June 2009 June 2009 | ||

|

Food Outlook | |

| Global Market Analysis | ||

|

SUGAR

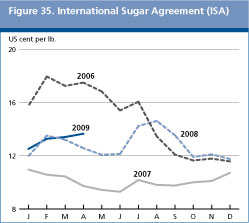

Strong global demand underpins world sugar prices Since the last issue of the Food Outlook in November 2008, international sugar prices1/ have followed a steady upward trend, moving from US 12.10 cents per pound2/ in November 2008 to US 13.65 cents per pound in April 2009 and reaching a three-year high of US 16.06 cents per pound in May 2009. This price pattern mainly reflected a reduction in global export availability, following a sharp decline in India’s sugar output in 2008/09. Prices could have moved higher, had it not been for the world economic downturn, which curtailed demand, and the weakening of national currencies relative to the United States Dollar, which sustained exports from countries such as Brazil, the world’s largest sugar exporting country. Sugar prices may well display increased volatility given the uncertainty related to the extent to which India will make use of the world market to make up for the deficit in production.

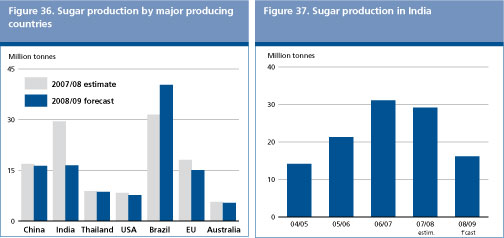

World sugar production to decline by 9 million tonnes in 2008/09 FAO has revised its estimates for world sugar production to 158.5 million tonnes in 2008/09, which is 2.5 million below the first estimate released in November 2008, and 9 million tonnes, or 5.4 percent less than in 2007/08. The revision was largely caused by a deterioration of production prospects in India, where sugar output is now estimated to have fallen by a drastic 45 percent. The drop would ensue from a decline in planted area, as many producers allocated land to alternative, more remunerative, crops, such as maize and soybeans. In addition to India, sugar production contracted in Australia, the European Union, Pakistan and the United States, with relatively small decreases foreseen in Thailand. However, in the Latin America and Caribbean region, sugar production in Brazil (October/September) is expected to rise to 39.6 million tonnes in 2008/09, about 29 percent more than in 2007/08, despite heavy rains at harvest time, which reduced yields. Sugar-cane production is set to reach 566 million tonnes, which corresponds to a 15 percent increase from last year, on account of a 12 percent expansion in cane planted area. It is estimated that about 60 percent of Brazil’s 2008/09 sugar-cane harvest will be processed into cane-based ethanol, buoyed by higher returns from domestic ethanol relative to export markets. However, if international sugar prices continue to augment, providing no upsurge in crude oil prices, the share of cane directed to sugar should be expected to increase. Elsewhere in the region, sugar production in Colombia is expected to increase by 3 percent in 2008/09, while it should remain relatively unchanged in Argentina and decline slightly in Peru. Table 9. World production and consumption of sugar

* Jan-May 2009 In Mexico, sugar production should reach 5.8 million tonnes, relatively unchanged from last season. Poor crop husbandry practices and insufficient fertilizer applications tended to offset the production incentives offered under the North American Free Trade Agreement (NAFTA), which gives Mexico’s sugar free access to both the Canadian and the United States markets. Sugar output is to expand also in Guatemala, the second largest sugar producer in the region, as a result of increased planted cane area, driven by higher administered sugar-cane prices. In Cuba, sugar output is now foreseen to decline in 2008/09 as a consequence of the damages caused by hurricanes Ike and Gustave, which hit the country in September 2008. Aggregate sugar production in Africa is forecast to rise by 8.3 percent to 11 million tonnes in 2008/09, outpacing the 3 percent annual growth experienced for the past three years. Expansion is largely attributed to increases in planted sugar-cane areas and new processing capacity. These investments take place mostly in anticipation of greater exports to the higher priced European Union sugar market under the Everything-But Arms initiative (EBA), which will allow least developed countries in Africa duty and quota-free access to the European Union market as of October 2009. In South Africa, the largest sugar producer of the continent, sugar production is set to reach 2.3 million tonnes in 2008/09, up 6.6 percent from 2007/08, on account of good weather in the main growing areas and notwithstanding a rise in fertilizer costs of 100 percent since 2007/08. At the same time, the devaluation of the Rand against the United States Dollar since 2007/08 has provided some relief to sugar exporters. Sugar production in Egypt is forecast at 1.9 million tonnes, only 1.4 percent more than in 2007/08, as attractive cereal prices, especially for wheat, have contained the expansion in beet areas. Production in the Sudan is estimated to gain 3.6 percent from 2007/08, due to favourable weather conditions and conducive public support. Production is set to expand significantly in the years ahead, particularly with the completion of the Nile Sugar Project, which provides irrigation infrastructure to boost cane area. Gains in the order of 8 percent are also foreseen in Kenya although the country’s sugar subsector faces strong competition from more efficient producers in the other members of the Common Market for Eastern and Southern Africa (COMESA). Increases in sugar output are also expected in 2008/09 for Mauritius, Mozambique, Swaziland and the United Republic of Tanzania.

The outlook for sugar production in Asia indicates a sharp decline from the levels attained in 2007/08, due to a substantial reduction in India and Pakistan. Sugar output in the former country is now expected to reach 15.8 million tonnes, a 45 percent drop from last year, following irregular rainfall and a shift of land allocation in favour of grains and oilseeds. As a result, India’s production is anticipated to fall short of consumption for the first time since 2004/05. Domestic prices have increased since the beginning of the year, forcing the Government to recommend changes to the statutory minimum price (SMP) for sugar cane, which may lead to a 54 percent price increase for the 2009/10 season. Similarly, sugar production in Pakistan is anticipated to decrease by as much as 23 percent, largely because the administered price did not provide sufficient incentives to producers, while reduced access to credit made it difficult for several mills to purchase and process sugar cane at the prevailing official prices. Although sugar production is forecast to contract by 2 percent in Thailand, the decline is much less than an earlier prospected fall of 5 percent following unfavourable weather and reduced sugar-cane areas. Sugar industry officials have blamed the tight credit situation for the fall in mills utilization capacity and hence sugar output. In the rest of the region, an expansion is foreseen in Indonesia and Turkey, while production in China may suffer a decline because of a sudden cold spell that hit the southern sugar growing regions at a critical time of crop development.  In Europe, sugar output in the European Union is expected to contract to 14.4 million tonnes, in line with production target, after reaching 17.4 million tonnes in 2007/08. The reduction in output is consistent with the implementation of the reform programme of the European Union sugar regime, which began in 2006/07, under which European Union’s sugar production is to be cut by 6 million tonnes over four years. So far, total renunciation has totalled 5.8 million tonnes. Sugar production is now concentrated in 18 Member States as opposed to 23 prior to the inception of the reform. On the other hand, production is anticipated to rise in the Russian Federation despite a fall in planted beet area, sustained by record yields, both at the farm and mill levels. Sugar output is expected to fall in Ukraine, where farmers cut the area sown to beet in favour of more profitable grains and sunflower seeds. In the rest of the world , sugar production in the United States is forecast below the 2007/08 level, following a 13 percent drop in sugar beet production, reflecting a shift to other crops. Preliminary estimates for 2009/10 indicated that area sown to beet could recover by 28 percent, under higher return prospects. In Australia, unfavourable weather conditions in the form of floods could depress output by 6.4 percent to 4.7 million tonnes.

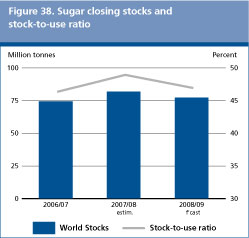

Global consumption to continue expanding but at a slower rate than the long-term trend World sugar consumption in 2008/09 is forecast to rise to 162 million tonnes, 2.4 percent more than in 2007/08, but a slow pace of increase if compared with the 3.4 percent and 4.7 percent rates of expansion recorded in 2007/08 and 2006/07, respectively. On average, per caput sugar availability is estimated to increase from 23.1 kg in 2007/08 to 23.4 kg in 2008/09. Rising domestic sugar prices and poorer economic prospects explain much of the anticipated slowdown in world sugar off-take growth. The economic downturn, in particular, may depress industrial sugar usage by the manufacturing and food preparations sectors, including the beverages industries, which is especially sensitive to variations in income. Growth in sugar consumption is therefore likely to subside faster in countries with large shares of industrial consumption in total sugar utilization3/. Sugar consumption in developing countries is foreseen to grow by 3.2 percent to 113.2 million tonnes, underpinned by per caput income and population growth. Sugar consumption in India, the largest consuming country, may reach 25.3 million tonnes, up from 24.6 million in 2007/08, a low increase if compared with the previous years, as relatively high domestic sugar prices depressed per caput demand. Although remaining positive, offtake growth is also anticipated to slow down in Brazil, China and Indonesia. On the other hand, little change in consumption is forecast for the developed countries, notably Australia, Japan and the European Union, given already high per caput usage, and slowing population growth. Consumption in the United States is set to grow, but much uncertainty remains relatively to the size of the expansion given the current economic downturn.

World import demand to rise World sugar trade is forecast to reach 50.2 million tonnes in 2008/09 (October/September), 6 percent more than the 2007/08 estimate, driven by a strong import demand by countries likely to face a production shortfall, in particular the European Union, India and Pakistan. Among the various areas of uncertainty, the size of sugar imports by India to cover the sharp 2008/09 production shortfall will determine, to a large extent, the final size of world trade over this marketing year. Based on current information, FAO expects India’s imports to hover around 3 million tonnes, after it had imported no quantities in 2007/08, following the recent decision by the Government to allow duty-free imports of white sugar. The second most important feature of the trade outlook is the European Union turning into a net-sugar importer, as production declines in line with the reform of the domestic sugar industry. Official imports are now set at 4.9 million tonnes, 53.6 percent, or 1.7 million tonnes, more than last season, much of which will be sourced from countries having preferential access to the European Union, given prohibitively high MFN tariffs. Elsewhere in Europe, imports by the Russian Federation, the largest sugar importer in 2007/08, are anticipated to decline by 14 percent to 2.8 million tonnes, on account of an expansion in output. Imports by the country have been less than in the previous years, owing to an exceptionally high import duty of USD 220 per tonne, which now will span for five months instead of six months as was previously applied. In Asia, purchases by India, Malaysia and Pakistan are foreseen to increase, mainly on account of either strong domestic demand or a drop in production. In the rest of the world, deliveries to the United States are forecast at 2.7 million tonnes, which corresponds to 800 000 tonnes more than in 2007/08, largely to cater for the prospect of a tight domestic sugar market. Additional imports may be required in the course of the season to rebuild reserves, given the relatively low stock-to-use ratio. Imports by countries in Africa are foreseen to expand by around 4.3 percent to 9.2 million tonnes, much lower than previously envisaged, as locally produced supplies could substitute for imports. The shortages in production in 2008/09, mainly in India, have induced a tighter supply/demand situation on the world market. Nonetheless, relatively comfortable stock availability in Thailand and good crops in Brazil and Guatemala would help sustain a 6.2 percent expansion in world export. Brazil, the world’s largest exporter, could be among those to benefit most from rising international sugar quotations. Indeed, the country could boost its shipments by 28 percent to 24.1 million tonnes, following a contraction in 2007/08, especially since falling freight costs may enable the country to regain market share, particularly in Asia. Overall exports from Asiaare expected to fall by 8 percent to 10.7 million tonnes in 2008/09, mainly reflecting smaller shipments in India and Pakistan. Driven by high international sugar prices, shipments from Thailand are set to increase by 41 percent to 5 million tonnes, mostly routed to neighbouring importing countries. Elsewhere, exports by Mexico are forecast at 600 000 tonnes, a 20 percent increase over 2007/08, but shipments could even reach 1 million tonnes, underpinned by duty and quota free access to the North American market.  1. International sugar prices are based on the International Sugar Agreement (ISA), produced by the International Sugar Organization (ISO), and computed as a simple average of the close quotes for the first three future positions of the Intercontinental Exchange Sugar Contract No. 11. 2. USD 266.7 per tonne 3. Among the major sugar consuming countries, industrial demand accounts for 68 percent of use in the European Union, about 60 percent in India and the United States and 48 percent in Brazil |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GIEWS | global information and early warning system on food and agriculture |