|

|

MEAT AND MEAT PRODUCTS

PRICES

|

|

Sustained increases in production costs, notably feed, in major producing countries, suggests that meat prices could come under greater pressure in 2008

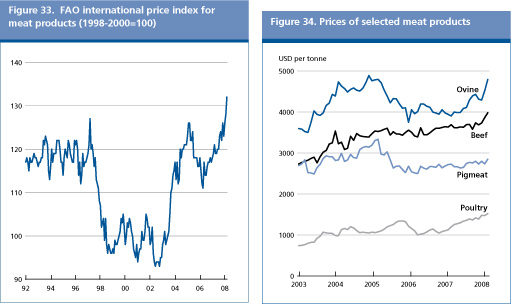

Preliminary estimates indicate that the FAO International Price Index of meat products reached its highest level of 136 points (1998-2000=100) in April 2008, continuing its recent upward trend that began in June 2006. The main reasons for this development are: higher feed costs, the depreciating US Dollar, and the rising demand for meat largely fuelled by economic growth in developing countries, particularly in Asia. Although, individual meat categories have exhibited different developmental paths in the past because of differences in feedstuffs used, feed conversion efficiencies, biological production cycles, as well as differences in contractual agreements, the trends for all since 2006 have been in the upward direction. Despite this, however, meat markets have not yet experienced price hikes of comparable magnitude to those observed in grains, oilseeds and dairy product markets. But sustained increases in production costs, notably of feed, in major producing countries, that are reducing the profit margins of meat producers, suggest that prices of meat products could come under greater pressure. The delay in the response of meat markets to developments that are taking place in the feed markets is partially due to typical livestock cycles, as well as recurring animal diseases.

Ovine prices climbed almost 17 percent over the first four months of 2008 compared with the same period a year ago, mostly reflecting the attempts of Australian sheep producers to rebuild their flocks through reducing slaughtering. During the same period, FAO's bovine price index rose by almost 7 percent, due to rising global import demand and limited export supplies from Argentina, Australia, Canada and New Zealand. International pigmeat prices experienced a similar increase, despite reaching the peak of the hog cycle in some of the large producing countries, such as Canada, European Union and Mexico. The largest increase in prices has, however, been observed for poultry products. The increase was slightly more than 28 percent over the same period as above, reflecting the increase in feed and energy that make up the largest portion of variable production costs. It is interesting to note that 54 percent of the increase in meat production for 2008 will come from poultry meat, as it continues to remain the most affordable meat.

| |

2006 |

2007 estim. |

2008 f'cast |

Change: 2008 over 2007 | | |

million tonnes |

% | |

WORLD BALANCE | | | | | |

Production |

271.5 |

274.7 |

280.9 |

2.3 | |

Bovine meat | 65.7 | 67.2 | 68.0 | 1.1 | | Poultry meat | 85.4 | 89.5 | 92.9 | 3.8 | | Pigmeat | 101.7 | 98.8 | 100.6 | 1.8 | | Ovine meat | 13.3 | 13.7 | 14.0 | 2.0 | |

Trade |

21.4 |

22.5 |

23.1 |

3.0 | |

Bovine meat | 6.8 | 7.1 | 7.2 | 1.0 | | Poultry | 8.5 | 9.2 | 9.6 | 4.3 | | Pigmeat | 5.0 | 5.0 | 5.3 | 5.2 | | Ovine meat | 0.8 | 0.9 | 0.8 | -5.9 | | | | |

SUPPLY AND DEMAND INDICATORS | | | Per caput food consumption: | | | |

| | World |

kg/year |

41.6 |

41.6 |

42.1 |

1.1 | | Developed |

kg/year | 81.1 | 82.4 | 82.9 | 0.7 | | Developing |

kg/year | 30.7 | 30.5 | 31.1 | 1.8 | | | | | | | | | | |

2006 |

2007 |

2008 |

Change:

Jan-Apr 2008 | | | | | | |

over Jan-Apr 2007 | |

FAO Meat Price Index | | | | | % | | (1998-2000=100) | | 115 | 121 | 131* | 10 |

* Jan-Apr 2008

BOVINE MEAT

|

|

Bovine markets are recovering from weather shocks and import bans

|

|

World production of bovine meat rose by 2.3 percent in 2007, and is projected to rise a further 1.1 percent in 2008 to 68 million tonnes. All of the increase in production will take place in developing countries, which now account for 56 percent of the global total.

In North America, bovine meat production is forecast to remain virtually unchanged. The increase in output in the United States will offset a 6 percent decline in Canada. The strong reduction expected in Canada is due mainly to the implementation of the Country of Origins Labelling (COOL) regulation by the United States, its major international market, the United States. The increase in the United States beef output is in part due to its depreciating currency, has increased its competitiveness. Moreover, high supplies of distiller-dried grains from the production of ethanol have helped to lessen the impact of higher feed costs.

In 2007 South American beef output increased by a healthy 5 percent, although the increase in 2008 is expected to be less than 2 percent. This reduction in the growth rate is due to developments in the two main producers in the region. In Brazil, the largest producer in the region, the 5 percent growth observed over 2007 is expected to be reduced to 2.5 percent in 2008, mainly as a result of the new restrictions imposed by the European Union on imports from the country due to product safety concerns related to animal diseases. In Argentina, on the other hand, production is expected to decline by 1 percent in 2008, reversing the 6 percent growth observed during the previous year, depressed by the imposition of higher export taxes and restrictions. These policies are changing the relative profitability of crop and livestock production, encouraging the producers to shift pasture areas into crop production and thus contributing to the decline in production of bovine meat. However, good pasture conditions in Chile, Columbia, Paraguay and Venezuela are expected to boost production by 5 percent. Shortages in replacement cattle have constrained the increase in Uruguay's production to less than 1 percent.

Bovine meat production in the European Union remains on a downward trend, as animals are being retained to increase the size of the dairy herd, following the increase in milk quotas. However, reduced imports from Brazil should stimulate the industry somewhat, limiting the decline in production to less than 1 percent.

Cattle slaughter in Australia is expected to contract by 3.3 percent in 2008, as its herd is in the rebuilding phase. Most of the production decline is expected in the grain-fed peak sector, following losses sustained by the feedlots due to higher feed costs in 2007. New Zealand's production numbers will increase slightly in 2008, stimulated by favourable product prices.

Steady herd expansion, improved genetics and feeding practices, as well as continued government support, are expected to sustain production increase of more than 3 percent in China. Bovine meat output is increasing also in India and Pakistan, in response to growing domestic demand. The increase also reflects the aging of their dairy herds, which has boosted the slaughter of older dairy cows.

International trade in bovine meat is forecast at 7.2 million tonnes in 2008, up 1 percent over 2007. The market continues to recover from consecutive droughts in Australia and from the Bovine Spongiform Encephalopathy (BSE) incidents in North America that had resulted in the imposition of bans by many importers. As these are being progressively lifted, trade in beef is resuming a more normal pattern.

Among the major importing countries, shipments to Japan are set to decline slightly, largely reflecting lower exportable supplies of grain-fed beef from Australia and continuing import restrictions on products from the United States. The foreseen increases in the consumption in the Republic of Korea will be partly met through increased imports, as BSE concerns dissipate. In the United States, increased domestic slaughter, coupled with a weaker US Dollar, may depress imports by 4 percent. Purchase of beef by the European Union will decline substantially, due to a partial ban on beef imports from Brazil and inability of other South American suppliers to fill the gap. Imports by the Russian Federation are likely to continue rising to compensate for a falling domestic production.

As far as bovine meat exports are concerned, those from New Zealand are expected to grow in 2008 despite a strong New Zealand Dollar. Shipments from Brazil will mirror production growth and be destined to non-traditional markets to offset import restrictions imposed by the European Union. While exports from Argentina are set to decline , shipments from Paraguay and Uruguay are expected to increase. Buffalo meat exports from India are likely to will rise in 2008, in response to strong import demand from Indonesia, Malaysia, the Philippines and countries in the Near East.

The strong Euro, high internal prices and decreased imports from Brazil, however, will discourage exports from the European Union. Canada's beef shipments are also expected to fall, negatively affected by the introduction of the Country of Origin Labelling legislation in the United States. Exports from the United States are anticipated to rise, sustained by a weak dollar and the progressive lifting of import bans by its traditional importing partners.

PIGMEAT

|

|

Pigmeat production to recover in 2008

|

|

Global pigmeat production is forecast to increase by almost 2 percent to 101 million tonnes after a 3 percent decline in 2007, which was largely the result of the impact of massive culling of nearly 1 million pigs following the outbreak of the Porcine Reproductive and Respiratory Disease in China, the world's largest pigmeat producer. This year, output in China is forseen to expand more than 1 percent, but recovery is being impeded by snow storms early in the year that destroyed 800 thousand pigs, particularly in back yard operations. In order to promote recovery, a number of subsidy, insurance and vaccination programmes have been implemented. In Canada and the European Union, where output last year was at cyclical highs, with low prices, production expected to decline in 2008. Viet Nam's production is also affected by PRSS and massive culling of all infected animals will reduce the growth in production for 2008.

In South America, an increase in pigmeat production is anticipated in virtually all producing countries for the fourth consecutive year. Argentina, Brazil and Chile, which have ample feed supplies, are the main contributors to the 4 percent output expansion projected for the region. In the Russian Federation, production is set to grow by more than 6 percent in 2008 as the pig population is continually increasing, aided by government support policies aimed at boosting quality and volume of domestic production and reducing dependency on imports. Pigmeat output in Australia remains stable as a result of a combination of drought-induced high grain prices and record imports driven by the strengthening of the AUD. In the United States, pigmeat production will increase as a result of favourable conditions in 2007, which were encouraged by the depreciation of the dollar. It's industry has also adopted a new vaccine that has lowered hog losses and increased productivity.

World trade of pigmeat is estimated to increase by 5.2 percent to 5.3 million tonnes in 2008. A continuing development for the sector in 2008 is the increased presence of China in the market as a buyer, as the country continues to be crippled by a lack of pork supplies following the outbreak of PRSS. China, this year is expected to import 150 000 tonnes of pork in an attempt to reduce the pressure on domestic prices. Purchases by Japan are expected to increase by 2 percent, in line with increased domestic demand and a reduction in domestic production brought by high feed costs. By contrast, shipments to the Republic of Korea are expected to increase, especially from Chile benefiting from lower import duties agreed to in the Korean-Chile Free Trade Agreement (FTA), sustained by rising domestic demand. Pigmeat deliveries to the Russian Federation, which continue to be subject to tariff rate quotas, are expected to remain stable, a reflection of large production gains consistent with prevailing government policy to stimulate output.

As for pigmeat exports, sales from Brazil and the United States are forecast to rise, partly a reflection of increased shipments to China and Japan. By contrast, reflecting strong currencies and higher feed costs, exports from Canada are now anticipated to decline while those from the European Union will remain stable in 2008. Imports of pigmeat by Mexico are to decrease substantially this year due to increasing consolidation of the industry, which helped raise production.

POULTRY MEAT

|

|

Poultry competitiveness in converting feed into meat is favoured when feed prices are high

|

|

Animal diseases, such as Avian Influenza (AI), continue to shape poultry trade patterns. Nevertheless, in developing countries, sustained high economic growth will continue to increase demand for meat, especially for low priced protein-rich meats such as poultry. The cost efficiency of poultry production can be largely attributed to the relatively high feed-to-meat conversion ratios that can be achieved when compared with the production of other types of meat. This implies that as the prices of animal protein rich products rise because of higher feed prices, as is currently happening, consumers tend to prefer relatively cheaper meat types and cuts. In line with these expectations, global poultry meat production in 2008 is projected at 93 million tonnes, almost 4 percent higher than last year. The growth is expected in all regions of the world. Poultry production in the United States is expected to increase by more then 2 percent. Canada's effort to contain its 2007 AI outbreak has been successful and the output is expected to increase slightly. Production may increase by 6 percent in South America. Argentina, Chile and Colombia will achieve 10 percent increases in production, while the growth rate in Brazil, the largest producer in the region, is expected to be about 5 percent. Adjusting to growing domestic consumption and export demand, Thailand broiler production is expected to increase by more then 6 percent in 2008. This year, despite recurring outbreaks of AI, China is anticipated to increase its poultry output through measures that improve feed conversion into meat. Most other major poultry producers, namely Australia, Indonesia, the Islamic Republic of Iran, the Philippines, the Russian Federation, South Africa and Turkey, are expected to increase their poultry production in 2008 in response to improved domestic demand. In Africa, poultry output is anticipated to increase by 1 percent, mostly reflecting higher production in North Africa. Despite the resurgence of AI in parts of the European Union, prospects for poultry production in 2008 remain relatively stable. Competitive prices, with respect to other meats, consumer preference for white meat and increased use in food preparations still favour poultry meat as in 2007. On the other hand, India and the Republic of Korea have increased poultry culling in order to stop the spread of the H5N1 bird influenza virus. This is expected to lower production in 2008 by 3 and 2 percent, respectively in these countries.

Trade in poultry meat is projected to rise by 4 percent to 9.6 million tonnes, due to increased import demand. Half of that growth is expected to originate in Asia, especially China where consumers are substituting broiler meat for pigmeat, the prices of which have been relatively higher. The Philippines and the United Arab Emirates are expected to increase poultry imports substantially to meet the domestic demand. Saudi Arabia, which is expected to decrease import tariffs for frozen poultry to help control food price inflation, will also increase poultry imports by 2.6 percent. The European Union is expected to become a net importer in 2008 with Brazil as the major supplier. In 2008, imports will increase by 1.4 percent paying full over quota duty because high domestic prices will still make it profitable. Imports by Turkey for 2008 are anticipated to recover from the 2006 contraction caused by AI reflecting consumer confidence returns. The Russian Federation is also increasing its imports of poultry meat as consumer demand continues to expand because of growing income and the shortage of supplies of other meat. Imports by Japan, on the other hand, are anticipated to decline by 1.6 percent.

As for poultry exports, larger sales of chicken meat by Brazil are expected to account for 38 percent of the global expansion in poultry trade. Exports from the country are now anticipated to grow by 4 percent, to almost 3.6 million tonnes, in response to strong import demand from countries in the European Union, the Near East countries, such as Saudi Arabia and the United Arab Emirates and Asia particularly Hong Kong and Japan. The Thailand broiler industry anticipates that exports of cooked chicken meat will continue to grow at least by 7 percent in 2008, in line with strong demand from the European Union and Japan despite recurrence of AI this year. Thailand has devised an approach, referred to as "compartmentalization", the goal of which is to convince major importing countries to import from those areas meeting stringent biosecurity measures, regardless of the country's overall AI status. The forecast for exports from the United States points to an expansion of 4 percent from last year. The United States accounts for one-third of the global expansion in poultry trade, despite the growing competition from Brazil on Asian markets. Its favourable exchange rate has kept the United States' exports competitive in Chinese and the Russian Federation import markets.

SHEEP AND GOAT MEAT

|

|

Global ovine output forecast to increase despite substantial production decline in Oceania

|

|

Global ovine production is forecast to rise by 2 percent to 14 million tonnes in 2008, particularly due to a higher output in China, the Islamic Republic of Iran and Pakistan. Output is also expected to rise in Africa, especially in Egypt, Morocco and the Sudan, accounting for almost two-thirds of the increase in production of the continent. North American output should increase, particularly in the United States, by more than 1.9 percent, as the income growth in the Hispanic community improves the demand for lamb. By contrast, production is anticipated to contract in most other developed countries. Despite improved weather conditions in Australia, lamb output should fall in 2008, mainly because of animal retention for flock rebuilding. Drought in the North Island of New Zealand and overall poorer climatic conditions may keep 2008 production even with that of 2007. Production in the European Union should continue to decline in 2008 by about 1.4 percent, reflecting the lingering effects of the decoupling of annual premiums for ewe numbers in major producing countries.

World exports of sheep and goat meat in 2008 are estimated to decline by 6 percent to 825 thousand tonnes. Overall sheep meat exports from Australia are now set to contract in 2008 by 9 percent, restricted by tighter supplies and a strong AUD. A similar situation is also expected for New Zealand. Among the major ovine meat importers, purchases by the United States are forecast to increase by 2 percent, driven largely by increased consumer demand. Lower domestic demand, partly caused by relatively high prices of sheep meat, should keep imports of the European Union at the same level of the previous year. It nevertheless remains by far the most important destination of trade in ovine meat.

|

June 2008

June 2008