INVESTMENT PRESENTATION

THE PROPOSAL

The Hand-in-Hand initiative facilitates investments in eight of 20 districts, unlocking untapped agricultural potential for both investors and farmers. These socially inclusive investments promise high returns for farmers, elevating farm incomes and reducing poverty. The initiative prioritizes transparent, innovative, and impactful investments in Bhutan's Special Agricultural Products (SAP), offering production and market advantages.

The government provides access to state land lease in addition to farmers’ holdings, supports with development of major infrastructures including road, irrigation and energy supplies; and has enabling policy environment to invest and operate trading. Recently, government has introduced investment allowance for priority sectors that includes agriculture.

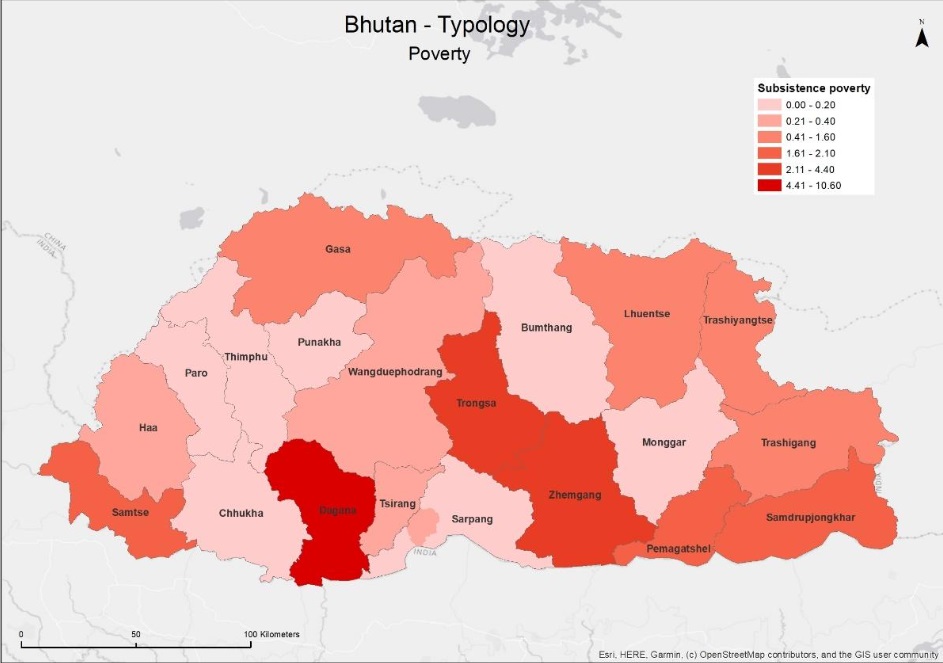

Poverty

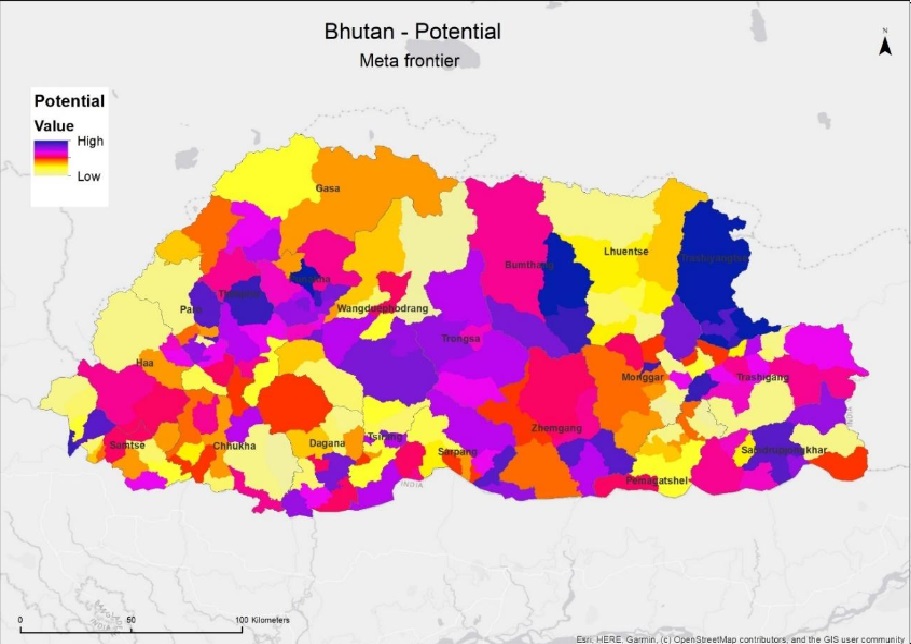

Potential

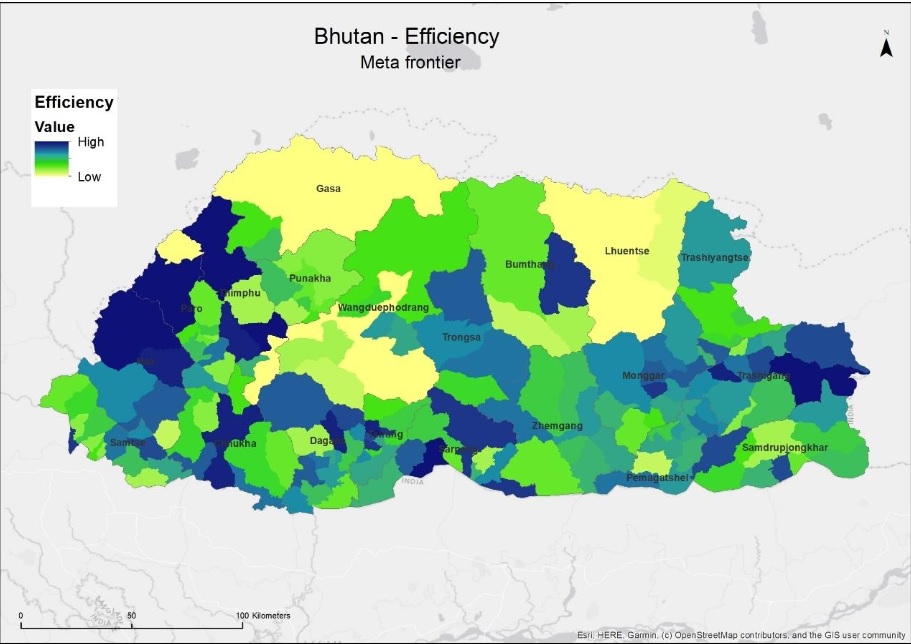

Efficiency

COMMODITIES AND INTERVENTIONS

Citrus Mandarin

Citrus mandarin from Bhutan is known for its high quality-better taste, unique favour and being grown under clean and green environment, and highly sought in the market both within and outside Bhutan. Climatic condition is suitable, enabling production from 300-1800 metres above mean seas level. Land and water resource are abundant for production and processing. Government provides access to state land lease for production expansion and supports for major infrastructures including road and irrigation. Rich production experiences with the farming communities, grown by more than 23 800 household over 13600 acres across the country.

Production can sustain over 30 years using local varieties, while new varieties being introduced to reduce seasonal gaps, meet demand for processing and export market. Currently, Bangladesh is the key export market and has scope to expand export volume, as Bangladeshi annual import is more than 260 000 MT, where Bhutan average annual export is less than 15000 MT. Bhutan is also targeting to expand its export market in Thailand and India.

Therefore, Bhutan is targeting to increase citrus production by 5000 acres in next five years that will benefit more than 5000 households in 6 most potential districts. Based on the production clusters, government also plans to establish three primary processing facilities to facilitate aggregation, grading, packaging, standardisation and certification to improve export market values and distribution systems.

This initiative requires an investment of US$ 37.49 million for a 20-year period to increase annual production by 28800 MT. Internal Rate of Return (IRR) estimated to be 14.23% with Financial Net Present Value (FNPV) of US$14.23 million. To support primary processing, additional investment of US$3.59 million will be required, and estimated IRR is 54.21% and FNPV of US$4.59 million.

This investment will have social impacts in terms of income increase by US$2844/farmer, production per labour unit by US$3937, 1056 full-time equivalent jobs/year; and environmental impacts- GHG emission reduction of 54 800 tCO2e.

Quinoa

Given the ideal agro-climatic conditions for growing it, quinoa has been identified as a strategic commodity and considered as future crop for the country to improve food, nutrition and income security of the marginal farmers. It is easy to produce, with low incidence of the pest and disease infestation and with minimal use of inputs and also could be managed under marginal land. It can be grown as a double crop after the production of maize or potatoes, and as a mixed crop with maize, potato and others. Production can be done round the year, taking advantage of diverse agroecological zones.

In order to address the challenges of post-harvest management and marketing, the Government plans to engage the private sector to improve the operations of crop processing facilities. Processing centres are critical not only to reduce post-harvest food losses, but also to process and maintain standards and quality required in the export and domestic markets.

A government is targeting to increase annual production by 2360 MT, over an area of 4000 acres under both rainfed and irrigated condition to benefit about 4000 households in eight potential districts, and improve existing facility of 4 MT/day and develop new facility with 8MT/day capacity. Production will need investment of US$13.76million, with estimated IRR at 20-30% with FNPV of US$3.06million for production under rainfed and US$3.43million for production under irrigated condition. In addition, processing will need investment of US$1.68 million, where IRR will be 45% with FNPV of US$2.09 million.

This investment interventions will have an impacts on increase in income by US$1623/farmer, 893 additional full time equivalent job, and GHG emission reduction of 22 921 tCO2e at the end of 20-year period.

Rainbow Trout

The fisheries sector is rapidly emerging as one of the fastest growing sector in Bhutan. Of various developments in this sector, cold-water aquaculture is gradually gaining momentum with the advent of rainbow trout farming in high altitude regions of the country. Besides contributing to the food basket, rainbow trout production has also been identified as a niche product with export potential. Given the meager domestic fish production, the significant demand for it has to be met through imports, leading to a substantial outflow of foreign currencies.

Therefore, government will increase trout production by another 72 MT establishing at least 13 new farms and increase to 120 MT within 10 years. Central aggregation and primary processing unit will be established to facilitate processing, packaging, standardisation, certification to increase export value and distribution systems.

Production requires an investment of US$ 1.335 million, where IRR is estimated at 14.32% with FNPV of US$0.47 million. Processing will require investment of US$ 0.50 million; estimated IRR is 45% and FNPV of US$0.97 million.

Black Pepper

Black pepper is considered as a strategic commodity thanks to the suitable agro-climatic conditions. There is no requirement for additional land as it can be grown along with arecanut. It is comparatively an easy crop to produce with very less incidence of pests, while its production period could be maintained even beyond 30 years. Investments will focus on improving the production practices including adoption of high yielding varieties, climate smart irrigation and linking producers to private aggregators and traders for exporting to India.

An investment of US$9.25 million over 20 years could increase production to 4,320 metric tons annually. The internal rate of return is estimated at 33% and FNPV will be more than US$ 62.25 million.

This investment has an impact of income increase by US$20717/farmer, 900 additional full-time equivalent, and GHG reduction by 68 640 tCO2e

Organic Asparagus

The Government has prioritized the production of organic asparagus as part of an effort to promote high-value, low-volume commodities and integrate climate-smart technologies into agriculture. Investments support is required for production in open-field conditions, adopting climate production systems and using organic inputs. Target export markets are Thailand, Singapore, Malaysia and Bangladesh.

This effort includes an expansion of cultivation area to 1,000 acres from the current 180 acres in Thimphu and Paro Districts, with 500 acres under rain-fed cultivation practice and the other 500 under irrigated cultivation practice. This is expected to benefit 2,000 households. There is a plan to improve post-harvest management by establishing aggregation units in each district, integrated with cold storage infrastructure to reduce spoilage and achieve high-quality standards.

An investment of US$4.84 million over a 20-year period is required. This will increase production to 700 - 900 metric tons annually, with an IRR of 15.5% for rain-fed asparagus with FNPV of US$0.92 million and 20.65% for irrigated asparagus, with FNPV of US$ 2.39 million. Processing will need investment of US$0.65 million, and estimated IRR is 24% and FNVP of US$4.41million over a period of 20 years.

This investment has impact of income increase by US$1659/households, 206 additional full-time equivalent employment, and GHG emission reduction of 255.8tCO2eq.

See the investment plan slide deck presentation from Bhutan for Investment Forum 2023.