The expected growth in demand has its origins in changes in the farming sector. Powerful influences here are summarized below, and discussed briefly in this section.

Evidence is accumulating of connections between climate change, and the increasing incidence of crop damaging weather events of extreme severity.

Farming is becoming steadily more commercialised, with greater levels of financial investment. Farmer/investors and their banks will frequently examine the feasibility of using a financial mechanism i.e. insurance, in order to address part of the risk to their financial investment. As a part of this trend to commercialisation greater use is now being made of contract farming arrangements, where insurance is one of many services provided, along with inputs, to growers. In summary, there is a trend to formalise risk management in farming, with insurance being one obvious mechanism which can be harnessed for this task.

The World Trade Organization (WTO) regulations generally forbid governments from subsidizing agriculture directly; however, they permit the subsidization of agricultural insurance premiums. For those countries wanting and able to effect transfer payments into their farming sectors, insurance provides a convenient channel for doing so. In the face of this WTO regulation, it is clear that demand for crop insurance will increase in those economies that wish to implement a policy of permitted subsidization of their farmers.

The dynamism of the farming sector, and its environment, is reflected in developments in the design of new insurance products. In the last decade two types of new products have been introduced. In some cases these have partially displaced existing covers; in others they have resulted in demand from new clients. The products are firstly, Crop Revenue products, secondly, Index or Derivative products.

Accidental introduction of exotic pests/diseases is something which concerns all countries where agriculture is an important part of the economy. Insurance can address the risk of a breakdown of these measures.

Insurance can also assist in managing the on-farm production risks consequent to changes in pest management practices. Such changes are increasingly required in order to address environmental protection and food safety concerns.

Many of these apparently diverse influences have a major common theme. This is that any insurance arrangement will involve not only the farmer and the insurer, but also important third parties. Consideration is now given to these changes to the business of farming, and to how they have increased demand for crop insurance, or might be expected to do so in the future.

One major reinsurer has calculated that the economic losses (adjusted for inflation) of weather-related events in the period 1985-1999 amounted to some US$707 billion. Over a longer period, 1950-1999, the average annual losses (again adjusted for inflation) have increased by more than ten times, while the global population has increased by a factor of 2.4[8]. While crop and forest losses are only a part of this, the same reinsurer estimates that the costs associated with crop damaging weather events are doubling each decade.

The scientific community is not unanimous in attributing the increases in extreme weather events to global warming. However, there is a strong body of opinion which holds that this is the case. Their thesis is that global warming means more energy in the system. A consequence of this is a rise in the frequency and magnitude of extreme weather events[9]. This is considered one of the causes of the increases in losses noted in the previous paragraph. The other major cause is linked to socio-economic factors such as increasing wealth (so there is more to be lost), and movements of populations to coastal areas which, although more productive in some senses, are more vulnerable to windstorm, storm (tidal) surges and flood damage.

The increasing incidence of crop damaging weather events is likely to continue to push demand for insurance coverage of losses. At the same time the insurance industry is mindful of increasing exposures, and is exploring new financial instruments to assist in managing this exposure.

Implementation of technology developments in farming usually involves investment. Such changes also frequently alter the risk profile of the enterprise. A common example is in minor irrigation. The availability of low cost pump sets has greatly increased the productivity of small farms in much of rural India, and has brought a boom in irrigated vegetable production in semi-arid areas of the Middle East, for example in Syria. But in both areas there is now vulnerability to falling water table levels.

Investor/farmers who have a substantial interest in the success of a given crop are likely to have borrowed from a bank in order to make the necessary investment. Banks with a heavy concentration of loan assets in farming face the prospect of substantial losses through systemic risk - i.e. risk that affects many at the same time. An example is unfavourable weather conditions over a wide geographical area. In both cases, i.e. borrower and lender, there is an interest in managing the risk of crop failure through the most economic means. There are occasions when insurance can be a key component in a range of risk management strategies.

This type of link, crop insurance and loans, is already very common, both in developing and developed agriculture. The vast, heavily subsidized scheme in India, mentioned above, is largely linked to bank lending. A more recent crop insurance initiative, in Morocco, is primarily motivated by a desire to safeguard the loan asset portfolio of the government agricultural bank, the Caisse Nationale de Crédit Agricole.

From an administrative point of view bank/insurer linkages make a lot of sense, since both these providers of financial services require similar client data. Moreover a bank can readily act as an agent for selling insurance. This means significant cost savings in obtaining data and in making financial transactions (payment of premiums and paying-out indemnities).

Also known as “inter-linked transactions” contract farming arrangements are one of the fastest growing business arrangements in both developed and developing countries[10]. They are becoming particularly common in countries which were formerly centrally planned, and where liberalised marketing arrangements under structural adjustment have meant the closing down of marketing boards and the loss of a known, secure market for small scale farmers. The impetus for the further development of contract farming has come from the increasing number of fast food outlets, the growing role of supermarkets, and the continued expansion of world trade in fresh and processed products.

In contract farming both the grower and the buyer expect to benefit financially from a crop which is up to normal expectations in terms of both quantity and quality. Both therefore have an “insurable interest”. This means that an insurance product could be structured so that each party receives an indemnity in the event of an insured loss.

Since contract farming arrangements are generally renewed annually, a record of production is built up over the years. This availability of accurate records, coupled with the existing financial linkages between contractor and grower, mean that insurance can be included in the range of services covered by the contract at minimal operational cost.

Some examples of contract farming arrangements in developing countries:[11]

many thousands of outgrowers produce tea under contract to the Kenya tea industry;

2 200 farmers from 164 villages in India grow maize and soybeans for a major poultry producer;

30 000 farmers in Northern Thailand grow vegetables for local exporting firms to export to Japan;

banana production by smallholders in Central America is very commonly arranged under contract with major fruit corporations;

fast food chains in the Philippines and elsewhere frequently contract with local farmers for supplies of potatoes for French fries, and also for salad vegetables;

44 growers in Northern India grow tomatoes for paste under contract to Hindustan Lever.

In many of these cases insurance protection could be arranged against major weather perils as part of the contractual arrangement.

One of the policy-making priorities of governments is to facilitate trade. For most developing countries agricultural exports are important, and it is vital therefore that WTO’s regulations are respected. Subsidization of crop insurance premiums is permitted by the WTO. They are considered as falling into the ‘Green Box’ of measures by which a government can support its producers. Whereas this development is still relatively new, the commercial insurance industry has experienced an upsurge in demand for information, from governments, on crop insurance.[12] The nature of these enquiries makes it clear that they are prompted by awareness of this apparent avenue for permitted assistance to the farming community.

There are several types of assistance by which a government can facilitate crop insurance. Among these are the following:

Provision of information, on weather patterns, incidence of perils, evidence of past losses following adverse weather events, numbers, areas and locations of farms/crops, historical crop yields (data and trends). Most countries do this on a regular basis. Some charge for information. The quality of the data varies greatly.

Meeting the costs of the research needed before any crop insurance programme can be started. Often this responsibility is shared by development organizations such as FAO - e.g. in the case of Pakistan in 1995 and Syria in 2000, and the World Bank - e.g. in the case of Morocco in the late 1990s.

Subsidization of premiums payable by farmers. This is very common, with Canada, Cyprus, India, Japan, the Philippines and the United States being examples.

Providing a layer of reinsurance. Although less common than premium subsidy, it is practised, for example, in the United States, Cyprus and India.

These crop insurance products account for by far the bulk of all crop insurance written globally. There are two main types, damage-based and yield-based products respectively. These are introduced below.

Insurance against crop losses from hail have been insured for more than 200 years. This type of crop insurance still accounts for a considerable proportion of crop insurance worldwide. The particular features of hail damage are discussed in Chapter 3 below. Suffice it here to note that hail policies are based on a measure of the actual damage which results. Other named-peril policies, such as those for frost and fire, are very similar to hail cover in essentials. The key features are:

Damage resulting from the peril is localised;

low degree of correlation of risk over a given area;

sum insured is agreed when the policy is purchased;

loss adjustment and eventual indemnity based on measurement of the percentage of damage after the incidence of the loss event;

this type of insurance is not suitable for perils which can impact over wide areas, e.g. drought, pest, disease.

Multi-peril crop insurance (MPCI) products have the defining characteristic that insurance is geared to a level of expected yield, rather that to the damage that is measured after a defined loss event. Other features are:

MPCI policies are suited to perils the nature of which mean that their individual contribution to a crop loss is difficult to measure;

similarly these yield-based policies are suited to perils which impact over a period of time;

establishing a farmer’s yield history provides the basis for determining the percentage of shortfall after a loss event;

the yield is measured at harvest; insured yield may typically be in the range of 50 to 70 percent of historic average yield;

yield shortfall may be determined on either an area or individual farmer basis.

In the first section of this booklet mention was made of the dynamism of research and development into new methods of managing risk through insurance mechanisms. Two fairly new products warrant brief descriptions. These are (i) products based on insuring a level of crop revenue, and (ii) products where insurable damage is determined in the basis of an index derived from data external to the insured farm itself.

The essence of this product is to combine production and price risk, the combination of production and price being the determinants of gross revenue from a given crop. Under normal supply/demand conditions a production shortfall might be expected to result in a rise in price. To some extent such a rise will cancel out the financial loss for the grower who suffers a production shortfall. But this will only be the case if he harvests sufficient crop and sells it at sufficient premium over the expected price. Crop-revenue insurance is designed to meet any remaining shortfall in revenue from crop sales. Frequently, too, crop-revenue products involve the determination of loss on an area basis, introducing important economies in the loss assessment process.

At present crop-revenue products are marketed mainly in North America, where they first became available to all corn and soybean growers in Iowa and Nebraska in 1996.[13] Here their use is facilitated by commodity markets being highly developed and by related information being reliable and readily available. In this connection it is important that the price element of the policy be market based, that is, on futures prices for the coming season. The alternative, to use some sort of target price, could lead to a distortion of supply. Furthermore, it is unlikely that a crop revenue product based on a target (i.e. non-market price) would find underwriting support.

Crop-revenue products have now (2002) spread beyond North America. The extent to which they could apply to developing countries will depend on the development of local crop futures markets, as well as on the availability of the necessary local expertise. However, these changes are really only a matter of time. Given the advantages to the grower and to the insurer, this type of insurance product is likely to grow in importance, though for smaller crop areas, as with yield assurance, it will always suffer from the problem of high administrative cost per unit of value.

The crop revenue approach follows from a new trend in agricultural insurance. This is to define the insurable interest as an income stream rather than as the intrinsic value (or expected value) of the biological item at risk. This redefinition leads readily to a consideration of farm loan and insurance linkages, since the servicing of interest and principal payments on an agricultural loan depend on the income stream produced. As already noted, some crop insurance programmes have been administratively arranged so that the insurance element is made a part of the loan, with the bank being the first recipient of any indemnity paid by the insurer, while the premium is a working capital item that is packaged with the loan itself.

A more recent development is that some banks are believed to be interested in direct coverage of portions of their loan portfolios, more particularly for catastrophic losses following a systemic peril. At the time of writing this development must be noted as an area where much future development is likely.

The Concept

In a classic crop insurance policy, evidence of damage to the actual crop on the farm, or in the area of the farm, is needed before an indemnity is paid. But verifying that such damage has occurred is expensive, and making an accurate measurement of the loss on each individual insured farm is even more costly.

An index (also known as ‘coupon’) policy operates differently. With an index policy a meteorological measurement is used as the trigger for indemnity payments. These damaging weather events might be:

a certain minimum temperature for a minimum period of time;

a certain amount of rainfall in a certain time period - this can be used for excess rain and also for lack of rain (drought) cover;

attainment of a certain wind speed - for hurricane insurance.

The classic insurance policy is replaced with a simple coupon. Instead of the usual policy wording, which would give the indemnity, or range of indemnity levels, on say a per hectare basis for a given crop, for losses from specific causes, the coupon merely gives a monetary sum which becomes payable on certification that the named weather event, of specified severity, has occurred. The face value of the coupon may be standard, to be triggered once the weather event has taken place for the area covered. Alternatively it could be graduated, with the value of the coupon then being proportional to the severity of the event.

Clearly this type of trigger operates over an area, encompassing many insured farms. Again, a trigger such as this cannot be used for certain perils, such as hail, where the adverse event normally impacts on a very limited area of land. On the other hand, it is suited to weather perils which impact over a wide area, for example drought. (See below under Key Perils - Section 3.4.1.)

Since there is no direct connection between a farming operation and the coupon, even those without crops at risk could theoretically purchase risk cover of this type. This is not a disadvantage. On the contrary, there are many persons besides farmers who stand to suffer financial losses from adverse weather events. Fishermen, tourist operators, outdoor vendors are among the many categories making up the potential clientele for index insurance products.

Examples of Index Products

Index-based crop insurance is a very new product. It has only started recently in a small way in a few parts of the developed world and it is still too early to be able to report much useful experience.

Examples to date include index insurance against drought on pasture land in the provinces of Alberta and Ontario, in Canada. Some preparatory work has been done for another coupon scheme, for drought in Morocco. This exercise, funded by the World Bank, is understood to be still at the stage of consideration by the Moroccan authorities and by insurers.

A recent development in India involves a pilot programme, by the private sector, with some involvement of a banking NGO. The risk being insured is insufficient rainfall, and the growing season for the crops in question, groundnuts and soybean, has been divided into sections, so that a critical shortage of precipitation in one part of the growing season will still trigger the index policy, even if ample rainfall at other times in the growing season means that the overall, aggregate precipitation would appear to be satisfactory for crop growth. In this pilot programme some 200 farmers are involved. At the time of writing no details of experience with the pilot are known.

A further example, on which FAO has done some preliminary work, illustrates some of the limitations of index insurance, when an attempt is made to apply it to a peril which does not impact evenly on the area to which the coupon relates. The data now given are simply proposals, and do not reflect a fully prepared business plan, let alone an actual index product. The estimates of uptake for farmers and fishermen respectively are the informed estimates of Bahamian officials who have been closely associated with past hurricane losses, and with government compensatory measures.

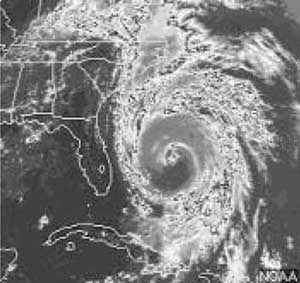

The outline given above conceals a major area of difficulty. This relates to the operation of the trigger. The aim with index-based insurance, as with other types of risk-sharing mechanisms, is maximum fairness to participants. With hurricanes there are three problems relating to the trigger. Firstly, hurricanes vary greatly in size, as illustrated in the comparative images below of Hurricanes Danny (1997) and Fran (1996). This means that defining a trigger as being activated when the hurricane eye passes within 100 km of a coupon zone will be fair for some, but if the hurricane is a large one, then there will be coupon holders who will not be compensated since they fall outside of the 100 km band.

The second major problem is the tendency for wind strength (and therefore damage) to vary along the track of the hurricane. This can impact on the categorization of the event, including the crucial shift from tropical storm to hurricane, and vice versa. These relatively quick shifts are not always recorded in the official reports, as the recording devices (ground, sea buoys and airborne instruments) do not always pick them up, as the network of devices is not as complete as might be desired.

The third area of difficulty is the fact that the track itself, as recorded by meteorologists coordinated in the Caribbean area by the National Hurricane Center in Miami, is only an approximation of the real path. In effect it is a best fit curve through a series of points recorded at intervals of six hours.

|

Region: |

Caribbean |

|

Country: |

The Bahamas |

|

Peril: |

Hurricane |

|

Trigger: |

Evidence of Category 1 hurricane “wall” passing within 50 km |

|

Insured area: |

Each major island would have its own coupon |

|

Coupon value: |

US$ 500 (once the hurricane is declared for the zone to which the coupon relates |

|

Target clientele: |

1 000 farmers (estimated coupon sale: 5 each) |

|

Tentative coupon price |

US$ 50 |

|

|

Hurricane Danny (left) in 1997 and Hurricane Fran in 1996 show the variability in hurricane size. (Images: U.S. National Hurricane Center/NOAA)

These three problems introduce the concept of Basis Risk, i.e. the potential mismatch between insurance payout and actual insurance losses. It is possible that this could be reduced to some extent by introducing the concept of a twin trigger. The first part of this twin would be the declaration of a hurricane for a given zone. The second would be evidence of storm damage gained from aerial photography soon after the passage of the hurricane.

Clearly hurricane is a difficult peril for index insurance. On the other hand, drought impacts more evenly over a given land area, and may well be more suited to this type of risk management mechanism. See Section 3.4.1 for further discussion on drought cover.

Despite the paucity of experience with index insurance, there is a high level of interest in both development and insurance circles in this risk management mechanism for developing countries. This interest is prompted by the belief that index insurance products offer an apparently practical solution to many of the barriers to classic crop insurance for small-scale, dispersed farmers in less developed areas of the world. These barriers, which will be discussed in more detail below, include:

Adverse selection - only those farmers more at risk will buy cover;

moral hazard - the insured farmer may not do everything possible to avoid or minimise a loss;

transactions costs - the huge costs of marketing individual insurance policies, coupled with the administrative costs involved in calculating and collecting individual premiums and paying claims;

loss assessment expenses - if loss assessment is done on an individual farm basis the costs can be very large in comparison to the premium paid.

The economic consequences to farmers of the accidental introduction of crop pests and diseases into a country or an area where they had not been known to exist can be very severe. Australia and New Zealand are among the most effectively isolated countries in which agriculture is a major part of the economy. Yet even in these island nations, the border protection personnel are a major force, and consequently an important cost item for the public sector.[14]

As long as protection protocols work effectively, then all is well. However, when they do not work then costs of eradication can be huge. New Zealand is currently (December 2002 and again in October 2003) trying to cope with the accidental introduction of the painted apple moth Teia anardoides - an Australian Lepidoptera sp. in a programme involving very costly aerial spraying of large areas. This insect has the potential to damage the country’s forest industry, as well as native forest reserves. There is a growing demand for insurance mechanisms to act as safety nets for at least some of the costs incurred when unwanted organisms are introduced, despite stringent border protection structures and procedures.

Safety in the food chain is a major concern in all countries, and increasing resources are being directed in many if not most countries to safeguarding domestic consumers. Whereas livestock and livestock products come readily to mind here - foot and mouth and BSE being recent and costly examples in Europe - safety is also vital in crop products. Aflotoxins and other mycotoxins in leguminous crop products, and moulds in cereals are among the crop-related diseases which can cause problems with the safety of food products, quite apart from their direct economic importance to growers and to the food industry.

Vigilance starts with setting up an appropriate structure at governmental level.[15] It continues with the application of correct on-farm practices, and is particularly important during harvesting, storage, processing and marketing. Many of the control measures are matters of appropriate procedures being followed in the food chain. However, where the appropriate measures are unknown, or when accepted controls prove to be inadequate, then large quantities of food could still be condemned for consumption, resulting in heavy losses. These losses could well be insurable with policies designed for the purpose. This is expected to become a growth area in the insurance industry.

Insurance can also assist in managing the on-farm production risks consequent to changes in pest management practices. There is clearly a community (and export trade) interest in phasing out the use of agricultural chemicals known to be harmful (e.g. the use of methyl bromide as a soil sterilant[16]). Growers may be reluctant to use more benign techniques because of their perception that the risk of infection might increase. This risk could be addressed by crop insurance.

|

[8] MunichRe (1999). [9] “The frequency and magnitude of many extreme climate events increase even with a small temperature increase and will become greater at higher temperatures (high confidence). Extreme events include, for example, floods, soil moisture deficits, tropical cyclones, storms, high temperatures, and fires. The impacts of extreme events often are large locally and could strongly affect specific sectors and regions.” UNEP/WMO (2001). [10] For further information on contract farming see Eaton and Shepherd (2001), Contract Farming, FAO, Rome. [11] Eaton & Shepherd (2001) op.cit. [12] The insurance clause was part of the Agreement signed in Marrakech in 1994 and implemented from 1 January 1995. [13] By 2000 the number of states in the USA offering this type of product had risen to 47, with the inclusion of crops such as cotton, grain sorghum, wheat and rice. In 2001 crop revenue products accounted for 43 percent of the insured acreage in the country. [14] It is estimated that the losses to the New Zealand economy of the accidental introduction of either foot and mouth disease or bovine spongiform encephalopathy (BSE) would be in excess of US$5 billion over just two years. This potential loss has prompted the introduction of legislation allowing very heavy penalties for persons convicted of deliberately infecting New Zealand livestock. (Source, Hon. Phil Goff, Minister of Justice, New Zealand, 23 October, 2003). [15] As a recent (July 2002) example, in New Zealand, the Ministry of Health and the Ministry of Agriculture and Forestry established the New Zealand Food Safety Authority (NZFSA) as a joint responsibility between these two organs of government. The role of this Authority is to administer legislation covering food for sale on the domestic market, primary processing of animal products and official assurances related to their export, exports of plant products and the controls surrounding registration and use of agricultural compounds and veterinary medicines. NZFSA is the New Zealand controlling authority for imports and exports of food and food related products. [16] The Montreal Protocol on Substances that Deplete the Ozone Layer has been signed by over 160 countries. This protocol has set targets for the phase-out of ozone depleting substances. Developed countries are expected to have phase out the use of methyl bromide by 2004, developing countries by 2015. In 1998 10 countries accounted for 81 percent of methyl bromide use with the USA the largest at 40 percent of the total. In this same year Italy was the second largest user at 12 percent. |