Fiscal, financial and economic benefits (FFE)

The strengthening of LAIs to generate an efficient, decentralized, transparent LAS helps to update information on tenure, and to set up systematic regularization, clearing and titling processes. When these activities work well together, they generate favourable conditions for increasing legal certainty and security of tenure (see the results and impacts chain in module 4). They thus help to generate various fiscal, financial and economic benefits such as an improvement in the efficiency of land markets, a reduction in land disputes, greater access to credit, and the removal of disincentives to long-term property investments. These benefits encourage local economic development in the long term owing to an increase in local demand for goods and services. The strengthening of LAIs and the updating of tenure information similarly generate benefits related to the reduction in the costs of the operation of LAS to the government, greater accessibility of services for users and an increase in municipal tax collection. Finally, a better understanding of LAI functions and processes also allows an increase in the number of transactions completed by LAIs and keeps tenure information up to date (see module 2 and module 3).

There are, in parallel, potential economic benefits related to environmental and social benefits outside the scope of the LAP, but which may result from the demarcation of protected areas or the recognition of ICT.

The selection of LAP benefits for the FFEA will depend on the nature of the objectives and expected outcomes of the projects and how their possible contribution to the FFEA is viewed. The FFEA will similarly depend on the feasibility of collecting information, organizing it and monetizing it to measure these benefits in monetary terms.

The economic analysis is carried out from the perspective of society as a whole, and includes the costs and benefits (at least those that are quantifiable and monetizable) that the implementation of the LAP has generated for all members of the society. It takes into account inefficiencies in markets and seeks to eliminate the effects of external factors.

The financial analysis is carried out from the perspective of investors, taking into account only costs and revenue (or savings) in cash; it could therefore be done from the point of view of central government, when this is the main investor in the LAP, or from the point of view of one of the LAIs, where this would include only the costs and revenue (or savings) in cash represented by the LAP, or at the household level, counting the costs and incremental revenues that the LAP has resulted in for land owners.

The fiscal analysis aims to measure the net increase in the collection of property tax resulting from the LAP. It can be done from the point of view of central government, but in LAPs it may be more common from the perspective of municipalities, as it is through these that tax revenue generally increases as a result of LAPs.

Economic benefits at national level

LAP activities give rise to two outcomes which help to generate economic benefits at the level of society, such as:

a) the increase in the value of properties for which legal certainty and security of tenure have been strengthened;

b) b) the saving due to the reduction in registration, cadastral or titling transaction costs for LAI users or beneficiaries of tenure regularization programmes.

a) Increase in property value

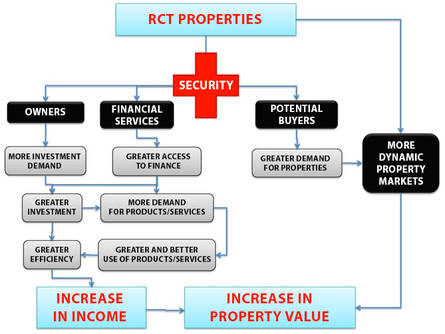

The improvement in certainty and legal security of tenure with RCT can, in principle, generate economic benefits through four main mechanisms:

- Increase in investment: by removing disincentives related to insecurity of tenure (limits and durability of associated benefits), investment in housing and in capital goods is increased; this mechanism has sometimes been called investment demand or the security effect.

- Increase in access to finance: by using land as collateral, both as capital for long-term investments and as working capital; this has been called the collateral effect.

- Improvement in how land markets work: by reducing transaction costs, the reallocation of land to its most productive use can be facilitated; this mechanism has frequently been called the efficiency or transactions effect.

- And finally, as effects of the above, the increase in property value which reflects to some extent the increase in the net present value (NPV) of its future expected benefits, by aiming to achieve its optimal use by removing previous barriers. This occurs even though there are no incremental financial flows for beneficiaries of RCT processes.

Each of these mechanisms generates a chain of impacts, and the validity and strength of this chain will depend on each geographical area and specific context. However, for titling to be considered beneficial in economic terms, at least one of these chains must be validated.1.

b) Increase in efficiency/Reduction in costs of procedures and access to information

Investments in setting up new systems, training and equipment for LAIs, along with the decentralization of services, can improve the efficiency of LAS and, as a consequence, generate savings in cost and time for private users and specialist users of the products and services provided by LAIs.

For example:

- When LAIs become more efficient, the procedures carried out in the cadastre or register can be quicker and users no longer have to return several times to check on their procedures (see Annex 7 Analysis of the cost and time of registration procedures).

- When LAS are decentralized, individuals who need to carry out procedures or get information on properties do not need to travel great distances, thus saving time and travel costs.

- LAPs can include substantial investments in data infrastructures at territory or country level which help to visualize the configuration of properties and their owners, which facilitates territorial planning work and the implementation of works and services (highways, bridges, electricity grids, etc.). The savings from studies that are carried out through these systems can also be considered economic benefits of LAPs.

Economic benefits at national level

LAPs also generate financial benefits, understood as cash income (or savings). These can result from an increase in income from paying taxes for services to LAIs, or from having a more dynamic land market (more transactions), as discussed in Module 2:

- A more dynamic land market and an increase in the number of formal transactions in property registers and/or cadastres would generate an increase in LAI incomes through tax collection and the sale of new services (maps, certificates, registration of mortgages, etc.).

- Modernizing land registers and facilitating links with cadastral databases can reduce the time taken to process transactions or registrations or for mortgage redemptions or the issue of certificates. These improvements can result in savings in operating costs or in an increase in the number of services that can be carried out over a given period of time.

- Updating land information in a given territory or the whole country can also make RCT processes easier and quicker and thus reduce the operating costs of property or land reform institutes which usually carry out these activities.

- Modern cadastral surveying methods can also represent a saving for the country, not only because they are usually cheaper than traditional mapping methods, but also because they can generate georeferenced databases which make information maintenance and providing users with cadastral certificates and plans more efficient.

Fiscal benefits at municipality and LAI level

LAPs usually have major impacts on tax collection levels (see the tax administration of municipal governments). The quantification of LAP impacts should take into account tax collection totals from a country or region, and they can therefore be very important in a government’s decision whether or not to fund a project, or whether to define public decentralization policies. The fiscal impact analysis is carried out by means of a comparison of the total sum of the investment with the present value of incremental net flows of tax collection as a result of the LAP.

LAPs usually include in their investments resources for updating cadastres, modernizing municipal land information systems, and training cadastral unit staff, which strengthens municipal land administration systems. The results of these investments can expand the cadastral base and thus increase the number of properties which need to pay property tax. More dynamic markets and a larger number of registrations in land registers can similarly increase the number of transactions and increase the collection of taxes on property or other assets, depending on the country.

The fiscal benefits of LAPs are not direct benefits recovered by the investor or by the central government, but they are normally collected by municipal governments (see fact sheet Impact on fiscal operations of LAPs).

Revenue from the “sale” of products/services by LAIs can likewise be considered fiscal benefits if revenue is not retained by the LAI to cover its operating or investment costs, otherwise they form part of the general revenue of the nation managed by the central government (e.g. Finance Ministry/Treasury). In this case, like municipal fiscal benefits, they should not be included in financial cost-benefit analyses (F-CBA) of LAPs (see fact sheet Financial Cost-Benefit Analysis (CBA) of LAPs).