FAO Cereal Supply and Demand Brief

The Cereal Supply and Demand Brief provides an up-to-date perspective of the world cereal market. The monthly brief is supplemented by a detailed assessment of cereal production as well as supply and demand conditions by country/region in the quarterly Crop Prospects and Food Situation. More in-depth analyses of world markets for cereals, as well as other major food commodities, are published biannually in Food Outlook.

Monthly release dates for 2024: 2 February, 8 March, 5 April, 3 May, 7 June, 5 July, 6 September, 4 October, 8 November, 6 December.

Global cereal production 2024 forecast on par with 2023 output, cereal trade likely to contract

Release date: 06/09/2024

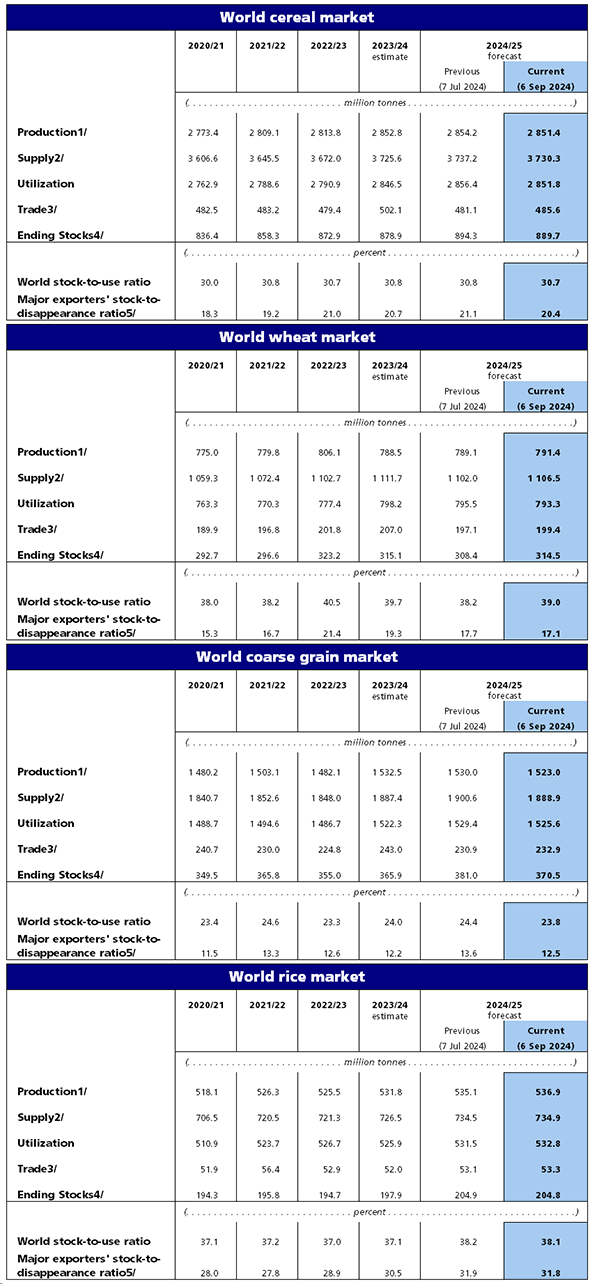

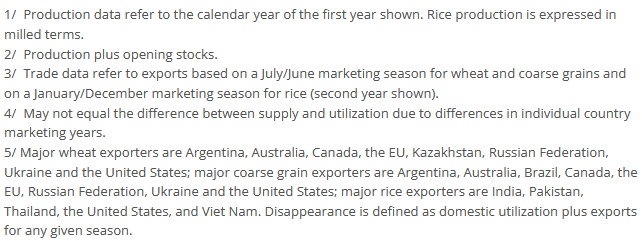

FAO’s latest forecast for world cereal production in 2024 has been scaled back by 2.8 million tonnes in September compared to the projection from July, linked to reduced prospects for coarse grain crops. This latest revision places the 2024 global cereal outturn at 2 851 million tonnes, almost on par with the previous year’s output.

FAO’s latest forecast for world cereal production in 2024 has been scaled back by 2.8 million tonnes in September compared to the projection from July, linked to reduced prospects for coarse grain crops. This latest revision places the 2024 global cereal outturn at 2 851 million tonnes, almost on par with the previous year’s output.

The production forecast for global coarse grains in 2024 has been adjusted downward to 1 523 million tonnes, a reduction of 7 million tonnes compared to July, and now sitting 9.4 million tonnes (0.6 percent) below 2023’s level. The recent cutback largely reflects the impact of hot and dry weather conditions in the European Union, Mexico and Ukraine, which have diminished yield prospects. The debilitating effects of the war in Ukraine also continue to weigh on agricultural production. Barley production forecasts have been trimmed in Canada and the European Union, amid the negative impact of higher-than-average temperatures on crop yields, which have also curtailed sorghum yield expectations in the United States of America, reducing the production forecast. Contrastingly, a substantial upward revision was made to the United States of America maize production forecast on the back of conducive weather conditions which are supporting better yield prospects; however, maize production is still foreseen to fall short of the output in 2023. FAO’s production forecast for the world wheat output stands at 791.4 million tonnes, up 2.3 million tonnes from the previous projection in July, and now nearly 3 million tonnes higher year on year. Most of the recent increase stems from better-than-expected results in the United States of America, with the winter harvest nearly complete, while smaller upward revisions have been made to production forecasts in China (mainland) and Argentina. Partly offsetting these upturns, downward adjustments have been made to the wheat production forecast in the European Union, on account of overly wet conditions, and in the Russian Federation where persistent adverse weather conditions have curtailed yields. FAO has raised its global production forecast for rice by 1.9 million tonnes since July, mostly due to an upward revision to historical output figures for Bangladesh. However, a higher-than-previously-anticipated winter-spring harvest combined with a strong pace of summer-autumn plantings also bolstered output prospect for Viet Nam. Alongside various other smaller forecast upgrades, these revisions more than compensated for slightly lower harvest expectations mainly for China and Indonesia. As a result of these changes, world rice production in 2024/25 is now anticipated to reach 537.0 million tonnes, up 1.0 percent from 2023/24 and an all-time high.

The forecast for world cereal utilization in 2024/25, now pegged at 2 852 million tonnes, up 0.2 percent from the 2023/24 level, has been lowered by 4.7 million tonnes since July. Total utilization of coarse grains is forecast to rise by 0.2 percent to 1 526 million tonnes in 2024/25 despite a downward revision this month of 3.8 million tonnes, largely driven by lower anticipated feed use of barley (mostly in Canada) and sorghum (mostly in China (mainland)). Historical revisions to China (mainland)’s wheat food consumption estimates were mostly behind a 2.2 million tonne downward revision to world wheat utilization, bringing the total world wheat utilization forecast for 2024/25 to 793.3 million tonnes, down 0.6 percent from the 2023/24 level. World rice utilization in 2024/25 is now forecast at 532.9 million tonnes, up 1.3 million tonnes from July expectations, amid more buoyant supply expectations for Asia and adjustments to global population figures. The revised forecast level suggests that world rice utilization is headed towards a record high this season, thanks to an accelerated expansion in food intake.

The forecast for world cereal stocks by the close of the 2025 seasons has been cut by 4.5 million tonnes since July, declining to 890 million tonnes, but still 1.2 percent above their opening levels. With the new forecasts, the global cereal stocks-to-use ratio in 2024/25 would remain nearly unchanged from last season at 30.7 percent, continuing to indicate adequate supply prospects in the new season. This month’s downward revision in world cereal stocks is attributed to a 10.6 million tonne cut in the global coarse grain stocks forecast. The biggest reduction is for maize stocks, stemming largely from lower inventories in the European Union, as well as in Ukraine, due to reduced production prospects. Barley stocks are also lowered, mostly in Canada and the European Union, as are sorghum stocks, in China (mainland) and the United States of America. Despite these downward revisions, global coarse grain stocks are still forecast to rise above their opening levels by 1.2 percent. By contrast, global wheat inventories have been raised by 6.2 million tonnes and are now forecast to remain nearly on par with their opening levels at 314.4 million tonnes. Historical revisions made to China (mainland)’s utilization led to a near 7.7-million-tonne upward revision to their wheat inventories this month. Higher wheat stocks in the United States of America, reflecting better production prospects, also contributed to this month’s upward revision. World rice stocks at the close of 2024/25 marketing seasons remain forecast at a peak of 204.8 million tonnes, essentially unchanged from July expectations.

FAO’s forecast for world trade in cereals in 2024/25 is pegged at 485.6 million tonnes, up 4.5 million tonnes from the July forecast but still pointing to a 3.3 percent contraction from the 2023/24 level. The forecast for world trade in coarse grains in 2024/25 (July/June) has been lifted by 2.0 million tonnes since the previous report in July. This mostly reflects an upward revision made to global maize trade supported by larger sales anticipated by the United States of America, resulting from a larger production forecast, along with stronger demand from Mexico and Viet Nam. Despite the upward revision, global trade in coarse grains is still forecast to decline in 2024/25 to 232.9 million tonnes, representing a 4.2 percent contraction from 2023/24. The forecast for world wheat trade in 2024/25 (July/June) has also been raised, by 1.2 million tonnes, to 199.4 million tonnes. Larger shipments foreseen for Kazakhstan and the United States of America, owing to larger anticipated harvests, along with greater purchases by the European Union, are behind this month’s upward revision. However, global wheat trade is still set to fall in 2024/25, by 3.7 percent. International trade in rice is forecast at 52.0 million tonnes in 2024 (January/December), 900 000 tonnes more than predicted in July, but still 1.5 percent below the already reduced 2023 level.

Summary Tables