1. Opening of the Session

2. Election of Officers

3. Adoption of the Agenda and Arrangements for the Workshop

4. Sessions

Background Review of Commercial Aquaculture

Enabling Factors of the Promotion of Sustainable Commercial Aquaculture in sub-Saharan Africa

Country Experiences and Brainstorming on Mitigating Strategies to Major Constraints

The Way Forward

5. Adoption of the Main Conclusions and Recommendations

MALAWI

Mr John Dominic BALARIN

Chief Technical Adviser

Ministry of Environmental and Natural Resources

Pvt Bag 396

Lilongwe

e-mail: [email protected]

Mr Alexander BULIRANI

Deputy Director of Fisheries

Fisheries Department

P.O. Box 593

Lilongwe

e-mail: [email protected]

Mr Patrick CHINKHUNTHA

Fish Farmer

Freedom Gardens

P.O. Box 70

Lumbadzi

Cell phone: +265 8899711

e-mail: [email protected]

Mr Cyprian KAGWIRA

Fisheries Assistant

Fisheries

Department

P.O. Box 593

Lilongwe

Tel.: +265 536 215

Mr Michael F. KATENGEZA

Honeydew Farm Ltd.

P.O. Box

30269

Lilongwe 3

Cell phone: +265(0)9957684

Mr Maurice MAKUWILA

Fisheries Officer

Fisheries Department

P.O. Box 593, Lilongwe

Tel.: +265 01 788 070

Fax: +265 01 788712

e-mail: [email protected]

Mr Shaibu A. MAPILA

Director

Fisheries Department

P.O. Box 593

Lilongwe

e-mail: [email protected]

Mr James K. MKANDAWIRE

Fish Farmer

c/o Fisheries

Department

P.0. Box 593

Lilongwe

Cell phone: 088 99049

Mr Harvey NDALAMA

Farmer

c/o Fisheries

Department

P.O. Box 593

Lilongwe

Mr Alban D. PULAIZI

Senior Fisheries Officer

Fisheries

Department

P.O. Box 593

Lilongwe

Tel.: + 265 01 332692

Mr Francis SIDIRA

Extension Officer

Department of Fisheries

P.O. Box 593

Lilongwe

Tel.: +265 788 070

+265 852 299

e-mail: [email protected]

ZAMBIA

Mr Godwin BANDA

Assistant Manager (Credit)

Zambia

National Commercial Bank PLC

P.O. Box 33611

Lusaka

Tel.: +265 01

221355/228979 ext. 1612

Mr Cleopher BWENPE

Project Assistant

Peace Corps

P.O. Box 50707

Lusaka

Tel.: +260 1 26377

e-mail: [email protected]

Mr Martin CHILALA

Chief Fish Culturist

Department of Fisheries

Ministry of Agriculture and Cooperatives

P.O. Box 350100, Chilanga

e-mail: [email protected]

Mr Sandford N. CHIWILA

Farmer

P.O. Box

22335

Kitwe

Cell phone: +260 096 907304

Mr Gordon CHIWILA

National Coordinator

Serenje Development Association

P.O. Box 36814

Lusaka

Tel.: +260 096 775077

Fax: +260 01 293746

e-mail: [email protected]

Mr Timothy Donald FULLER

Farm Manager/Director

P.O. Box

320211

Lusaka

Mr Peter HATUMA

M.D. Kafue Fish Farm

P.O. Box 350131

Chilanga

Tel.: +260 278275

Cell phone: +260 097852213

e-mail: [email protected]

Mr Daniel IRVINE

Associate Director

US Peace

Corps

Box 50707

Lusaka

Tel.: 260377

Mr Peter LINTINI

Managing Director

Edenvale Zambia Ltd

P.O. Box 35107

Lusaka 10101

Mobile tel: +260 9777 4531

Direct: +260 123 8004

Fax: +260 122 4158

e-mail: [email protected]

Mr C.T. MAGUSWI

Director of Fisheries

Ministry of Agriculture, Food and Fisheries

P.O. Box 350100, Chilanga

Tel.: (260)1.278173

Fax: (260)1.278418

e-mail: [email protected]

Mr Rory McDOUGAL

Farmer/Consultant

Bedrock

P.O. Box 446

Mazabuka

Tel.: +260 32 30968

Cell phone: +260 091 793008

e-mail: [email protected]

Mr Bigie MIYOBA

Agriculture Services Manager

P/Bag

308

Lusaka

Tel.: +260 01 224743

Mr Davie MILAMBO

Operations Manager

Mutumbi Ranching

Ltd

P.O. Box 36571

Lusaka

Mr Chanda MUKUKA

Projects Manager

Anti-Casual and Commercial Sex Movement

P/Bag 290X

Ridgeway

Lusaka

e-mail: [email protected]

Mr Brighton Katota MULONGA

Quality Assurance Manager

Tiger Animal Feeds

P.O. Box 31712

Lusaka

e-mail: [email protected]

Mr John MWANGO

Chief Aquacultural Research Officer

Department of Fisheries

P.O. Box 350100

Chilanga

e-mail: [email protected]

Ms Mary NANDAZI

Micro Bankers Trust

P.O. Box

51122

Lusaka

Mr Jo NJELEKA

Programme Officer, (JICA)

P.O. Box

30027

Lusaka

Mr Soft Dick NYONI

P.O. Box 830217

Mumbwa

Tel.:

800075

Fax: 800099

Mr Adrian PIERS

Managing Director

African Fish Ltd.

P.O. Box 36383

Lusaka

Tel.: +260 1 223344

e-mail: [email protected]

Ms Bagie SHERCHAND

Chief of Party/Executive

Director

Zambian Agribusiness Technical

Assistance Center (ZATAC)

Project

191 A Chindo Road

Kabulonga, Lusaka

Tel.: 260 1

263512/529/537

Fax: 260 1 263502

FAO FISHERIES DEPARTMENT

Dr Nathanael HISHAMUNDA

Fisheries Planning Officer

Development Planning Service (FIPP)

Viale delle Terme di Caracalla

Rome

Tel.: (39) 0657054122

Fax: (39) 0657056500

e-mail: [email protected]

Mr Raymon VAN ANROOY

Fisheries Planning Analyst

Development Planning Service (FIPP)

Viale delle Terme di Caracalla

Rome

Tel.: (39) 0657053031

Fax: (39) 0657056500

e-mail: [email protected]

FAO SECRETARIAT

Ms Patricia BRENNAN

Secretary

Development Planning Service (FIPP)

Viale delle Terme di Caracalla

Rome

Tel.: (39) 06.57054479

Fax: (39) 0657056500

E-mail: [email protected]

|

FI:7 52/2002/RVA1 |

World aquaculture supply of catfish and tilapia |

|

FI: 7 52/2002/RVA2 |

Fish consumption and markets for catfish and tilapia in the European Union |

|

FI: 7 52/2002/RVA3 |

European Union trade and marketing requirements for fishery products |

|

FI: 7 52/2002/RVA4 |

Fish marketing information sources |

Honourable Minister, Mr Chairperson, Mr Director, Ladies and Gentlemen.

First, I want all of you to know that I appreciate this opportunity to come over here and be with you as you begin this Workshop.

To begin, Honourable Minister, I want to thank the Government of Zambia, on behalf of FAO and the Workshop participants, for its kind invitation to hold this Workshop in Lusaka. I am sure that the warm friendliness of the Zambian people is already working its magic on our colleagues from Malawi and Rome.

Now let me try to expand your horizons a bit. You are here to discuss the promotion of aquaculture. But the bottom line is that you will be discussing development, poverty reduction and food security.

When I contemplate on how to deal with these fundamental issues, I invariably find myself first asking: what is working? And then: how can we build on that? I also know that new opportunities must be seized and for Zambia and Malawi the rapid and sustainable development of aquaculture is an opportunity. Are there any countries in Southern Africa that are better endowed for aquaculture?

The importance of commercial aquaculture in food security and poverty alleviation, especially for impoverished rural communities is obvious. It can contribute directly to food security by producing fish for food and indirectly by generating employment and income. Its commercial side will broaden the tax revenue base and it can earn foreign exchange.

But for commercial aquaculture to take off, there are prerequisites. Technical conditions must be suitable; there must be economic stability and opportunity; necessary infrastructure must be in place and financial and other services must be available. And, Honourable Minister, government policy must be right before those things can happen.

By providing the legal and regulatory framework, by defining the role of the public sector and sticking with that through consistent implementation, the other players will feel secure to do their part and invest. And let me emphasize that the public sector is not just the Ministry or the Department of Fisheries. They have to provide the leadership, yes. But the public sector includes those other sectors (roads, water, land, trade, environment, health, education) that must also do their part so that aquaculture can work.

While some of the prerequisites for commercial aquaculture development are in place in Malawi and Zambia, obviously many are not. In this Workshop you will have the opportunity to examine the major impediments to aquaculture development in your countries and explore ways to tackle them. In the course of these few days, FAO will share with you the preliminary findings on the status and potential of commercial aquaculture, markets and trade in farmed fish and shrimp in sub-Saharan Africa as well as the general policy framework used in many countries, both developed and developing, to promote commercial aquaculture. You will also be discussing a suggested Legal, Regulatory and Institutional Framework for the promotion of sustainable aquaculture in Malawi and Zambia.

As you know, FAO organized a Technical Consultation on Legal Frameworks and Economic Policy Instruments for Sustainable Commercial Aquaculture in Africa South of the Sahara. This took place in Arusha, Tanzania, last December. Delegates to that gathering reaffirmed the need for and agreed on recommendations for the promotion of sustainable commercial aquaculture. Sharing these recommendations is one of the aims of this Workshop.

Your tasks, over the next few days, are to identify actions that need to be taken to develop sustainable commercial aquaculture in Malawi and Zambia, identify additional information required on commercial aquaculture for the elaboration of your national strategies and suggest the next steps to follow for the promotion of commercial aquaculture - something that Zambia is already engaged in. You will also have the opportunity to consider how FAO can help you to seize the opportunity.

And your final task? Use what you learn and accomplish here when you return to your offices.

Thank you.

The FAO Representative in Zambia, the Resident Representative, JICA, the Resident Representative, UNDP, Delegation Leader, Malawi, Distinguished Invited Guests, Ladies and Gentlemen.

It gives me much pleasure and gratitude to be accorded this opportunity to officiate at this very important meeting of aquaculture development in Zambia and Malawi.

On behalf of the Government of the Republic of Zambia and indeed on my own behalf, I wish to extend a warm welcome to you all and in particular to our colleagues from Malawi and to the Food and Agriculture Organization (FAO). I hope you will enjoy your stay in the country.

Chairperson,

Let me take this opportunity to thank FAO for bringing together Zambian and Malawian technocrats to discuss this important subject of aquaculture development and indeed poverty reduction. We are all aware that aquaculture as an industry is a relatively young sub-sector of fisheries. I am reliably informed that despite its infancy, globally it has grown at a very fast rate. We know that our traditional sources of fish have reached a peak and demand has continued to grow, especially in the developed world where there has been a marked shift away from red meats products.

Chairperson,

Zambia just like Malawi is richly endowed with natural resources ideally suited to aquaculture production. However, capture fisheries have continued to provide much of the domestic fish requirements in these countries. This situation has continued to exist but is being threatened by reduced catches per fishery due to most natural fisheries having reached their maximum sustainable limits.

Chairperson,

You may also wish to know that currently, the Zambian aquaculture sub-sector produces about 10 000 metric tonnes of fish per annum. Of this, 75 percent comes from subsistence and small-scale aquaculture and 25 percent from commercial farms. Lately, the Zambian case has experienced a situation where the involvement of small-scale farmers is on the increase as compared to the commercial farmers’ involvement which has declined. It is therefore important that resources are channelled to this sector to bring this number of small-scale farmers to a level where they can attain commercialization.

Chairperson,

If ever we have to achieve anything in the field of fisheries development, the involvement of the private sector (which includes the banks and insurance companies) and non-governmental organizations is of vital importance. It is my hope therefore that, as you discuss the role of commercial aquaculture in achieving food security, you will also take time to dwell on aspects of lending to the farmer as well as safeguarding of the farmers’ production through insurance. I have no doubt that the broad representation at this Workshop will generate many ideas from which the two countries can draw worthwhile conclusions.

May I, once again, thank FAO for bringing the two countries together. This is what regional cooperation is all about and this should be encouraged.

I look forward to receiving the conclusions of your Workshop and the implementation plan so that we can urgently promote the growth of the aquaculture sub-sector and thereby contribute to poverty reduction amongst our populations.

With these few remarks, I now declare this Workshop officially open.

I thank you.

I. INTRODUCTION

In 2000 the total world supply (aquaculture plus capture) of catfish and tilapia was estimated at about 567 844 and 1 883 197 metric tonnes respectively. The supply has increased between 1995 and 2000 with respectively 14 percent and 51 percent. Much of this growth can be attributed to aquaculture (Table 1).

Table 1. Total world production of catfish and tilapia in metric tonnes (MT) in the year 2000.

|

|

Catfish |

Tilapia |

||

|

|

MT |

% |

MT |

% |

|

Aquaculture |

414 962 |

73 |

1 265 609 |

67 |

|

Capture fisheries |

152 882 |

27 |

617 588 |

33 |

|

Total |

567 844 |

100 |

1 883 197 |

100 |

(Source: FAO Fishbase, 2001)

II. CATFISH

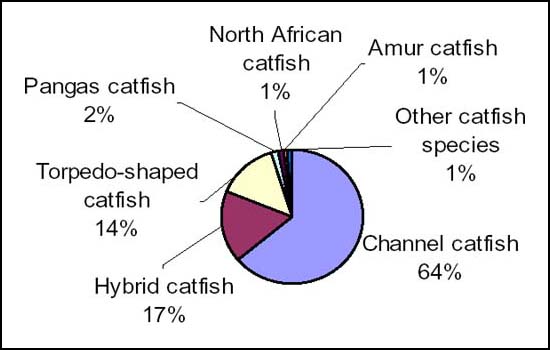

As indicated in Figure 1, the world supply of catfish is dominated by three species, Channel catfish (Ictalurus spp.), Hybrid catfishes (Clarias spp.) and Torpedo shaped (Clarias spp.) catfishes. These three groups of species together accounted for 95 percent of the world aquaculture output of catfish in 2000. The USA is the main producer of Channel catfish, while Hybrid catfish is mainly produced in Thailand and Torpedo shaped catfishes in India, Indonesia and Nigeria. Although not recorded in the official statistics the production of especially Pangasius spp. catfish is increasing rapidly in Vietnam, while in other South East Asian countries Hybrid catfish production has been booming in recent years.

Figure 1. World aquaculture production of catfish by species in 2000.

(Source: FAO Fishbase, 2001)

With a catfish aquaculture supply of just over 5 000 MT in 2000, sub-Saharan Africa accounted not more than 1.2 percent of the total world supply of this species. Nigeria has been the main catfish producing country in sub-Saharan Africa for the last decade, although its production fluctuated heavily. Ninety percent of the catfish supply in sub-Saharan Africa in 2000 occurred in Nigeria (Table 2). Other countries in the region hardly produced any catfish. Torpedo shaped catfishes and Upside-down catfishes (Synodontis spp.) were the main cultivated species. They respectively account for 83 and 9 percent of the total volume produced in the region in the year 2000 (Table 3).

Table 2. Catfish aquaculture supply in sub-Saharan Africa (MT).

|

Country |

1995 |

1996 |

1997 |

1998 |

1999 |

2000 |

|

Nigeria |

6 200 |

6 837 |

7 962 |

4 929 |

2 652 |

4 518 |

|

Côte d'Ivoire |

175 |

189 |

155 |

297 |

345 |

230 |

|

Kenya |

n.a |

n.a |

2 |

7 |

92 |

124 |

|

Ghana |

200 |

200 |

100 |

105 |

110 |

76 |

|

South Africa |

10 |

20 |

35 |

40 |

15 |

23 |

|

Malawi |

3 |

5 |

7 |

10 |

12 |

15 |

|

Rwanda |

4 |

5 |

4 |

5 |

40 |

14 |

|

Mali |

40 |

24 |

24 |

24 |

30 |

11 |

|

Gabon |

n.a |

n.a |

n.a |

n.a |

n.a |

10 |

|

Cameroon |

2 |

3 |

3 |

3 |

3 |

10 |

|

Swaziland |

n.a |

23 |

18 |

4 |

5 |

6 |

|

Liberia |

n.a |

n.a |

n.a |

n.a |

n.a |

2 |

|

Guinea |

4 |

4 |

<0.5 |

<0.5 |

<0.5 |

<0.5 |

|

Lesotho |

2 |

2 |

2 |

<0.5 |

<0.5 |

<0.5 |

|

Other countries |

102 |

158 |

23 |

2 |

2 |

n.a |

|

Total |

6 742 |

7 470 |

8 335 |

5 426 |

3 306 |

5 039 |

(Source: FAO Fishbase, 2001)

Table 3. Aquaculture supply of catfish by specie in sub-Saharan Africa in 2000.

|

|

Metric tonnes |

% |

|

Torpedo-shaped catfishes nei |

4 201 |

83 |

|

Upside-down catfishes |

451 |

9 |

|

North African catfish |

291 |

6 |

|

Bagrid catfish |

96 |

2 |

|

Total |

5 039 |

100 |

(Source: FAO Fishbase, 2001)

III. TILAPIA

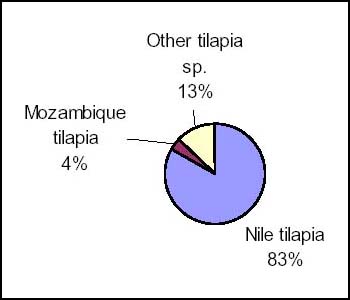

Two-thirds of the world tilapia supply is derived from aquaculture. China, Egypt, Thailand and the Philippines are the main producers of Nile tilapia (Oreochromis spp.), which accounted for 83 percent of the world aquaculture supply of tilapia in 2000 (Figure 2).

Figure 2. World aquaculture supply of tilapia by species in the year 2000.

(Source: FAO Fishbase, 2001)

Indonesia is the major supplier of Mozambique tilapia (Oreochromis spp.). Tilapias sp. are produced by numerous countries, among which Taiwan, Mexico, Brazil, Sri Lanka and the Philippines. As far as capture supply of tilapia concerns, countries in sub-Saharan Africa such as Uganda, Tanzania and Kenya are important producers.

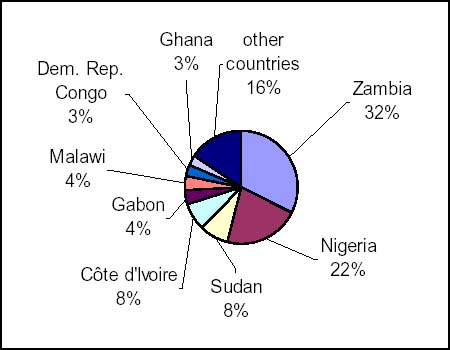

The tilapia aquaculture suuply in sub-Saharan Africa has been relatively stable over the last five years. Around 12 000 MT was produced annually (Table 4). This quantity represents only one percent of the world tilapia aquaculture supply. The tilapia supply from capture fisheries by Uganda, Tanzania, Kenya and other sub-Saharan African countries was over 200 000 MT in 2000. As far as capture fisheries concerns, sub-Saharan Africa contributed almost one-third to the world catches and over 10 percent to the total world supply (aquaculture plus capture) by volume in 2000. The tilapia suuply from aquaculture per country in sub-Saharan Africa in 2000 is presented in Figure 4.

Figure 4. Tilapia aquaculture production per country in sub-Saharan Africa in the year 2000.

(Source: FAO Fishbase, 2001)

FAO estimates that 32 percent of the total tilapia aquaculture production of the sub-Saharan African region is realized in Zambia and 22 percent in Nigeria. Although official statistics are absent it is acknowledged that Zimbabwe (Lake Harvest Tilapia) produced in 2000 a considerable quantity of tilapia, estimated at around 2 000 MT. Nile tilapia and other tilapias were the species groups most cultivated in sub-Saharan Africa in the year 2000, each accounting for 37 percent of the total supply (Table 5).

Table 4. Tilapia supply from aquaculture in sub-Saharan Africa (MT).

|

Country |

1995 |

1996 |

1997 |

1998 |

1999 |

2000 |

|

Zambia |

3 237 |

4 403 |

4 430 |

3 942 |

3 960 |

4 020 |

|

Nigeria |

6 020 |

3 259 |

4 978 |

4 471 |

1 589 |

2 705 |

|

Sudan |

1 000 |

1 000 |

1 000 |

1 000 |

1 000 |

1 000 |

|

Côte d'Ivoire |

162 |

933 |

258 |

495 |

575 |

967 |

|

Gabon |

37 |

59 |

54 |

150 |

530 |

533 |

|

Malawi |

28 |

20 |

22 |

22 |

565 |

500 |

|

Congo, Dem. Rep. of the |

600 |

600 |

550 |

500 |

414 |

414 |

|

Ghana |

350 |

350 |

300 |

315 |

320 |

347 |

|

Rwanda |

70 |

90 |

110 |

120 |

241 |

252 |

|

Kenya |

536 |

500 |

124 |

87 |

118 |

222 |

|

Tanzania, United Rep. of |

200 |

200 |

200 |

200 |

200 |

210 |

|

Congo, Republic of |

139 |

106 |

99 |

140 |

190 |

200 |

|

Uganda |

116 |

40 |

288 |

200 |

200 |

200 |

|

Central African Republic |

200 |

140 |

80 |

80 |

117 |

120 |

|

South Africa |

25 |

15 |

20 |

70 |

85 |

110 |

|

Senegal |

40 |

53 |

53 |

3 |

105 |

105 |

|

Togo |

20 |

21 |

17 |

25 |

150 |

102 |

|

Zimbabwe |

50 |

70 |

70 |

70 |

75 |

75 |

|

Burundi |

50 |

50 |

50 |

55 |

55 |

55 |

|

Cameroon |

50 |

50 |

60 |

60 |

60 |

40 |

|

Swaziland |

n.a |

47 |

25 |

48 |

32 |

38 |

|

Sierra Leone |

25 |

30 |

30 |

30 |

30 |

30 |

|

Mali |

58 |

35 |

35 |

35 |

50 |

19 |

|

Niger |

35 |

11 |

13 |

12 |

14 |

15 |

|

Liberia |

<0.5 |

<0.5 |

<0.5 |

n.a |

n.a |

12 |

|

Burkina Faso |

<0.5 |

30 |

45 |

40 |

25 |

5 |

|

Mozambique |

36 |

4 |

1 |

1 |

1 |

1 |

|

Ethiopia |

50 |

35 |

20 |

10 |

<0.5 |

<0.5 |

|

Total |

13 134 |

12 151 |

12 932 |

12 181 |

10 701 |

12 297 |

(Source: FAO Fishbase, 2001)

Table 5. Aquaculture suuply of Tilapia by specie in sub-Saharan Africa in 2000.

|

|

Metric tonnes |

% |

|

Tilapias (unspecified) |

4 548 |

37 |

|

Nile |

4 533 |

37 |

|

Three spotted |

2 750 |

22 |

|

Longfin |

210 |

2 |

|

Redbelly |

201 |

2 |

|

Mozambique |

55 |

0 |

|

Total |

12 297 |

100 |

(Source: FAO Fishbase, 2001)

Fish consumption and markets for catfish and tilapia in the European Union

I. CONSUMPTION

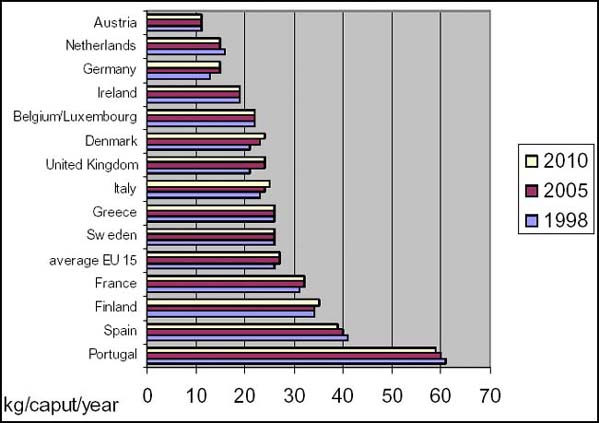

Of all EU countries Portugal has the largest consumption of fish per capita: 61 kg/year, followed by Spain, Finland and France with 41, 34 and 31 kg/capita/year respectively. Table 1 presents the per capita fishery consumption figures of EU countries. It shows that there exists a big variation in fish consumption and expenditures on fishery products between EU consumers. In terms of value consumed, the Belgians and Italians are spending much more than people in the other EU countries on fishery products. Belgians and Italians spent, on average, respectively 169 € and 147 € per person in 1999. Projections by CEMARE show a very small increase in EU fishery products consumption per capita, with only 1 kg till the year 2010. Current and forecasted per capita fishery products consumption data are presented in Figure 1. According to the model used, the fishery products consumption in the United Kingdom and Denmark will increase with 3 kg between 1998 and 2010. German and Italian per capita consumption will increase by 2 kg over the same period. In contrast, the per capita consumption in Portugal, Spain and the Netherlands is expected to decrease.

Table 1. Per capita fishery products consumption figures of EU countries.

|

Country |

Average consumption per capita (kg/year) 1994-1998 (a) |

Consumption per capita in value (€/year) in 1999 (b) |

|

Spain |

41 |

96 |

|

France |

31 |

38 |

|

Italy |

23 |

147 |

|

Germany |

13 |

49 |

|

UK |

21 |

24 |

|

Denmark |

21 |

25 |

|

Netherlands |

16 |

23 |

|

Portugal |

61 |

83 |

|

Belgium/Luxembourg |

22 |

169 |

|

Sweden |

26 |

58 |

|

Greece |

26 |

94 |

|

Austria |

11 |

23 |

|

Finland |

34 |

91 |

|

Ireland |

19 |

35 |

|

average EU 15 |

26 |

68 |

(Source: (a) Cemare, 2002; (b) CBI, 2001. Note: Ireland and UK excluding shellfish, UK excluding frozen fish, Spain excluding dried, salted and smoked fish)

Figure 1. Current and forecasted per capita consumption of fishery products in the EU countries.

(Source: Cemare 2002)

Over the period 1996-2000, the volume of fishery products consumed in France, Italy and Spain increased with respectively 16 percent, 9 percent and 13 percent. In contrast, over the same period, the fishery products consumption in Germany decreased by 5 percent (UNIPROM, 2001). As the vast majority of data on fishery products consumed in EU countries is derived from fisheries and national fisheries industries it is difficult to estimate future consumption of aquaculture products, and almost impossible to forecast consumption of aquaculture products from Africa.

Catfish and tilapia are expected to continue being imported by EU countries mainly in frozen form (whole and filets). It is also expected that imports of aquaculture products will continue to increase relatively more rapidly than those of capture fisheries. Forecasted annual consumption changes till 2030 are presented in Table 2. No general trend towards or away from certain product groups can be identified as countries populations’ consumption behaviour appears to differ a lot and will continue to differ in the future.

Table 2. Annual consumption change projections till 2030.

|

Country |

Annual consumption changes (percentage) projections till 2030 (a) |

||

|

|

crustaceans |

fish fillets |

frozen fish |

|

Spain |

0.3 |

0.3 |

-1.3 |

|

France |

1.3 |

0.6 |

0.0 |

|

Italy |

0.0 |

0.1 |

0.0 |

|

Germany |

-0.3 |

0.8 |

-0.6 |

|

UK |

0.0 |

0.3 |

-0.2 |

|

Denmark |

-1.3 |

1.3 |

1.3 |

|

Netherlands |

-1.3 |

1.3 |

0.0 |

|

Portugal |

0.0 |

-0.7 |

0.0 |

|

Belgium/Luxembourg |

-0.6 |

1.3 |

-1.3 |

|

Sweden |

2.1 |

-0.6 |

0.0 |

|

Greece |

0.2 |

0.6 |

0.0 |

|

Austria |

0.0 |

1.5 |

1.3 |

|

Finland |

-0.6 |

0.0 |

0.0 |

|

Ireland |

0.0 |

0.0 |

0.0 |

(Source Cemare, 2002)

II. CURRENT TRENDS IN EU FISH CONSUMPTION

The EU fishery and aquaculture products market is very dynamic. Current consumption trends are towards an increase in demand for fresh and value added products and a decrease in demand for whole frozen fish and canned products.

Innovation in new fish products should go through the food service sector. Fish is an ideal restaurant food. Chefs love to work with it; consumers prefer fish in restaurants because of convenience (they consider its preparation at home difficult) (EIFAC, 2001). In addition, consumers are more willing to try new products in restaurants than at home.

Although it is generally believed that consumers make the purchasing decision, it is probably more accurate to say that retailers (supermarket chains and fish specialty shops), caterers, restaurant chefs, processing industry and middlepersons influence the consumer decision whether to buy ceratin products or not. They decide what is available in what quantities, where and in which form.

Much of the farmed aquaculture products, except for salmon and trout, are not recognised by consumers as farmed products. This lack of awareness does not mean that most of the consumers would prefer wild fish over farmed fish. Only a small share (e.g. less than 20 percent in France) of the fish consumers seem to prefer wild fish over farmed fish. The large majority of the consumers are indifferent to the source of the fish as long as the price is right and quality/freshness is guaranteed.

In the last decade, especially the segments of fresh fillets, specialities and ready to cook (convenience) fish products have gained market share in the EU countries. The market for smoked fish products seem to stabilize after a large increase in the last years of the twentieth century. Nevertheless, "new" products as smoked tuna and swordfish are entering slowly the market as specialities. The more traditional smoked salmon has, under the continuous decrease in market price, lost part of its image as specialty product for celebrations (Christmas, New Year and birthday parties) and its consumption is now more evenly spread over the year.

Salads containing fish and surimi based products are well received by the European consumers. Markets are developing for these products in almost all EU countries. However, so far, aquaculture products are hardly used as raw materials for surimi.

Recent studies have shown that the retail business and especially supermarket chains and the catering business (chain restaurants and institutional caterers) are in favour of, and willing to support, aquaculture products market entrance and development in the EU markets. Retailers and caterers tend to prefer aquaculture products over fsiheries products for the following reasons:

1) Homogeneous sizes of fish delivered (fish size can be adjusted to portions demanded by consumer, filleting is easy and generally without much losses, better meat-waste ratios).

2) Homogeneous meat/flesh (colour can be partly adjusted to the preference of the consumers; white meat is prefered by hospitals and many canteens).

3) Year round availability (fish farmers can guarantee, to a certain extent, a steady delivery and allow supermarkets to anticipate demand and sell the product fresh during the whole year).

4) Less odour (some of the customers in supermarkets do not like the smell of fish and neither do many consumers).

5) Less fishy taste (some of the consumers like to eat fish but do not like the specific fish taste which is often the case with marine species; supermarkets acknowledge this situation and like to offer their customers such products).

6) Traceability (aquaculture products offer supermarket chains the possibility to trace the product back to its source, giving them a greater control over product safety).

7) Inexpensive price (aquaculture products as tilapia, trout and catfish are generally cheaper than many marine fish species, allowing supermarkets to provide customers with a wide range of varieties in fish products and prices).

III. CATFISH MARKETS

A large part of the catfish consumed in the EU originates from the EU itself. In 2000 the Netherlands and Belgium produced 3 355 metric tonnes. The USA, Thailand and Vietnam are the main competitors in the EU market for catfish products. The Netherlands and Belgium mainly produce (North) African Catfish (Clarias spp.) while catfish from the USA and Vietnam are respectively of the species Ictalurus spp. and Pangasius spp. The intensive and highly water efficient recirculation systems currently used by Dutch and Belgium catfish farmers are a result of the ever more rigorous environmental government policies; this in contrast to the pond production systems used in Eastern Europe (Silurus spp.), Thailand and Viet Nam.

EU catfish farming has increased rapidly in the last few years and apparently market demand is still increasing. However, prices are under pressure as there seems to be some local oversupply and products from South East Asia enter the market in increasing quantities. Catfish imports from the USA fluctuated a lot over the last years; they were valued at US$1.8 million in 1996, just US$80 000 in 2000 and US$294 000 in 2001 (USDA, 2002).

The EU consumer demand for catfish species is largest in Germany, Austria and France. Especially in Germany the product is becoming better known and accepted as an alternative to Carp (Cyprinus spp.) and Pike-perch (Lates spp.). In 1994 "The Catfish Institute" of the USA tried to introduce its catfish products in Germany with limited success. Consumers got aware of its existence through a large advertisement campaign and other market promotions such as trade fairs. Only recently however the demand for catfish started to increase, especially as people were searching for alternatives in the period of the Foot and Mouth Disease crises, Bovine Spongiform Encephalopathy (BSE) crises and Pork and Poultry plagues which hit the EU markets since 1995.

Of the four species of catfish consumed in Germany, Silurus spp. (European catfish) and the marine species Anarhichas spp. (Wolf fish) are traditionally known. African and American catfish started to enter the market in the 1990’s. European catfish and Wolf fish are sold fresh in sizes of 1.5 kg per fish or larger. African catfish is generally sold in filet form (fresh and frozen) from fish larger than 1 kg. African catfish filets have a redder appearance than American (channel) catfish, but the industry is trying to produce hybrid catfish with white meat in order to better meet consumer preferences. An estimated 90 percent of the African catfish (Clarias spp.) produced in the EU is processed to fillets (Proteau, Volker and Linhart, 1996). Germans prefer larger sized catfish than Americans and German retailers are indifferent as far as the origin of the product concern. In addition, retailers show a clear preference for fresh fish over frozen product which is reflected in the price (Lombardi and Anderson, 1998).

A large part of the catfish produced in the EU is consumed in restaurants, institutional canteens and hospitals. The latter institutions request a type of fish filet that has a relatively firm texture (in view of the cooking processes used) and not much of a fishy smell and taste.

IV. TILAPIA MARKETS

The domestic production of Tilapia in the EU is very limited. Only in Belgium some farmers have started to raise this species (especially the Gabriel Group) but not more than some 180-240 MT are produced annually. At present, the import of tilapia is dominated by African, Asian and Central American countries. Competition from Israeli producers and in the near future from Hungarian producers is expected to increase (EIFAC, 2001). Imports of tilapia filets and tilapia meat from the US have been very limited over the last years. These imports were valued just at US$10 000 in 2000 and US$89 000 in 2001.

Nile perch, Lates niloticus, (a cheaper fish) has entered the Italian market as tilapia in recent years and in Spain the same specie is known as grouper (EIFAC, 2001). Differentiation between fish species is very difficult for the majority of the consumers especially for frozen boneless fillets. They rely on the label on the package, or when the fresh fish is displayed on the counter of the retailer they will need to rely on him/her. Nile perch is a clear competitor for tilapia from Africa. Tanzania, Kenya and Uganda are the main exporters of Nile perch. Nile perch is relatively cheap (on average around 20 percent) and can be delivered in large quantities within 48 hours to the market in the EU. Most of the imports pass through Dutch companies, as logistically this is most efficient, and are distributed from there to other EU markets.

Due to the generally low prices for freshwater aquaculture products and the pressure on producer margins for aquaculture products, under the influence of large retail chains market power, it is relatively difficult for producers from outside the EU to market their product. Nevertheless, fresh tilapia fillets from Zimbabwe reach the Dutch market within 24 hours after being caught from the cage.

Frozen tilapia fillets are generally imported from China, Taiwan, Jamaica, Costa Rica, Viet Nam, Thailand, Indonesia and the Philippines.

Tilapia is in the EU countries still considered as a niche product, although there are companies like Anova which market more than 500 MT/year. The demand for the specie is limited to particular ethnic groups (especially Asians and North Africans). Therefore consumption of tilapia is largely limited to countries with large communities of these ethnic groups (United Kingdom, Germany and France) and, to a lesser extent, to Belgium, Austria, Italy and the Netherlands. London is the largest market for tilapia in the EU, where tilapia fillets already appear in the common fish and chips dish of the Londoners. Supermarket chains such as Sainsbury’s and Tesco import tilapia products including fresh fillets from Jamaica.

Prices of tilapia have been relatively stable. Due to its white meat it is a good substitute for other whitefish species (Vannuccini, 1998). Consumer acceptance has been continuously rising and restaurants have put tilapia on the menu as a low calorie dish. The fish meat has medium fat and high protein content. As most tilapia sold in the EU markets originates from aquaculture, the supply can be guaranteed which makes it an attractive product for retail chains (supermarkets).

On the whole the European market prefers tilapia of a bigger size than the USA. Nile tilapia is the preferred specie in Germany where it is used as a substitute for redfish (Sebastes spp.). The consumers in the United Kingdom prefer fresh imported product from mainly Jamaican origin (Vannuccini, 1998). Fresh products are appreciated more than frozen and have a related higher market value.

Tilapia is not expected to gain a market as large in the EU as it did in the USA as it is still considered a low quality product; however the trend of eating exotic food is affecting the demand for this species in a positive way. A slow but steady increase in market demand for tilapia is expected in the central and northern EU countries. Prices of tilapia are however expected to fall a bit due to increased competition with other freshwater fish species (e.g. Nile perch and catfish).

References:

CBI, 2001. EU strategic marketing guide 2001 Fishery products. Centre for the Promotion of Imports from Developing Countries (CBI), Rotterdam, the Netherlands

CEMARE, 2002. Future Fish Consumption in the European Union in 2015 and 2030. Centre for the Economics & Management of Aquatic Resources (CEMARE) (in preparation).

EIFAC, 2001. Report of the Ad Hoc EIFAC/EC working party on market perspectives for European freshwater aquaculture, Brussels, Belgium, 14-16 May 2001, European Inland Fisheries Advisory Commission (EIFAC), Occasional paper No. 35, Rome, Italy.

Lombardi, W.M. & Anderson, J.L. 1998. The market potential for farmed freshwater finfish in Germany: a focus on catfish. Aquaculture Economics and Management, Volume 2, no.2, pp. 43-48

Proteau, J.P, Volker, H. & Linhart, O. 1996. Etat actuel et perspectives de la production aquacole de poissons-chats (Siluroidei) en Europe. Aquatic Living Resources, Vol. 9, pp.229-235 (in French).

UNIPROM, 2001. Studio di mercato sul ruolo della grande distribuzione organizzata europea nella commercializzazione dei prodotti ittici. Instituto di studi per la Direzione e Gestione di Impresa -STOA, Consorzio Promozione Prodotti Ittici - UNIPROM, Rome, Italy- (in Italian).

USDA, 2002. http://www.fas.usda.gov/ustrdscripts/USReport.exe

Vannuccini, S., 1998. Western world - the focus of new tilapia market. Infofish International, no. 4.

I. EUROPEAN UNION DIRECTIVES

Since the early 1990’s the EEC and later the EU have emphasized that fishery products, including aquaculture products, entering the European market should be safe food and of high quality. Technical standards might be set by national authorities but the European Commission (EC) plays a leading role in regulating the trade of fishery and aquaculture products. It is the EC which issues directives. The national authorities are responsible for their application and enforcement (CBI, 2001a).

There are two important EU directives that refer to trade of fisheries and aquaculture products. The Directive 91/493/EEC and Directive 91/492/EEC. The Directive 91/493/EEC lays down the health conditions for the production and the placing on the market of fishery products, while the Directive 91/492/EEC determines the health conditions for the production and the placing on the market of live bivalve molluscs. For sub-Saharan African fish and shrimp exports to the EU the directive 91/493/EEC is thus most relevant. The integral text of the various directives can be found on the internet at http://europa.eu.int/eur-lex/en/search.html. In short, both directives deal with the hygienic conditions during handling, preparation, processing, packing, storage and transport. In addition to the two directives above Directive 2406/96/EU lays down the common marketing standards for certain fishery products. It discusses various freshness categories for fresh and chilled products, size categories (the latter for fishery purposes) and the labelling requirements for imports from third countries.

Directive 91/493/EEC stipulates that all fishery and aquaculture products (fresh, as well as chilled, frozen, canned, smoked, dried or salted) entering the EU market must come from a an establishment where fishery and/or aquaculture products are prepared, processed, chilled, frozen, packaged or stored which is approved by the competent national authorities. Updated lists of the establishments endorsed by the EU in each exporting country can be found on the internet at http://forum.europa.eu.int/irc/sanco/vets/info/data/listes/ffp.html and are published also in the Official Journal of the EU. Listed establishments receive from the EU a number that authorizes their exports of certain products to the EU.

The Hazard Analysis Critical Control Point (HACCP) quality assurance system forms the basis of the 91/493/EEC Directive. For fish and shrimp farmers, wholesalers and processors Chapter 3 of the annex of the directive is very useful as it describes the general conditions for establishments on land including specific requirements for the working areas, equipment to be used in handling, preparation and processing areas, and general conditions of hygiene. The HACCP system allows, through a rational approach and by applying the necessary measures to control the microbiological hazards which manifest themselves at various stages in the handling and processing of the products.

Its main purpose is to avoid systematic detention, heavy sampling and laboratory checks at the point of entry in the EU (CBI, 2001a). This means a shift from the traditional approach of end product inspection and certification to prevention and that large part of the actual control has been moved from the entry points in the EU to the so called "third countries", the exporting countries. As a consequence the third countries, which are often developing countries, got a number of new tasks added to their responsibility; e.g. a quality inspection system needed to be developed, legislation and regulations needed changes, the establishments of (independent) institutions/organizations for quality control, development of procedures for obtaining health certificates.

Countries exporting fishery and aquaculture products must submit complete legislation on the export of these products to the EC, as well as complete reports on the functioning of its controlling authority and the infrastructure in which it operates. This documentation will be carefully studied by the EC and if found satisfactory, a delegation of experts will be send to the exporting country, which visits at random some companies (CBI, 2001a). Following the reports of the delegation the EC may give permanent or provisional approval for exports of these products to the EU. When the national controlling authority is recognised officially by the EU, it is held responsible for monitoring and checking if establishments in the country are following the procedures as stipulated in the legislation.

For the implementation of these EU Directives the EC is developing harmonized import conditions for the third countries exporting fishery and aquaculture products to the EU. The specific conditions for imports of specific products and product forms are being documented, which is a long process. Therefore, a transition period has been defined, during which so called "third" countries are allowed to export fishery and aquaculture products to the EU. In the meantime the list of countries is updated from time to time. Since July 1998 imports of fishery and aquaculture products are only possible, if a country appears on the first three of the following four lists.

1) European Area Countries (these are: Iceland and Norway)

2) Completely harmonized countries, the so called "list 1" countries

3) Provisionally harmonized countries

4) Non-harmonized countries

Of all "list 1" countries the EU has determined specific import conditions, including a published list of recognized establishments and a health certificate for each country. If issues regarding to packaging and labelling and the inspection requirements are met, then exports can take place without any problem. Fourteen sub-Saharan African countries are under Commission decision 2001/635/EC listed in this list up to June 2002: Ivory Coast, Gambia, Ghana, Guinea Conakry, Madagascar, Mauritania, Mauritius, Namibia, Nigeria, Senegal, Seychelles, Uganda, South Africa and Tanzania.

The provisionally harmonized countries have been listed under directive 95/408/EC "on the conditions for drawing up, for an interim period, provisional lists of third country establishments from which member states are authorized to import certain products of animal origin, fishery products or live bivalve molluscs". Although the decision was intended to apply only till the end of December 1996, it is still into force. Commission Decision 2001/635/EC amended the earlier decision and the lists of countries. The countries listed here await their definitive harmonization. As most import conditions (e.g. in relation to packaging and control) are more or less identical to those for the completely harmonized countries, the main difference is that not all EU member states accept products from these countries (Eastfish, 1998). Moreover, no list of EU recognized establishments has been made officially yet for these countries. Sub-Saharan African countries which are mentioned in this list (updated till June 2002) are the following ten countries: Angola, Benin, Cameroon, Republic of Congo, Eritrea, Gabon, Kenya, Mozambique, Togo and Zimbabwe.

Non-harmonized countries are not allowed to export fishery and aquaculture products to the EU. A large number of sub-Saharan African countries are not harmonized, e.g. Ethiopia, Malawi, Zambia, Central African Republic, Rwanda, Burundi, Congo Brazzaville, Somalia, Niger, Mali, Chad, Sudan, Guinea Bissau, Sierra Leone, Liberia, Burkina Faso, Botswana, Lesotho, Swaziland and Djibouti.

In addition to the above health and product quality related EU directives, the EC also decided that a health certificate has to accompany all imports from fishery and aquaculture products from third countries under Decision 95/328/EC. Moreover, EU Directive 93/43/EC of June 1993 on the Hygiene for Foodstuffs, which became effective in January 1996, stipulated that: "foodstuff companies shall identify each aspect of their activities and ensure that suitable safety procedures are established, applied, maintained and revised on the basis of the HACCP system". The consequences of the latter directive directly affect the investments to be made by fish and shrimp processors, packers, transporters, wholesalers, distributors and exporters. As far as exporters concern, this group does not need to have an approved HACCP system, but in most cases the importer in the EU will request HACCP system compliance as they will be held legally responsible for the imported products (CBI, 2001a).

II. GENERAL SYSTEM OF PREFERENCES

Since 1971 the European Community has granted trade preferences to developing countries. The General System of Preferences (GSP) is used by the EU to create a stronger trade, based on unilateral concessions which are granted by individual industrialized countries (DIPO, 2001). EC Council Regulation 2501/2001 on a "scheme of generalized tariff preferences for the period from 1 January 2002 to 31 December 2004" follows a similar regulation (EC/2820/98) and "extends the duty-free access without any quantitative restrictions to products originating in the Least Developed Countries (LDCs)", (classified so by the United Nations). With the exemption of three products (bananas, rice and sugar) which are included in a transition period, all goods (thus also fish and shrimp) are allowed duty-free import when exported by LDCs to the EU. For the remaining developing countries there are varying reductions in duty. Countries, including LDCs, can be excluded (temporary) from the advantages of the GSP on the basis of observed slavery or forced labour, violation of association, export of goods made by prison labour, fraud and unfair trading. Issues considered of importance, for which countries are given incentive arrangements under the GSP are the protection of labour rights, the protection of the environment and to combat drug production and trafficking.

In addition to the GSP the EU has signed several partnership and trade agreements. One of these, which is highly relevant for sub-Saharan African Countries is the agreement between the EU and the 77 African, Caribbean and Pacific (ACP) countries a partnership. This agreement (which was a follow up on the former Lomé Convention) was signed in June 2000, regulates the trade between the two groups of countries, and also deals with the political dimensions of their relations, their development cooperation strategies and their financial cooperation (DIPO, 2001).

The partnership agreement with the ACP countries, under which zero-tariff duty for fishery and aquaculture products is defined, will be valid till December 2007 after which it seems unlikely that new tariffs will be imposed, in view of the trend of growing membership in the World Trade Organization (WTO). The WTO favours generally reductions in tariffs and related duties. It should however be noted here that zero-tariffs only apply to those fisheries and aquaculture products which originate 100 percent from the ACP countries.

With one of the ACP countries, South Africa, the EU has a separate agreement in which it is agreed that the level of import duties (in both directions) as existed in the year 2000 will be gradually reduced towards the year 2010. Exact and up to date information on import duties (in view of special considerations and exemptions to the rules) is available from national chambers of commerce, the EC, customs departments and trade promotions offices in each of the member countries of the EU.

III. PRODUCT QUOTA

Although there are no import quotas for fishery or aquaculture products, there exist certain tariff contingents which are applicable during (part of) the year. Contingents define volumes of fishery products, which may be imported for a special tariff if the customs value at least equals the reference price. At the moment the total EU imports of the product exceed the contingent, the general tariff applies again (CBI, 2001b). Contingents are laid down by the EU each year. As far as the three products discussed here in the report concern, tariffs are not applicable to Penaeus spp. shrimp and neither to catfish or tilapia.

Moreover, the reference price system as used by EU as a form of market protection for products as herring, sardines, anchovies, cod, hake, cuttlefish, squid, tuna, and shrimp of Crangon spp. has so far not been extended to aquaculture products, and there is no indication that this might happen in the near future. The latest information can be found on the internet at http://europa.eu.int/eur-lex/en/search.html.

IV. PRODUCT AND PRODUCTION INFORMATION

EC Regulation 2065/2001 laying down the detailed rules for the application of Council Regulation 104/2000/EC "with regard to informing consumers about fishery and aquaculture products" specifies that products may be offered for retail only on the condition that a number of requirements regarding consumer information are met. Information on the origin (marine or freshwater, aquaculture or caught) of production should be made available by means of the labelling or packaging of the product, as well as its commercial designation and the scientific name. The EC considers it important that the scope of information to be passed on to the consumer throughout the marketing chain should be specific and that member states should establish arrangements for checking the traceability of the products covered by the above regulation.

In this respect the earlier EU regulation, 96/2406/EC on the common marketing standards for certain fishery products laid down that products as e.g. cod, hake, certain crustaceans and cephalopods imported from third countries may be marketed in the EU only if they are presented in packages on which the following information is clearly and legibly marked:

Although EU regulation 96/2406/EC does not specify shrimp, catfish and tilapia it is advisable to follow the above labelling requirements also for these species. In view of the increasing requests for information from retailers and consumers the following information could also be added on the packages:

Special Eco-labels for environmentally sound fisheries and aquaculture products addressing the demand of certain consumer groups are not (yet) part of any EU regulation. However, recent experiences with dolphin-safe tuna (e.g. Flipper seal) and in sustainable fisheries management (Marine Stewardship Council logo) have shown that there is a market for Eco-labelled products.

In addition to the fact that consumers increasingly demand environmentally-friendly products and services it is becoming important for companies and organizations to demonstrate that not only their products are produced in a sustainable manner, but also that their investment strategies and day-to-day operations are sustainable. Two voluntary systems of standards have been developed and are currently used to cover this issue: ISO 14001 and the EU Eco-Management and Audit Scheme (EMAS). Both are tools for companies and other organizations to evaluate report and improve their environmental performance. ISO 14001 is integrated in the EU EMAS as its environmental management system. An attractive logo allows companies, which are EMAS accredited, to show their environmental awareness. Since September 2001 the EC adopted Decision 2001/2591 whereby the EC politically engages in a process of applying the EMAS regulation into its activities. The EMAS scheme is still relatively bureaucratic, but it might provide companies in the fisheries and aquaculture sectors with new business opportunities in markets where green production processes are important, increase their credibility and learn from good examples of other companies and organizations.

V. PACKAGING GUIDELINES

As packaging is used to present the product as well as protect it from possible damage and maintain its quality it is a very important issue for shrimp and fish producers and all involved in the marketing chain of these products. Although at present a large amount of the fishery and aquaculture products from developing countries, which are destined for the EU market, are re-packed and sometimes further processed or re-exported, there is a trend of more and more packaging for the catering and retail industry being carried out in the developing countries. Therefore it is important to know which packaging materials and techniques are allowed under various regulations and which ones are desired by the importers and retailers. The EU Directive 94/62/EC "on packaging and packaging waste" emphasizes that EU members states are supposed to reprocess between 50 and 65 percent of their packaging waste. There is an opportunity for those involved in the marketing of fishery and aquaculture products to use the right materials (e.g. non-toxic, minimize PVC use) which are, as far as plastics concern listed in so-called list of positive plastics, which is annexed to Commission Directive 95/3/EC which amends Directive 90/128/EEC relating to plastic materials and articles intended to come into contact with foodstuffs. As for packaging, the CBI (2001a) provides the following list which might help to determine the right packaging material:

VI. REQUIREMENTS FOR EXPORTING TO THE EU

As far as export of fishery and aquaculture products concerns, in most sub-Saharan African countries these products cannot be exported without authorization of a ministry, which is in general the Ministry of Industry and Trade. In addition, the customs at point of exit demand a kind of "trading licence for fish" (e.g. Uganda) or "export certificate" (e.g. South Africa) and a health certificate. Most sub-Saharan African countries removed their system of export duties, taxes and subsidies over the last years. Often transport documents (e.g. airway bill, freight transit orders) are requested to be shown to the customs.

An internationally certified bureau of standards (e.g. in Tanzania) is often in charge of overseeing standards, testing, labelling, and certification of fishery products imports and exports and should be contacted for the necessary documentation/information and approvals.

Many national governments in sub-Saharan Africa request that exports are paid for in foreign currency and have established regulations for payment. These can be obtained at the national banks. Payment documents are therefore often requested.

In addition to the above documents a packing declaration and sometimes an import notification form is requested by the importing countries to obtain the necessary import permit/licence.

Inspections of consignments originating from third countries are carried out on all consignments, at the first point of entry into the EU territory and at approved border inspection posts. Import controls are done in three consecutive steps:

Each transport must be accompanied by a sanitary certificate following the model drawn up by EU Decision 2001/65/EC. An example of such a health certificate can be found on the internet at: http://www.nmfs.noaa.gov/trade/EUCONTENTS.htm#Example%20Health

A certificate may be issued for goods produced in different establishments, but can only be made to one consignee. A certificate may be issued for several containers of the same product considered to be a single lot. It must be noted that a certificate defines the lot; therefore a rejection may be decided for all goods covered by the same certificate, even if only a part of it presents a sanitary or documentary problem (Vrignaud, 2001).

The certificate must be issued in one of the official languages of the country of entry into the EU territory, and if necessary in the language of the country of destination. In practice, the veterinary office of the point of entry into the EU does the documentary check and issues an "Annex B" which has to be in the language of the country of destination.

Each import control (one certificate = one control) is subject to inspection fees. In the case of processed fish and shrimp, the European importer must have an "import licence" from the Customs Authorities before the import process can be started.

Products imported from "harmonized" countries are subject to the documentary, identity and physical checks at the approved border inspection post at the first point of entry into the EU territory. When such a consignment satisfies EU requirements, it is then considered as an EU product. That is to say that if a consignment is allowed to enter the market in one member state; it can be marketed in all the others without being subject to non-harmonized rules (Vrignaud, 2001). However, marketing of fish and fishery products is subject to EU Directive 91/493, those products remain in the so-called "non-harmonized products" category. This means that national rules can still be applied in addition to the EU legislation. The Eastfish (1998) "Guidelines for fish exporters: requirements for the European markets" provide relevant information on specific national markets in this respect.

Transport insurance is not required but advised for the products exported. As all above procedures related to the export and import, can be very time consuming, it is advised to use specialized forwarding agents or brokers to guarantee smooth forwarding of the goods to the final consignee. Once informed that goods have arrived, the forwarding agent takes delivery of the documents, contacts the veterinary and customs services for various clearances. They then organize the delivery of goods to the final consignee. Forwarding agents are also valuable sources of information on specific regulations regarding the entry of products into any given country (Tettey, 2001).

With reference to the duty-free import in the EU of fish and shrimp products originating from ACP countries, it is necessary to complete and present a Circulation of Goods Certificate "EUR 1". A copy of this certificate can be found on the internet at: http://secretariat.efta.int/efta/library/legal/fta/plo/20-Protocol_B-Annex_IIIb.PDF.

Although not required, it is useful to have a written contractual agreement, as these are taken very seriously by EU importers. Verbal/Gentleman’s Agreements are also used, but only once a good trade relationship has been established. The CBI (2001a) distinguishes the following details which should be mentioned in such a contract:

REFERENCES:

CBI, 2001a. EU strategic marketing guide 2001 Fishery products. Centre for the Promotion of Imports from Developing Countries (CBI), Rotterdam, the Netherlands.

CBI, 2001b. Fishery products: EU market survey 2001, Centre for the Promotion of Imports from developing Countries, Den Haag, Netherlands.

DIPO, 2001. Exporting to Denmark: a guide for exporters from developing countries. The Danish Import Promotion Office for Products from Developing Countries, Copenhagen, Denmark.

EASTFISH, 1998. Guidelines for fish exporters: requirements for the European Union market. FAO Eastfish Fishery Industry Vol. 20, Copenhagen, Denmark.

Tettey, E. 2001. Markets and trade mechanisms for farmed tilapia, catfish and shrimp in Sub-Saharan Africa, FAO, Rome (not published).

Vrignaud, S. 2001. How to export seafood to the European Union. United States mission to the EU, Brussels, Belgium.

MAGAZINES/NEWSLETTERS

|

Title |

Issues covered |

Frequency |

Language |

Contact details |

|

Fish Farming International |

Marketing shrimp news new products country profiles exhibitions |

Monthly |

English |

Agra Europe (London) Ltd |

|

World Fish Report |

Policy and trade. legislative issues CFP consumption prices |

Two-weekly |

English |

Idem. |

|

Seafood International |

Processing and packaging prices, supply, species companies new products |

Quarterly |

English |

Idem. |

|

Globefish -Highlights |

Market analysis prices market news supply outlook commodity outlook |

Quarterly |

English French Spanish |

FAO Globefish |

|

European Fish Price Report |

Prices of main fish products traded in Europe |

Monthly |

English |

Idem. |

|

Infopêche Trade News |

Prices of main fish products traded from sub Saharan Africa |

Two-weekly |

French English |

INFOPÊCHE |

|

Infofish Trade News |

Prices of main fish products traded from Asia |

Two-weekly |

English |

InfoFish |

|

Seafood Business |

New products processing consumption retail |

Bi-monthly |

English |

Diversified Business |

Other useful publications which are frequently updated

|

Globefish - Directory of Fish Importers, Exporters and Producers: Europe |

Annually |

English |

FAO Globefish |

|

Infopeche Exporters Register |

Annually |

French English |

INFOPECHE |

|

Globefish Commodity Update - Shrimp - Freshwater Fish and others |

Bi-annually |

English |

FAO Globefish |

|

Infofish - Directory of Fish importers |

Quarterly |

English |

InfoFish |

Internet/websites

|

Address |

Topics |

|

fish price reports, marketing reports, research reports, links |

|

|

daily market prices at several auctions |

|

|

market prices, reports, trade information, companies, technology, links |

|

|

fish inspector reports, prices, market reports, conferences and exhibitions |

|

|

trade, consumption, export, import, aquaculture |

|

|

market prices, industry reports, aquaculture news, codes of practice |

|

|

code of conduct, statistics, production info, reports, links |

|

|

market prices in France |

|

|

code of conduct, quality issues, marketing, role of associations |

|

|

markets, trade, aquaculture, handling, legislation, safety, quality, fisheries, projects, news, technologies, links |