June 2007 June 2007 | ||

|

Food Outlook | |

| Global Market Analysis | ||

|

RICE

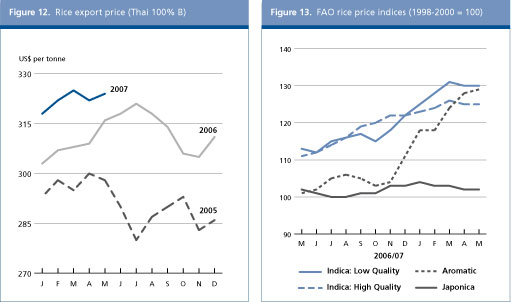

International rice prices followed a steady upward trend between December 2006 and March 2007, but have stabilized since, largely influenced by falling export quotations in the United States. These tendencies were reflected in the FAO All Rice Price Index (1998-2000=100) that passed from 115 points in December 2006 to 120 points in March 2007, a value it retained also in April and May 2007. The pattern of prices was relatively consistent across all rice categories, except for aromatic rice, the prices of which continued to surge in the past three months, largely reflecting supply shortages of Basmati rice in India and Pakistan. A slow pace of sales in the United States is largely behind the weakening of export quotations in the country, which suffered the imposition of tight quality certification requirements in key import markets. By contrast, despite the arrival of new supplies from the 2006 secondary crop and recurrent releases of rice from government stocks, prices in Thailand remained firm, sustained by brisk demand but also by the strong Baht relative to the US dollar. Buoyant sales also prevented prices from weakening in Viet Nam in the wake of new crop supplies. Moreover, news concerning the exchanging of price information between Thailand and Viet Nam have been recurring, an initiative launched several years ago by the Government of Thailand to keep export prices at remunerative levels. Supplies from India, on the other hand, are expected soon to become dearer, following the rise in the levy prices which the Food Corporation of India pays to buy rice locally, in competition with private traders, and a strengthening of the Rupee against the US dollar. In Pakistan, prices are also on the rise, based on scant availabilities for export. With large imports anticipated for the rest of the year and limited current supplies in exporting countries, pressure for rice international prices to strengthen is likely to linger over the next few months, a tendency that could be further exacerbated should the US Dollar weaken further vis-à-vis major exporters’ currencies.

Table 4. World rice market at a glance

More detailed information on the rice market is available in the FAO Rice Market Monitor which can be accessed at: http://www.fao.org/es/ESCen/20953/21026/21631/highlight_23001en.html

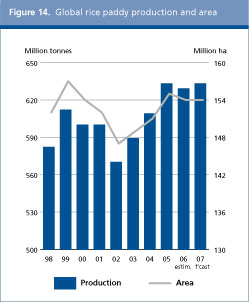

Following a series of setbacks, the 2006 paddy season concluded with a global production estimated at 629 million tonnes, 4 million tonnes less than the record-breaking 2005 season. The decline was concentrated in Asia and affected some of the major producing countries, in particular Bangladesh, Cambodia, India, Japan, the Republic of Korea, Nepal and Thailand. Moreover, growth in China, Indonesia, the Philippines and Viet Nam was very modest. In the other regions, smaller crops were harvested in Brazil, Colombia, Peru and Venezuela as well as in the United States, while production rose in most African countries and in Australia.

Although still highly tentative, the FAO forecast of global paddy production in 2007 stands at some 633 million tonnes, virtually matching the record achieved in 2005. Expectations of growth in 2007 not only reflect positive price expectations and renewed institutional support to the sector, but also assume a return to average growing conditions. Much of the 2007 anticipated gains are likely to originate in Asia , where the major producing countries are foreseen to grow more rice this season, with a few exceptions. Among these, production may fall in Japan and the Republic of Korea, a consequence of ongoing sectoral reforms, but also in Indonesia, where a late arrival of the rainfall depressed plantings, and in Sri Lanka. On the other hand, strong output growth is anticipated in Bangladesh, Cambodia, the Islamic Republic of Iran, Laos, Malaysia and Nepal, with more modest gains foreseen in China, India, Thailand and Viet Nam. In Africa, a further increase in paddy output may be witnessed in 2007, provided growing conditions remain favourable. Much of the increase would be prompted by rising prices but also by government support to the sector. However, in Madagascar, where the season is already quite advanced, production may fall, as a result of heavy floods that hit the country early this year. In Latin America and the Caribbean (LAC), the outlook is positive in Central America and the Caribbean, but negative in South America, especially for Argentina, Brazil and Uruguay. However, Colombia, Guyana, Peru and Venezuela may all reap larger crops, owing mainly to prospects for improved returns, which could boost plantings. In the rest of the world, expectations are mixed. In the wake of drought, Australia is set to garner one of the smallest crops on record. Similarly, production in the United States is foreseen to fall by 6 percent to its lowest level in the past ten years, reflecting a shift of land towards more profitable crops. The cut is expected to affect both long and medium grain rice varieties. In the European Union, drought constrained plantings in Spain, which may lead to a small contraction in output by the EU-25. However, adding 43 000 tonnes expected to be produced by Romania and Bulgaria, the two member states that joined the Union in January 2007, total production in the EU-27 is currently forecast at 2.644 million tonnes, compared with a level of 2.613 million tonnes for the EU-25 in 2006. Production is set to increase in the Russian Federation, following the stepping up of border protection. Table 5. India – Rice production by crop

Source: Department of Agriculture & Cooperation – India.

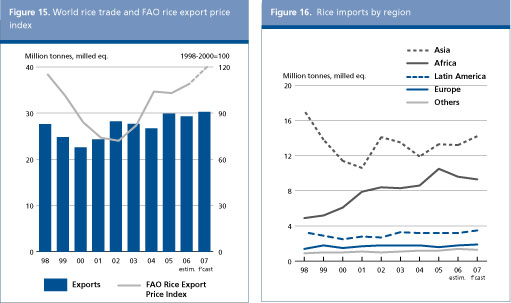

According to the latest FAO forecasts, world trade in rice may strike a record of 30.2 million tonnes in 2007, which would be 1 million tonnes or 3.4 percent more than in 2006. Surging import demand is the force driving trade growth this year, as there is less pressure for trade expansion from an exporter perspective, given the tight supply situation that most exporting countries are facing. Asian countries are anticipated to be responsible for most of the expansion in global imports, with much of it accounted for by Indonesia, where restrictions on rice importation had to be relaxed to check soaring domestic prices and to foster a rebuilding of stocks. As a result, the country is now foreseen to purchase 2 million tonnes of rice, substantially above the 800 000 tonnes it is estimated to have brought in 2006. Shipments to Bangladesh, Nepal and Viet Nam are also foreseen to increase, while those directed to the Islamic Republic of Iran, Iraq, Malaysia and the Philippines may decline. Overall imports to African countries are currently anticipated to decline from 9.6 million tonnes in 2006 to 9.3 million tonnes in 2007. Deliveries to most countries in the region are expected to remain in the same order as in 2006, a reflection of the generally positive production outcomes last season, but they are forecast to be cut in Guinea and in Nigeria, where Governments are promoting rice self-sufficiency. By contrast, imports by countries in Latin America and the Caribbean are set to rise, underpinned by larger purchases by Brazil, Colombia, Cuba and Peru. In the rest of the world, larger purchases are likely to be made by the United States and the European Union, while the Russian Federation may cut its, following an increase in tariffs and the application of more stringent controls over the quality of rice from all origins.

Among exporters, Thailand and Cambodia are anticipated to account for the bulk of the expansion of world trade. In the trail of an excellent 2006 crop, Cambodia is forecast to ship close to 1 million tonnes, 3 times as much as estimated in 2006. Large stocks accumulated through the government procurement programme should also enable Thailand to sell 9 million tonnes of rice, up from 7.7 million tonnes last year. Attractive world prices may also foster some modest increases of exports by China, Guyana and Egypt, while shipments from India and Viet Nam are currently anticipated to remain about unchanged at 4.4 million tonnes and 4.7 million tonnes, respectively. All the other traditional suppliers, including Argentina, Australia, Pakistan, the United States and Uruguay are now foreseen to cut theirs, reflecting reduced availabilities.

Total rice utilization, the bulk of which is for human food consumption, is forecast to rise to 425 million tonnes (in milled equivalent) in 2007/08, 4 million tonnes more than estimated in 2006/07. On average, this would imply a small decline in global per caput availability to 56.8 kg per year. The world average is largely influenced by the pattern prevailing in Asian countries, where strong income growth is encouraging a diversification of diets, resulting in declining demand for rice. However, based on current estimates, rice availability per inhabitant could also fall in Africa, given the expected drop in imports. Per caput consumption is also forecast to fall somewhat in Latin America and the Caribbean, while little change is currently foreseen for the developed countries as a group.

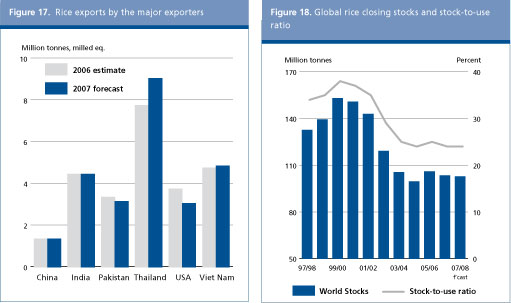

Given current forecasts of production, trade and utilization, world rice stocks by the end of season in 2008 may fall to 102.6 million tonnes, 700 000 tonnes below their opening levels. The entire decline is expected to be concentrated in the developed countries, reflecting bleak outlooks for 2007 paddy seasons while little stock change is anticipated for the developing countries as a group. Region-wise, inventories are expected to end lower in all the continents, except in Asia, where stocks are currently forecast to rise by 600 000 tonnes, largely reflecting some rebuilding taking place in China. Inventories held by the major exporting countries, excluding China, are forecast to decline by 1.3 million tonnes, which may give rise to further tightness of the market in 2008.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GIEWS | global information and early warning system on food and agriculture |