This chapter reviews the main environmental and social issues in banana production and trade and introduces the certification programmes that have arisen in response to growing concerns among consumers and society in general. It then analyzes the markets for two types of certified products: organic and fair-trade bananas.

The expansion and intensification of production in large plantations in the 1980s and early 1990s gave rise to a series of environmental problems. The expansion of banana cultivation was historically done at the expense of forests and other natural vegetation. For example, in Costa Rica the area under cultivation increased from 20 000 hectares to 50 000 hectares in just five years. More importantly, the production of bananas for export is generally intensive, with high levels of external inputs, and often takes place in monoculture plantations organized along agro-industrial lines. Most farms rely on the frequent use of agrochemicals to maintain fertility and limit losses caused by pests. Because large monoculture crops are prone to increased attacks by pests and diseases, growing quantities of pesticides are generally needed. In turn, the extensive use of agrochemicals has given rise to the emergence of pest strains that are resistant to pesticides. Pollution was also caused by inadequate disposal of waste such as pesticide-impregnated plastic bags or rejected fruit. Inappropriate production practices have often led to pollution of land, watercourses and aquifers, and a reduction in biological diversity.

The 1980s and 1990s witnessed rising public awareness of environmental issues. These were reflected at the 1992 United Nations Conference on the Environment and Development in Rio de Janeiro, when governments recognized the importance of good stewardship of natural resources in achieving sustainable development. As consumers have become increasingly sensitive to environmental issues, the intensive mode of agricultural production has attracted growing attention. Due to the high concentration of production and trade in large transnational companies, the banana sector came under close scrutiny in the 1990s (see Chapter 6). Strong pressure from NGOs, negative media coverage and a shift in consumer preference towards ‘ecofriendly’ products led some companies to take measures to reduce the adverse impacts of banana cultivation on the environment. Waste disposal has improved considerably over the past ten years. The collection of plastics, the composting of organic rejects and the filtering of wastewater have all become common practices on many plantations.

In the meantime, the world banana market has become oversupplied and prices have declined, thus reducing the incentive to increase banana production. The area cultivated in bananas has stabilized in the main producing countries and it is expected that future production increases will derive from yield increases in existing farms rather than expansion to new land. As a result, banana production is now less of a threat to primary forests.

However, the pollution caused by the intensive use of agrochemicals in monoculture production remains a challenge for the producer, as changes in input use affect productivity. Banana monoculture attracts a wide range of pests and diseases, notably fungal diseases, which are difficult to combat in a tropical climate. The main fungal disease, Black Sigatoka, is able to mutate and develop resistance to fungicides, posing a problem to plantation managers seeking to reduce agrochemical use. Biological techniques to control this fungus have not proved conclusive so far and further research is needed in this area.

Part of the solution may be found in integrated pest management (IPM) and integrated production and pest management (IPPM) methods. IPPM methods manage pests by mechanical and biological means as much as possible and only use chemical pesticides as a last resort. When pesticides have to be used, the preference is for those that are less toxic and persistent. The focus of IPPM shifts away from the eradication of pests and towards limiting their population to a level where the damage they cause is financially acceptable to the farmer. IPPM also makes a careful use of fertilization to avoid the contamination of surface and underground water.

In addition to the negative impacts on the environment, pesticides may also have adverse effects on the health of plantation workers and neighbouring communities. Although due by practices of the past, the health problems caused by nemagon (a nematicide) persist today for many workers. Some victims have sued banana and agrochemical companies and obtained compensation, while others are still engaged in lawsuits.

Even authorized pesticides may cause health problems if the recommended safety measures are not strictly followed. Safety measures may include the use of facial masks, boots, gloves or impermeable clothes. However, some of these are extremely uncomfortable in the hot and humid conditions of banana cultivation. For this reason, the International Code of Conduct on the Distribution and Use of Pesticides of the FAO states in Article 3: “Pesticides whose handling and application require the use of personal protective equipment that is uncomfortable, expensive or not readily available should be avoided, especially in the case of small-scale users in tropical climates” (FAO 2002).

In addition, the banana industry often faces conflicts related to labour rights on plantations. In several instances, the conventions of the International Labour Organization (ILO) and even national labour laws were not enforced, leading to abuses such as child labour, excessive working hours, discrimination, sexual harassment, disrespect of health and safety regulations. Another frequently debated social issue in banana production is the right to freedom of association and collective bargaining, as formulated in ILO conventions No. 87 (1948) and No. 98 (1949). In many cases plantation management resisted independent workers unions, while in others demands for higher wages and other benefits were perceived as unrealistic. In general, the relationship between unions and banana companies is extremely contentious (see Chapter 6).

Some conflicts and cases of labour rights abuse were taken to the ILO and publicized in the major banana importing countries. These cases helped to increase consumer awareness of the “ethics” of food production and trade, and were carried out through campaigns launched by various NGOs working in areas such as human rights, social development and “fair-trade”. Working conditions or the “fair” remuneration of farm workers and small producers in developing countries attracted the attention of public opinion in developed countries. NGOs put pressure on companies to ensure that workers’ health was not put at risk by the lack of adequate safety measures on the farm or the use of pesticides known to be hazardous. They have been increasingly involved in labour rights issues, including freedom of association or the right to join an independent trade union. Under pressure from NGOs, retailer demands and increased consumer awareness of ethical trade in the importing countries, companies took steps to improve the situation of their work force. This tendency was initially seen in shops selling imported handicraft products which guaranteed their customers that their rugs were not produced with child or forced labour. More recently, the movement reached larger manufacturers of consumer goods, and demanded a closer monitoring of the working conditions in their subsidiaries worldwide (e.g. garments and sport shoes). Social concerns also reached the agricultural sector in general and the banana sector in particular.

Some progress has been observed in recent years as relations with trade unions have gradually improved in many countries. For example, Chiquita signed an agreement in 2001 with the International Union of Food and Agricultural Workers’ Associations (IUF, an international federation of trade unions) and Colsiba (Central American federation of banana worker unions) in the presence of the Director General of the ILO (IUF 2001). However, many tensions still remain as exemplified by a recent report by Human Rights Watch on Ecuador in 2002.

A wide range of concepts, tools and mechanisms has been suggested by the international community to address these environmental and social challenges in production and trade. Some of them are mandatory and rely on national or multilateral agreements, while others are voluntary. A few countries have taken unilateral steps to ban the importation of goods believed to be produced in a way which is harmful to the environment (e.g. tuna fishing with nets that can kill dolphins). However, in most cases such measures are found inconsistent with WTO rules, mainly because they discriminate on the basis of production process and methods (see FAO 2003 on WTO and eco-labelling).

Some NGOs and governments of developed countries have suggested the insertion of social and environmental clauses in international trade agreements. The idea is to give exporting countries market access conditional to meeting previously agreed social and environmental standards. These standards would be based on intergovernmental agreements reached in multilateral fora (e.g. the Conventions of the International Labour Organization for labour standards). However, the inclusion of social and environmental clauses in international trade agreement is opposed by many countries and companies.

Some governments have defined voluntary environmental guidelines for specific sectors of the economy, whereby each company is free to adopt them or not. However, companies may have little incentive to implement guidelines if these result in higher costs and no commercial or financial rewards.

The civil society also made proposals, some of which were led by NGOs and others by the business sector. NGOs were pioneers in promoting more sustainable forms of agricultural production and trade such as organic farming and alternative trade (see below). More recently, companies have also felt the need to respond to the growing concerns of consumers for environmental and social sustainability. The concept of corporate social responsibility has gained momentum since the 1990s. Some firms made efforts to protect the environment or to introduce social guidelines in their operations. The most common response in the corporate sector has been the introduction of voluntary in-house codes of practice. As regards their internal operation, many large companies developed ethical guidelines and appointed “ethics officers” or “corporate social responsibility officers”. In some cases, industry-wide codes were considered. In the United Kingdom, the association of banana importers has adopted a code of conduct for ethical trading. In Colombia, the banana industry has set up a programme to improve its environmental and social performance. In addition, some major retailers in European countries (e.g. United Kingdom, Switzerland) have set up ethical sourcing rules aimed at ensuring that their suppliers comply with social and environmental requirements. In the UK, the Ethical Trading Initiative (ETI) brings together stakeholders from a broad range of sectors (industry, retail, NGOs, government) and aims to develop the use of corporate codes of conduct to improve labour conditions.

While corporate codes of conduct are a necessary first step, their actual impact might be limited. Codes are written, implemented and monitored by the companies themselves, which in turn can be accused of being judge and jury. Codes written and verified by retailers for their suppliers can be reliable, but there are still potential conflicts of interests as the codes are written by one party in the commodity chain. As a result, many of the larger banana producing companies have gradually turned to certification instead of standards established by outsiders. In this system, the implementation of the standard is monitored by an independent certification body (third party verification).

A number of NGOs have developed international voluntary standards and certification mechanisms for sustainable agriculture. National certification programmes promoted by governments or national trade associations also exist (for example, the Bandera Ecológica in Costa Rica), but these are not included in this publication.

Voluntary certification is a proactive, market-oriented mechanism devised by organizations that follow the evolution of market demands (in this case demands for environmental and/or social concerns). Voluntary certification programmes add to traditional regulatory frameworks by using market incentives that encourage improvements above the minimum levels required by law. Certification may help to rationalize operations and to reduce costs (for example by using lower quantities of pesticides), thereby adding value to the product by enhancing the company’s image vis-à-vis customers, business partners, regulators and the wider public.

At present, banana companies use various environmental and social certification schemes. It should be noted that these programmes apply to a range of agricultural products beyond bananas. The most important are:

The above certification programmes use different approaches and criteria. Some emphasize environmental issues, while others social equity and labour rights. Another type of certification, EUREPGAP, is included in the discussion below, for although its focus is on food safety and traceability, it has nevertheless requirements on worker safety and environmental protection.

Organic standards and certification

"Organic agriculture is holistic production management systems which promote and enhance agroecosystem health, including biodiversity, biological cycles, and soil biological activity... Organic production systems are based on specific and precise standards of production which aim at achieving optimal agro-ecosystems which are socially, ecologically and economically sustainable. Terms such as "biological" and "ecological" are also used in an effort to describe the organic system more clearly. Requirements for organically produced foods differ from those for other agricultural products in that production procedures are an intrinsic part of the identification and labelling of, and claim for, such products."

FAO/WHO Codex Alimentarius Commission Guidelines for the Production, Processing, Labelling and Marketing of Organically Produced Foods, 1999.

There are many private standards for organic farming, such as the Basic Standards of the International Federation of Organic Agriculture Movements (IFOAM)[36]. In addition, many countries have developed national organic standards and regulations to prevent fraud and facilitate trade. Organic standards for plant production typically include criteria for conversion periods, using organic fertilizers and natural pesticides, the type of seeds and propagation material used, measures to conserve soil and water, recycling organic materials and pest, disease and weed control.

Fair-trade[37]

Fair-trade initiatives seek to provide better market access and trading conditions to small farmers. Better trading conditions include price premiums which are invested in social and environmental improvements at farm level. Fair-trade labelling NGOs verify that producers and traders comply with fair-trade standards, but do not trade to remain independent. NGOs founded in 1997 the Fair-trade Labelling Organizations International (FLO International) as a legally-independent certification body that uses local auditors to monitor the compliance with specific standards. These standards are set by FLO International and include criteria for: participation in farmer associations and co-operatives, worker’s freedom of association in plantations and factories, wages and accommodation, occupational health and safety, preventing child or forced labour. Environmental criteria for bananas include the use of buffer zones and a ban on herbicides. Standards also stipulate minimum prices set by FLO International plus the fair-trade premium, and traders pay farmers in advance up to 60 percent of the value of the merchandise.

ISO 14001

The International Organization for Standardization (ISO) sets voluntary internationally harmonized industry standards. ISO-14001 was designed to support the implementation of environmental management systems. It requires companies to develop an environmental policy, including an implementation and communications plan, the definition of responsibilities, staff training activities, documentation and monitoring. The standard does not set specific performance targets, which means that its actual impact on the environment depends on the targets set by the certified company.

Certification for ISO-14001 is carried out by either governmental or private certification bodies under their own responsibility. The ISO logo cannot be used in connection with certification or on product labels. However, an indication on the product that the process is ISO 14001 certified would be allowed under the control (and logo) of the certification body (ISO 1998).

ISO 14001 is rapidly becoming a default certification for plantations. It may be useful to companies in structuring documentation, monitoring their environmental impact, providing environmental management tools and, in some cases, reducing costs.

Sustainable Agriculture Network / Rainforest Alliance[38]

The Sustainable Agriculture Network (SAN) is a coalition of conservationist NGOs in the Americas. Its secretariat is based in The Rainforest Alliance, a US international conservation NGO whose mission is to protect ecosystems and the people and wildlife that live within them. SAN standards prohibit clearing primary forests, and include requirements for soil and water management, for the conservation and buffer zones, the use of agrochemicals, integrated pest management and waste management. SAN certified companies should respect ILO conventions ratified by the country in which they operate. In addition, criteria include requirements for a social policy and communication to workers; contracts and wages; no discrimination; no child labour below the age of 14; no forced labour; freedom of expression and the right to organize and collective bargaining; occupational health and safety; working hours; training; accommodation; and linkages with local communities.

In 2003 SAN’s “Better Banana Project” and “ECO-OK” seals are being replaced by a new label “Rainforest Alliance Certified”. Until now the labels have seldom been used directly on the product. Both Chiquita and ReybanPac have had all their plantations certified against the SAN standard.

SA8000[39]

The Social Accountability standard SA8000 was developed in 1998 by Social Accountability International (SAI), a New York-based NGO. The SAI Advisory Board includes experts from trade unions, businesses and NGOs. The standard requires compliance with the core ILO conventions, including the prohibition of child or forced labour, enforcement of safe and healthy working environments, rights to freedom of association and to collective bargaining and criteria on working hours, wages, freedom from discrimination and the requirement for a social management system. The standards for the agricultural sector were approved in 2000.

SAI accredits independent certification bodies to audit production facilities. The individual auditors performing the inspections must be accredited as well. The SAI-SA8000 label is not used on products. Companies that do a substantial amount of sourcing from contracted suppliers can join the Signatory member programme, which requires that the company issue a plan for moving company owned and supplier facilities to SA8000 certification over time and report publicly on progress. Dole is a signatory member. So far, 2 banana plantations have been certified SA-8000 (Dole and Chiquita).

EUREPGAP[40]

EUREPGAP is a private certification system driven by 22 large-scale retail chains in Europe that form the core members of the Euro-Retailer Produce Association (EUREP). Other members include large fresh produce suppliers and producers as well as associate members from the agricultural input and service industries. The declared aim of EUREP/GAP is to increase consumers’ confidence in the safety of food but the standard also includes some environmental (IPM practices) and social (workers’ health) criteria.

There is no product label associated with EUREP/GAP certification and no price premium. The market for EUREP/GAP certified produce consists of the 22 EUREP retailers. Certification will not be a guarantee for being “listed” by those supermarkets, but may become a prerequisite (although no clear deadline has been set by EUREP).

National agricultural census data and official import statistics normally do not distinguish between certified and non-certified products. Therefore, the figures on organic banana markets presented in this section are estimates. Figures for fair-trade bananas in this paper refer to bananas produced on farms certified by FLO International and traded under fair-trade conditions controlled by FLO International. Bananas certified under programmes other than fair trade and organic are not covered in this section, as they are sold on the conventional banana market without any certification label or price premium.

Supply

World exports of certified organic bananas were estimated to range between 130 000 and 140 000 tonnes in 2002, accounting for over 1 percent of total banana trade. The world largest supplier of organic bananas is the Dominican Republic. In 2002, its exports totalled over 60 000 tonnes, exceeding exports of conventional bananas[41]. The second largest producer of organic bananas is Ecuador, where output has grown at high rates. Peru exported nearly 19 000 tonnes in 2002, up from less than 1000 tonnes in 2000. Other suppliers of organic bananas are Mexico, Colombia, Honduras, Guatemala and the Canary Islands (Spain). The Windward Islands, Colombia, Peru, Costa Rica and Ghana also export fair-trade bananas.

Market situation: Organic

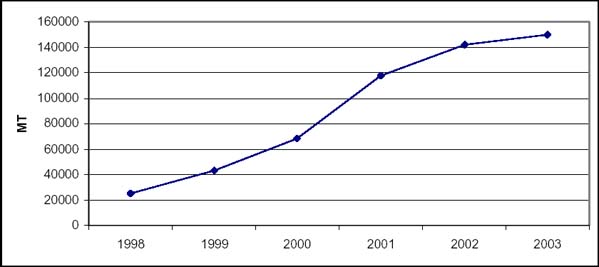

Table 22 and Figure 34 provide an overview of the growth of the organic banana market in recent years. While growth rates have been high compared to conventional bananas, organic imports represent only about 2.5 percent of the total European banana market and just over 1 percent of the North American market.

Table 22 Estimated fresh organic banana imports per year and by region/country

|

Region/country |

Imports (000 metric tonnes)a |

Annual growth (%) |

||||||

|

1998 |

1999 |

2000 |

2001 |

2002 |

99-00 |

00-01 |

01-02 |

|

|

USA & Canada |

13 b |

16 |

22 |

39 |

48 |

37 |

78 |

23 |

|

Europe1 |

13 |

27.5 |

45.5 |

73 |

88 |

66 |

59 |

13 |

|

Japan |

3 |

4.4 |

5.7 |

5 |

5.4 |

30 |

-12 |

7 |

|

Other |

- |

- |

- |

0.5 |

0.4 |

|

|

|

|

Total |

29 |

48 |

73 |

118 |

141 |

53 |

60 |

21 |

1 EC(15) + Switzerland + Norway

a Based on industry estimates, country surveys and official country statistics, unless stated otherwise.

b Sauvé, E. (1998), the global market for organic bananas, INIBAP, Montpellier, France

Figure 34 World exports of organic bananas 1998-2003 (estimated)

Fair-trade

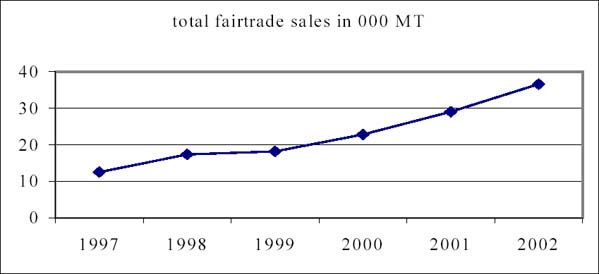

Fair-trade banana imports started in 1996 and Western Europe has remained the main market. Total fair-trade banana imports increased from around 12 500 tonnes in 1997 to about 36 600 tonnes in 2002. From 1998 to 2001 this increase was due partly to their penetration into a larger number of countries in the European Union, and also to a steady increase of fair-trade imports into Switzerland (Table 23). About 25 percent of fair-trade bananas are estimated to be also certified organic, and this share is increasing.

Table 23 Imports of labelled fair-trade bananas into Europe 1998-2002

|

Country |

Imports (metric tonnes) |

Annual growth (%) |

|||||

|

1998 |

1999 |

2000 |

2001 |

2002 |

00-01 |

01-02 |

|

|

Switzerland |

7 500 |

10 778 |

11 403 |

13 170 |

15 090 |

15 |

15 |

|

UK |

- |

- |

5 557 |

9 701 |

11 426 |

75 |

18 |

|

Finland |

- |

- |

- |

1 707 |

2 833 |

|

66 |

|

Netherlands |

5 200 |

4 180 |

3 603 |

2 303 |

1 996 |

-36 |

-13 |

|

Austria |

- |

- |

- |

- |

1 775 |

|

|

|

Belgium |

849 |

431 |

401 |

925 |

1 314 |

123 |

42 |

|

France |

- |

- |

- |

82 |

696 |

|

750 |

|

Sweden |

50 |

301 |

570 |

568 |

586 |

0 |

18 |

|

Denmark |

725 |

847 |

493 |

294 |

365 |

-40 |

24 |

|

Luxembourg |

- |

74 |

179 |

168 |

178 |

-6 |

6 |

|

Norway |

- |

- |

- |

33 |

154 |

|

367 |

|

Germany |

3 042 |

1 580 |

617 |

101 |

117 |

-84 |

16 |

|

Italy* |

- |

- |

- |

20 |

82 |

|

310 |

|

Total |

17 366 |

18 191 |

22 823 |

29 065 |

36 612 |

27 |

26 |

Source: FLO International

* actual imports are higher as sales from CTM, the main Italian importer of fair-trade bananas, are not included in FLO International’s figures

In Japan, small quantities (e.g. 2000 tonnes in 1998) of fair-trade “balangon” bananas have been imported from the Philippines since 1989 by Alter Trade Japan, which is not a member of FLO International.

Figure 35 Sales of fair-trade banana 1997 - 2002 (MT)

Prices

Organic

Very few data are available on prices for organic bananas. Reported wholesale prices in Italy in 2002 ranged from €2.00 per kg in February to €4.71 per kg in September, while the average price over the period February-November was €3.15 per kg[42].

Traders indicate that FOB and CIF prices in nominal terms have remained stable throughout the years, with CIF prices in Europe at around €17 per box. CIMS reported FOB prices for the first quarter of 2003 of $5.4 to $8.5 per box, depending on origin, and observed an organic premium of $1 per box compared with conventional bananas from the same origin (CIMS 2003). FOB prices reported from Peru were 5.5US$/box in 2001 to 6US$/box in 2002. Producer prices for organic bananas in Peru were as low as 2.3 US$/box in 2002[43].

Some sources state that producer prices cannot decrease below the current level if organic banana production is to remain profitable. Production capacity of organic bananas is much higher than what is sold at the moment, especially in Peru. As a result, some producers have to sell organic bananas on the conventional market at conventional prices. Furthermore, new suppliers are entering the market.

Fair-trade

Fair-trade prices are set on the basis of production costs. FLO International estimates the average production costs per country, taking into account “extra” costs as specified during fair-trade certification, such as the “living wage” for workers. The minimum fair-trade price to be paid by licensed traders is the production cost plus a fair-trade premium.

Market prospects

Organic

World imports grew less rapidly in 2002 than in 2001, and the deceleration trend is expected to continue in 2003. While the market share of organic bananas in 2002 reached 1.2 percent in North America, the short term potential could range between 2 and 2.5 percent, which is the current share of organic fresh fruits and vegetables in conventional supermarkets. This would translate into volumes of 85-110 000 tonnes for North America in 2005-2006. In the longer term, and assuming that a 5 percent share is reached in 2010, imports might total some 230 000 tonnes. This would require a sustained growth rate of some 22 percent per annum, which is equal to the growth rate observed between 2001 and 2002. However, if the current trend of deceleration continues for organic banana imports, the quantity imported in 2010 would be lower. If the rate gradually declined to 15 percent per annum after 2005, imports would stand at some 170 000 tonnes in 2010. Organic bananas would then account for 3.7 percent of imports.

In Western Europe, the growth of the organic banana market has slowed down, which is not surprising after the dramatic growth in 1999, 2000 and 2001. The high growth rates have resulted in a current market share of organic bananas of 2.1 percent, which is in line with that of other organic fruits. Sales are expected to continue growing at around 15 percent per year, which is equivalent also to the rate of other organic fruits during the last years. At this rate, organic bananas could reach a market share of 3 percent in Western Europe in 2005, accounting for between 130 000 and 140 000 tonnes. If the rate decreased to 10 percent per annum after 2005, consumption of organic bananas would range between 210 000 and 220 000 tonnes in 2010, accounting for over 4 percent of banana consumption. In Japan the market is forecast to expand rapidly as organic producers and traders adapt to the recent Japanese Agricultural Standard (JAS) regulation on organic labelling.

Considerable areas are being converted to organic agriculture, especially in Ecuador and Peru, and supply is anticipated to continue increasing rapidly. Supply will probably outstrip demand and prices are expected to be subject to a downward pressure.

Fair-trade

Market prospects for fair-trade bananas are favourable. High growth can be expected in France, where consumer awareness and recognition of the fair-trade mark has increased dramatically during the last two years and two supermarket chains started to sell fair-trade products. Other countries where growth can be expected are Austria, Finland, the United Kingdom and Italy. Conversely, the Dutch market is expected to shrink further and sales in Germany are forecast to remain at current low levels.

The introduction of a new EC banana import regime in 2001 did not greatly affect the fair-trade market. Fairtrade organizations are uncertain on whether they will benefit from the transition to a tariff-only import system expected from 2006.

Outlook and implications for banana producers

Organic

Although supply appears to be sufficient to cover demand, some technical and managerial problems remain to be solved at every step of the chain. At production level, industry sources report that organic control of Black Sigatoka and crown rot diseases remain major technical constraints for growing and transporting organic bananas. More research on organic control methods for those two diseases is recommended.

At import level, strict phytosanitary rules and inspections pose challenges for the organic banana sector, notably in Japan, New Zealand and the United States. The different organic regulations in the main markets (including different standards), and above all different inspection and certification requirements cost time and money to producers and traders.

Competitiveness with conventional bananas is likely to improve, as retail price differentials are expected to narrow down with improvements in the efficiency of the marketing chain. Also, the high number of rejects at various points along the supply chain should decrease as traders select higher quality at farm level and enhance post-harvest and transportation methods.

In view of the oversupply situation, the main commercial risk of conversion to organic production is that some producers might not be able to find an outlet and be forced to sell the organic bananas as conventional, despite the higher production costs incurred. Another risk is that farm-gate prices may decrease.

Fair-trade

Production of bananas by existing fair-trade producers currently exceeds market demand. As a result, future demand growth will primarily be met by these producers, making it difficult for other growers to belong to FLO International’s register of suppliers. New producer groups seeking inscription have to demonstrate that they will be able to sell in a new fair-trade market, so that they will not compete with existing fair-trade producers. Otherwise, fair-trade may need to be managed as an import quota system.

| [36] The IFOAM traders group

has also launched a voluntary Code of Practice for Organic Trade in February

2003, promoting for example “transparency and accountability of negotiations”

and “equitable distribution of returns”. IFOAM (2003) IFOAM

Code of conduct for organic trade: guidance document. www.ifoam.org

(visited June 2003). [37] See FLO International on www.fairtrade.net (visited June 2003). [38] See Rainforest Alliance (2002) Sustainable Agriculture; www.rainforest-alliance.org (June 2003) [39] See www.sa-intl.org (August 2003) [40] See EUREPGAP at www.eurep.org (August 2003) [41] This figure is an underestimation of its real potential, as exports from the DR decreased in 2002 for the first time due to a drought that curtailed production at the beginning of the year. [42] See Osservatorio Nazionale dei Prezzi dei Prodotti Biologici. Prezzi Bio at www.prezzibio.it (June 2003) [43] Soldeville (2003); personal comm. |