by

Helga Josupeit and Nicole Franz

Fish

Utilization and Marketing Service (FIIU), FAO

Rome, December

2003

1. Forecast

The following analysis tries to look into the by prospects of international trade in view of resource limitations, aquaculture expansion and future demand growth, especially in the developing world. Most experts concur on the fact that capture fishery has essentially reached its sustainable limit. Future fish commodity production increase will be mainly by reason of rapidly growing aquaculture production. The latter one is influenced primarily by technological development, feed prices and environmental issues. Demand development will depend on various factors, including mainly population increase, income and price trends.

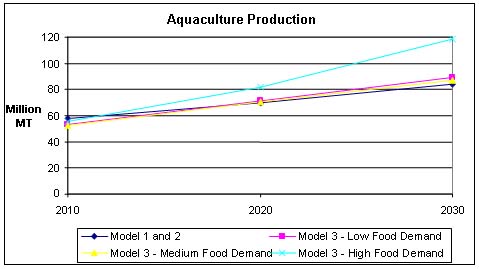

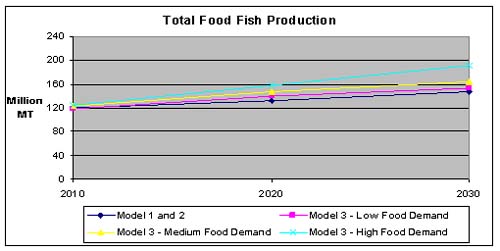

Developing countries will confirm their role as main consumers, but their importance as producers will grow - especially concerning aquaculture production. The increasing demand will have impact on per caput consumption and trade patterns. Various scenarios exist in FAO to project future demand and supply of fish and fishery products[26]. With regard to supply, the three scenarios agree on the fact that the world food fish capture production has basically reached its limit at about 70 million tonnes and any production increase will be primarily due to aquaculture.

Total supply is estimated to reach almost 160 million tonnes by the year 2030. In fact, scenario one and two forecast an annual aquaculture production raise of two percent, reaching about 84 million tonnes by 2030, while it arrives at more than 87 million tonnes in the medium food demand scenario of Chan.

Figure 1: Fish production (in million tonnes)

On the demand side, the three scenarios lead to different outcomes.

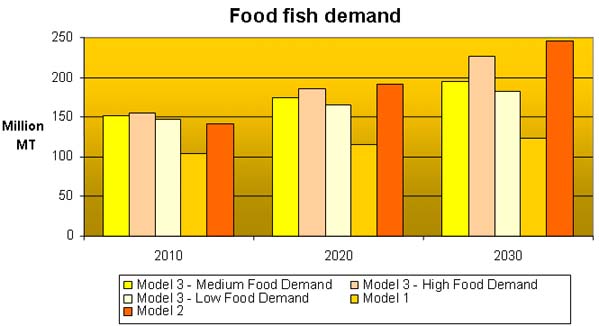

Scenario 1 keeps the present per caput consumption stable in all countries. This would result in food fish demand in developed countries growing only slightly to 29 million tonnes, while demand in developing countries - due to higher population growth - would go up from 75 million tonnes at present to 97 million tonnes. Thus total world demand for food fish commodities would be about 126 million tonnes, 20 percent below potential production. This would in turn lead either to lower prices - and probably to higher consumption - or to less interest in expanding aquaculture.

Scenario 2 on the other hand considers a constantly growing per caput consumption which leads to a substantial increase in demand. In this case, total demand would more than double from present level to almost 250 million tonnes, well ahead of potential production. Given the prevailing trade patterns (South-North) it would result in a strong increase in prices, both in developed and developing countries, resulting in a lower demand. International trade would suffer, as more fish can find a market in the domestic market of developing countries with strong interest in fish consumption, such as China and South East Asia.

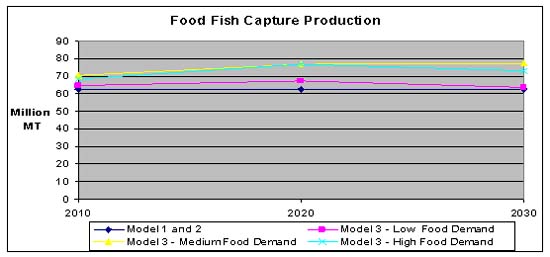

The demand scenarios provided by H.L. Chan offers three different outcomes, reaching respectively the values of 182, 194 and 225 million tonnes in the year 2030. In any of these scenarios demand goes past supply.

At the level of regional distribution, the major increase will take place in Asia, followed with a large gap by Africa and Latin America.

Figure 2: Food fish demand (in million tonnes)

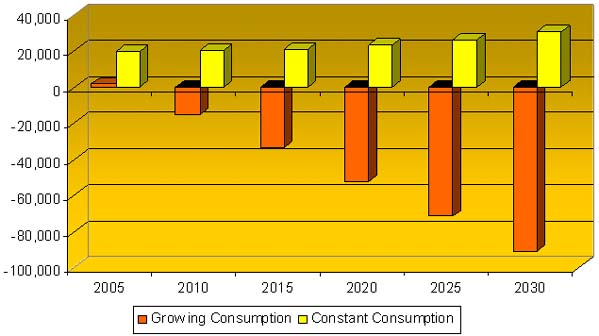

The following graph shows the difference between food fish supply and food fish demand in scenario one and two.

Figure 3: Future consumption scenarios (in 1 000 tonnes)

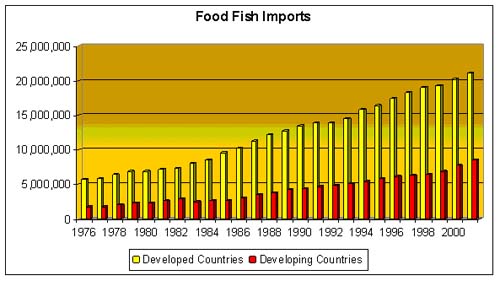

Currently, developed countries are importers of food fish commodities.

At the level of international trade, the trend illustrated in the previous paragraph may translate in reduced exports or growing prices of export commodities, especially as the growth in food fish demand is almost entirely due to the developing countries.

Figure 4: Food fish imports (in tonnes)

2. Trends of fish marketing in Latin America

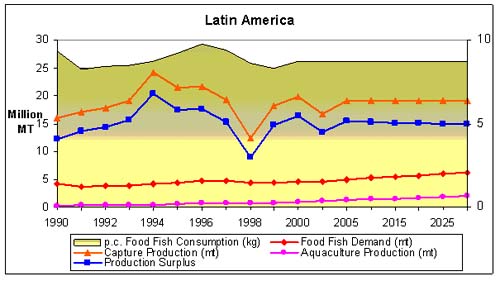

In Latin America the per caput consumption of fish products has been relatively stable during the past years. Considering an average per caput consumption of 8.7 kg in the future, the region as a whole will produce an annual surplus of 15 million tonnes of fishery products (including fishmeal). In the projection, capture production is supposed to stabilize at 19.1 million tonnes, while aquaculture grows at a rate of 1.8 percent per year.

Figure 5: Latin American fish production and consumption - past and future (in million tonnes)

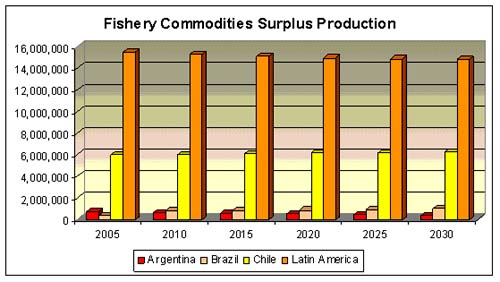

A closer examination of some Latin American countries shows different evolutions on national level. Chile for instance confirms the regional trend with a surplus production (fishmeal included) of currently four million tonnes which will raise up to 6.3 million tonnes in 2030.

As a result of an increase in aquaculture production, Brazil will also be able to produce a positive supply-demand difference of one million tonnes in the year 2030. However, it has to be kept in mind that the per caput consumption of Chile lies by more than 20 kg, while the Brazilian one reaches only about 6 kg.

Argentina's presumed strong increase in demand for fishery products from currently 8.6 kg per caput to 14.7 kg in 2030 leads to a different scenario. Capture production almost certainly remains stable at 1.1 million tonnes and the growth in aquaculture is unable to keep the pace of demand. The surplus production of fishery products will decline by almost 50 percent from presently 0.6 million tonnes to 0.34 million tonnes in 2030.

Figure 6: Fishery commodities surplus production (in tonnes)

3. Intraregional trade pattern

International trade patterns at present are a net-flow from south to the north, while the trade among developing countries is still relatively low. With higher income, developing countries, especially those where fish is a well liked commodity, are likely to purchase more fish products, and a part of the supply will come from neighbouring developing countries.

Already at present South East Asia is a strong exporter to countries from the same sub-region with almost ten percent of total export earnings. Intra-regional trade is lower in other regional grouping among developing countries, and lowest among Central American and Caribbean countries.

3.1 Central/South America

Intra-regional trade has a major impact on fishery commodity imports in the region of Central/South America. In the period between 1995 and 1997, about 60 percent of the imported value originated from countries belonging to the region of Central and South America. This share remained basically stable in 1998-2000.

The importance of intraregional trade is also growing for exports. The average value of fish commodities exported to countries in the region didn't even reach three percent of the region's total fish commodity export value in 1995/1997, while it passed 8 percent in 1998/2000.

The predicted reduced production in combination with increasing national demand will surely influence future trade and consumption on national, regional and international level.

Figure 7: Regional import/export flows in central and South America (value)

|

|

|

|

|

|

|

|

3.2 Southern, East and Southeast Asia

Intra-regional trade accounts also for an important part of fishery commodity trade in the South/East area of Asia. In value, about a quarter of all fishery product imports in the region is coming from East and Southeast Asia (US$755 217 000 in 1998/2000, US$819 796 000 in 1999/2001).

Intra-regional export values are still on a rather low level, but the trend is showing an increase, in terms of percentage as well as in absolute terms. In 1999/2001, the intra-regional exports amounted up to US$888 440 000, which is equivalent to 9.29 percent of the whole fishery commodity export value in the region (1998/2000: 8.77 percent).

Figure 8: Regional import/export flows in South/East Asia (value)

|

|

|

|

|

|

|

|

3.3 Eastern, Central, Western and Southern Africa:

The assessment of intra-regional trade in Africa is more problematical because of a certain lack of data and because of substantial amount of informal trade, which completely escapes trade statistics. The figures available do not cover the whole African trade in fishery commodities. However, the accessible data indicates only a very low exchange of fishery products on regional level (1999/2001: 10.52 percent of imports (in value), 0.46 percent of exports (in value)).

4. Interregional trade pattern

As mentioned before, trade in fishery products is mainly governed by a south-north flow from developing countries to developed countries. The increase in aquaculture production in developing countries will most likely confirm this trend in the future.

The interregional trade between developing countries is still in its beginning. However, the available figures indicate a growing potential for future commercial relations, especially between Central/South America and Southern, East and Southeast Asia. In fact, almost five percent of the Central and South American import value is due to fishery products originating from Southern, East and Southeast Asia. On the other hand, more than eight percent of Southern, East and Southeast Asian import value originates from Central /South America. Africa accounts for almost four percent of the Asian import value.

Table 1: Interregional trade (value)

Central and South America

|

|

EXPORT to |

IMPORT from |

||||||

|

|

1998/2000 |

% |

1999/2000 |

% |

1998/2000 |

% |

1999/2000 |

% |

|

Southern, East and |

213,517 |

3.53 |

259,200 |

4.07 |

44,512 |

4.90 |

40,058 |

4.74 |

|

Africa |

7,512 |

0.12 |

524,665 |

8.24 |

6,114 |

0.68 |

7,799 |

0.92 |

Southern, East and Southeast Asia

|

|

EXPORT to |

IMPORT from |

||||||

|

|

1998/2000 |

% |

1999/2000 |

% |

1998/2000 |

% |

1999/2000 |

% |

|

Central and South America |

38,960 |

0.41 |

4,616 |

0.05 |

222,343 |

8.10 |

282,956 |

8.44 |

|

Africa |

25,112 |

0.26 |

54,884 |

0.57 |

101,302 |

3.70 |

116,374 |

3.47 |

The projected demand increase for fishery products in the developing world will have a strong impact on trade. Even though production in these countries will grow by way of aquaculture, net exports towards developed countries will probably decline while interregional as well as the intraregional exchanges could intensify. This will depend mainly on prices, regional income growth and western trade regulations.

5. Artisanal fisheries

Artisanal fisheries are already now an important player in international trade, and have the opportunity to expand this role. Growing attention towards sustainable fishery may represent an opportunity for reconsidering traditional capture practices.

To develop the potential for a future expansion, new and better infrastructures must be provided to artisanal fishers. These infrastructures have to include roads, landing sites, airports and other transport services as well as electric supply and storage facilities in order to smooth the progress of trade expansion. The use of ice for instance guarantees a better quality and helps to meet international standards for quality and safety. Artisanal fisheries can contribute to urban markets and exports by offering more high value fish. The earnings from trade in urban areas and from export are probably higher than the revenues from traditional markets. However, artisanal fishers have little knowledge of good handling practice and lack of marketing skills. They need training to facilitate access to new markets.

Obviously, expansion and modernization of artisanal fisheries bear also risks. In fact, better infrastructures might lead to the replacement of artisanal fishers through industrial operators and strengthen the oligopolistic power of some major supermarkets. Furthermore, trade expansion in urban areas and for export could have a heavy negative impact on the often already overexploited resources in coastal areas. Growing trade outside the traditional markets will result in a drop of fish consumption or at least in a change towards lower value fish in the coastal communities. Unfortunately, for the time being a detailed analysis of the sector is limited by the lack of concrete data.

|

[26] Scenario 1:

Constant per caput consumption In this scenario, the growing demand for fish commodities depends mainly on population increase. Scenario 2: Growing per caput consumption The demand increase in this scenario refers principally to the average annual growth rate of per caput fish consumption in the past. Scenario 3: H.L.Chan This scenario is based on a publication by H. L. Chan ('Long-term world projections of fish production and consumption') and considers three different situations. |