FAO/18528/G. Bizzarri

University of National and World Economy, Department of

Agribusiness,

Studentski grad "Hristo Botev", Sofia 1700, Bulgaria

The paper provides an overview of the status of land markets in Bulgaria and the progress made towards a functioning system. At present, the land market is being reform driven and is in its inception. The existing information on land markets comprises a mixture of anecdotal information and documentary records, partly based on market evidence. This hampers decision-making processes on different levels. In order to be functional and effective, certain measures need to be undertaken with regard to its legal basis, regulatory institutions, participants, goods and services, financial instruments and government policy.

INTRODUCTION

The land market in Bulgaria is in the inception phase of its development. As an institution, the land market is being reform driven. To develop effectively, the land market needs to be reformed from its pre 1989 position. A critical number of properties with clear titles, secure boundaries and disposition of property rights need to be developed. Regulatory institutions need to be put in place and there needs to be a critical number of participants with access to adequate funding. This implies that this phase is being dominated by initial legal, institutional and regulatory reforms.

Land restitution and the dismantling of collective farms have been the key elements of agrarian reform in Bulgaria since 1991. The process of land reform has focused on: (a) restoration of land property rights to former owners, and (b) dismantling of collective farms and distribution of their assets. Reinstatement of land property rights created the necessary preconditions for land transactions. By contrast, secure access to land is the most important condition for sustainable agricultural development and livelihood in rural areas. In this regard, the establishment and creation of conditions for an efficiently functioning land market is an indispensable component.

Future development of Bulgarian agriculture is closely related to expected European Union (EU) membership. The EU has a list of conditions that prospective applicants have to meet prior to initiating membership negotiations. There are two major requirements that are relevant to land markets. First, there must be transparent and secure title on real estate (including land); second, there must be an emerging and open land market. At present, Bulgaria meets these two conditions only in part. The main objective of this case study is to provide an overview of the status of the land market and the progress made towards its functioning, within the framework of the broader development agenda at national level, as well as to identify priority areas and recommendations for future action.

To achieve the above tasks, different sources of information have been employed: official publications of the National Statistical Institute (NSI), the Ministry of Agriculture and Forests (MAF); unpublished information from MAF; the Research Institute for Agricultural Economics (RIAE); the Department of Agribusiness, University of National and World Economy (UNWE) - Sofia; papers developed for different projects funded by the FAO, World Bank and EU Delegation; and interviews with government officials and experts.

The paper is organized as follows. First, the criteria for an operational land market and the general framework are discussed from a theoretical point of view. The following section focuses on current status and development requirements. Identified areas for possible technical assistance to support the land market institution are then presented, followed by concluding remarks.

GENERAL FRAMEWORK OF THE LAND MARKET

Twelve years on from the start of the reform programme, is there a functioning land market in Bulgaria? The answer to this question is complex and may be given on the basis of an evaluation of its current status, according to theoretical criteria for a functional land market:

a clear definition and sound administration of property rights;

a minimum set of restrictions on property usage consistent with the common good;

the transfer of property rights must be simple and inexpensive;

there should be transparency in all markets; and

there must be available capital and credit.

An efficient and effective land market can then be characterized in terms of players, goods and services, and the means of exchange, according to the "rules of the game". Using as a basis the Land Market Model developed under the Action for Co-operation in Economics (ACE) project P2128R: "The Development of Land Markets in Central and Eastern Europe", the characteristics of the land market in Bulgaria are listed in Table 1 in comparison with efficient and effective land markets.[28]

In order to compare the relative development of the land market and carry out a comparative analysis, the indicators developed and applied for more advanced Central and Eastern European Countries (CEECs, Czech Republic, Poland, Slovakia, Latvia and Slovenia) have been calculated for Bulgaria. The purpose of these indicators is to determine how close the country is to a functioning land market (by comparing its status with that of EU countries). The indicators are purely qualitative. The summary results using the ACE methodology are given in Table 2.

The results indicate that market reforms are faster in land registration than in valuation and finance. There is an urgent need for the development of financial instruments for land sales/purchases. The problems relating to collateral need to be solved. The current situation in Bulgaria reveals an increased demand for financial services. Land Market Normative Activity Indicators are an instrument that is used to measure the overall activity levels and compare them with EU norms. Similarly, the results for Bulgaria are presented in Table 3.

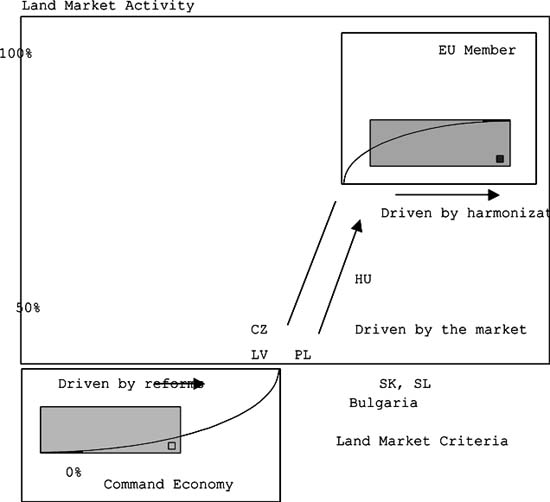

The current status of the land market in Bulgaria shows that it is an early phase of development. An illustration of this is given in Figure 1, in which the land market in Bulgaria is compared with development in other CEECs. Assessment of the transition status of the land market indicates Bulgaria's place in comparison with levels of activity in EU countries.

The general conclusion derived from the above characteristics of the land market in Bulgaria is that an efficient and effective land market has not been developed in Bulgaria, as a result of institutional, financial and legal reasons. Twelve years after initiation of agricultural reform, it is still in its inception. In order to promote an effective and efficient land market, the state must establish a regulatory framework and adopt policies that will support and stimulate the development of the land market. These policies should identify and remove barriers to individual initiatives.

TABLE 1

Land market and land prices

|

Criteria |

Characteristics of the land market in Bulgaria |

General remarks |

|

Legal Basis |

1. Ownership rights are secured by the Ownership and Use of

Agricultural Land Act (OUALA). |

· All legislation on land needs to be reviewed and amended in the light of EU harmonization. |

|

Regulatory Institutions |

1. Unified property/land register and unified cadastre

register are being developed. No comprehensive system is in place. |

· There is a need for planning

and zoning reviews to be published for all 28 regions. |

|

Participants |

1. Land owners and tenants exist and represent a range of

different stakeholders |

· The growth of the private

sector is correlated with the level of development of the land market. |

|

Goods and Services |

1. Well-developed urban asset market (apartments, houses,

residences of various types and sizes, offices, commercial buildings), but

not yet a farm land market. |

· The agricultural land market is not functioning because of: lack of funding, unstable agricultural market, lack of information, perceptions of landowners, etc. |

|

Financial Instruments |

1. Lack of reliable information on cash sales. |

· The government and the financial institutions need to establish the regulatory framework necessary for the protection of all parties' interests. |

|

Government Policy |

1. There is no clear government policy on land

administration. |

· Urgent need for the

development of a land administration policy. |

TABLE 1

Land market and land prices

(continued)

|

Planning region (NUTS 2)1 |

Land prices 2001/02 |

Rental prices 2001/02 |

|||||

|

Municipalities (NUTS 3) |

Transactions |

Area |

Price |

Farm land leases |

Extent of Land |

Agreed lease payment |

|

|

North West Region |

2 823 |

30 766 |

115 |

31 605 |

448 310 |

Mixed |

|

| |

Vidin |

769 |

6 102 |

78 |

776 |

15 382 |

10 - 15% of the production or Mixed |

|

Vratza |

1 170 |

13 477 |

130 |

5 725 |

141 378 |

Mixed or 10 - 15 BGN/dca |

|

|

Montana |

884 |

11 187 |

115 |

25 104 |

291 550 |

Mixed or 10 - 20% of average yield |

|

|

North Central Region |

6 949 |

73 277 |

120 |

21 729 |

526 688 |

Mixed |

|

| |

Veliko Tarnovo |

2 349 |

27 751 |

135 |

3 709 |

110 908 |

3 - 10 BGN/dca or rent in kind |

|

Gabrovo |

145 |

547 |

470 |

224 |

1 004 |

2 - 12 BGN/dca |

|

|

Lovetch |

295 |

2 194 |

160 |

803 |

133 891 |

20 - 40 kg cereals/dca |

|

|

Pleven |

1 728 |

18 911 |

115 |

5 311 |

156 245 |

15% of the average yield |

|

|

Russe |

2 432 |

23 874 |

90 |

11 682 |

124 640 |

N/d |

|

|

North East Region |

13 510 |

173 189 |

107 |

32 970 |

745 248 |

Mixed |

|

| |

Varna |

1 692 |

14 637 |

100 |

7 026 |

216 599 |

15% of the average yield |

|

Dobrich |

3 881 |

59 082 |

140 |

10 720 |

215 409 |

Mixed or 5 - 25 BGN/dca |

|

|

Razgrad |

2 880 |

37 990 |

85 |

4 627 |

92 219 |

5 - 12 BGN/dca |

|

|

Silistra |

2 590 |

33 383 |

100 |

5 176 |

111 478 |

4 - 15 BGN/dca |

|

|

Targovishte |

1 299 |

10 266 |

95 |

2 975 |

33 375 |

5 - 12 BGN/dca |

|

|

Shumen |

1 168 |

17 831 |

80 |

1 446 |

76 168 |

Mixed |

|

|

South East Region |

4 676 |

33 509 |

164 |

7 923 |

320 775 |

Mixed |

|

| |

Burgas |

1 242 |

12 289 |

240 |

1 916 |

107 523 |

6 - 35 BGN/dca |

|

Sliven |

1 472 |

2 045 |

165 |

2 026 |

N/d |

Mixed |

|

|

Jambol |

1 962 |

19 175 |

115 |

3 981 |

213 252 |

Mixed |

|

|

South Central Region |

5 353 |

32 796 |

281 |

10 106 |

292 269 |

Mixed |

|

| |

Kardjali |

120 |

469 |

218 |

685 |

3 218 |

N/d |

|

Pazardjik |

1 017 |

4 638 |

312 |

315 |

2 555 |

20 - 60 kg cereals/dca |

|

|

Plovdiv |

2 257 |

11 068 |

305 |

4740 |

66 967 |

4 - 30 BGN/dca |

|

|

Smolijan |

204 |

665 |

248 |

23 |

794 |

10 - 100 kg cereals/dca |

|

|

Stara Zagora |

762 |

5 711 |

248 |

2 389 |

218 735 |

N/d |

|

|

Haskovo |

993 |

10 245 |

270 |

1 954 |

N/d |

N/d |

|

|

South West Region |

2 139 |

9 194 |

438 |

2 503 |

98 271 |

Mixed |

|

| |

Blagoevgrad |

825 |

3 402 |

509 |

37 |

773 |

N/d |

|

Kuijstendil |

341 |

1 051 |

360 |

1 013 |

10 774 |

40 kg cereals/dca |

|

|

Pernik |

230 |

868 |

490 |

3 |

3 675 |

N/d |

|

|

Sofia |

743 |

3 873 |

390 |

1 450 |

83 049 |

Mixed |

|

|

Total for Bulgaria |

35 450 |

352 731 |

141 |

106 836 |

2 431 561 |

Mixed |

|

1 NUTS: Standard nomenclature of territorial units for EU statistical purposes.

2 dca = decare (one tenth of a hectare).

TABLE 2

Land market indicators

|

|

CZ |

HU |

LV |

PL |

SK |

SL |

Mean |

BG |

% |

|

Policy Framework |

2.5 |

2.8 |

2.1 |

2.3 |

2.3 |

2.9 |

2.5 |

1.85 |

74 |

|

Market Assessment |

2.1 |

2.8 |

2.3 |

2.5 |

1.9 |

2.4 |

2.3 |

2.2 |

95.65 |

|

Land Registration |

3.5 |

3.7 |

3.2 |

2.8 |

2.8 |

3.0 |

3.2 |

3.0 |

93.74 |

|

Valuation |

2.2 |

2.6 |

2.0 |

2.4 |

2.0 |

2.0 |

2.2 |

2.0 |

90.9 |

|

Finance |

2.2 |

2.9 |

2.3 |

2.2 |

2.2 |

2.3 |

2.4 |

1.33 |

55.42 |

|

Overall Assessment |

2.5 |

3.0 |

2.4 |

2.4 |

2.3 |

2.5 |

2.5 |

2.076 |

83.04 |

Note: The scoring methodology used is on the scale 0 to 5, indicating, respectively, that there is no evidence of development to that level that would be required for an EU member state. A score of less than 1.5 would indicate a closed, command economy with an adequate regulatory framework and a favourable land policy.

Source: ACE Project P2126R and author,s calculations for Bulgaria.

TABLE 3

Land market normative activity

indicators

|

|

CZ |

HU |

LV |

PL |

SK |

SL |

EU |

BG |

|

Land Regularization Status |

60 |

95 |

50 |

75 |

30 |

90 |

100 |

93 |

|

Title Loading |

90 |

80 |

30 |

50 |

30 |

0 |

100 |

90 |

|

Title Enquiry |

10 |

15 |

5 |

10 |

10 |

10 |

100 |

13 |

|

Transfers |

1 |

2.5 |

1 |

1 |

1 |

1 |

7 |

1 |

|

Mortgages |

0.1 |

0.2 |

0.05 |

0.05 |

0.1 |

0.1 |

9 |

0.02 |

|

Overall Assessment |

35 |

45 |

20 |

30 |

20 |

20 |

100 |

30 |

Note: The overall assessment is based on a percentage norm where 100 percent indicates a land market reaching a level of market activity that would be found in one of the more advanced EU states.

Source: ACE PHARE Project P2128R and author,s calculations for Bulgaria.

FIGURE 1

The place of Bulgaria on the

transition curve of land market activity.

Notes: As noted earlier, the first attempt to develop a transition curve of land market activity has been done by the team members of ACE PHARE Project P2128R. The author has incorporated the Bulgarian case on this graph.

SK = Slovak Republic; SL = Slovenia; LV = Latvia; PL = Poland, CZ = Czech Republic, HU = Hungary

LAND MARKET STATUS AND DEVELOPMENT REQUIREMENTS

Legal framework

Despite the frequent changes in legislation relating to land, the laws that affect land market development to the greatest extent were adopted in the early 1990s. A brief description of their main characteristics is given below.

Property rights to land in Bulgaria are protected by the country's Constitution. There are three types of land ownership: private, municipal and state, all of which are guaranteed by the Constitution. The imbalance between private property and state/municipal property has been regained as a result of the democratic reforms undergone in recent years. This has, however, caused a widespread fragmentation, especially of farm and forest land ownership. The cooperative category of land ownership[29] has been entirely abolished.

The Constitution places restrictions on land ownership, and particularly on farmlands, for foreign legal and physical bodies. According to Article 22 of the Constitution, no foreign physical or legal entity shall acquire ownership of land, except through legal inheritance. Ownership thus acquired shall be duly transferred. A foreigner (i.e. a physical or legal entity)[30] is free to acquire user rights, building rights and other real rights on terms established by the Foreign Investment Act (FIA). According to Article 23 of the FIA, foreign entities can acquire right of ownership and Act (FIA) (prom. SG. 1997, amend. SG 28/2002). According to Art.5 (1) In the context of this law, foreign persons shall be: (a) a corporate entity that is not registered in the Republic of Bulgaria; (b) a company that is not a corporate entity and that is registered abroad; (c) a physical entity - a foreign citizen with permanent residence abroad. (2) Bulgarian citizens with permanent residence abroad, who also have another citizenship, shall choose whether to be considered Bulgarian or foreign citizens under this Act. limited real rights on real estates. A foreign entity, including through a branch or as a sole proprietor, cannot acquire ownership of land.

Reinstatement of ownership of agricultural land was the subject of the Ownership and Use of Agricultural Land Act (OUALA).[31] According to the OUALA, agricultural land was restored to the landowners as of 1946. This procedure of land restitution in Bulgaria was complex. There were two means of establishing property rights - in actual or restorable boundaries and under land re-allocation plans. Both methods were time- and resource-intensive. This first phase of land reform is almost complete (98.8 percent restored land to private owners as of December 2001). The OUALA guarantees private ownership rights to landowners and their heirs. Landowners receive ownership documents (titles)[32] and have the right to decide by themselves what to do with the land. Although the OUALA is supposed to provide a juridical framework of land use, it does not incorporate a specific section on this. The MAF is developing a draft proposal for an amendment of the act that would fill this gap on land use.

Inheritance of real rights in Bulgaria follows the general legal pattern of the Napoleonic Code, resulting in fragmentation of the land in two or three generations. The underpinning principle is that all the heirs receive a share fixed by law - by the Inheritance Act, or by will of the estate of a deceased ancestor; this share is expressed as a fraction of the whole. The land in such an estate often remains undivided in real terms for several decades. This is why there is a high incidence of co-ownership (i.e. in undivided shares fixed as a fraction of the whole) on all types of property. For both rural and urban lands, there are minimum sizes of the land parcel[33] by law, which facilitates co-ownership and discourages fragmentation. In addition, the institution of marital joint ownership (i.e. ownership of the two spouses that is not explicitly shared as a fixed fraction) has high incidence - for all the property acquired during the marriage. In larger towns, the condominium in blocks of apartments is the prevailing type of housing. Co-ownership status is usually an obstacle for efficient property management, hampering the decisionmaking process and land transactions. Liberal inheritance law and tradition that provide for equal shares of all heirs in the estate are the major driving forces resulting in fragmentation and are the major obstacles to the development of a functional land market.

Bearing in mind the considerable soil diversity (on average, three or four very different soil categories) within territories belonging to one settlement (TBS), subdivision of an estate tends to produce a physical split of each individual plot into a number corresponding to the number of heirs, rather than a distribution of plots without a physical subdivision. In this way, each heir receives an equal share by both size and soil quality. Another factor that produces greater fragmentation is the established land use pattern within the TBS, e.g. irrigated land, orchards, vineyards and fields. Typically, heirs would seek to obtain an equal share of all available land uses within the farmland estate.

Very few transactions with land are registered in certain parts in the country, although a significant number of rent and lease contracts do exist. In this regard, two acts play an important role: the Obligations and Contracts Act (OCA) and the Agricultural Lease Act (ALA). Many landowners either do not have a clear understanding of their land ownership rights or do not have an interest in actively using the land. This is why the most appropriate ways to use land are through rent/lease agreements with active farmers, cooperatives or farming companies.

The purpose of ALA is to establish longterm, secure and fruitful relationships between lessors and lessees. It would be a step forward if lessees could also obtain funding from the banks by pledging their rights under the lease agreements to the creditors.

Legal tenancy arrangements in Bulgaria are personal, rather than real rights, and this is an inherent limitation to their tradability and transferability. Typical land tenancy arrangements are rental agreements (i.e. the generic tenancy arrangement stipulated by the OCA) and leases (i.e. a specific type of tenancy arrangement stipulated by the ALA) for private properties, and concessions for public domain properties. The rental term would not exceed 10 years, whereas the lease term should be more than 4 years and is unlimited in time. There is no obligation to register rental agreements, which are registrable if their term is over 1 year, whereas leases must be registered (under a stipulation of the Co-operatives Act, CA) to be legal. Rental agreements may be verbal (though rarely practised), whereas leases must be in a written form and certified by a notary public to have legal effect.

Farming cooperatives are required to sign rental agreements or leases with the landowners of the lands they use/cultivate. The law does not limit the amount of land under one lease. There are no restrictions on the minimum or maximum rent/lease payment for private lands. State/municipal lands have minimum rental/lease rates fixed by the competent state/local authorities on an annual basis. Rent/lease payments may be in cash, in kind or mixed. Land use may be changed only under leases, upon the explicit written consent by the landowner. Subletting is illegal, except when stated otherwise in the agreement.

Land leasing must be encouraged by any means (through tax alleviation, non-disturbance of the free initiative for negotiation between the lessee and lessor, etc.); however, lease relations must be secure for both parties. In general, land leasing could be encouraged by tax alleviation (with respect to income generated by the lease or otherwise) but only if the parties have registered their lease agreement in the land registry. This approach would stimulate the registration of leases and would allow the state authorities to obtain information about land use, lease terms and land values. As the short- and mid-term future of Bulgarian farmland utilization is through leases, and leases are an effective way of land utilization, any liberalization would facilitate the land consolidation process.

The CA must also be amended in such a way as to ensure transparency of the process. Before joining the cooperative, owners must be aware of all their rights and obligations. The CA does exclude a cooperative from becoming an owner of the land possessed by its members. Thus, the cooperatives are encouraged to rent or to lease land from their members or others (physical or legal entities),[34] which would also stimulate the land market.

As a practical measure against fragmentation of farmland use, the government plans to facilitate a specific form of spatial planning agreement between land owners for the formation of consolidated land use blocks, or the socalled "land use massifs". Through it, the owners and tenants agree to use their lands within certain geographical boundaries in a uniform manner, for example only as a wheat field. The agreement may be concluded only in writing. Joining the agreement is voluntary, and the agreement is registrable both at the MAF (the former Land Commissions) and at the municipal council. Legally, this is a voluntary private agreement, introducing self-limitation of the right of use on the farmland. The owners and users would opt for such massifs because of economic and competitive benefits. This would improve the land lease market.

The Regulation on the Procedures of Setting Current Land Market Prices (ROPSCLMP) was adopted by the Council of Ministers in 1998, and has been amended several times since, the latest being in May 2001.

Its main objective is to fix current market prices for agricultural land in the following cases:

for land compensations in cash;

for the determination of land price for "marginal lands"[35] around large cities and towns;

for the calculation of the cash equivalent of agricultural land in case of sale, exchange and other deals between the state and physical and legal entities;

for the determination of land prices for lands from the State Land Fund when land is given to the those without land;

for the determination of rent for state land.

Current market prices (CMPs) are calculated on the basis of starting (basic) prices, which differ according to the their allocation, economic factors and status. CMPs express the level of capitalized rent value by agricultural land category and market conditions in the country. Rent values are differentiated by coefficients for land size, available irrigation, allocation (north or south Bulgaria), distance from major markets, distance from large cities, etc. The land value calculated is used as a basis for the rent rates on land from the State Land Fund. In addition, these rent levels are used by the municipal councils when leasing land from the Municipal Land Funds.

Availability of land

The status of the land market in Bulgaria was affected by radical land reform that began in 1991. Agrarian reform and particularly land reform created prerequisites for the development of the land market in Bulgaria. The philosophy underpinning the reform was predominantly farmland restitution, defined as reinstatement of land ownership to that prior to setting up of collectives. The land reform was initiated in 1991 and by 2000 was almost completed. By the end of December 2001, 98.84 percent of agricultural land was restored land.

The land reform created 8.7 million parcels of land and established approximately 5.1 million new landowners. Almost 65 percent of the population became (co-) owners of land. Every new landowner receives a decision for reinstatement of his/ her property, including a detailed drawing of the land unit, by the MAF. According to the May 1998 amendment to the OUALA, these decisions are considered to be equal to the certificate of "ascertained notarial deed" and on their basis landowners can trade/lease their land. Landowners may, if they wish, use these documents to have a certificate of title issued by the notary public office. As a result, a large number of new participants in the market have been created, as well as a large number of new completely defined land units.

The reform produced extremely fragmented land areas, resulting in higher transaction costs, and therefore more difficult sales and reduced land availability.

Reinstatement of property rights on small plots of land dispersed within the whole TBS hampers land transactions and the establishment of viable and profitable farms. It becomes a bottleneck for an effective land market. Dispersed parcels hinder spatial planning in terms of land administration, land-use planning and land management. Although the land reform in Bulgaria is now almost complete, the resulting land fragmentation has had a negative impact on the sustainable development of the land market and agriculture. Improving livelihoods in rural areas requires effective resource allocation; in a narrow sense, this means land consolidation and spatial planning (Kopeva and Noev, 2001). According to expert assessments in Bulgaria, land fragmentation causes a 30 percent decrease in land prices, as well as difficulties in selling dispersed parcels of land. Evidence exists that in some places market players on the demand side refuse to rent/lease fragmented plots.

Estimates show that the reform has resulted in over 2.6 million private farmland titles (in the name of the 1946 landowners), for an average holding of 2 ha. The forecast is that over 12 million plots of 0.4 - 0.5 ha on average will be established. In places where the land reform was completed earlier, a further reduction in the average holding size by a factor of 1.6 - 1.7 has been observed within the first 3 years following the restitution (Batanov, 1998). This is a result of the ongoing subdivision of restitutive land among the present heirs of original titleholders. Subdivisions are currently the most frequent transactions of farmlands. Extrapolation indicates that the average plot size may be reduced further, to 0.3 ha, which is the actual legal minimum for plots used as fields. (This minimum is 0.2 ha for orchards and 0.1 ha for vineyards, but restitution - especially within existing physical boundaries - has produced even smaller plots.) In parallel, processes of natural consolidation through the sales market are as yet insignificant, as the reform is in its inception. Quick radical changes in this market seem unlikely, given Bulgarian preferences. The leasing market might otherwise easily achieve some consolidation; however, it is currently underdeveloped and hardly provides sufficient security of tenure for the farm enterprises to invest in land improvements.

Participants

As previously mentioned, a large number of new participants have entered the market through the land reform programme and in particular after the subdivision of land between heirs. There are many participants who own very small plots. Thus, the main participants on the land market are physical and/or legal entities, the state and the municipalities.

The restitution process has resulted in the establishment and readjustment of the relationships between landowners, land users and the land itself. As a result of the land reform, three independent land funds were established. The State Land Fund (SLF) and the Municipal Land Fund (MLF) are institutionalized, whereas there is no fund, by right, for land owned by physical and legal entities. De facto, this is the largest "land fund"[36] and the key stakeholders all come from this group. Nearly 72 percent of the landowners are "absentee' - living far from the land they own and employed in other sectors of the economy. Expectations are that some of these landowners will begin to sell their land upon finalizing property subdivision between co-owners (as a result of liberal inheritance laws). Others will become more actively involved in the land rental market. The SLF manages state-owned land, whereas the MLF manages municipal property.

The SLF and MLF play an important role in the process of land compensation, giving land to those who do not own land.

However, these funds only have a limited amount of land available. SLF and MLF use administratively determined prices.[37]

Land market participants, especially those who supply land, provide an indication that there is a misunderstanding as to "what land prices should be". Their expectations are for enormously high land prices unrelated to the current economic environment in Bulgaria.

Land market information

Trading land requires accurate information on value and pricing. Ideally, prices rise and fall in response to demand, assuming that information on market behaviour is freely available. In the land market in Bulgaria, the flow of information is considerably curtailed, either through a real lack of market activity or through the lack of an institution to monitor, report and publish information regarding the markets.

In the absence of accurate data on actual sales, the seller is dependent upon the services of a valuer, who use their expert knowledge to assess the "market" value of the asset. If there is no established methodology that provides an accepted connection to the market value, then there is a certain risk in accepting the value estimate. Different participants would have different perceptions of what constitutes an acceptable level of risk, and this would be reflected in any credit rating that may apply.

The Agricultural Marketing Information Service (AMIS) collects information through their own network; real estate agencies have also developed data sets on a regional basis. In both cases, the volume of data is too small for accurate prediction.

The information collected is a mixture of anecdotal information and documentary records, partly based on market evidence. These surveys are a useful indicator of the land market and its development since the end of the restitution process in 1998. Some of the assumptions made in the data analysis are arbitrary, and the simple averaging within territories is unjustifiable. The AMIS land market data set needs to be improved, as it is very heterogeneous, pays insufficient attention to detail and has no clear data quality controls. Nevertheless, it is an admirable effort towards a regular and specialized collection of land market data, and demonstrates a good practice of partnership between MAF and AMIS.

The surveys do not systematically and consistently focus on details important for analysing the land market and tenure data, such as: terms and conditions of agreements (duration of term, payment terms, etc.); physical features of the subject farmlands (size, fragmentation, etc.); and land use and purpose of sales (land for development etc.). These details are usually covered by expert comments in the narrative part of the survey, but the sources and substantiation of the conclusions are unclear.

The data sets published for 2000, 2001 and 2002 are sometimes broken down by TBS,[38] with aggregates by municipality and district, and sometimes only the aggregated data are shown by municipality and district.

On this basis, the AMIS newsletter has published average data for the sales and the leases of farmlands at NUTS I [Standard nomenclature of territorial units (NUTS) for EU statistical purposes], NUTS II and NUTS III level. In addition, the newsletter has a narrative part explaining the trends and tendencies observed at NUTS III, giving details not covered in the tables and conclusions made by the authors. This narrative part makes use of the abundant anecdotal data collected in the survey, and expands upon specific case studies in the geographical areas of importance to Bulgarian agriculture, from the point of land markets (Dobrudzha), and further analyses of factors that influence land prices, rent/lease payments, charts and diagrams.

The AMIS surveys correspond to the level of development of the farmland markets in Bulgaria. Interviews with survey authors and MAF representatives indicate that the government is aware of the imperfections of this data set and has a policy of improving it. The main areas of improvement are the collection of raw data by MAF and a better legislative framework, enabling MAF to register all farmland tenancy agreements.

The existing valuation system calculates an administrative (official) land value based on a range of soil characteristics and the potential productivity of particular crops for a particular soil ecology unit. This system is unrelated to market value.

Twelve years after the launch of the restitution process in agriculture, the country offers a rather varied view in terms of supply and demand of agricultural lands and the location and size of lands that are offered and sought. In general, the initial expectations of the new owners and the governing bodies have not been met. At present, a land market exists only in certain regions - Dobrich, Plovdiv and Silistra. In other regions, the first signs of a real market are present - Veliko Tarnovo, Varna, Rousse and Lovech. In the remaining regions - Sofia, Bourgas, Sliven, Shoumen, Razgrad, Blagoevgrad, Vidin, Vratza, Stara Zagora, Targovishte, Gabrovo, Pleven, Montana, Pazardzhik, Smolyan, Haskovo, Kardzali, Yambol and Kyustendil - individual sales of agricultural lands have been accomplished. The latter are deemed representative and do not provide reliable evidence to suggest that there is an established land market in these regions.

There is no significant active land market for agricultural land. Lands sold currently are of such a small size that there can be no meaningful level of investment value estimated for them. This lack of a market is due to a variety of reasons. In addition to those already mentioned, there are social and cultural factors as well as the lack of loan funding available from banks and lending institutions. It is essential that the government and MAF stimulate the development of an active land market for the future benefit not only to the farm sector economy but to all sectors of the national economy as well.

Over the last three years, the supply and demand of land has grown, but not to a satisfactory degree. The main reasons for this are:

the restitutive ownership of land and the opportunity to perform deals with land;

in certain regions, the demand for consolidated land suitable for a particular type of production by largescale producers with developed markets and channels for the distribution of their products;

the economic needs of some households.

The land deals are geared towards:

- Purchase of land from physical entities for agricultural needs. The price varies between 500 and 2 000 BGN/ha, in certain regions up to 4 000 - 5 000 BGN/ha.

- Purchase from physical entities of land adjacent to important infrastructure developments (highways, main roads, harbours, resorts, international bridges, etc.), in order to be included in regulation plans of settlements. The price is determined per square metre, not per hectare.

- Purchase of land from the municipalities.

- Transfer of ownership by the owner to others, most often relatives, at token prices.

- Purchase of land to be exchanged later for state consolidated land.

- Sales from the SLF.

The purchase of land from the SLF and MLF is not widespread as a result of the procedure for land compensation, with nominal compensatory bonds being initiated in 2001. The SLF is being used to provide such bonds.

Real-estate agencies play an important role in the purchase/sale process. At present, these agencies face and create different problems that hamper the land market: employment of unqualified agents; ignorance of existing legislation; lack of control on new businesses, which damages the reputation of wellrun companies. Often, the fees collected by real-estate agencies are so high that should a landowner decide to change agent he or she will not make a profit from the sale. Some firms also take the original documents (notary deeds) for the property, do not restore them to the landowners and force the landowner to use their services regardless of the quality they provide.

Institutions

The lack of incentive for private-sector real-estate professionals to provide market services/consulting indicates that MAF should provide funding or seek foreign aid to finance capacity-building of such expertise and the actual availability of these services/advice. The local authorities are natural stakeholders in the development of rural estate markets. It seems that so far they have not been properly involved in bringing together the potential demand and supply of farmlands (both sales and leases). In various regions, there are community development centres, business incubators or municipal development agencies supported financially by local authorities, local chambers of commerce and foreign donors. These are regions where such capacity-building may be developed. Initially, these centres may register potential supply by owners, try to assemble attractive packages of farmlands and offer them to domestic farmers and potential foreign investors. They may also facilitate the communication and negotiation free of charge for both parties.

The current land administration system is confusing, strongly fragmented in a number of poorly coordinated institutions, inefficient and overly bureaucratic. Consequently, the system does not meet modern requirements in general and those of the transition to a market economy in particular.

Therefore, the transition to a modern land administration system should focus on several objectives, the most important of which are:

streamlining the land administration institutions by re-engineering, transition to a positive land titling system and formation of a single government land registration/cadastre agency;

optimization of the variety of legal interests in land from the perspective of the rural land economy and the establishment of sustainable farmland tenure patterns;

development of simplified, inexpensive, quick, yet legally secure procedures for land leasing/conveyancing and mortgaging;

provision of flexible, market-driven, client-oriented services to the public, rather than just improving the public repository of property rights;

improvement of the efficiency, transparency and accountability of land administration authorities; and

land information management consolidation.

Bulgaria is facing a problem that is common to a number of CEE countries. The responsibility for administration and policy development on land issues has been split between many ministries. As a result, there are conflicting aims and no comprehensive policy. Currently, there are at least three ministries (with their associated institutions) that are involved in land policy issues - MAF, the Ministry of Regional Development and Public Works, the Ministry of Justice and the Ministry of Finance. In addition, Bulgaria has never had a history of land title-based property rights as was the case in those countries that were part of the former Austrian - Hungarian Empire or Prussia. The current system of personal registration of property rights (deeds registration) entails a slow and uncertain property transfer chain in the land market.

The split of responsibilities between ministries and institutions causes problems with regard to the availability of land records and information. These are fragmented between many agencies and, in addition to being in various stages of maintenance to reflect the current status of data, there are no clearly enforced responsibilities for transfer of information changes between institutions. This lack of integrated records not only hinders the development of a land market but also contributes to the lack of transparency in the clarification and registration of ownership rights. A solution could be developed if a single institution was assigned the responsibility for the cadastre and land title registration.

Finding a solution to this vicious circle of land policy issues requires the involvement of a high-level government authority to coordinate the decision-making and achieve synergy among the various vested interests. Such a decision-making process should, as much as possible, account for the interests of the public, rather than departmental interests. Such a body might be a government land agency, whose major concern may be the registration of legal interests in land and the coordination of land information management (i.e. a possible land registration/cadastre agency).

From the point of view of market development, a major reform of the present Bulgarian land administration is needed. Both the Bulgarian Government and the international funding institutions supporting the country during its economic transition have recognized this need since 1991, in particular for the restructuring of the rural sector; however, no action has been taken so far.

A comprehensive land administration policy implemented through appropriate legislative measures needs to be applied. The implementation of such a policy should have sound financial support provided in advance; implementation may otherwise fail with far-reaching adverse effects. In this regard, international aid/ donor organizations have indicated that further support to land administration reengineering in terms of both funding and technical assistance is dependent upon the sustainability of the transition policy adopted by the government.

Financial instruments

The levy of a land tax is a sensitive issue. This would affect land prices and ownership, as well as land use and conservation. The land tax may become an important source of revenue to municipal budgets. Agricultural land, as with any other property, should be subject to taxation. According to the OUALA, agricultural land shall not be subject to taxation for a period of five years upon the completion of land restitution. This period expired in 1999 for those agricultural lands that underwent restitution earliest.

The land tax has generated much controversy on issues such as what should be the means of settling and who should be the taxpayer (owner and/or tenant). The legal concept of land tax is equally affected by the recognition of property as a set of legal rights in land. Those rights are factually divided among multiple parties - landowner, tenant, state, municipality and public owners (churches, schools, universities, etc.). The land tax may be considered as a "payment made to the holder of one set of those rights by the holder of another set for the privilege of their continued use and enjoyment". Most of the economic debate concerns the necessity for the land tax to be linked with the system of property ownership (FAO, 2001b). The system comprises the ownership rights of the title holder and of tenure rights. This issue is more important for lifetime and long-term lease contracts. Thus, one of the possible solutions is that the tenant would be liable to pay the tax.

Several interviewees have suggested that a penal land tax/fee should be imposed on non-cultivated farmlands. The suggestion is that it would act in a way similar to the suggested annual land tax by launching the land market and the natural, marketdriven land consolidation process, with the additional advantage that prudent owners/farmers would enjoy a "tax-exempt" status. If the same criteria were applied to the evaluation of the annual land tax, the arguments would be similar. Such a penal tax may be acceptable from the point of view of apparent fairness. It is also arguably acceptable with regard to social consequences for the same reasons as given for the annual tax. From the perspective of economic acceptability, it would not burden the agriculture sector. From a perspective of potential revenue, however, a possible penal land tax on non-cultivated lands would be very expensive and difficult to enforce, because of the necessity to monitor fields at least once a year and the relatively difficult identification of both idle lands and tax-liable individuals. As a result, such a tax may not be economically viable, and therefore levying a penal land tax for noncultivated lands is not recommended.

According to the Local Taxes and Fees Act (LTFA), farmlands are subject to transfer tax (both on conveyance for consideration and gifts) in the case of real-estate transactions, and to inheritance tax levied on property belonging to a deceased person. There is no capital gains tax on land at present.

With regard to incidental farmland taxes, there are issues related to the valuation/ assessment of taxes and fees due in the case of conveyance for consideration. The present statutory valuation methodologies stipulated by the LTFA and the Ordinance on Basic Market Prices of Farm Lands (OBMPFL) lead to confusion among both potential sellers/buyers and officials charged with the collection of these incidental taxes. The fact that the capital values of farmland produced under the LTFA and OBMPFL are frequently higher than actual market prices, and that the tax is assessed often on the higher OBMPFL value, is an additional discouragement that hampers the development of the land market. Land transaction costs are too high and reduce the attractiveness of land sales, especially in case of small rural holdings of 0.5 - 1 dca, where land prices per decare are comparable with the monthly retirement allowances.

Concurrently with the agricultural reform, the banking sector itself is being restructured and is therefore not in a favourable position to meet farmers' credit demands. Agriculture suffers from the problem that it is dependent upon both demand and supply forces. Lack of collateral, low profitability and macroeconomic uncertainty make banks view the agricultural sector as a high-risk customer. Expected decline in profitability and macroeconomic uncertainty discourage borrowing at high nominal interest rates. Farmers' immediate plans are uncertain as a result of a lack of working capital. There is also the long-term problem of ensuring adequate funding to facilitate structural adjustment and to enable farmers to apply effective technologies.

There is a shortage of investment capital for farming and the agricultural land market, which is a factor hindering its development. No banks and financial institutions provide long-term loans to farmers against a mortgage on farmland. The problem is even greater for farmers who do not work their own land. They can only pledge future crops to obtain financing from banks. Banks are not inclined to give such credit, as they cannot find a market for the collateral. On the positive side, insurance companies in Bulgaria have demonstrated willingness to insure future crops, which might stimulate the banks to provide such credits.

In this respect, adopting legislation that would enable banks to issue mortgage bonds is critical. By doing so, banks would hedge their risk. A bill to that end has been drafted; however, agricultural lands have been excluded from its framework. In addition, a possibility should be provided for the lessors to obtain credit against pledging their rights under the lease agreement.

Collateral

With the land reform in Bulgaria almost completed, land is not fully tradable, which inhibits its possible use as collateral. The current legislation prevents the pledging of assets in cases when the latter are in the process of privatization or restitution. Alternative collateral is required until property rights are fully restored on all types of assets.

Collateral must not be used as a substitute for efficient loan appraisal and evaluation procedures. Loan guarantees, more widely known as guarantee funds, have often been proposed in many countries. Empirical evidence, however, is not very encouraging. Under some circumstances, the guarantee mechanism may add value, at reasonable cost, to lending operations. For this to occur, a highly developed financial market needs to be present. The guarantee mechanism should be avoided until such a market is in place.

Farmers often have to provide longterm assets as collateral for short-term loans. In addition, banks normally require attractive property in urban areas and often refuse agricultural land as collateral, even with property rights fully restored, either because of the absence of a functioning land market or because of low land prices. Bulgarian bankers would accept as collateral about 50 percent of the market value of fixed assets in urban areas and 30 percent in rural areas. As a result of a high inflation rate during the transition period, banks sometimes require 150 - 200 percent of the total loan as collateral.

High monitoring and loan screening costs further repress agricultural credit availability. The continuous restructuring of agricultural enterprises and the difficulties in monitoring agricultural operations make agriculture an unattractive sector to bankers. The lack of reliable accounting systems for individual farms hampers an accurate flow of information to the banks. Efforts to provide increased public funding to projects related to agricultural information system development, extension services, professional and vocational training, taxation systems and businessplan development are therefore being made. These initiatives are aimed at reducing many of the problems faced by lenders in obtaining information and at minimizing transaction costs for both contracting parties, without interfering with the actual market allocation mechanisms.

Government policy

A land policy should be adopted and widely publicized. This policy should not affect farmland alone, but should address the more general issue of managing the national land resources (urban, rural and forest) in the best interests of the state. The formulation of such a policy should address the need of the state in its credibility in establishing a regulatory framework protecting Bulgarian citizens' land ownership rights and obligations. For example, it should address expanding the period of time that individual owners have for making decisions and plans regarding their farmlands, beyond the present shortterm perspective of 3 - 10 years currently observed throughout the country (even state lands are not leased for periods longer than ten years).

A long-term national land resource management strategy is needed. Currently, the government's responsibilities with regard to the management of this limited national resource in the best interests of the nation and in a sustainable manner are very fragmented. Apart from a few internationally funded regional initiatives and urban planning efforts in some of the large cities, there is hardly any regional/ local physical planning of the territories; farm and forested territories seem to be missing from regional/local planning (if any). Regional/local development, landuse issues, rural land consolidation strategies, farmland acquisition for public need, environmental protection measures, development of farm infrastructure and services (roads, irrigation systems, erosion control, hailstorm protection, etc.) have to be properly addressed by such a long-term national strategy.

The national land policy in Bulgaria is unclear and suffers frequent radical changes of direction. The country is undeniably moving towards a land tenure system based on private rights and interests, together with liberalization of land markets, under the overall objective of a transition from central command towards a market economy. However, there is a widespread misinterpretation of laws as policy, rather than only as instruments serving to implement such policies. (Thus, in Bulgaria there is a popular fallacy that land reform and agrarian reform are synonymous.) Hardly any systematic attempts have been made to develop comprehensive national land policies, and typically a piecemeal approach to solving land-related issues has resulted. In consequence, there is a global lack of accessible, credible and comparable information on land tenure, land use and land markets, as well as practically no comprehensive physical planning.

Specific land policy issues related to rural development that need to be addressed by the MAF include:

in striving towards a better legal security of land tenure, plan the transition to a modern land administration system as a critical infrastructure prerequisite for the development of the land markets;

draw up and implement a consistent longer term land taxation policy, including monitoring of the land markets;

consolidate the currently fragmented and often inconsistent land policies that are being implemented by various government agencies;

develop a long-term national land resource management strategy, including issues of regional/local physical planning of the territory, rural land consolidation, etc.;

encourage foreign investment and access to long-term bank credit.

IDENTIFICATION OF AREAS FOR POSSIBLE TECHNICAL ASSISTANCE

Several areas have been identified for possible technical assistance to support the development of active land markets and an adequate Land Consolidation Act.

Development of a Land Bank

Existing land fragmentation could be overcome by the development of a Land Bank. The concept behind the Land Bank is the establishment of an institution that would manage state and municipal land funds and would trade land after its consolidation. The Land Bank can overcome the existing trade problems relating to small, unattractive parcels of land, and can play a vital role on the land market.

Spatial organization (land consolidation)

In terms of planning, there are critical deficiencies in the relevant policies and practices. The most important regional development issues, including rural development, are: lack of a comprehensive, conceptually sound and long-term policy; weakness and lack of experience in the institutions (especially at subnational level); unsatisfactory sectoral coordination at all levels; insufficient local and regional initiatives and activity; and a shortage of up-to-date and reliable regionally and/or locally specific information. With regard to the present situation, mechanisms should be created to stimulate the consolidation of land used by one person or a group, as well as the establishment of farms. At present, the state does not have a clearly defined agricultural policy, nor a mechanism to encourage land consolidation. As the problem in question is of major importance to the revival of agriculture and the land market, the state should without delay define its strategy for encouraging consolidation. The likely natural evolution from the present situation of fragmented land ownership would follow the route of a "quick" leasehold land consolidation; the establishment of viable and sustainable leasehold farms; gradual and slow development of the sales/purchases market; and gradual consolidation of land ownership, most probably in the hands of successful leasehold farm owners. From the point of view of least interference of the state in the market, and least negative social consequences, this seems to be an acceptable course of development. Assuming that the developing lease market reaches a state of integrity, and that efficient farm operators succeed in reaching economic farm sizes and stability on the basis of leaseholds, it is easily conceivable that they would start buying lands from absentee owners, especially where lessee farmers have built a good relationship with the lessors. Thus, both physical and legal land consolidation would expand in the longer term. Such a natural course of development would be better than any direct interference by the MAF.

Development of training courses on land management

The worldwide experience of international institutions (World Bank [WB], FAO, Deutsche Gessellschaft für Zusammenarbeit [GTZ], etc.) should be used to develop a programme of training courses on land management. The target group would include surveyors, MAF staff, NGOs, regional agricultural offices, farmers and representatives of branch associations. The lack of incentive for private-sector real-estate professionals to provide market services/consulting indicates that the MAF should provide funding or seek foreign aid (FAO, WB, EU) to finance capacity-building of such expertise and the actual availability of these services/advice. The local authorities are natural stakeholders in the development of rural estate markets. It seems so far that they have not been properly involved in bringing together the potential demand and supply of farmlands (both sales and leases). In some regions, there are community development centres, business incubators or municipal development agencies financially supported by local authorities, local chambers of commerce and foreign donors. These are where such capacity may be further developed. Initially, these centres may register potential supply from owners, attempt to assemble attractive packages of farmlands and offer them to young domestic farmers and potential foreign investors. They may also facilitate communication and negotiation free of charge to both parties.

Land valuation

In a well-functioning land market, land valuation is one of the three pillars that support its existence and development. It provides the connection between land and monetary value. It thus produces an estimate of the capital value of the asset. There are various ways to calculate this capital value, which may involve estimates of the income potential or the actual market value of the property, consistent with any usage and occupation constraints that may apply. Investors use this estimate to control their financial risk. Clearly, the system needs to reflect the nature and type of property, its usage, the type of lease or ownership and the location. Currently used systems of land valuation are contradictory and need methodological improvement. The expected levels of land values for compensation purposes further confuse the situation for farmlands, which will not undergo restitution via the OUALA (where the recognized farmland ownership exceeds the physically available farmlands in a TBS). These expectations are based on the OBMPFL, which is underpinned by an artificial formulaic approach to determining land values.

Development of standard gross margins in agriculture

The development of standard gross margins would provide information for the minimum and maximum levels of rent that farmers can pay, and can be used in the implementation of different approaches to land valuation.

Development of land policy

A land policy should be formulated and widely publicized. It should not affect farmland alone, but should address the more general issue of managing the national land resources (urban, rural and forest) in the best interests of the nation. The formulation of such a policy should address the need to increase the credibility of the state in the establishment of a regulatory framework protecting Bulgarian citizens' land ownership rights and obligations. For example, it should address the need to increase the time that individual owners have to make decisions and plans with regard to farmlands, beyond the present short-term perspective of 3 - 10 years currently observed throughout the country (even state lands are not leased for periods of longer than ten years). A long-term national land resource management strategy is needed; at present the government's responsibilities with regard to the management of this limited national resource in the best interests of the nation and in a sustainable manner are highly fragmented. Apart from some internationally funded regional initiatives and urban planning efforts in some of the large cities, there is hardly any regional/ local physical planning of the territories; farmland and forest territories seem to have been omitted from regional/local planning (if any). Regional/local development, land-use issues, rural land consolidation strategies, farmland acquisition for public needs, environmental protection measures, development of farm infrastructure and services (roads, irrigation systems, erosion control, hailstorm protection, etc.) need to be properly addressed by such a long-term national strategy.

CONCLUSIONS AND RECOMMENDATIONS

Current reforms and the ongoing market transition will continue and there will be no substantial change of political direction or orientation. The process of application for EU accession will continue, with the consequent need for harmonization of legislation to that of the EU. The government is committed to support development of transparent land markets as a long-term objective; this corresponds to one of the basic requirements for EU accession.

There is no doubt that without a properly functioning market it will be virtually impossible to move towards the desired restructuring of land tenure and the establishment of competitive operating structures in the sector. The development of the land markets and their support by appropriate secure land administration are high and indispensable priorities for the restructuring of the economy.

BIBLIOGRAPHY

ACE. 1998. The development of land markets in Central and Eastern Europe. Final Report Project P2128R, ACE PHARE Programme, Brussels. (unpublished report)

AMIS. 1998 - 2001. Land Market Pricing Newsletter.

Batanov, K. 1998. Ownership and land market in the Dobrich Region. Paper presented at the USLMB Symposium, Sofia, November 1998.

FAO. 1999. Strategy for agricultural development and food security, Project No. Bulgaria TCP/BUL/ 7821 (A). Rome.

FAO. 2000. Aspects of land consolidation in Bulgaria, by D. Kopeva, N. Noev & Vl. Evtimov. Rome. 121 pp.

FAO. 2001a. Transfer of ownership and land fragmentation in the transition to family farms in Bulgaria (Case study), by D. Kopeva. Rome. 15 pp.

FAO. 2001b. Land rental markets in Bulgaria (Case study), by D. Kopeva. Rome. 44 pp.

Kopeva, D. & Noev, N. 2001. Aspects of land consolidation after the land reform. In I. Osamu, ed. The new structure of the rural economy of post-communist countries, pp. 123 - 159. Sapporo, Japan, Slavic Research Center, Hokkaido University.

National Statistical Institute. 1998 - 2001. Statistical series. Sofia, National Statistical Institute.

|

[27] This research was

undertaken with support from the World Bank (WB). The content of the publication

is the sole responsibility of the author and in no way represents the views of

the WB or the University of National and World Economy (UNWE). [28] In the development of this comparative table, I have used a Land Market Model developed under the ACE PHARE Project P2128R: "The Development of Land Markets in Central and Eastern Europe". The project team developed the Three Pillar Model and conducted evaluation for Poland, Czech Republic, Slovak Republic, Hungary, Slovenia and Latvia. [29] Land in this context means land and buildings. [30] Specific explanation on who are regarded as foreigners and what their rights are is provided by the Foreign Investments [31] OUALA prom. SG 1990, multiple amendments; last amendment 2001. [32] Notarial deed accompanied by a drawing of the property (both issued by MOAF, the former Municipal Land Commission). [33] 3 dca for fields; 2 dca for meadows; 1 dca for orchards and vineyards; 10 dca for forests (OUALA). [34] According to Article 31 (4), CL: Ownership and real rights over agricultural land shall not be submitted as a property of the cooperative or be constituted in its benefit. The cooperative shall use agricultural land owned by its members only under a rent/lease contract duly signed in writing. [35] Marginal lands are those allocated along the "border" between agricultural land and urban land around large cities. This land was allocated for the construction of summer houses and dachas during socialist rule and is now claimed for restitution. According to the OUALA, these prices will be used to settle ownership between both parties in the dispute. [36] Here the category "land fund" is used as a concept representing agricultural land that has undergone restitution to physical and legal entities, outside of the state and the municipality. [37] The administratively determined prices are stipulated by ROPSCLMP. [38] Territories belonging to settlements (TBS) are the lowest level administrative subdivision in Bulgaria (individual settlement - either village or town). There are about 5 000 TBSs within 272 municipalities (NUTS IV), grouped in 28 regions (NUTS III), six planning regions (NUTS II) and the country (NUTS I). |