China: Shrimp market downturn in 2023

.png?sfvrsn=7f6ae663_1)

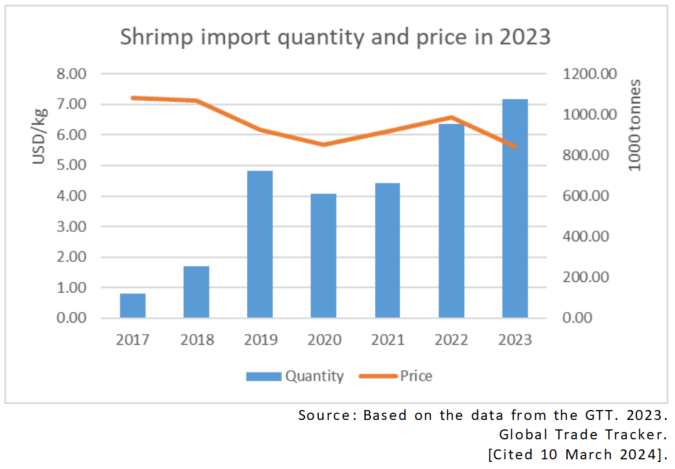

Following the lifting of epidemic control measures in December 2022, data showed a 12.3 percent increase in the volume of shrimp imports into China in 2023, including a surge of Ecuadorian shrimp. A historic high of 1.1 million tonnes was recorded, making China the first country to reach this seven-digit milestone. However, these imports coincided with a significant decrease in domestic demand towards the end of 2023, which resulted in market prices plunging to their lowest levels as compared to recent years. This slowdown in domestic demand growth exceeded expectations, leading to extensive hoarding by wholesalers and retailers. An industry insider commented, "Typically, when we see a significant global price drop, it stimulates demand, total volumes sold, and value growth. However, last year, in the context of China's macro-economic weakness, especially in the second half, this was an exception." Challenges

Prospects Over the past decade, China has become the largest importer of Ecuadorian shrimp, absorbing 50 percent of the supplies. However, this scenario may change as the National Aquaculture Authority of Ecuador (CNA) recently stated that approximately 110 000 hectares of shrimp aquaculture areas are at risk of damage due to floods caused by the El Niño phenomenon, putting the entire Ecuadorian shrimp industry in jeopardy. If this happens, it could lead to changes in domestic shrimp prices in the future. Demand for shrimp products is likely to expand with the gradual recovery in the domestic market due to improving economic conditions and confidence-boosting measures by the Government. It is worth noting that the International Monetary Fund, in its latest "World Economic Outlook", has revised China's economic growth expectations upwards in 2024. |  |