June 2008 June 2008 | ||

|

Food Outlook | |

| Global Market Analysis | ||

|

WHEAT

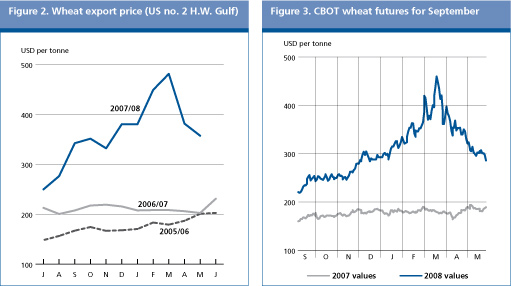

Favourable weather conditions and greater confidence in more plentiful supplies in the new season have driven prices down sharply in recent weeks. International wheat prices began to slide in April and by mid-May, prices stood about 50 percent (USD 240) below their peaks in late February. By April, the price of United States' wheat ( No.2 Hard Red Winter, f.o.b. Gulf) averaged USD 382 per tonne, 25 percent down from March but an elevated 80 percent above the corresponding period last year. Depleted old crop supplies continue to provide some support to cash prices in spite of the favourable outlook for the new crop. Supplies in the United States are becoming increasingly scarce with this season's ending stocks falling to a historically low level. The prevalence of export restrictions and the continuing closure of the wheat export registry in Argentina, one of the world's leading wheat exporters, are also sustaining high prices in world markets. The recent declines in the United States' wheat futures have been pronounced, driven by firmer prospects for a significant increase in this year's domestic output (the United States' winter wheat is forecast up 17 percent) as well as at the world level (up almost 8.7 percent). In May most United States' wheat futures fell to a five-month low in light of prospects for a record wheat crop this year. As of mid-May, wheat futures prices for September delivery on the Chicago Board of Trade (CBOT) hovered at around USD 286 per tonne, down 38 percent since its peak in mid-March but still some 50 percent more than in the corresponding period last year. Table 2. World wheat market at a glance

* Jan-Apr 2008

Derived from IGC Wheat Index

FAO's latest forecast for world wheat output in 2008 stands at a record 658 million tonnes, representing a significant (8.7 percent) increase from 2007. The bulk of the increase is expected to stem from the major exporting countries. In the northern hemisphere, where the wheat crop seasons are more advanced, bigger harvests are expected in all regions with the exception of Asia, where although declining slightly, output will remain close to last year's record high. In North America, the winter wheat crop in the United States is already well developed, especially in the southern regions. Given a 4 percent increase in plantings and indications of above-average winter survival rates and yield prospects, the crop is forecast to increase by some 17 percent to reach 48 million tonnes. With the aggregate area of spring wheat also increasing sharply, the country's aggregate wheat output in 2008 is foreseen to rise 16 percent to some 65 million tonnes, the largest crop since 1998. In Canada, with planting underway in May, early indications point to a large increase in area. After rotating significant area into oilseeds last year, farmers are well-placed this year to take advantage of the strong price outlook and put more area back into wheat. Based on indications in late April, the country's aggregate wheat area for harvest in 2008 is forecast to increase by more than 16 percent from last year, and assuming average yields, output could increase to nearly 26 million tonnes. In Europe, the aggregate wheat crop is currently forecast to rise by almost 13 percent from last year's reduced harvest, reflecting a larger area and better yield prospects. Given the favourable price outlook, plantings increased in most major producing countries, facilitated in the European Union by the reduction of the compulsory land set-aside requirement from 10 percent to zero for the 2007/08 cropping season. Furthermore, generally favourable weather conditions have allowed crops to develop well throughout the region, pointing to better yields than last year's below-average levels, especially in countries situated in the eastern Black Sea zone, such as Bulgaria, Romania and Ukraine, that was hit by severe drought in 2007. Assuming that normal growing conditions prevail for the remainder of the season, production in the EU-27 is forecast to reach some 138 million tonnes, nearly 15 percent up from 2007's depressed output. In the European CIS countries, given an anticipated sharp recovery in Ukraine and another expected good crop in the Russian Federation, the aggregate output of the subregion is set to rise to a bumper 70 million tonnes in 2008. In Asia, despite favourable prospects for this year's wheat crops in several major producing countries, the region's total output could slip back a little from last year's record level, because of dry conditions affecting some countries in the Asian CIS group and Near East subregion, to the east and south of the Caspian Sea. The most significant producing countries affected are the Islamic Republic of Iran, where output may fall by some 2 million tonnes from last year's record to 13 million tonnes, and Kazakhstan, where a significant reduction to about 14 million tonnes is expected after last year's excellent crop. This would still be a comparatively good crop considering the average of the past five year average. Production is also forecast to decline slightly in Pakistan, because of dry conditions in some areas and a reduced use of inputs, but may nevertheless remain slightly above the average of the past five years. In India, where the harvest is already underway, the attainment of good yields has resulted in a more favourable outlook indicating that this year's crop could turn out to be a record, close to 77 million tonnes. In China1/, despite drought in some eastern parts, increased plantings and higher yield expectations in areas not afflicted by dry conditions point to another slight increase this year, reaffirming the country's upward trend in wheat production. In North Africa, wheat crop prospects are satisfactory in Egypt, the subregion's major wheat producer, and in Morocco, where despite some dry weather again in recent weeks, the wheat crop there is still expected to recover somewhat from last year's severely drought-reduced level. In the southern hemisphere, the 2008 wheat season is just starting. In South America, plantings are underway in Brazil, and early indications point to an expansion of area reflecting favourable planting conditions combined with the outlook for good producer returns. By contrast, in Argentina, the recent government policy to increase taxes on exports which has effectively reduced farmers' incentives to produce wheat and this combined with unfavourable dry weather, looks likely to result in a reduction of this year's wheat area and a return to an about-average crop after last year's bumper level. In Oceania, as of early May, wheat planting was well underway in the west of Australia following widespread rainfall but producers were still awaiting the arrival of good soaking rains in most of the main growing areas of the southeast. With farmers set to maximize grain production this year after two successive poor crops, given the good start already in the west, and assuming a return to a normal season also in other parts of the country, wheat output is forecast to recover sharply in 2008 to about 26 million tonnes; double last year's level.

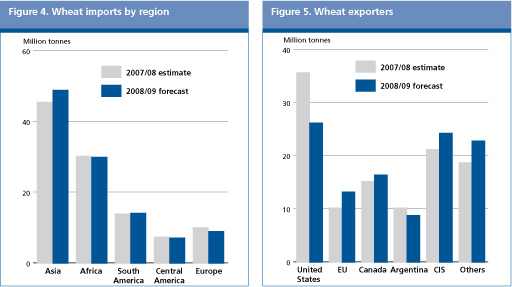

FAO's first forecast for world wheat trade (exports) in 2008/09 (July/June) points to a small increase from 2007/08, to 110.5 million tonnes. Total wheat imports by Asia are currently forecast to approach 49 million tonnes, up 4.7 million tonnes from 2007/08. The increase is mostly a result of higher imports by a few countries. In the Islamic Republic of Iran, below average rainfalls have hampered production and imports may rise to 2 million tonnes. This would represent the largest level of imports in five years during which time the country remained largely self-sufficient in wheat. Higher imports are also anticipated for Afghanistan, Indonesia, Iraq and Saudi Arabia. On the other hand, because of an improved domestic supply situation, wheat imports by India are forecast to decline sharply. In Africa, total imports are forecast at 29.7 million tonnes, close to the estimated record in 2007/08. The increase mostly reflects rising demand in northern Africa, especially in Algeria, Libya and Tunisia. Egypt is again expected to make sufficient large purchases in the new season in order to bring down domestic prices. Morocco which required significant wheat deliveries in 2007/08 because of a severe drought may import 1 million tonnes less but still more than normal because of the need to replenish stocks. In Latin America and the Caribbean, imports by Mexico, are expected to remain large and exceed the levels in 2007/08 due to strong demand and the need to rebuild stocks. Brazil could import slightly less because of higher production. However in Europe, a sharp decline in wheat imports is anticipated in the European Union as a result of the expected recovery in output this year.

World export supplies in the 2008/09 marketing season are expected to prove more adequate than the situation of the 2007/08 season. The anticipated production increases and supply recoveries in nearly all major exporting countries contribute to this expectation. However, larger supplies may not necessarily boost exports as domestic demand in several major exporting countries is also expected to increase. This is notably the case in the United States where in spite of an increase in domestic production, exports could fall sharply in the new season due to strong domestic demand for feed and a historically low level of carryover stocks. But most other major exporters are seen in a better position to expand their market share in the new season. Assuming that this year's production in Australia will recover, exports from Australia could double the reduced level of 2007/08. Wheat shipments from Canada and the European Union are also likely to increase significantly as a result of improved supplies. In Argentina, exports are currently suspended due to the closure of the export registry and this combined with a possible decline in domestic production could even result in smaller overall wheat sales from that country in the new season. However, ample supplies soon entering the market in Ukraine are expected to lessen the need for export restrictions and boost sales in the new season. The forecast increase in exports from Ukraine is likely to more than offset a possible decline in sales from Kazakhstan which recently decided to ban exports until the beginning of September 2009 following a rise in domestic prices. The prospect for an improved supply situation in the Russian Federation is also expected to lead to the lifting of current export restrictions from that country and could result in large exports in 2008/09.

Early signs for world wheat utilization in the 2008/09 marketing season point to the first substantial expansion since 2004/05. World total wheat utilization is forecast to climb by 17 million tonnes, or 2.7 percent, from the stagnant level in 2007/08. At 635 million tonnes, world wheat utilization would even slightly exceed the ten-year trend. In sharp reversal to the situation of 2007/08, the anticipated recovery in wheat supplies in the new season is expected to boost feed use in particular, especially in light of anticipated lower availabilities of coarse grains, maize in particular. Indeed, total feed utilization of wheat is forecast to rebound strongly and approach 118 million tonnes, up almost 8 percent from 2007/08. The bulk of this anticipated growth is likely to occur in the United States, where the increase in domestic wheat production combined with smaller availabilities of feed grains could triple feed wheat utilization to at least 6 million tonnes, the highest since 2000/01. Feed wheat use is also forecast to rise in Australia, China and the European Union driven by this year's anticipated increase in production. The European Union is the world's largest market for feed wheat with over 40 percent of its aggregate domestic wheat production destined for this use. Total feed utilization of wheat in the European Union in 2008/09 is currently forecast to reach 58 million tonnes, 2 million tonnes more than the estimated usage in 2007/08. World food consumption of wheat in 2008/09 is forecast to rise to 453 million tonnes, up by 7 million tonnes, or 1.6 percent, from 2007/08. At this level, world wheat consumption, on a per caput basis, would remain steady at around 67 kg per annum. In the developing countries, per caput wheat consumption is expected to remain unchanged at around 60 kg in spite of an anticipated further decline in China. Annual wheat consumption in that country has dropped by over 14 kg per person over the past decade to currently around 64 kg per annum. This decline is driven by a slow but continuous shift away from wheat to high protein food. Highly elevated wheat prices are regarded as responsible for some of the decline in consumption levels in several developing countries in 2007/08 but a small recovery is expected in the new season given the prospects for more favourable consumer prices.

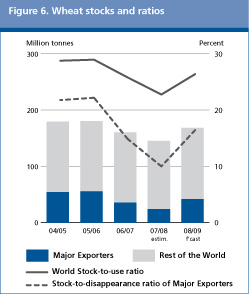

After falling to nearly a 30-year low, world wheat stocks by the close of the crop seasons in 2009 are forecast to rise to 168 million tonnes, up 23 million tonnes, or 16 percent, from their opening levels. The strong anticipated increase in global wheat production in 2008 is helping with this modest recovery in world inventories. At the current forecast levels, the world wheat stocks-to-use ratio for the new season is forecast at 26.4 percent which would represent a near five percentage point increase from the 2007/08 low but still well below the 30 percent at the start of the decade. Strong demand for wheat especially for feed use as a result of tighter supplies of other feed grains is seen to prevent wheat stocks, and therefore the stocks-to-use ratio, from any marked improvement than is currently envisaged. On the other hand, in major exporting countries, the anticipated rebound in output this year is likely to enable them to replenish their heavily depleted granaries. Based on current production and utilization forecasts, total wheat stocks held by major exporters could reach roughly 43 million tonnes, up 18 million tonnes, or more than 70 percent, from their low opening levels. At this level, the ratio of the major exporters' stocks-to-disappearance (defined as their anticipated exports plus domestic consumption) is expected to recover from a historical low of only 10 percent in 2007/08 to 16.4 percent in 2008/09. Wheat inventories in all major exporting countries are expected to rise substantially with the largest expansion in the United States (up 6.5 million tonnes), the European Union (up 5.5 million tonnes) followed by Australia (up 3.3 million tonnes) and Canada (2 million tonnes).

Aside from major exporters, wheat inventories are anticipated to increase also in a number of other countries in the new season. The largest increase is expected in China where higher production and reduced exports could result in an increase of at least 4 million tonnes in ending stocks, to 58 million tonnes. Total stocks in India are also forecast to increase. By early May, the Government of India was reported to have procured over 17 million tonnes of wheat, up almost 9 million tonnes from the same period last year. The increase in the minimum procurement price and an anticipation of a bumper crop this year are boosting government wheat purchases. High world wheat prices have encouraged many countries to reconsider their policies with regard to stocks. In this respect, several countries have announced new programmes with the view of creating or expanding their strategic reserves of major foodstuffs such as wheat and rice particularly among countries in Asia such as in Bangladesh, Japan and Pakistan. Nonetheless, wheat inventories in several countries could also decline in 2008/09 especially if the current high world prices were to persist. In Africa, smaller wheat stocks are anticipated for Egypt, Kenya, the Sudan, Tunisia and the United Republic of Tanzania. In Asia, inventories in Indonesia and the Syrian Arab Republic are forecast to decline. In most CIS countries, stocks are likely to remain unchanged but those in the Russian Federation and Ukraine are expected to increase, mainly because of the higher anticipated domestic production this year. 1. All references to China refer to Mainland China unless otherwise specified. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GIEWS | global information and early warning system on food and agriculture |