COARSE GRAINS

PRICES

|

|

Prices remain high driven by strong demand

|

|

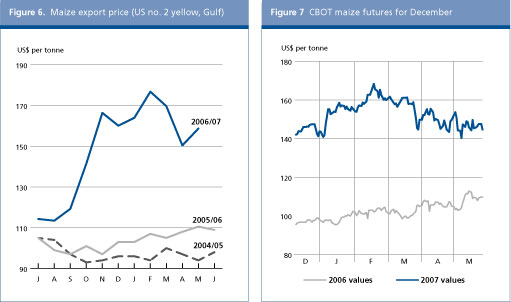

Despite the expected record world harvest to be collected this year, international coarse grains prices are likely to stay high in the 2007/08 season. The United States’ yellow maize (US No. 2 Gulf, fob) averaged US$ 159 per tonne in May, up US$ 9 per tonne from April and US$ 48 above the corresponding period last year. Record crops in Argentina and Brazil helped to bring prices down between February and April. However, as overall demand for maize remains robust and larger supplies in the United States are used domestically by the ethanol sector, the likeliness of further reductions in world prices in the new season is weakening. Prospects for continued strong prices are confirmed by developments in the futures market: By late May, the Chicago Board of Trade (CBOT) December maize futures price stood at US$145 per tonne, some US$ 35 above the corresponding period in 2006.

| |

2005/06 |

2006/07 |

2007/08 |

Change: 2007/08 over | | | |

estim. |

f’cast |

2006/07 | | | | | | |

million tonnes |

% | |

WORLD BALANCE | | | | | |

Production |

1002.4 |

983.1 |

1072.8 |

9.1 | |

Trade |

107.5 |

110.0 |

108.0 |

-1.8 | |

Total utilization |

994.1 |

1022.5 |

1057.6 |

3.4 | | Food | 176.6 | 180.5 | 182.8 | 1.3 | | Feed | 623.1 | 626.5 | 623.8 | -0.4 | | Other uses | 194.3 | 215.6 | 251.1 | 16.5 | |

Ending stocks |

190.2 |

150.7 |

162.7 |

8.0 | | | | |

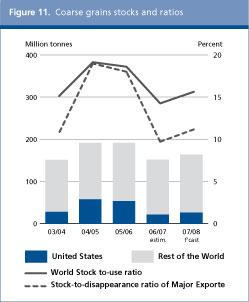

SUPPLY AND DEMAND INDICATORS | | | Per caput food consumption: | | | | | | World (Kg/year) | 27.4 | 27.6 | 27.6 | 0.1 | | LIFDC (Kg/year) | 28.4 | 28.6 | 28.7 | 0.4 | | World stock-to-use ratio % | 18.6 | 14.2 | 15.6 | | | Major exporters’ stock-to-disappearance ratio % | 18.0 | 9.7 | 11.2 | |

PRODUCTION

|

|

Record coarse grains production in 2007

|

|

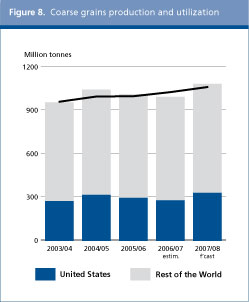

FAO’s latest forecast for world production of coarse grains in 2007 is 1 073 million tonnes, up 9 percent from last year and a record high. The bulk of the increase is expected in maize, which accounts for about 70 percent of total coarse grain production with output set to reach a record 770 million tonnes in 2007. In the southern hemisphere, the main 2007 harvests are underway or already complete. In South America, a record main maize crop is being gathered in Argentina, Brazil and Chile, following increased plantings, in response to strong demand for ethanol production, and favourable growing conditions, which led to bumper yields. The secondary crop in Brazil also looks set to increase. In Southern Africa, however, prospects are less favourable and aggregate output is forecast slightly lower than last year‘s below-average crop. In the northern hemisphere, the bulk of the maize crops has now been sown, with all the main producing countries expected to harvest larger crops. However, by far the most noteworthy development this season is the approaching completion in the United States of the highest level of maize planting since 1944, mostly in response to exceptionally strong domestic demand for maize-based ethanol production.

Regarding barley, the second most important coarse grain, output is forecast to increase in 2007 by nearly 6 percent to about 148 million tonnes. A switch from wheat to barley in Canada, improved yields in parts of the EU, after adverse weather last year, and a sharp recovery from the 2006 drought-reduced crop in Australia are expected to account for most of the increase.

The world sorghum output in 2007 is forecast at some 60 million tonnes, slightly up from last year. The increase should mostly come from larger crops in just a few countries, namely Argentina, Mexico, and the United States. In Africa and Asia, which account for about 40 and 20 percent respectively, of the world sorghum output, production is forecast to change little in 2007.

TRADE

|

|

Small reduction in world trade

|

|

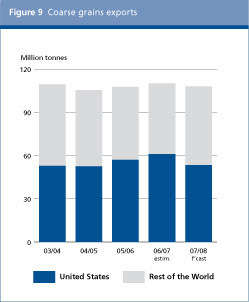

International trade in total coarse grains in 2006/08 (July/June) is forecast at 108 million tonnes, down 2 million tonnes from the previous season. Most of the reduction is expected in Asia, mainly because of expected cuts in maize imports. Total maize trade is set to reach 82 million tonnes, down nearly 3 million tonnes from 2006/07. However, the decline in maize trade would be in part compensated by larger trade in barley which is forecast to reach 17 million tonnes, one million tonnes more than in 2006/07. Trade in sorghum is expected to decline slightly, to 5.5 million tonnes.

In Asia, total imports in 2007/08 are forecast at 58 million tonnes, down 1.6 million tonnes from 2006/07. An expected bumper harvest in Indonesia and larger production in Turkey are the main reasons for this decline. Among countries in Latin America and the Caribbean, smaller maize imports by Brazil would more than offset some increase in sorghum imports by Mexico. In Africa, purchases of barley by Morocco are forecast to double in 2007/08 to 800 000 tonnes to compensate for the production shortfall while maize imports by South Africa, normally a net maize exporter, are expected to increase to one million tonnes as the increased production was not sufficient to cover needs.

Because of larger output in exporting countries, the overall exportable supply prospect for 2007/08 is favourable. Argentina and Canada in particular are set to increase sharply their shipments. However, sales to foreign markets by the United States, the world largest maize exporter, may decline in spite of an anticipated record production because of strong domestic demand. Aside from the five major exporters, sales from China may decline by about 2 million tonnes, to 3 million tonnes, while improved supplies may boost exports from Brazil and Ukraine.

UTILIZATION

|

|

Higher industrial use boosts total demand for coarse grains

|

|

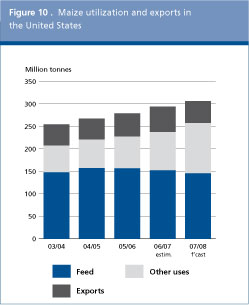

World utilization of coarse grains in 2007/08 is forecast to rise to roughly 1058 million tonnes, both 3.4 percent above the estimated level in 2006/07 and the 10-year trend. Total use for feed, which normally accounts for the bulk of coarse grains utilization, is forecast at 624 million tonnes which is slightly below the level estimated for 2006/07. High prices in most markets and expected reductions in maize feed use in the United States are among the main factors for the decrease. This contrasts with the prospect for a large expansion in coarse grains industrial use, predominately driven by strong demand from the ethanol sector, especially in the United States where, according to the latest official forecasts by the USDA (May 2007), some 86 million tonnes of maize are to be used for production of ethanol in 2007/08. This would represent a staggering 30 million tonnes, or almost 60 percent, increase from an already record use in 2006/07. Utilization of coarse grains for human food consumption is forecast to reach 183 million tonnes, up just over one percent from the previous season. Most of this increase is expected in several developing countries in southern Africa and Latin America.

STOCKS

|

|

Small recovery in world stocks

|

|

World coarse grains carryovers by the close of seasons in 2008 are forecast to reach roughly 163 million tonnes, up 12 million tonnes, or 8 percent, from their sharply reduced level at the start of the season. Most of the increase reflects larger anticipated inventories in major exporting countries, forecast to reach 61 million tonnes. At the current expected levels, the world stocks-to-use ratio for coarse grains would reach 15.6 percent, up from the low 14.2 percent of the previous season and still relatively small. Among the major producers in the southern hemisphere, where most of this year’s crops have been harvested, record maize crops in Argentina and Brazil are likely to result in a significant stock build-up in both countries, which will more than offset the anticipated stock drawdown in southern Africa, except in Malawi where a record crop is likely to boost reserves. Among northern hemisphere countries, coarse grains inventories in the United States are currently forecast to rise by 5 million tonnes. Some minor increases are also forecast in Canada, China and the EU, mostly consistent with current expectations for higher production.

|

June 2007

June 2007