Dr.V.Balakrishnan

Professor and Head, Department of

Animal Nutrition

Madras Veterinary College

Chennai -India.

INTRODUCTION

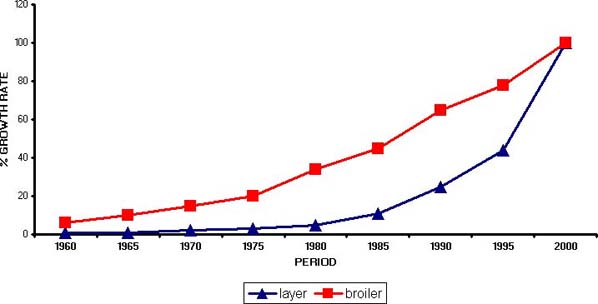

India’s animal wealth is huge in terms of its population of cattle (204.5 million), buffaloes (84.2 million), poultry (800 million), sheep (50.8 million), goats (115.3 million) and pigs (12.8 million). Compared with the rest of the livestock sector the poultry industry in India is more scientific; it is well organized and progressing towards modernization. The Indian poultry industry’s success story is uniquely exceptional. From a backyard venture, it has made a quantum leap to emerge as a dynamic industry. Over the last three decades, there have been significant developments in the poultry industry with each decade focusing on different sectors. The seventies saw a spurt in egg production; the eighties an acceleration in broiler production; the nineties advances in poultry integration, automation and feed production (Fig.1). The present decade promises to exploit value added products and the global trade avenue. The growth of the poultry industry is so fast that authenticated statistics are irrelevant by the time they are published.

PRESENT SCENARIO OF THE INDIAN POULTRY INDUSTRY

India has 150 million laying hens and 650 million broilers. It is the fifth largest producer of eggs (40 billion eggs/year) and ranks 18th in world broiler production (Directorate of Economics, 1992).

The poultry industry is one of the fastest growing sectors in the country. The overall growth rate of the poultry industry is 15-20 percent per annum. At present the total turnover of the Indian poultry industry is Rs.90 billion (2 billion US$) and the industry has set a target for achieving a total turnover of Rs.270 billion (6 billion US$) by the year 2005.

The government’s policy initiative under different five-year plans has generally helped this transformation in the poultry sector, but cannot claim to have propelled the poultry industry to its existing heights.

The government funds research activities related to the sector either through research organizations like Agricultural Universities/Indian Council of Agricultural Research or through trade regulatory bodies - the Agricultural and Processed Products Exports Development Authority (APEDA). The government also supports the industry by extending loans through nationalized banks especially the National Bank for Agriculture and Rural Development (NABARD) and through technical expertise. However, the Indian poultry industry is dominated by the private sector (World Bank, 1996).

Despite the phenomenal expansion in commercial poultry farming, many rural households continue to raise indigenous breeds in their backyard. The backyard poultry units, though not the main income generator for rural producers, are called ‘walking banks’ because their products are sold to meet emergency expenses. Furthermore, they contribute substantially to the family’s food and nutrition. In urban areas the poultry products from ‘desi birds’ (indigenous birds) are sold at a premium rate for their unique flavour and taste. This uniqueness is due to the scavenging nature of the birds. In addition, chickens, ducks, quails, turkeys, geese and guinea fowl are only reared in a few pockets of the country. Eggs and poultry meat are typically marketed in fresh form. However, with the advent of cold storage facilities and the entry of branded food products, the consumption of processed/preserved products is gaining momentum. Further, with the urban family size getting smaller, housewives are looking for chicken in small and convenient packs. In addition, the rapid mushrooming of fast food chains and growing dependence on convenience foods means the poultry sector is poised for a quantum jump.

Figure 1 POULTRY PRODUCTION IN INDIA

Source: Private Sector Partnership in Poultry Production

CONSUMPTION PATTERN

The average per capita egg consumption is around 36 and that of poultry meat around 850 g per annum. However, in urban areas the per capita consumption is 100 eggs and 1200 g of poultry meat per annum. The NECC (National Egg Coordination Committee), which is involved in the fixing of egg prices, has set a target for increasing annual per capita egg consumption to 180 by the year 2015. Industry estimates are that about 75 percent of the output of the poultry industry - egg and poultry meat - are consumed in the urban areas (25 percent of the population). In general, the availability of eggs and broilers in rural areas is low and the selling price of eggs higher than in the cities. Periodic and apparently cyclical gluts in broiler supply regularly contribute to depressed market conditions, which has led to the exit of many small and inefficient producers. Similarly, the egg price continues to swing due to cyclical periods of excess supply, in spite of the availability of cold storage facilities and efficient transportation. Indian egg prices are lower compared to the price of eggs in many other countries. The South Indian broiler industry has become highly integrated (Table 1) while the operation in North India remains largely unorganized. The concept of integration is limited in the layer industry to the extent of partnership activity between farmers and traders listed in Table 2.

Export potential

Export markets are also likely to open up as subsidies on agricultural products are phased out internationally under World Trade Organization (WTO) agreements. By making the quality and cost of eggs and poultry meat competitive, the Indian poultry sector is expected to capture a significant share of the export market currently dominated by the United States, Brazil, Netherlands and Thailand. India has already started exporting shell eggs to gulf countries and egg powder to the European Union (EU) and Japan. India also exports large quantities of hatching eggs to Bangladesh, Singapore, Maldives, United Arab Emirates, Saudi Arabia and Oman and specific pathogen free eggs to the EU for pharmaceutical purposes.

TABLE 1

Type of vertical integration or contract farming

in vogue with respect to the broiler industry

|

Broiler farmer |

Integrator |

|

Owner of broiler shed and equipment |

I. Supplies the following inputs |

TABLE 2

Major kind of partnership activity in the layer

industry

|

Input by the farmers |

Input/facilities by the trader |

|

Land and housing |

Feed |

Source: Private Sector Partnership in Poultry Production and Marketing in India. (FAO, 2001)

DISTRIBUTION OF EGG AND MEAT PRODUCTION AMONG VARIOUS STATES IN INDIA

Eight states account for the total egg production in India. They are Andhra Pradesh, Gujarat, Haryana, Karnataka, Maharasthra, Punjab, Tamil Nadu and West Bengal. Andhra Pradesh is the largest egg producing state accounting for one-third of the country’s entire output.

In broiler production, one district of Tamil Nadu alone accounts for more than 30 percent of the total production.

SUPPORTING SECTORS

India is almost self sufficient in all inputs required for producing eggs and chicken meat. The Indian poultry industry receives excellent backing from its supporting sectors, which are drawn from various input industries. They consist of a network of about 600 hatcheries, 10 000 veterinary pharmaceuticals, numerous equipment manufacturers, 130 feed mills and several education and research institutes.

Hatcheries produce almost all commercial breeds of chicks that are available in America and Europe. The annual turnover of the veterinary pharmaceutical industry is estimated to be Rs.75 000 million, indicating the presence of a vital support service to ensure sound health of the birds in the country. The growing veterinary infrastructure - 40 000 veterinary hospitals/dispensaries/first aid centres - supports livestock production with better health care for poultry. In addition to several veterinary colleges and premier institutes, each state government extends its technical know how and marketing support through the co-operative sector. Even though tremendous progress has been made in developing diagnostics and vaccines, serious problems still exist because of the lack of adequate infrastructure for disease surveillance and monitoring. As far as availability of equipment is concerned, India is self sufficient in all basic equipment required for rearing and breeding poultry. All nationalized commercial banks in the country provide credit facilities to invest in poultry ventures. Poultry insurance is available to cover abnormal risk of mortality.

Feed sectors

Consumption of commercial feed by the poultry sector at present is 28 million tonnes/year. The poultry industry is highly dependent on the feed industry, which is only 35 years old. The Indian feed industry caters predominantly to the dairy and poultry sector. Manufacture of feeds for other categories of livestock is practically non existent. At present, the Indian organized feed industry produces around 3 million tonnes of feed/year, which is only 5 percent of its actual potential. A substantial quantity of feed is prepared by the farmers themselves in order to reduce the feed cost.

Raw materials for manufacture of poultry feed

The raw materials that are used for manufacture of poultry feeds are grouped as follows:

1. Cereal and grains: maize, rice, wheat, sorghum, bajra, ragi and other millets, broken rice, germs, middling and damaged wheat that is discarded from the food industry as unfit for human consumption.

2. Cakes or Oil meal: groundnut cake, soybean meal, rapeseed meal, sesame meal, sunflower meal, coconut meal, palm meal are used as protein resources.

3. Feed of animal origin: meat meal, fish meal, squilla meal, hatchery waste and bone meal are used. However, farmers face production problems due to bacterial contamination of fish and meat meal.

4. By-products: rice bran, rice polish, solvent extracted rice and wheat bran, molasses and salseed meal are by-products used in poultry feeds.

5. Minerals and vitamins: poultry feeds are enriched with calcium, phosphorus, trace minerals such as Fe, Zn, Mn, Cu, CO and I and vitamins A, D3, E, K and B Complex.

6. Feed additives: additives commonly used are antibiotics (usage not banned in India) prebiotics, probiotics, enzymes, mould inhibitors, toxin binders, anti-coccidial supplements, acidifiers, amino acids, antioxidants, feed flavours, pigments and herbal extract of Indian origin.

These raw materials for feed are adequately available in India.

As feed cost is the key factor in determining the profitability of poultry farming, feed manufacturers as well as farmers attempt to produce least cost rations by including some of the following products, depending upon their cost, availability and nutritive value:

forest produce (babul seed, rubber seed, tamarind seed, salseed, etc.);

food industry waste (biscuit waste, coco shell, bread waste, powder, cocoa beans, macaroni waste, skim milk powder, etc.);

gum and starch industry (guar meal, tapioca, tapioca spent pulp, etc.);

fruit and vegetable processing waste (citrus wastes, mango waste, tomato pomace, pineapple waste, tea leaves, etc.);

alcohol industry waste (yeast sludge, grape extractions, breweries’ dried grain, etc.).

Availability of raw materials has increased as the production of food grains and oil seeds in the country have risen over the past few years.

The production is estimated to be well over 190 million tonnes for food grains and 16 million tonnes for oil seeds. Increasing domestic production of maize, a major ingredient in poultry feed, is likely to contribute to the reduction of poultry feed prices. The liberalization of feed maize imports will also increase domestic supplies and provide a cushion for domestic production (Table 3). This will help to avoid possible feed crises such as occurred in 1992, which severely hurt the poultry industry.

The World Bank Document on the Indian livestock sector review quotes a number of regulations that control the distribution of feed ingredients (Table 4). Movement controls on cereals under the Essential Commodities Act are reported to hinder arbitrage between surplus and deficit areas, while the Storage Control Act has been reported to limit private inter-seasonal storage.

TABLE 3

1995 tariff schedule for selected feed

ingredients (%)

|

Commodity |

Tariff level |

GATT Tariff |

Quantitative restriction |

|

|

Binding |

Exports |

Imports |

||

|

Feed maize |

0 |

0 |

Restricted |

Free |

|

Barley |

0 |

100 |

Restricted |

Canalized |

|

Rye |

0 |

100 |

Restricted |

Canalized |

|

Sorghum |

0 |

0 |

Restricted |

Canalized |

|

Millet |

0 |

0 |

Restricted |

Canalized |

|

Soybean |

40-50 |

100 |

Restricted |

Canalized |

|

Groundnuts |

40-50 |

100 |

Restricted |

Canalized |

|

Linseed |

40-50 |

100 |

Restricted |

Canalized |

|

Rapeseed |

40-50 |

100 |

Free |

Canalized |

|

Sunflower |

40-50 |

100 |

Free |

Canalized |

|

Oats |

0 |

0 |

Restricted |

Canalized |

|

Oilcakes, meals |

35 |

150 |

Free |

Restricted |

The commodities act was enacted in 1955 to control and regulate the production, supply and distribution of essential commodities so that they could be made available to consumers at reasonable prices. Under the Act, interstate movement of commodities requires a general or special transport permit. Similarly, enforcement of the act subjects wholesalers to maximum stockholding limits. In Maharastra state, the maximum storage period is 15 days for wholesale dealers. Continual changes in these regulations contribute to market uncertainty.

Another major constraint to the expansion of the feed concentrate sector is the small and highly volatile supply of quality feed ingredients. Feed manufacturers often face problems of adulteration of feed ingredients, such as when urea and sawdust are added to fish meal. Poor post-harvest handling and storage of feed ingredients result in low quality inputs. Analytical reports based on several thousands of samples spread over five years by a premier feed analytical laboratory (Personal Communication, 2002) situated in the egg laying belt of the country suggest that ground nut cake and maize should be regularly screened for aflatoxin. In these reports, 54.6 percent of maize samples and 99 percent of the ground nut cake tested positive for aflatoxin. The aflatoxin menace was observed both in rainy and non rainy seasons. Concomitant occurrence of other toxins viz. ochratoxin, citrunin were also reported.

Quality standards are available from the Bureau of Indian Standards, but no mechanism ensures that these standards are met by the industry for both ingredients and finished products. The Bureau of Indian Standards has initiated debate on the use of genetically modified organisms (GMOs) in feed in one of its recent meetings, but otherwise no guidelines are available.

Though it is out of context to mention bovine spongiform encephalopathy (BSE), a brief note could allay fears, especially in the absence of regulatory mechanisms to prohibit the use of rendered by-products in cattle feed. As cows are considered to be sacred in India, cattle are fed on vegetarian diets devoid of feed stuffs of animal origin. Further, in the absence of feed meant exclusively for sheep, goats and swine, the BSE problem is virtually non-existent in the country.

Briefly, the poultry industry is growing at a fast pace, which in itself is an indicator of the prevalence of a conducive environment. Along with the poultry industry, the feed industry is keeping pace. Hence most of the research work on animal feed is practical and focuses on the use of by-products, upgrading of ingredients and enhancing productivity in order to reduce production costs. Several innovative ideas have emerged in the trade sector to tackle critical situations.

TABLE 4

Government interventions in feed and feed

ingredient marketing

|

Regulation |

Government level |

Examples |

|

Coarse cereals |

|

|

|

Trade licensing |

Central and state |

Food Grains Licensing and Procurement Order, Uttar Pradesh food grains and other Essential Articles, Haryana Food Articles Licensing and Price Control, Punjab Trade Articles |

|

Price control |

Central and state |

Support price, Uttar Pradesh Food Grains Act. |

|

Transport |

Central |

Motor Vehicles Act (Maximum weight = 16.2 t) |

|

Inter-state Trade |

State |

Punjab Maize Movement Order |

|

Dealer Trade |

State |

Punjab Trade Articles |

|

Storage quantity |

Central and State |

Licensing Order, Punjab Trade Articles |

|

Storage licensing |

State |

Uttar Pradesh Scheduled Commodities Dealers’ Licensing Order, Punjab Trade Articles |

|

Oil seeds |

|

|

|

Trade licensing |

Central/State |

Essential Commodities Act; |

|

Transport |

State |

Essential Commodities Act |

|

Storage quantity |

Central/State |

(Class A; City Wholesalers 150 t, retailer 10 t; Class B; City Wholesalers 50 t, Retailers 5 t) (Maximum quantity 2.5 t) |

|

Storage licensing |

State |

Haryana Food Articles |

|

Marketing |

Central/State |

Agricultural Produce Marketing Act (oilseed manufacturing restricted to small-scale enterprises) |

Above all the growth of the poultry industry should not be viewed only from the success it has achieved from the commercial standpoint but should also be regarded as a dynamic and vital tool for building a better and healthier nation.

REFERENCES

Directorate of Economics and Statistics. 1992. New Delhi, Ministry of Agriculture, Government of India.

FAO. 2001. Private sector partnership in poultry production and marketing in India. Case study, Tamil Nadu. Project report. Chennai, India, Tamil Nadu Veterinary and Animal Sciences University.