FAO Cereal Supply and Demand Brief

The Cereal Supply and Demand Brief provides an up-to-date perspective of the world cereal market. The monthly brief is supplemented by a detailed assessment of cereal production as well as supply and demand conditions by country/region in the quarterly Crop Prospects and Food Situation. More in-depth analyses of world markets for cereals, as well as other major food commodities, are published biannually in Food Outlook.

Monthly release dates for 2025: 7 February, 7 March, 4 April, 2 May, 6 June, 4 July, 5 September, 3 October, 7 November, 5 December.

Cereal trade revised downwards amid weaker demand

Release date: 06/12/2024

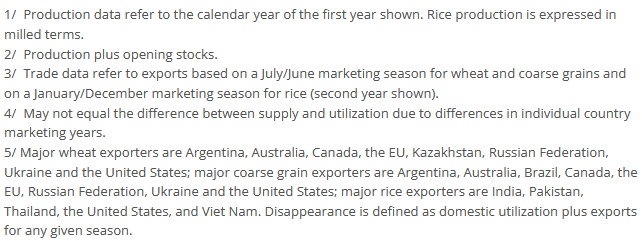

The latest forecast for global cereal production in 2024 has been revised downward from the previous month and now stands at 2 841 million tonnes. At this level, the world cereal output is 0.6 percent lower year on year but remains the second largest on record. The reduction this month primarily reflects downward revisions to maize and wheat production forecasts. The global maize output, accounting for about 80 percent of the coarse grains total, is pegged at 1 217 million tonnes, slightly lower than the previous month's forecast and 1.9 percent below the 2023 level. The adjustment is driven by lower-than-expected yields in the European Union and the United States of America. Similarly, the global wheat production forecast for 2024 has been marginally reduced to 789 million tonnes, which is now on par with the 2023 outturn. The bulk of the month-on-month decrease is linked to a lower wheat estimate in the European Union, where overly wet conditions curbed yields in parts. As for rice, FAO’s forecast of world rice production in 2024/25 has changed little since November. Thus, it continues to point to area expansions resulting in a 0.8 percent annual increase in global rice output to a record high of 538.8 million tonnes (milled basis).

The latest forecast for global cereal production in 2024 has been revised downward from the previous month and now stands at 2 841 million tonnes. At this level, the world cereal output is 0.6 percent lower year on year but remains the second largest on record. The reduction this month primarily reflects downward revisions to maize and wheat production forecasts. The global maize output, accounting for about 80 percent of the coarse grains total, is pegged at 1 217 million tonnes, slightly lower than the previous month's forecast and 1.9 percent below the 2023 level. The adjustment is driven by lower-than-expected yields in the European Union and the United States of America. Similarly, the global wheat production forecast for 2024 has been marginally reduced to 789 million tonnes, which is now on par with the 2023 outturn. The bulk of the month-on-month decrease is linked to a lower wheat estimate in the European Union, where overly wet conditions curbed yields in parts. As for rice, FAO’s forecast of world rice production in 2024/25 has changed little since November. Thus, it continues to point to area expansions resulting in a 0.8 percent annual increase in global rice output to a record high of 538.8 million tonnes (milled basis).

Turning to the 2025 crops, planting of the winter wheat crop is underway across the northern hemisphere, and softer prices in 2024 may dissuade area expansions. In the United States of America, sowing of the winter wheat crop is progressing at an average pace and, owing to recent beneficial rainfall, 55 percent of winter crops are rated as good to excellent at the end of November, 5 percentage points higher than last year. In the European Union, sowing operations were delayed due to a wet start of the autumn period in western areas, particularly in southern Spain. While dry conditions in November accelerated the sowing pace, continued water deficits in eastern countries hindered early crop development in some regions. Below-normal rainfall in key southern wheat-growing areas in the Russian Federation has led to low soil moisture levels, hampering planting operations. Less-than-favourable weather conditions also impeded sowings in Ukraine, where the war continues to be a major impediment to the agriculture sector. In Far East Asia, remunerative prices and government support policies, coupled with favourable soil moisture conditions, are likely to see similar-sized wheat plantings in China (mainland) and India for the 2025 crop, with potential for expansions.

In the southern hemisphere, the 2025 coarse grain crops are being planted. In South America, early signs point to a pullback in Argentinian maize sowings, as farmers have been discouraged by dry conditions and the risk of stunt disease transmitted by leafhoppers, which adversely affected production in 2024. In Brazil, early planting intentions point to an unchanged maize area for the 2025 crop, and a return of rainfall in central and southeastern regions has bolstered prospects of an increase in yields following a small downturn last year. In South Africa, preliminary expectations point to an unchanged maize area, as an anticipated increase in white maize sowings, buoyed by record prices, is expected to offset a likely contraction, albeit small, in the yellow maize area.

World cereal utilization in 2024/25 is forecast at 2 859 million tonnes, up 1.8 million tonnes from the previous month and 0.6 percent higher than in 2023/24. Global coarse grain utilization in 2024/25 is raised month on month by 1.2 million tonnes to 1 526 million tonnes, now 0.4 percent above levels in 2023/24. The upward revision stems from fractionally higher feed use, mostly of sorghum, and industrial use of maize. Nearly unchanged from last month, global wheat utilization in 2024/25 is forecast to remain near last season’s level at 796 million tonnes, with growth in food consumption seen balancing a decline in feed use of wheat. FAO has raised its forecast of world rice utilization in 2024/25 by 900 000 tonnes since November, largely reflecting prospects of more pronounced use expansions in Asia. As a result, global rice utilization is now forecast to reach 536.7 million tonnes, which would represent a 2.0 percent increase from 2023/24 and an all-time high.

FAO’s forecast for world cereal stocks by the close of seasons in 2025 has been cut by 14.2 million tonnes since the previous month to 874 million tonnes, now pointing to a decline in global stocks of 0.7 percent below the opening levels. Based on the latest forecast, the global cereal stock-to-use ratio would be 30.1 percent in 2024/25, down from 30.8 percent in 2023/24 but still indicating a comfortable supply level. Following this month’s 8.2-million-tonne downward revision, global coarse grain inventories are now forecast to fall below opening levels by 1.2 percent to 360 million tonnes in 2024/25. A cut in maize stocks makes up the bulk of the downward revision and mostly reflects lower inventories in China (mainland), the European Union, and the United States of America as a result of smaller imports foreseen for the former and lower production for the latter two. World wheat inventories have also been lowered by 5.1 million tonnes since November’s report, bringing the forecast for 2024/25 to 310 million tonnes. Most of the downward revision is made in the European Union reflecting the lower production estimate. FAO has trimmed its forecast of world rice stocks at the close 2024/25 marketing years by close to 900 000 tonnes since November, as less buoyant stock prospects for China, India and Thailand outweighed a slight upgrade for Indonesia. Despite the revision, world rice reserves remain forecast to expand by 2.6 percent to a peak of 204.5 million tonnes, reflecting expectations of carry-over increases in exporters (Thailand and Pakistan, in particular) and in importers (namely in China and the Philippines).

The world trade in cereals forecast for 2024/25 stands at 484 million tonnes, down 1.1 million tonnes from last month and 4.6 percent lower than the 2023/24 level. Global trade of coarse grains in 2024/25 (July/June) is revised downwards by 1.7 million tonnes since the previous forecast to 230 million tonnes, down 5.8 percent below the 2023/24 level. This month’s revision stems from a 2.0-million-tonne cut in the global maize trade forecast this month, supported by weaker maize import demand anticipated from China (mainland) and marginally smaller exports from Brazil, the European Union, and the United States of America, bringing the global forecast for 2024/25 to 186 million tonnes; this represents a year-on-year decline of 6.3 percent. Pegged at 198 million tonnes, the forecast for world wheat trade in 2024/25 (July/June) is nearly unchanged month on month and still points to a decline of 5.4 percent from last season, mostly driven by a fall in expected purchases by China (mainland) and the European Union, as well as smaller sales from the European Union, the Russian Federation, and Ukraine. International trade in rice in 2025 (January-December) is now forecast to reach 55.6 million tonnes, up from a revised forecast of 53.6 million tonnes for 2024. On the export side, given the September/October repeal of export restrictions on non-fully broken rice, India remains forecast to underpin the trade expansion envisaged for 2025, while export prospects are downcast most notably for Cambodia, Thailand and Viet Nam.

Summary Tables