June 2009 June 2009 | ||

|

Food Outlook | |

| Global Market Analysis | ||

|

FISH AND FISHERY PRODUCTS

World production of fish products (excluding seaweed and marine mammals) is estimated to have reached 141.6 million tonnes in 2008, a slight increase over 2007, driven by a 2.5 percent expansion in aquaculture to 51.6 million tonnes, while capture fisheries remained stable around 90 million tonnes. Based on current estimates, aquaculture products contributed 45 percent of total food fish supply. However, lower prices in 2008 and 2009 for a number of the most important traded farmed species, such as Pangasius (Vietnamese catfish), are also causing a supply response and lower volumes are now forecast to reach the market in 2009. 2008 was a record year for global fish trade with imports topping USD 100 billion for the first time; China confirmed its position as the dominant exporter whereas Japan regained its top position among fish importers, helped by a stronger yen. Prospects for 2009 are dominated by overriding concerns over the impacts of the economic crisis on demand and prices. Sales are sluggish in all major markets and prices and margins are under pressure for most seafood products. The only exception is for species facing tight supply situations due to lower catching quotas or production problems in aquaculture. In this respect, the implosion of the Chilean salmon industry in 2009, following a virus attack, is a warning sign for many countries targeting high growth in the aquaculture sector. Per caput food fish consumption in 2008 is estimated at 16.9 kilo in 2008, unchanged from the previous year, of which 8.5 kg came from capture fisheries and the remainder from aquaculture. Lower prices for most fish species have helped sustain consumption, although falling purchasing power are leading consumers in many countries to cut purchases and shop for the cheaper alternatives. According to the FAO GLOBEFISH Price Index1/, fish prices reached an all time high in September 2008, but have been dropping ever since, and much more than normal for the season. As a result, in February 2009, prices were 3.4 percent lower than 12 months earlier, and 10.2 percent below their September peak. Although supply is expected to be downsized as a result, the adjustment may take time, so further price weakness is expected for most species over the next six months.

Table 13. World fish market at a glance

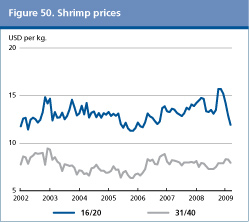

Shrimp The shrimp sector has been suffering from a weakening of demand, which is tightly linked to demand for food services, including restaurants. This demand has been much affected by the economic woes, as consumers cut down on away-from-home meals and turned to less expensive seafood products. As demand faltered, producer prices remained depressed, leading many farmers to convert to alternative production such as tilapia. Poor consumer demand also affected imports in 2008, which decreased by 5 percent in Japan, 7 percent in Spain, 2 percent in France and 8 percent in the UK, whereas they recovered by 1 percent in the United States. Prospects for trade in 2009 remain downbeat, given the current state of the economies, which may result in a further contraction of world imports and prices.

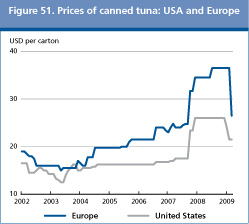

Tuna Demand for fresh and frozen tuna for direct consumption has been falling, whereas the canned tuna market (and the related raw material needs) has been boosted by stronger demand from price sensitive consumers. In 2008, prices followed a downward trend despite declining tuna supplies. Frozen skipjack was selling for USD 1 100/tonne in Bangkok in March 2009, about USD 500/tonnes below the March 2008 price. Similarly, the price of frozen yellowfin fell to USD 1 600/tonne compared to USD 2 200/tonne in March 2008. On the positive side, after years of weak consumption arising from concerns over mercury presence in tuna, the United States’ canned and fresh tuna markets both seem to have stabilized. Captures of tuna fish in the western Indian Ocean, which had been constrained by tension over access to the water, are expected to improve, after the EU agreed to pay an access fee of Euro 9 million per year for fishing in Seychelles’ Exclusive Economic Zone. Spanish and French purse seine boats operating in the Indian Ocean haul approximately 350 000 tonnes annually through Seychellian ports. While the agreement is expected to boost tuna captures, the fishing activity is likely to be negatively affected by the intensification piracy activity off the coast of Somalia, which contributed to depress Indian Ocean tuna catches by 30 percent in 2008. Elsewhere, in Japan, the Ministry of Fisheries recently announced further cuts in the tuna fleet, with compensation offered to fishermen. However, the impact of the measure on actual fishing activity is uncertain as the remaining ships are expected to increase the scale of their operations. As for trade, Japan’s imports of tuna have declined every year since 2005. In 2008, they shrank by a further 17 percent in quantity and 2.4 percent in value. Deliveries of canned tuna to Europe were also lower, as purchases by Germany, France and Italy fell. Only the UK, the main European market, increased its imports by 10 percent. Imports of canned and pouch tuna by the United States totalled 171 300 tonnes in 2008, virtually unchanged from the previous year, but rose strongly in value, USD 661 million, or 26 percent more than in 2007. Thailand, the main canned tuna producer, saw exports recover in 2008 from the 2007 low, increasing by 8 percent to 506 000 tonnes.

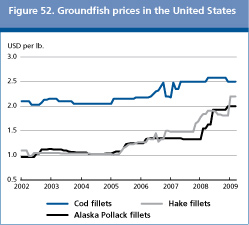

Groundfish The groundfish market is getting increasingly complex; a number of species from traditional sources (some of which are now also farmed) compete with new species from Southern hemisphere aquaculture, such as tilapia and pangasius, especially in the fillet market. Overall, global groundfish supply appears more than adequate, especially as cod production in Canada is finally recovering after two decades of virtual disappearance from markets. Higher availability of Alaska pollack from Russia is further exerting downward pressure on prices. The market weakness has also affected farmed cod and turbot prices negatively, amidst increasing availability from both farmed and wild sources. The United States pollock fishing quota in Alaska has been reduced by 18.5 percent in 2008 to 815 000 tonnes, its lowest level in ten years. This is forcing Europe’s buyers to turn to other whitefish alternatives, such as cod and farmed pangasius and tilapia, or buy double-frozen pollock from Russia and China. Within the sector, farmed cod producers are suffering from falling prices and high costs and many companies are reported leaving production altogether. This is disappointing given the high expectations that cod aquaculture was raising only a few years ago. In 2008, the United States imports of fillets and blocks decreased by 8 percent (to 90 000 tonnes) and 15 percent to (42 000 tonnes) respectively. In Europe, German and French imports of Alaska pollock fillet grew 7.5 percent (to 176 800 tonnes) and by 9 percent (to 41 500 tonnes) respectively thanks to larger shipments from China. Frozen cod imports by the UK and Germany were both weaker in 2008, falling 8 percent and 11 percent. A weaker hake market in Europe caused German imports of frozen hake fillets to drop by 6 percent in 2008. Hake prices, on the other hand, are now firming, with fillets increasing from USD 1.80/lb in December 2008 to USD 2.20/lb in March 2009. Italian hake imports were stable in 2008 at 30 000 tonnes.

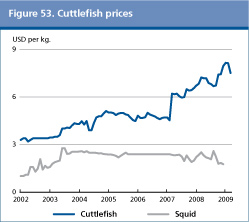

Cephalopods 2008 was for the most part positive for cephalopods; octopus, in particular, was traded at high prices. By contrast, prices of squids moved downwards, notwithstanding lower catches, which is encouraging many producing countries to reduce them further this year. In fact the first indications for the 2009 Southwest Atlantic fisheries show a significant reduction in volumes, bringing some relief to the market. However, prospects continue to be bleak, especially in the light of faltering demand in Spain, the main importer of Argentine squid. Total squid catches in the South West Atlantic reached 400 000 tonnes in 2008, 30 000 tonnes below the 2007 record. Catches off the Falklands/Malvinas fell to 158 000 tonnes, 45 000 tonnes less than in 2007. Loligo catches were up by 25 percent in 2008 to 52 300 tonnes, but the much larger Illex catches in the area declined sharply by 33 percent to 106 600 tonnes. Mainland Argentina reported 255 000 tonnes of Illex catches in 2008, a 22 000 tonne increase over 2007, and Loligo catches stable at 18 000 tonnes Japan’s octopus imports fell to 44 700 tonnes and USD 330 million in 2008, down 4 percent in volume and 1 percent in value. EU’s imports of octopus grew in 2008, led by Italy, followed by Spain. A major development in squid markets in 2008 was China becoming the main importer from Argentina with 66 400 tonnes, almost double the 2007 figure.

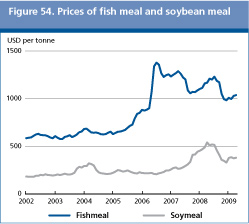

Fishmeal World demand for fishmeal has also been affected negatively by the slowing economic growth, especially in China. As a result, prices have fallen below the USD 1 000 per tonne mark after two years of high levels. However, quotations are now moving upward again because of limited availability and downward expectations for fishmeal production. In 2008, the fishmeal production in the five world’s major exporting countries declined somewhat. A total of 2.6 million tonnes were recorded, about 100 000 tonnes less than in 2007. It is unlikely that 2009 will see a reverse of this downward trend. Despite lower production, Peru managed to export more fishmeal in 2008, drawing from the inventories accumulated in 2007. Total Peruvian fishmeal exports reached 1.6 million tonnes last year, up 24 percent. The main import market remains China with a 53 percent share of Peruvian exports. Germany is a distant second with 190 000 tonnes imported.

Fish oil Although the opening months of the calendar year are always a slow period, this year’s production was lower than normal. The contraction is a response to a weakening of demand and falling prices, but also reflects the effects of falling salmon production in Chile. Fish oil production in 2009 is likely to be in line with 2008, as the anchovy fishery is well managed and subject to stringent fishing quotas.

Tilapia The global economic downturn is depressing demand for tilapia and other Chinese export species, causing their domestic market prices to fall. However, demand both in the United States and Europe is picking up again as lower prices make tilapia more attractive among other fishes. Chinese production, which experienced a drop in 2008 due to cold winter temperatures, is likely to recover rapidly in 2009. Tilapia imports by the United States rose y 3.3 percent to 179 500 tonnes in 2008 with values up sharply, to USD 734 million.

Pangasius (Vietnamese catfish) Vietnamese farmers are suffering from lower prices with pangasius fetching around USD 0.92/ kilo in the Mekong Delta region, making production uneconomic. As a reaction, farmers are refraining from harvesting while others are not restocking. 2009 output could therefore be lower than last year’s despite official forecasts of further increases in production to almost 1.5 million tonnes in 2009. Imports by the EU, the main market for pangasius from Viet Nam with about one third of export volumes and 40 percent of value, rose in 2008. The increase was mainly on account of Spain, is the single biggest EU market, having grown by almost 30 percent. However, Viet Nam has been successful in opening new markets, with Russian imports doubling in 2008 to 118 000 tonnes. Ukraine and Egypt showed even higher growth, trebling their 2008 imports from Viet Nam. The United States market is also expanding. In 2008, exports of Pangasius from Viet Nam rose by 48 percent in value and 66 percent in quantity to 640 000 tonnes and USD 1.5 billion. Also, China reported a strong increase in catfish deliveries to the United States. European seabass and bream Production of European seabass and bream rose in 2008 to new record levels, not only in the largest producer countries, namely Greece and Turkey, but also in Spain. However, prospects for 2009 production are negative, as tight liquidity is forcing many producers to reduce output. In 2008, Italian imports of bream increased due to attractive prices whereas relatively high bass prices led to a decline in consumption and imports. Total Italian bass and bream imports were down 6 percent. Spain is also suffering whereas the French market has held up surprisingly well with imports rising in 2008. Strong sales in supermarkets are making the UK a valuable outlet for Mediterranean bass and bream producers. The large rise in supply of European seabream in 2008 in Greece and Turkey, the two major producing countries, had a significant downward effect on prices, whereas seabass prices held up well. The outlook for the rest of 2009 is not positive. Bream prices, in particular, were low in the initial months of 2009 and the strong upward movement currently at play mainly reflect seasonal shortages before the summer production reaches the market. Small pelagics Global herring and mackerel markets experienced mixed fortunes during 2008, affected by fluctuating currencies, reduced quotas, and one major market, Russia, imposing a temporary ban on imports. As a result, Norway’s mackerel exports in 2008 were basically flat at 335 000 tonnes, with Japan accounting for about one third of total exports. China is also an important market for mackerel, mainly for reprocessing, with the final product ending up in the Japanese market. Herring exports from Norway were strong, reaching new a new height of 492 000 tonnes, with Russia, Nigeria and the Ukraine as the main destinations. Atlantic salmon Total production (and exports) of farmed Atlantic salmon reached record heights in 2008, but a major reason behind the increase was the decision by Chilean producers to harvest early a large part of the production planned for harvesting in 2009. The decision was connected with a virus attack, starting in 2007 and spreading in 2008, which prompted producers to anticipate the harvest. Therefore, this year and next, Chile’s production will be drastically reduced also because producers are reluctant to restock their cages until an effective vaccine has been found. Despite some increases in Norway, total production will be much lower than last year. Chile’s salmon and trout exports in 2008 grew 6.8 percent to USD 2.4 billion, boosted by the early harvesting, a decision expected to have strong repercussions on 2009 sales from the country. Norway also increased 2008 exports by 3 percent to a record 722 500 tonnes. Much of this growth has beebn driven by strong imports by EU, in particular France but also Poland thanks to a growing processing industry. Japan’s salmon imports finally showed a small rebound in 2008, after years of decline. However, import volumes fell by 3.4 percent in the United States. Russia, and Eastern European and South American countres are emerting as new important destinations for farmed salmon. The virtual implosion in 2009 of the Chilean salmon industry, due to a virus attacking the Atlantic salmon species, is having a tremendous impact on total Salmon supply, with prices skyrocketing in all markets. Norwegian companies are the main beneficiaries, although those operating in Chile have been hurt as well. The situation is not expected to improve until 2011 at the earliest. In the meantime prices will remain high. The Chilean experience is also raising wider questions about the long-term sustainability of the aquaculture sector and whether it can grow as fast as previously expected to cover future demand increases for fish and fishery products. Although most analysts expect the Chilean industry to be back in force in a few years, the case underlines the necessity of combining growth with sustainable management practices, institutional strengthening and an improvement of the regulatory framework in many producing countries. Table 14. World Production of Farmed Salmon

Source: GLOBEFISH AN 12201

* estimated

1. University of Stavanger |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GIEWS | global information and early warning system on food and agriculture |