 percent of estimated revenue collection, and the treasury made a net contribution to the sector of US$40 000. In 2003 the situation should be fundamentally different and the sector should be a net contributor to government revenue, principally due to increased EEZ licence revenues.