Umm E. Zia

National Consultant for Milk Marketing

Islamabad

Pakistan is the sixth most populous country in the world, with an estimated population of over 160 million, 25 growing at a rate of more than 1.8 percent per annum. Agriculture, being the mainstay of the economy, generates 20.9 percent of the total GDP and employs 43.4 percent of the total workforce. 26

With an almost 50 percent contribution, livestock is by far the most important subsector in agriculture. In the past ten years, the subsector grew by an average of 5.8 percent. 27 The share of livestock in agriculture growth jumped from 25.3 percent in 1996 to 49.6 percent in 2006. 28 The higher growth in the livestock sector has been mainly attributed to growth not only in the headcount of livestock, which is commercially important, but also in milk production. Within the livestock sector, milk is the largest and single most important commodity. Despite decades of oversight by the Government, Pakistan is the fifth-largest milk producer in the world. 29 According to the 2006 livestock census (Table 1), 30 milk production had increased by 36 percent since 1996.

Table 1: Relative increase in milk production over the past two decades

Type of animal |

Gross annualproduction ** (billion litres) |

% change between | |||

1986 |

1996 |

2006 |

1986 & 1996 |

1996 & 2006 | |

Cows |

7.07 |

9.36 |

13.33 |

32.4 |

42.4 |

Buffalo |

14.82 |

18.90 |

25.04 |

27.5 |

32.5 |

Total |

21.89 |

28.26 |

38.37 |

29.1 |

35.6 |

|

|

| |||

** Calculated using average annual lactation lengthof 250 for cows and 305 days for buffalo. | |||||

Source: Economic survey of Pakistan 2007 | |||||

Production base

Despite being the most lucrative livestock product, milk production is the least commercialized enterprise in the agricultural economy. The majority of the national livestock herd is distributed in small units throughout the country. About 55 million landless or smallholder farmers produce the bulk of the country’s milk supply.

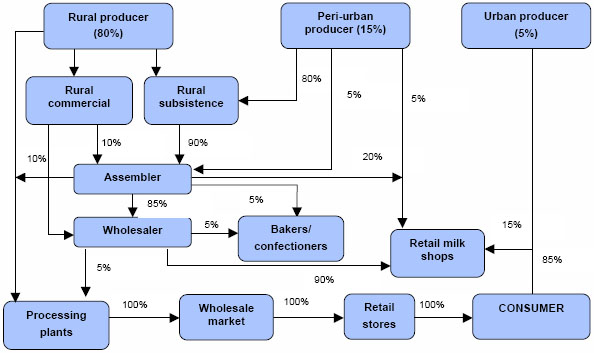

Buffalos and cows are the major milk-producing animals. According to a FAO study on milk marketing in Pakistan in 2003, 80 percent of the milk in the country was collectively produced by rural commercial and rural subsistence producers. The peri-urban producers account for 15 percent of the total production, whereas urban producers contribute 5 percent.31 Annex III shows the distribution of milk as it moves along the various links in the overall supply chain.

According to the 2006 livestock census (Table 2), 51 percent of the 8.4 million reported dairying households owned 1–4 animals, 28 percent of dairying households maintained herd sizes of 5–10 animals; another 14 percent had herds of 11–50 animals). Only 7 percent of the dairying farms in the country could be considered large, with more than 50 animals.

Table 2: Herd size by household

No. of animals |

Ownership by household (%) |

1–2 |

27.32 |

3–4 |

23.73 |

5–6 |

14.32 |

7–10 |

13.68 |

11–15 |

6.29 |

16–20 |

2.65 |

21–30 |

2.58 |

31–50 |

2.71 |

51 or more |

6.72 |

TOTAL |

100 |

Source: Pakistan Livestock Census, 2006 | |

Supply and demand

As a food item, milk (both milk and liquid milk equivalents) is second only to cereals in the level of per capita consumption in Pakistan ,32 which nationally is 190 litres.33 Province-wise, per capita consumption stands at 246 kg in Sindh, 132 kg in Punjab , 86 kg in North-West Frontier (NWFP) and 108 kg in Baluchistan .

Due to rising inflation and high poverty levels, the majority of Pakistani consumers are price conscious. Therefore, demand for raw milk is large compared to processed milk. Hence, raw milk is the primary dairy product marketed in the country. More than 90 percent of the marketed milk is collected and sold unprocessed through the informal market by a multi-tiered layer of marketing agents.

The supply of milk to meet domestic demand has usually lagged. To fill the gap, powdered milk is imported every year. From July 2006 to November 2007, dairy products34 worth 2 320 million rupees (US$38.6 million)35 were imported. The Statistics Division lists the products as “milk and milk food for infants”.

Milk markets and chains

Milk markets in Pakistan can be classified into three categories: rural, urban and international. Similarly, the three marketing chains in Pakistan are rural, urban and processed marketing chains, as the following explains.

Rural marketing chain

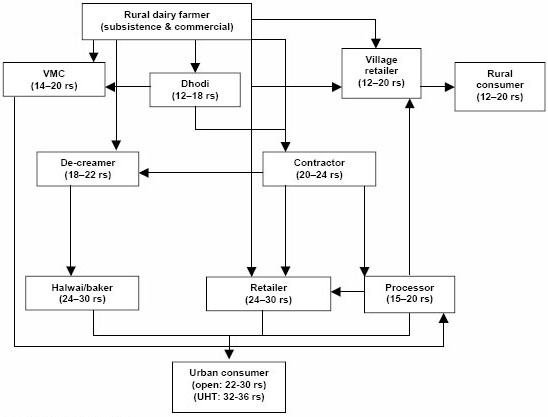

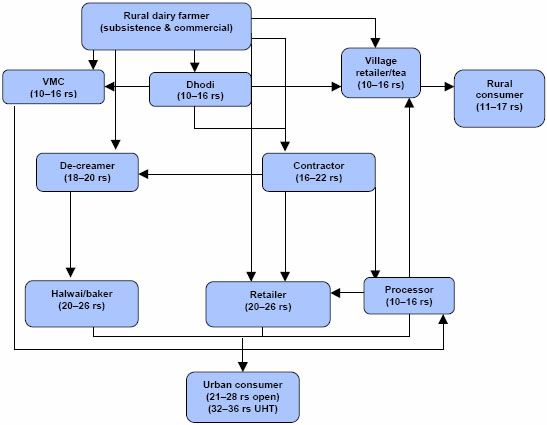

A significant proportion of the milk produced in rural areas is consumed at source within the hamlet or village, either through farmstead consumption or in some cases, direct sales by the farmer to the neighbourhood. The remaining 30–40 percent is marketed through an intricate marketing chain, consisting of multiple layers of intermediaries. Figure 1 elaborates the rural milk marketing chain and the price of milk at each node in the chain.

Figure 1: Rural marketing chain (estimated procurement prices at rupees per litre)

Source: Market information, 2007

Urban marketing chain

Urban consumers in Pakistan consume an estimated 9–12 million litres of milk every year. To satisfy some of this demand, milk is produced in urban and peri-urban areas of the country, accounting for 5 percent and 15 percent of the total milk production, respectively. Because this quantity is not sufficient to meet the entire urban demand, the deficit is met by rural producers.

Peri-urban dairy farms are located on the outskirts of major cities. These are usually owned by market-oriented farmers and can be classified into two general groups, distinguished by herd size. Most operate on relatively small scale, owning 10–50 dairy animals. The larger farmers usually own up to 500 dairy cows. This latter category of farm is either owned and operated by a progressive farmer individually or is part of the peri-urban cattle colonies.

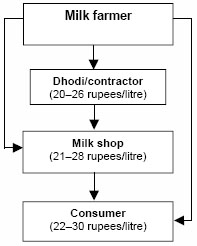

As depicted in Figure 2, the urban milk marketing chain, the producer has relatively more control over the supply because the consumer is easily accessible and is also willing to pay a high price for milk. Hence, in many instances, farmers in the urban milk marketing chain integrate production and marketing functions in their operations. Instead of relying on a middleman, they sell the milk directly.

Figure 2: Peri-urban marketing chain (estimated procurement prices at rupees per litre)

Source: FAO. 2006. Analysis of milk marketing chain, Pakistan

Processed marketing chain

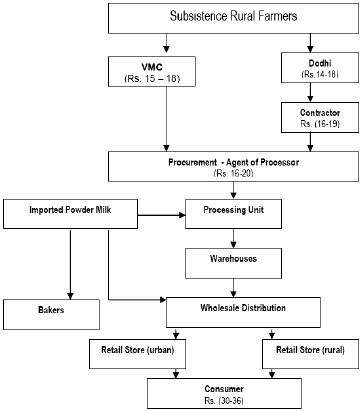

Most of the milk in the country is marketed in raw form. According to industry estimates, only 3–5 percent of the milk is marketed through formal channels as processed milk. Currently, there are more than 20 dairy processing plants operating in the country. The major product produced by them is UHT or pasteurized milk. Other products include powdered milk, butter, cream and lassi. Figure 3 depicts the marketing chain for UHT milk.

Figure 3: Marketing chain of UHT milk (estimated procurement prices at rupees per litre)

Source: FAO. 2006. Analysis of milk marketing chain, Pakistan

Constraints

Milk production and marketing in Pakistan is exclusively dominated by the informal private sector, consisting of various agents, each performing a specialized role at the relative link in the supply chain. These consist of producers, collectors, middlemen, processors, traders and consumers.

As previously noted, only 3–5 percent of the country’s total milk production is marketed through formal channels. The remaining 97 percent is produced and marketed in raw form by informal agents in the marketing chain. The following is an overview of the informal and formal channels as a way of imparting a description of the opportunities and problems associated with dairying enterprise in Pakistan.

Informal production and marketing channels

Subsistence farmers constitute the majority of dairy farmers in the country and are responsible for 70 percent36 of the milk produced. They own one to five milk-producing animals. The following characteristics typically define the informal production and marketing channels.

Productivity

Due to lack of proper management practices and poor breeding, animal production tends to be very low. This results in low farm profitability and reduced national productivity. For instance, in comparison with, say, Germany , there are three times as many dairy animals in Pakistan but the milk yield is only one-fifth.37

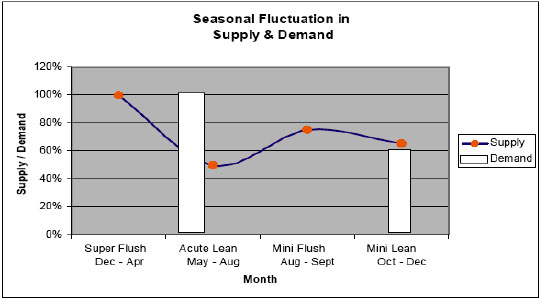

Seasonality

Production and consumption of milk in Pakistan are affected by seasonal fluctuations (Figure 4) that are at relative odds with each other. Milk production is associated with the availability of green fodder and is at its maximum between January and April, hitting a low from May to August. Alternatively, milk consumption is low during the winters and is at its peak during the summer due to heightened preference among consumers for products such as lassi, yogurt and ice cream.

Unorganized farmers

Smallholder dairy farmers in Pakistan are unorganized and mostly carry out production and marketing in isolation from each other. The highly fragmented production base particularly hampers farm profitability. Where it occurs, collective marketing enables individual farmers to reach more markets and results in increased revenue.

Figure 4: Seasonal fluctuation in supply and demand

Source: Umm E. Zia, 2006. Analysis of milk marketing chain

Financial services

For smallholders, milk sales are a way of regular cash flow, and the livestock owned by them constitutes an invaluable asset.38 But in the absence of financial services, such as insurance and credit, they do not have a financial recourse in times of emergency, such as livestock disease or mortality. Similarly, smallholders do not have ready access to credit that enables them to improve their enterprise, such as the addition of improved marketing infrastructure.

Market exploitation

Smallholders have to rely on middlemen to market their produce. Drawing on their monopolistic role, middlemen can exploit farmers by paying low prices, executing binding sales contracts and not passing on gains when prices are seasonally high in response to lower supply.

On the other hand, in their capacity, middlemen also fill the gap of essential support services, such as provision of credit and veterinary care.

Infrastructure

To ensure product quality, proper transportation of milk also requires a cold chain. But agents in the marketing chain in Pakistan rarely have access to cold storage facilities; consequently a major portion of their milk is lost. According to an Asian Development Bank report an estimated 15– 20 percent of the total milk production in some areas is lost due to the unavailability of cold storage.

The primary reason behind the unavailability of cold chain facilities is the operating expense. For instance, the purchase cost of a 1 000-litre capacity cooling tank is approximately 300 000 rupees ($5 000), a sum well beyond the reach of a small farmer. Also, cooling tanks are affected by the absence of electricity in rural areas. Where the Government supplies electric power, it is expensive because dairy farmers do not get subsidies similar to the ones given to agricultural farmers on equipment (such as tube wells).

Input–output price

By regulating the price of milk, the Government plays a significant role in milk marketing.39 Because the law generally gives broad authority to the local government in setting foodstuff prices, the specific law followed can be different from one locality to another within a province (see Box 1 for a description of t he two common laws used in regulating milk prices).

Under the law, the Provincial Food Department can declare various commodities, including milk, to be foodstuff. A District Price Review Committee regularly reviews milk prices; it can set different prices for different localities in the district. The committee consists of representatives from the livestock department, dairy farmers, milk retailers and consumers.

When the committee re-sets a price, a notice is circulated among various government agencies and other stakeholders, such as the provincial secretary, the district and town Nazims (mayors), district and session judges, the chief of police, the Information Department, the Food Department, the Agriculture Department, the rationing controller and the official gazette.

Interestingly, in some instances, the local government has used the wrong law while re-setting a price. For example, in the district of Narowal, the Punjab Essential Articles (Control) Act, 1973 is cited even though milk is not listed in its commodity schedule. The price set by districts studied for this case study report varied between 16 and 30 rupees per litre.

Box 1 : Legislation affecting the dairy sector

Preamble: Whereas it is expedient in the public interest to provide for the continuance of powers to control the supply, distribution and movement of and trade and commerce in foodstuffs in Balochistan/NWFP/Punjab/Sindh. Application: Section 3 – The Government so far as it appears to be necessary or expedient for maintaining supplies of any foodstuffs or for securing its equitable distribution and availability or prohibiting storage, movement, transport, supply, distribution, disposal, acquisition, use or consumption thereof and trade and commerce therein….may provide… Penalties: (i) imprisonment for a term that may extend to three years

Preamble: Whereas, it is expedient to provide for price control and prevention of profiteering and hoarding. Application: Section 3 – The Federal Government, so far as it appears to it to be necessary or expedient for securing equitable distribution of an essential commodity and its availability at fair price may, by notified order, provide for regulating the prices, production, movement, transport, supply, distribution, disposal, and sale of the essential commodity and for the price to be charged or paid for it at any stage of transaction therein… Delegation of powers: The Federal Government may, by notified order, direct that any power conferred on it by or under this Act shall, in relation to such matters and subject to such conditions, if any, as may be specified in the direction, be exercisable also by: Schedule: A schedule of “essential commodities” listed by the Act includes: Penalties: (i) punishable with imprisonment for a term, which may extend to three years and Provided that, if a person convicted for an offence punishable under this subsection is again convicted for such offence, the term of imprisonment awarded shall not be less than one year. Source: Food laws manual, 2006 |

In contrast, prices of inputs used by farmers for dairy production are not regulated. On the contrary, the prices of some essential inputs have increased by 100–200 percent in the past five to six years (Table 3).

The imbalance between gains in production and output costs has an inverse affect on farm productivity because farmers are barely able to recover their production cost. With growing inflation, this price imbalance recently prompted many well-established large farmers to shut down operations; it also has discouraged new investment in dairy production.

Table 3: Comparison of prices for milk and basic inputs for a dairy farm

Input |

Price (rupees) |

Price (rupees) |

Increase |

Milch animal |

20 000 |

60 000 |

200% |

Cotton seed cake |

270 |

560 |

107.4% |

Wheat bran |

170 |

380 |

123.5% |

Maize cake |

370 |

680 |

83.78% |

Fresh milk |

20 |

32 |

60% |

Formal production and marketing channels

Formal marketing is carried out by corporations, which only control 3–5 percent of the county’s milk supply. In the past two to three years, the private sector has shown a keen interest in the dairy industry, leading to large-scale investment in refurbishing old plants and, in some instances, setting up new processing units.

Currently, there are more than 25 dairy processing plants, producing UHT milk (predominantly), butter, cream and lassi. Sind and Punjab are the major milk-producing provinces. However, with the exception of Engro Foods, all dairy processors are located in Punjab.40

Supply constraints

Dairy processing units collect milk from smallholders situated in the far-flung rural areas of Punjab.41 This has led to a saturation of supply in the province. The competition has resulted in price wars in collection zones and the establishment of additional processing units by some of the major corporations, such as Nestl é.

Moreover, factors such as lack of cold chains, a fragmented farm base and distance to dairy farmers affect the processing operations. Consequently, none of the processing units is operating at optimal capacity. Hence, many processors have been eying options to reduce or eliminate their reliance on individual smallholders for their supply. Two of the favoured options being considered are i) vertical integration of activities by piloting corporate farming, an idea new to the national dairy practices; and ii) providing additional support services to medium- and large-sized farmers in return for selling bulk quantities of fresh milk to the processors.

Government support

The Government and international donors have been very supportive of the processing industry. This is evident in the 2006–2007 budget in which the Government announced numerous subsidies and tax breaks for the dairy-processing industry, including exemption of sales tax on packaged milk and the subsidized import of processing and other equipment.

Other examples of government and donor championing are the mega projects initiated to improve dairy development; however, almost all of them were designed to immediately benefit medium- to large-scale farmers with minimal practical interventions for smallholders. These include projects such as the Pakistan Dairy Development Company and the Livestock and Dairy Development Board.

Expected future developments

Despite the extensive government support in the form of loans,42 subsidies, tax breaks and project assistance, many fear the renewed interest in corporate dairy may be short lived. This apprehension is based on several underlying factors: i) scarcity of supply and increasing prices of input for smallholders, ii) inability of processors to collect milk required due to transport and cold chain problems, iii) reliance of processors on limited and undiversified products,43 iv) lack of sustainable farmer-development policies and v) the history of dairy processing in Pakistan (in the 1970s and with the help of the Asian Development Bank, as many as 22 processing units were initiated but failed in a few years due to similar problems).

Smallholder dairy farmers

Currently, the dairy sector has received unprecedented investment from the Government and international donors. However, apart from a few exceptions, most of the programmes are geared towards the development of medium- and large-scale dairy farmers. The following two case studies assess the impact of recent support programmes on smallholder dairy farmers.

Case study 1 – Milk packaging project

The project titled Milk Packaging Project in Central and Southern Districts of the Northwest Frontier Province (NWFP) is an innovative initiative of NWFP’s Livestock and Dairy Development Department. It is a four-year effort (2005–2009) with an investment of 13.367 million rupees ($222 783) and adopts a bottom-up approach to develop the province’s dairy industry through cooperation between the public and private sectors.

The project was designed to create groups of smallholders, with the ultimate objective of sustainably reducing poverty in remote areas of central and southern districts through increased livestock productivity via the provision or establishment of milk-marketing channels. Project activities include technical and management support services in the form of breed improvement, animal health, feed enhancement, management training for women, training of village extension workers and farmers, establishment of milk collection and processing units, and developing marketing links.

Within the project, dairy farmer groups have been formed in selected villages with the purpose of promoting organized milk production and marketing (see Box 2 for terms of membership). Upon formation of a farmer association in a targeted village, a small milk-collection centre equipped with a cooling tank is set up.

The project was initiated with three partially operational associations collecting an average of 550 litres of milk per day. These initial associations received four cooling tanks and two power generators, which they operate and manage.

However, in a period of just two years, intensified farmer interest in the area led to an expansion of the project and resulted in the number of associations increasing to 36, with a total representation of 873 members and daily collection of 7 275 litres. The number of cooling tanks received has increased to 12.

|

Box 2: Terms of membership in farmer associations

The project is to provide support services, including veterinary care, breed improvement, training of member farmers on livestock management and introduction of improved fodder variety and feed supplements. |

The project also has resulted in exponentially increased incomes for farmers because they can market their produce outside the village for 30 – 32 rupees per litre, in contrast to the village price of 26–28 rupees per litre.

Based on this tremendous success, the provincial government is planning to build a milk-processing plant near these localities. Additionally, there are plans to expand project activities to neighbouring districts.

Lessons learned: A critical lesson is that organizing local farmers around a profitable initiative is a possible goal to achieve within the current context of the Pakistani dairy industry. However, such an initiative requires comprehensive measures instead of a limited focus on production. These measures range from encouraging farmers to form groups by providing support in the areas of technology transfer, market links and enterprise management.

Case study 2 – UNDP Community Empowerment Through Livestock Development and Credit project

The UNDP-initiated project, Community Empowerment Through Livestock Development and Credit (CELDAC), is a three-year, $6.1 million intervention aimed at smallholders, in partnership with two major private dairy processing corporations, Nestl é and Engro. UNDP is bearing 82 percent of the project cost, with the private partners providing the remainder in the form of cash and kind.

The project objective is to promote women’s role in livestock development by creating a cadre of community livestock health workers. The University of Veterinary Animal Science, a leading public sector institute, provides technical support in training the master trainers and 3 600 women livestock health workers. The project area is limited to the milk-collection zones of each of the two private companies involved.

Although it is a heavily funded effort, the project is rather limited in scope. Moreover, it tends to be biased in favour of the large corporations: animal productivity will be enhanced in the milk sheds accessed by the two corporate partners, thereby increasing the supply available only to them. Hence, they will enjoy the major long-term economic benefits through a minimal investment in an otherwise social sector initiative.

Lessons learned: It is possible to develop the dairy sector through successful public–private partnerships (in this case, a partnership between the project, corporations and a public university). Women in dairying households are responsible for most activities related to animal management, including feed, shelter and some veterinary care. However, developing their capacity is often overlooked. The CELDAC project has trained a cadre of women extension livestock workers despite the stereotypical belief that women cannot be formally trained due to the social barriers imposed on them.

In addition to training women livestock extension workers, the other major component in the project design was the provision of credit for enterprise development through links with financial institutions. However, the project thus far has had difficulties in finding a partner in the finance industry for such support. This implies that new and innovative ways to tap into credit facilities need to be identified, particularly those that link the timing for repayment of loans with the biological cycle of the specific animal species, in this case dairy cows and buffalo.

The project is relatively new, limiting the lessons until it is further along in implementation. A large criticism so far has been the negligible contribution provided by the corporate partners, despite the long-term economic benefits headed their way.

Smallholder dairying in Pakistan has inherent weaknesses and is confronted with various threats. However, the sector can build on its strengths and use opportunities to satisfy the increasing demand. Based on the current situation and an analysis of smallholder dairy producers in Pakistan, the following national and regional strategic initiatives for public and private stakeholders are recommended.

At the national level, the following issues will need a concerted response from both the Government and the private sector to enable the participation of smallholder dairy farmers in dairy markets and to help them competitively supply expanding consumer markets.

Issue 1: Lack of proper livestock management practices and inaccessibility to support services leads to low animal productivity.

To enhance productivity, the following measures are recommended:

Issue 2: In the absence of an integrated cold chain, adulteration is rampant and access to markets is hampered.

To improve the provision of quality milk as well as enhanced market access for small holders, the following measures are recommended:

Issue 3: Smallholder dairy farmers need to coordinate their marketing activities.

To further organize smallholder farmers into groups that can reap maximum market benefits, the following measures are recommended:

Issue 4: The local government is authorized to fix the price of milk on the pretext that it is an essential commodity. However, the prices of inputs are not regulated in the same manner and keep increasing with the growing inflation.

To ensure parity between input and output prices towards profitable dairying, the following measures are recommended:

Issue 5: Data on the dairy sector is often outdated and/or unreliable. Improved market information is a must to facilitate effective planning and investment by all stakeholders.

To improve information-based planning and decision-making, the following measures are recommended:

Issue 6: Despite proximity to milk-deficit regions, including Central Asia and the Middle East, Pakistani producers do not export their products.

To promote exports of Pakistani dairy products, the following measures are recommended:

Issue 7: Currently, most equipment for storage and processing is imported from Western countries. This leads to greater need for in-country expertise for operations and maintenance.

To promote production independence, the following measures are recommended:

Issue 8: Learning the lessons

Often, lessons learned from countries with different socio-economic environments are presented for replication in Pakistan, resulting in unanticipated outcomes. For example, an international corporation recently mobilized medium- to large-scale farmers to buy high-yielding cattle from Australia. Due to the heat and climate stress, many of the animals perished, which resulted in a loss of over 100 000 rupees ($1 666) per animal. Because the initiative was not insured, the farmers had to bear the loss directly. Similarly, an international donor promoted the use of automated milking without considering the almost impossible break-even numbers on equipment costs because cheap labour is readily available for such operations.

To succeed in applying models or measures that were successful in other countries, it is more than recommended – it is crucial – to embrace those that worked in countries with a similar socio-politico-economic profile.

|

Box 3: Key definitions Marketing: All the activities that are involved in moving products from producers to consumers. This includes product-exchange activities, physical activities and auxiliary activities. The functions of marketing can be further divided into buying and selling as exchange activities; storage, transport, processing and standardizing as physical activities; and financing, risk-bearing and market intelligence as auxiliary activities. Marketing chain: The flow of commodities from producers to consumers that brings in economic agents who perform complementary functions with the aim of satisfying both producers and consumers. Marketing node: Any point in the marketing chain where an exchange and/or transformation of a dairy product takes place. A marketing chain may link both formal and informal market agents. Marketing agents: Individuals, groups of individuals or organizations that facilitate the flow of dairy products from producers to consumers through various activities, such as production, purchasing, processing and selling. Examples of market agents include farmers selling dairy products, retailers, wholesalers, dairy cooperatives, importers and exporters. Milk producers: Rural subsistence farmers, rural market-oriented farmers, commercial dairy farmers and city and peri-urban milk producers. Milk collectors: Dhodhis , contractors, village milk collection centres and dairy cooperatives (MPOs). Dairy processors: Large-scale private dairy processing corporations. Retailers: Milk shops, peri-urban farmers-cum- dhodhis , traditional dodhis , rural subsistence and market-oriented farmers and retail shops. Cooling tank: A refrigerated unit used for milk storage; also known as a “chiller”. |

References

Afzal, M. 2003. Livestock: Its role in poverty alleviation. In Farming Outlook. January– March 2003.

Ahmad, A. 2003. Milk collection – Linkages and development . CDL Foods Ltd. Pakistan.

Akhtar, N. & Athar, I.H. Value addition opportunities in dairy sector of Pakistan in a national and global perspective. National Agricultural Research Council. Pakistan.

Akhtar, Nasim & Athar, M. Izhar. 2003. Value addition opportunities in the dairy sector of Pakistan in a national and global perspective.

Asian Development Bank. 2005. Report and recommendation of the President RRP . PAK 33364.

Athar, I.H. 2004. National demonstrations on the lactoperoxidase system of milk preservation. National Action Plan Pakistan. AG:TCP/RAS /3001. Ministry of Food, Agriculture and Livestock & FAO. Islamabad .

Austin, J.E. A. 2006. The white revolution: Strategic plan for the Pakistan dairy industry. PISDAC-USAID Pakistan.

Awan. E. A. 2006. Food laws manual. Revised Edition 2006. Nadeem Law Book House.

Burki, M., Khan, M. & Bari, F. 2005. The state of Pakistan ’s dairy sector: An assessment . CMER Working Paper No. 05-34. Lahore University of Management Sciences.

Experts Advisory Cell. 2003. Dairy sector profile. Ministry of Industries and Production, Government of Pakistan. Islamabad.

Fakhr, H. et al. 2006. The white revolution – White paper on Pakistan ’s dairy sector. Pakistan Dairy Development Company.

FAO. Market orientation of small-scale milk producers: Background and global issues by J. Henriksen. Rome.

FAO. 2006. Analysis of milk marketing chain , by U. Zia. Pakistan.

FAO. 2005. Development of the Livestock and Dairy Development Board for a dairy development strategy in Pakistan by Khalili, M. Islamabad.

FAO. 2003. Plan of action for the development of dairy colonies around Karachi by M. Afzal. Islamabad.

FAO. 2003. Livestock sector brief Pakistan . Livestock Information, Sector Analysis and Policy Branch AGAL.

FAO. 2002. Market opportunities for milk producer organizations by S. Staal.

FAO. 2002. Proceedings of the FAO-China Regional Workshop on Small-scale Milk Collection and Processing in Developing Countries by W. Jiaqi and J. Lambert.

FAO. 1997. Agricultural and food marketing management by Crawford, I.M. Rome.

FAO. 1994. Experiences in dairy development. In World Animal Review. -79 1994/2. Rome.

FAO statistics. 2007. Food and Agriculture Organization of the United Nations. 2007. <http://faostat.fao.org/default.aspx>.

Garcia, O., K. Mahmood, and T. Hemme. 2003. A review of milk production in Pakistan with particular emphasis on small-scale producers . PPLPI Working Paper No. 3. Rome : Food and Agricultural Organization of the United Nations.

Government of Balochistan. 2005. Concept paper: Provision of milk chillers to farmers for collection, preservation and marketing quality milk. Department of Livestock and Dairy Development, Balochistan.

Government of Balochistan. 2005. Establishment of milk collection, preservation and marketing centre for the supply of quality milk to the public in Quetta. Department of Livestock and Dairy Development, Balochistan.

Government of N.W.F.P. 2006. Khyber dairy: An overview . Department of Livestock and Dairy Development, NWFP.

Government of Pakistan. 2006. Agricultural statistics of Pakistan 2005-2006.

Ministry of Food, Agriculture and Livestock, Economic Wing. Islamabad.

Government of Pakistan. 2006. Pakistan economic survey 2005-2006. Finance Division, Economic Adviser’s Wing. Islamabad .

Government of Pakistan. 2007. Pakistan economic survey 2005-2006 . Finance Division, Economic Adviser’s Wing. Islamabad.

Government of Pakistan. 2003. Milk production, processing, and marketing in Pakistan . Ministry of Food, Agriculture and Livestock, Livestock Wing.

Government of Pakistan. 2005. Yearbook 2004-2005. Ministry of Food, Agriculture and Livestock. Islamabad.

Government of Pakistan. 1998. Livestock census 1996. Agricultural Census Organization, Statistics Division, Lahore.

Government of Pakistan. 2007. Population Census Organization. http://www.statpak.gov.pk/depts/pco/

Government of Pakistan. 2007. External trade statistics, http://www.statpak.gov.pk/depts/fbs/statistics/external_trade/externaltrade_statistics.htm Federal Bureau of Statistics

Government of Pakistan. 2006. Pakistan Livestock Census 2006 . Agricultural Census Organization, Statistics Division, Lahore.

Government of Pakistan. 2000. Strategy development in milk production and distribution. Small and Medium Enterprise Development Authority.

Government of Punjab. Livestock vision 2010. Department of Livestock and Dairy Development. Punjab.

Hanif, M., Khan, S.A. & Nauman, F.A. 2004. Agricultural perspective and policy . Ministry of Food, Agriculture and Livestock.

Haque, I. & Anwar, M. 2003. Prospects of dairy industry in Pakistan: Issues and policy interventions. Millac Foods Pvt. Ltd

Hasnain, H.U. & Usmani, R. H. 2006. Livestock of Pakistan . Livestock Foundation. Islamabad.

Jabbar, M. A., Tambi, E. & Mullins, G. 1997. A methodology for characterizing dairy marketing systems , International Livestock Research Institute ILRI.

Malik, H.A. & Luijkx, M. 2004. Agribusiness Development Project TA. No. PAK 4058. Interim report. ADB. Pakistan.

Mazari, S.A. 2003. Modern dairy technology and prospects for growth. Unilever Pakistan Ltd.

Ministry of Finance. 2006. Budget speech 2006-2007. Islamabad.

Mirbahar, K.B., Kalhoro, A.B., Soomro, F.M. & Junejo, B.M. 2003. Action plan – Livestock management in Sindh . Sindh Agricultural University Tandojam & FAO.

FAO. 2002. Organization and management of milk producers organizations by J. Phelan.

Punjab Laws Online. 2006. Provincial Assembly. Government of Punjab. 2006. <http://punjablaws.gov.pk/>.

Punjab Lok Sujjag. 2003. The Political Economy of Milk in Punjab – A people’s Perspective. Punjab Lok Sujjag.

Rafiq, Ch. M. 2002. Manual of Agricultural Produce Markets Committee Laws. Khyber Laws Publishers.

Raja, R.H. Pakistan Smallholder Dairy Production and Marketing , Ministry of Food, Agriculture and Livestock Livestock Wing, Islamabad, Pakistan.

FAO. 2003. Action plan for livestock marketing systems in Pakistan by Social Sciences Institute, NARC.

Younas, M. 2003. A study on the livestock sector in Pakistan . University of Agriculture. Faisalabad.

Annex I: Milk flow chart example

Source: Pakistan livestock marketing action plan 2003. From Analysis of the milk marketing chain, report prepared for FAO TCP/PAK/3004 technical cooperation programme project: Assistance in Up-Scaling Dairy Development in Pakistan by Umm E. Zia, August 2006.

Annex II: Milk price chart (rupees)

Source: Pakistan livestock marketing action plan 2003. From Analysis of the milk marketing chain, report prepared for FAO TCP/PAK/3004 technical cooperation programme project: Assistance in Up-Scaling Dairy Development in Pakistan by Umm E. Zia, August 2006.

25 Population Census Organization, 2007

26 Economic survey of Pakistan 2007

27 Economic survey of Pakistan 2006

28 Pakistan livestock census 2006

29 Husnain and Usmani, 2006

30 A national livestock census is taken every decade. Thus, the 2006 census is of particular importance.

31 SSI-NARC, 2003

32 SSI-NARC, 2003

33 Pakistan dairy development company, 2006

34 Milk, cream and milk food for infants

35 Statistics Division, 2007

36 R.H. Raja, 2003

37 IFCN, 2003

38 The average price of a buffalo is about 50 000 rupees (US$833.33) and of a cow is 35 000 rupees ($583.33)

39 The two most common laws in this regard are the Balochistan/N.W.F.P/ Punjab/ Sindh Foodstuff (Control) Act, 1958 and the Price Control and Prevention of Profiteering and Hoarding Act, 1977.

40 Collection operations in Sind are problematic due to socio-economic constraints, such as security and road conditions. This has even led Engro to also shift its operations to Punjab by setting up an additional processing unit in the province.

41 To ensure profitability, the processing industry is forced to purchase milk at low prices from far-flung areas. In these areas, farmers do not have access to the urban fresh milk retail market, which tends to be more profitable for the farmstead.

42 Most local investors have borrowed heavily from state-run banks to set up dairy processing. This also was the practice during the 1970s and led to the failure of most dairy processors, leading to massive defaults and closures.

43 Experience shows that large-scale dairy processing, not a very cost-effective enterprise, is only profitable if the company has investments in other lucrative yet low-cost products, such as Nestlé, whose biggest source of cash flow in Pakistan is its bottled mineral water.