June 2008 June 2008 | ||

|

Food Outlook | |

| Global Market Analysis | ||

|

SUGAR

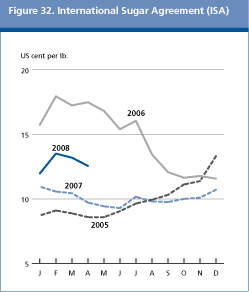

International sugar prices recover during the first quarter of 2008 Since the last issue of the Food Outlook in November 2007, international sugar prices1/ have increased by 30.7 percent, in spite of an expected second consecutive year of surplus supplies in 2007/08. In March 2008, prices reached a 20-month high of United States 15.21 cents per pound, before declining by the end of the month. The average price for April of United States 13.20 cents per pound was 5 percent lower than the average price in March but around 29 percent higher than the corresponding month in 2007.

The apparent disconnection between international sugar prices and market fundamentals illustrates the influence of factors exogenous to the sugar market itself, including high energy prices, the weakness of the US Dollar, and the potential influence of investment funds on the sugar futures markets. FAO expects the market will tighten somewhat, given anticipated drop in production for 2008/09.

Global sugar production to expand further in 2007/08 FAO's latest estimate for world sugar production in 2007/08 now stands at 168 million tonnes, 1.1 million tonnes less than anticipated earlier and almost 2 million tonnes above the previous season. The downward revision is based on lower than expected sugar output in Australia, China and India. However, global sugar production is estimated to exceed consumption by as much as 9.8 million tonnes, contributing to a build-up of global inventories and an increase in stocks-to-use ratio to 48.3 percent, up from 46.2 percent in 2006/07. Led by a strong performance in Brazil developing countries will be responsible for the bulk of the growth in output, which is forecast to reach 127.5 million tonnes, a 2.1 percent increase compared with 2006/07. Total production in developed countries is forecast at 40.4 million tonnes, 1.8 percent less than the previous year, as a result of lower than anticipated output in Australia. In the Latin America and Caribbean region, Brazil is estimated to produce 34.1 million tonnes in 2007/08, a strong 6.6 percent, or 2 million tonnes, more than in 2006/07. Favourable weather conditions and high sugar extraction rates helped boost sugar production to an all-time high. It is estimated that 56 percent of Brazil's 2007/08 sugarcane harvest will be processed into ethanol. This compared with a 50 percent share in 2006/07. The introduction of flex-fuel vehicles (FFVs) in 2003, which can run on pure ethanol, gasoline, or a combination of the two, has enabled consumers to take advantage of the price differential between ethanol and gasoline. Rising gasoline prices relative to ethanol prices encourages consumers to switch to ethanol fuel, which in turn provides additional incentive for millers to process more sugarcane into ethanol and less into sugar. The demand for ethanol is becoming a fundamental component of the sugar market in Brazil, especially as the number of FFVs continues to expand. Today, these types of vehicles account for over 85 percent of passenger cars sold in Brazil. Sugar production is also expected to increase in Argentina, buoyed by a 10 percent area expansion to cater for the expected rise in ethanol demand. Strong growth is expected in Peru, while sugar output in Colombia should remain relatively unchanged from 2006/07. Table 7. World production and consumption of sugar

* Jan-Apr 2008

In Mexico, sugar production is estimated at 5.7 million tonnes, a 1.9 percent rise over 2006/07. The growth in production reflects a slight increase in planted area and higher yields. Production will be just enough to cover domestic consumption, but the full opening of the sweeteners market, free of duties, under the North American Free Trade Agreement (NAFTA), could result in a greater usage of high fructose corn syrup (HFCS) sourced from the United States by local industries, at the expense of locally produced sugar, leading to calls for the Government to introduce substantive measures to support the sector. Sugar output should expand also in Guatemala, the second largest sugar exporter in Latin America and the Caribbean, as a result of a 10 percent increase in cane area. In Cuba, sugar output is forecast slightly above last's year level, but still below expectations, as poor infrastructure and low productivity continue to constrain the sector. Output is also expected to rise in the Dominican Republic to 500 000 tonnes, up 4.5 percent from 2006/07. Aggregate sugar production in Africa is set to reach 10.7 million tonnes in 2007/08 2.1 percent above the previous year. Production in most countries in the region is too small to have a mentionable impact on international sugar prices. However, sugar production has been rising at a steady 2.2 percent per annum over the past five years, compared with a ten-year average annual growth of 1.5 percent. Expansion in production underpins rising domestic and regional sugar consumption, but it also mirrors expansion programmes to boost exports, as a number of African sugar producing LDCs will gain duty and quota free access to the European Union sugar market from 1 October 2009, under the EBA initiative3/. In South Africa, the largest sugar producer of the continent, sugar production is forecast at 2.5 million tonnes in 2007/08, up 3.3 percent from the weather damaged crop of the previous year. Expected gains are also foreseen in Kenya, where output could reach 600 000 tonnes, up 5.7 percent from 2006/07. The greatest challenge facing the industry in that country is the impact of full liberalization of the sugar trade within the Common Market for Eastern and Southern Africa (COMESA). Already, Kenya has committed to raise its free of duty import quota by 40 000 tonnes within the context of the COMESA free trade agreement for the next three years, and to reduce gradually out-of-quota tariffs. Increases in sugar output are also forecast for 2007/08 in Mozambique, the United Republic of Tanzania, Zambia and Zimbabwe and where rehabilitation and expansion programmes have been launched to take advantage of improved market access to the European Union under the EBA initiative. In Egypt, sugar production is expected to decline slightly from last year's output of 1.9 million tonnes. The emphasis is on expanding the area sown to beet, which reached about 68 000 hectares in 2007, as the Government is keen on promoting beet ahead of cane production to mitigate the problems posed by limited area and water resources. Production in Ethiopia is estimated at 310 000 tonnes, down 50 000 tonnes from 2006/07, due to unfavourable weather condition, but the sector may benefit from renewed public support. The Government has recently put out plans to expand sugar output five fold by 2010. In Swaziland, sugar production is expected to remain relatively unchanged from last year's level. Estimated production in Asia now stands at 65.8 million tonnes for 2007/08, marginally lower than in 2006/07 and 3.6 percent below the FAO estimate in November, mainly reflecting smaller than anticipated production in China and India. Sugar output in India is now estimated to decline by 6.2 percent to 28 million tonnes after two seasons of increases. The industry is still struggling to cope with supply levels that are well above domestic demand, leading to low internal sugar prices and a significant increase in inventories. The Government has introduced a series of measures to support domestic prices, including 5 million tonnes buffer stock and the implementation of export subsidies. Similarly, sugar production in China is set to reach 13.7 million tonnes, below earlier estimates as severe frost damaged crops in the Guangzi province, China's largest sugar producing region. In Thailand, sugar output is expected to increase by 7.7 percent to 7.6 million tonnes in 2007/08, following an increase in cane plantings. Likewise, production in Pakistan may surge by 14 percent to an overall 4.4 million tonnes, influenced by remunerative prices over the past two crop years. In the rest of the region, an expansion is also foreseen in Indonesia and Turkey. In Europe, sugar output in the EU-27 rose slightly to 17.4 million tonnes in 2007/08, following favourable growing conditions, which boosted yields, compensating for a small reduction in beet area. Under the reform of the sugar regime, the European Union aims to cut sugar production by 6 million tonnes over the four years of its restructuring programme. So far, quota renouncement by producers has been below expectations, leading the EU Commission to announce that it will make compulsory quota cuts by 2010, if the proposed reduction of sugar output is not achieved. Production is to decline in the Russian Federation by 5.4 percent, as a result of less than favourable growing conditions which reduced beet yields. The industry benefits this year from increased external protection, under a seasonal import tax which spans six months beginning in December 2007, as this was raised from USD 140 to USD 220 per tonne. Sugar output is also expected to fall in Ukraine, following a surplus in 2006/07, which created a large domestic market imbalance and depressed prices. As part of its commitment to the World Trade Organization (WTO), the country agreed to open a tariff rate quota for raw sugar of 206 000 tonnes, increasing annually up to 267 800 tonnes in 2010. This move may have strong negative implications for production as the domestic sugar industry will face increasing competition from low cost sugar imports. In the rest of the world, sugar production in the United States is estimated at about the same level as 2006/07, reflecting a return to normal growing conditions. The country's area sown to beet is expected to come under pressure as some producers may switch to higher priced alternative crops, such as grains. In Australia unusually wet weather in the main sugar producing region reduced output to 4.9 million tonnes, slightly down from the previous year.

Developing countries behind growth in sugar consumption Global sugar consumption in 2007/08 is estimated to reach 158.2 million tonnes, 4.2 million tonnes more than in 2006/07, reflecting increases in Asia and in Latin America and the Caribbean. World sugar consumption has expanded by an average 3.8 percent per annum over the past three years, well above the ten-year average of 2.5 percent. The global expansion in consumption is being driven by rising per capita income in developing countries and lower prices. On average, per caput sugar consumption is estimated to increase from 23.6 kg in 2006/07 to 23.9 kg in 2007/08. Current price relationships are also expected to induce some shifts away from high fructose corn syrup (HFCS) to sugar, given high maize prices. Sugar consumption in developing countries is estimated to grow by 3.5 percent to 109.4 million tonnes, sustained by increases in per caput income and population growth. Sugar consumption in India, the largest sugar consuming country in Asia, is foreseen at 23.1 million tonnes, up from 22.4 million in 2006/07, buoyed by lower prices and strong economic growth. Similarly, year-on-year utilization is expected to increase in China, boosted by rising per capita income, strong demand from the food and beverages sectors, and weaker competition from alternative sweeteners such as HFCS. Sugar consumption is also forecast to rise in Latin America and the Caribbean, where most of the growth will be accounted for by Brazil and Mexico where utilization is estimated at 12.2 million tonnes and 5.7 million tonnes, respectively. Year-on-year sugar offtake is forecast relatively stable in developed countries, particularly in the EU-27, Australia and Japan, as these markets are already saturated and population growth is limited. Relatively higher growth is expected in the United States, reflecting greater use of sugar in food and beverage processing.

World sugar trade to remain flat on weak import demand World sugar trade is forecast to reach 45.6 million tonnes in 2007/08 (October/September), slightly lower than the 2006/07 trade estimate, reflecting lower imports by China, Indonesia, Pakistan and the Russian Federation. The decline in trade was mainly caused by reduced imports, following higher production in most traditional importing countries. In fact, overall production in the world's five largest sugar net-importers is expected to grow by 2.6 percent in 2007/08. In Europe, imports by the Russian Federation, the world's largest sugar buyer, are expected to increase by 200 000 tonnes to 3.5 million tonnes in 2007/08, despite a much higher seasonal import duty of USD 240 per tonne, to compensate for the expected decline in production. The import duty has little effect on the total volume of imports but rather influences their distribution throughout the year. Overall imports by the EU-27 could reach 3.2 million tonnes, virtually the same level as in 2006/07 by the EU-25, while purchases by Egypt and Ukraine are forecast to rise, mainly on account of lower than anticipated domestic output. In Asia, purchases by China, Indonesia and Pakistan are also foreseen to drop, mainly reflecting improved domestic supply availabilities. In the rest of the world, deliveries to the United States are forecast at 1.9 million tonnes, a 1.6 percent increase over the previous year. Imports by countries in Africa are projected to expand by 3.6 percent to 9.2 million tonnes, sustained by strong domestic demand. On the outset, sugar stands to benefit from the development of regional free trade agreements between several African countries. Free trade could stimulate imports to less efficient sugar producing markets and enable consumers to benefit from lower domestic prices. Export availability is anticipated to increase slightly in 2007/08, after a strong 16.3 percent growth in 2006/07. However, Brazil, the world's largest exporter, may cut shipments by 3.2 percent to 20.8 million tonnes, reflecting tighter competition in world markets, since the return of India as a net-sugar exporter. It is reported that India has gained market share from Brazil in the Asia market, owing to competitive pricing resulting from its cost-freight advantage. Overall exports from Asia are foreseen to exceed 13.4 million tonnes, up 1.3 million tonnes, or 0.8 percent from 2006/07. In India, exports could reach 2.7 million tonnes, driven by ample supplies and incentives created by the government's export subsidy scheme. A strong increase in domestic output is expected to boost sales by Thailand to 5 million tonnes, mostly directed to neighbouring markets. The accumulated surplus over the past two years has caused some exporters to struggle with large sugar inventories. The challenge is to find market outlets for these volumes in the midst of an over-supplied global market. 1. International sugar prices are based on the International Sugar Agreement (ISA), produced by the International Sugar Organization (ISO), and computed as a simple average of the close quotes for the first three future positions of the Intercontinental Exchange Sugar Contract No. 11. 2. Sugar production figures refer to centrifugal sugar derived from sugar cane or beet, expressed in raw equivalents. Data relate to the October/September season. 3. Other African, Caribbean and Pacific Group of States (ACP) are also keen on boosting production under the Economic Partnership Agreements (EPAs) of the European Union. The EPAs will replace the trade chapters of the 2000 Cotonou agreement, which regulated the sugar trade between both parties. The European Union has offered duty and quota free access to the ACP countries after 2015. The impact of such a proposal on the ACP group, and individual countries within ACP, is still uncertain. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GIEWS | global information and early warning system on food and agriculture |