Success stories

How MAFAP is helping to boost Uganda's dairy and beef sectors

MAFAP has been providing Uganda with policy support through a number of reports on price incentives, exports and consumption.

©FAO/Luis Tato

01/02/2024

Background and the problem

The livestock sector represents 17 percent of Uganda’s agricultural GDP (or 4.3 percent of GDP) and cattle, for either meat production or dairy production, is the leading livestock sub-sector. At household level, one in five Ugandan households owns some cattle. Cattle rearing and dairy production are concentrated along the he country’s Cattle Corridor, spanning from the southwest to northeast of Uganda. While most cattle heads are used for meat production, dairy farming represents a growing share of agricultural GDP and an emerging export-oriented sub-sector. Consequently, both beef and dairy became commodities to prioritize under Uganda’s third National Development Plan (NDP III) for the 2020/21 – 2024/25 period.

In recent years, the Uganda Development Bank (UDB), a government-owned development finance institution, has been looking to increase its agrifood lending portfolio. However, agrifood investments have been perceived as risky and less viable, thereby limiting the supply of financial services to the sector.

To over come this, FAO's AgrInvest and the UDB tasked the Uganda Agribusiness Alliance (UAA) and the Dairy Development Authority (DDA) to organize policy dialogues with public and private actors from the beef and dairy value chains. The objective here was to pinpoint the main problems and bottlenecks and identify evidence-based policy measures to address them.

What did MAFAP do?

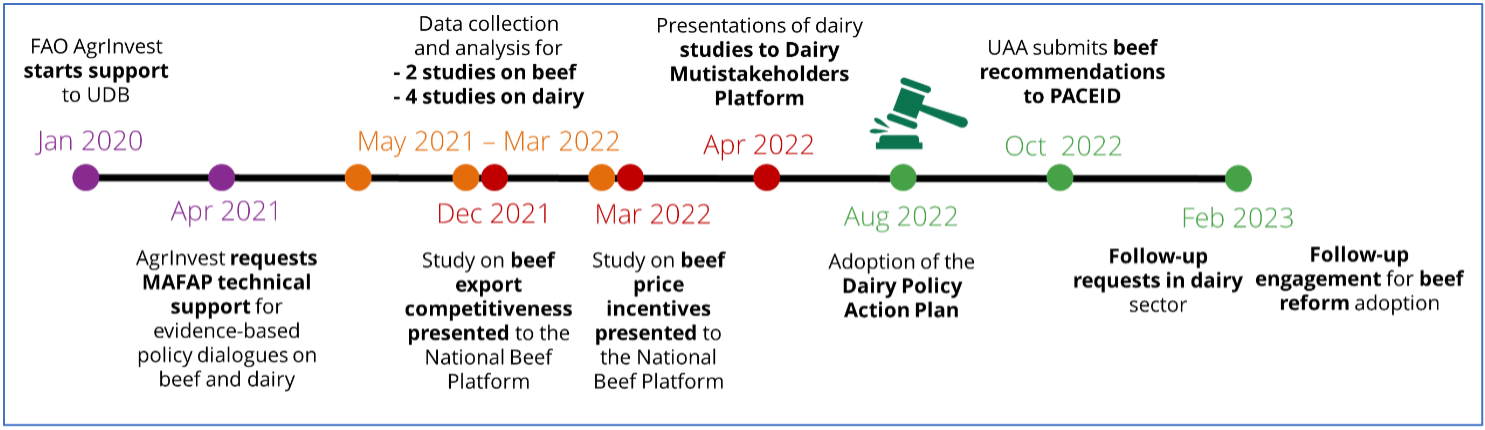

The Government of Uganda requested the support of MAFAP to provide data and policy evidence for the stakeholder policy dialogues for beef and dairy.

For the beef stakeholder policy dialogues, this involved two analyses – one on price incentives for beef producers, and the second one on the export competitiveness of beef. For dairy, this entailed producing 4 reports – one on price incentives for milk producers, a second on domestic dairy consumption, a third on the performance of milk collection centres, and a fourth on post-harvest losses in the milk and dairy sector.

The MAFAP team, in collaboration with the UAA and the DDA, engaged with stakeholders to prioritize the recommendations stemming from the reports to turn them into policy reforms. For the dairy sector a reform milestone was reached in August 2022 when the Multi-stakeholder Dairy Platform and the DDA approved and adopted the Dairy Policy Action Plan (DPAP), a 5+ year framework to transform the sector.

The MAFAP team in Uganda has also supported a number of policy dialogues with beef and dairy stakeholders.

Impact

The DPAP contains a list of 23 policy interventions and 105 actions that public and private stakeholders should take in the immediate, short term, medium term and long term to boost the dairy sector domestically and externally. The DDA has already undertaken a number of actions including training over 2,900 farmers on best husbandry practices, training on value addition, 4 renovated milk collection centres, several milk coolers distributed to farmer groups at parish level and over 1,800 dairy business registered and licensed.

For the beef sector, the policy actions prioritized in the beef stakeholder policy dialogue have been included in the Presidential Advisory Committee on Exports and Industrial Development to boost agrifood exports. Such recommendations include a review on standards and grades for beef products, and integrated livestock market information system and the production, procurement and distribution of veterinary drugs.

Related links

Our work in the media:

- FAO joins forces with Uganda’s Dairy Development Authority to boost dairy sector - The Kampala Report

- FAO joins forces with Uganda’s Dairy Development Authority in bid to boost the dairy sector - PML Daily

- FAO, dairy agency partner to boost Uganda’s dairy sector - The Cooperator

- Milk round: how FAO is helping to turn Uganda’s dairy sector around - LinkedIn article by Nana Nkuingoua