Fertilizers

UREA

|

|

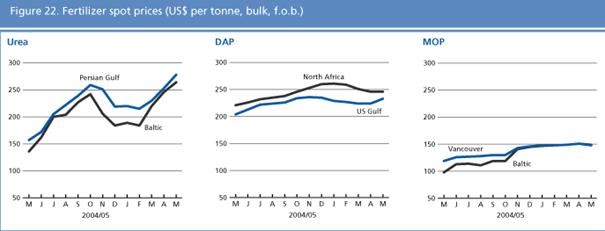

Urea prices have continued to increase in the past months. As of late May, quotations were between 74 and 90 percent higher than one year ago and the upward price trend is expected to continue in the near future. This mainly reflects reduction of exports from China. China has imposed a new 30 percent export tax on f.o.b. prices of urea, replacing the existing US$31 per tonne export tariff. Demand in Latin America is increasing, particularly in Brazil where, as well as normal large imports, the country is expected to restrict exports. The timing of Brazilís imports is significant for price developments in the CIS from where the country purchases. Lack of rain for planting in Mexico delayed the start of the normal seasonal rise in demand. Pakistan tenders for 190†000 tonnes have been awarded to suppliers in Indonesia, the CIS, the Persian Gulf and Bangladesh. Imports into the United States and Canada are scheduled from eastern European and Persian Gulf producers.

DIAMMONIUM PHOSPHATE (DAP)

|

|

DAP prices increased slightly in April and May after falling in the first quarter of the year. As of late-May prices were some 10 percent higher than a year ago. Further price increases are likely in response to expected large demand from India and Pakistan at the same time as reduced production from Morocco. Indian DAP production is below the target and a significant amount may need to be imported to meet demand for the Khariff season crops now being planted. China is importing from the United States, where DAP prices increased by US$10 per tonne in less than a month. The normal import season in Central America is nearing its end; however, some demand is still expected as a result of planting delays in Mexico. Turkey is importing from the Russian Federation and North Africa.

MURIATE OF POTASH (MOP)

|

|

As of late-May, MOP prices were 25-50 percent higher than a year ago. Markets are supported by decreasing freight rates due to a combination of fewer cargos, quieter market conditions, and greater tonnage availability. Demand in Latin America and South East Asia is increasing. Viet Nam, Thailand and Pakistan arranged supplies from Canada, the Russian Federation, and the Persian Gulf. Demand in parts of Thailand, Viet Nam and southern China is adversely affected by drought and in Europe by late planting and drought in Spain and Portugal. China imports large quantities from the Russian Federation, Israel, Jordan, Germany and Canada. Brazilís imports are from Israel, the Russian Federation and Spain. The EU antidumping measures on MOP imports from the Ukraine expired mid-May 2005. India is importing large quantities of MOP to meet strong demand in southern and eastern parts of the country. Potash producers in Canada and the CIS are scheduling supply capacity expansions.

†

|