|

|

COARSE GRAINS

PRICES

|

|

Prices remain high

|

|

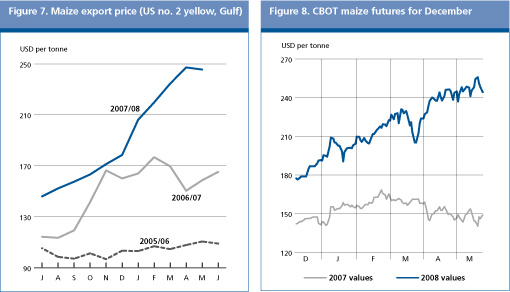

Strong demand coupled with uncertainties surrounding this year's crops has continued to push prices higher so far this year. The increase in energy prices and a continuing slide in the US Dollar have also provided support. Depending on the type and origin, most coarse grains registered substantial price gains in recent months, rising by as much as 45 to 65 percent above the corresponding period last year. International maize prices started to increase from February, breaking all-time high levels on several occasions since. The price of United States' maize (No. 2 Yellow, Gulf) averaged USD 247 per tonne in April, up 20 percent since the beginning of the year. By mid-May, the United States' maize prices were at around USD 240 per tonne, down from April but still 50 percent, or USD 80 per tonne, more than the corresponding period last year. The main factor for the continuing strength in maize prices is tight supplies. In the United States, the world's largest maize producer and exporter, the reported decline in this year's planted area coupled with cold and wet weather which slowed seedings continued to lend support to maize as well as to prices of other feed grains in April and early May. In other markets, feed Barley prices have increased by around 45 percent compared with last year's level. Good prospects for this year's crops have put some pressure on barley prices but the general tight market situation is seen to continue until production estimates become firmer. Sorghum prices have risen by around 60 percent compared with last year boosted by strong import demand and record purchases by the European Union.

Price developments in the futures market also echoed the prevailing situation in the cash markets with expectations of tighter maize supplies and strong demand pushing up prices. By mid-May, the December 2008 contract at the Chicago Board of Trade (CBOT) stood at around USD 244 a tonne, some 60 percent, or some USD 90, above the corresponding period in 2007. Based on the current supply and demand forecasts for the new season, prices could be expected to remain high. While, to some extent, the greater abundance of wheat could dampen the demand for coarse grains and put some downward pressure on prices as the season progresses, the general fundamentals remain supportive with further gains still possible especially if production in 2008 falls below the current expectation. On the demand side, the most important factor is likely to be the eventual size of maize intake by the United States ethanol sector.

| |

2006/07 |

2007/08 |

2008/09 |

Change: 2008/07 over | | | |

estim. |

f'cast |

2007/08 | | |

million tonnes |

% | |

WORLD BALANCE | | | | | |

Production |

987.5 |

1 071.6 |

1 088.6 |

1.6 | |

Trade |

111.3 |

123.0 |

111.5 |

-9.4 | |

Total utilization |

1 017.5 |

1 072.0 |

1 096.3 |

2.3 | | Food | 179.8 | 182.6 | 185.1 | 1.4 | | Feed | 616.3 | 635.9 | 630.4 | -0.9 | | Other uses | 221.3 | 253.5 | 280.9 | 10.8 | |

Ending stocks |

162.2 |

159.4 |

148.0 |

-7.1 | | | | |

SUPPLY AND DEMAND INDICATORS | | | Per caput food consumption: | | | | | | World (kg/year) | 27.6 | 27.6 | 27.6 | -0.3 | | LIFDC (kg/year) | 28.6 | 28.7 | 28.8 | 0.2 | | World stock-to-use ratio % | 15.1 | 14.5 | 13.6 |

| | Major exporters' stock-to-disappearance ratio % | 12.6 | 11.7 | 9.6 | | | | | | | | | |

2006 |

2007 |

2008 |

Change:

Jan-Apr 2008 | | | | | |

over

Jan-Apr 2007 | |

FAO Coarse Grains Price Index | | | | % | | (1998-2000=100) | 120 | 162 | 225* | 37 |

* Jan-Apr 2008

PRODUCTION

|

|

Coarse grains production in 2008 to rise above last year's peak

|

|

With the first of the major 2008 coarse grain crops already being harvested in several countries around the world, FAO forecasts world output of coarse grains at a record 1 088.6 million tonnes, slightly (1.6 percent) up from the global high of last year. After an exceptionally sharp increase in 2007, maize production is expected to remain virtually unchanged in 2008, at 779.6 million tonnes. Larger crops already being gathered in the southern hemisphere and a recovery in Europe's output are expected to offset a production decline in the United States.

In South America, harvesting of the main season crops is underway and output is expected to increase to a new record of nearly 89 million tonnes, following area increases in Argentina and Brazil, the region's largest producers, in response to high international prices. In southern Africa, despite far from ideal weather conditions throughout the season, with late planting rains, followed by floods and a subsequent return to excessive dryness in parts, the overall outlook for the main coarse grain crops is judged to be favourable, particularly in South Africa which was affected by drought last year.

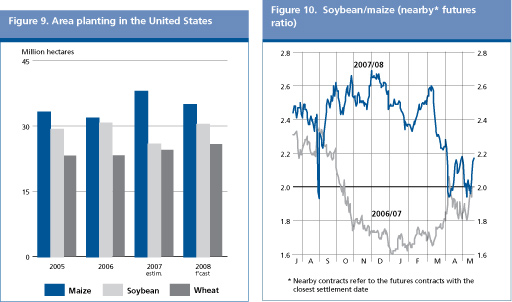

In the northern hemisphere, the bulk of the major 2008 coarse grain crops will be sown in the coming weeks. In the United States, area under maize is forecast to decline by about 8 percent after last year's exceptional plantings but, nonetheless, the expected area would still be at a very high level relative to recent history, reflecting strong demand and high prices. However, with significant planting delays experienced in late April and early May because of wet weather, achieving the planned area will depend crucially on drier weather during the remainder of the planting season. Assuming producers can complete their intended plantings within the normal planting window, a crop of around 308 million tonnes is expected in 2008, some 7 percent down from last year.

| |

According to the Prospective Plantings Report (USDA, 9 May 2008), farmers in the United States are expected to reduce the area of maize to about 35 million hectares, after last year's exceptionally high level of almost 38 million hectares, which was the largest area since 1944. However, although down significantly from last year, this remains a very high level, reflecting the continuing strong price outlook for maize. The area coming out of maize is expected to be shifted back to other crops because of rotational requirements and the prospect of equally good, if not better, returns from some alternative crops. The main alternative in most cases will be soybeans, production of which was sharply reduced last year in favour of maize, but for which returns are expected to be more attractive this year, given higher prices and less input costs compared with maize. This is expected to be particularly the case in eastern parts of the Corn Belt where soils are less suited to maize and obtaining high maize yields needs perfect weather as well as high inputs. In these parts soybeans are a surer option as shown in the trend in nearby soybean/maize price ratio since January 2008. From a historical perspective, whenever the ratio exceeds two, the general bias favours soybean over maize, resulting in a shift of planting area from maize to soybeans.

| |

In Europe, maize output is forecast to recover sharply from last year's reduced level when drought affected crops in some of the main producing countries in eastern parts of the region such as Hungary, Romania and Ukraine. This year's maize crop in Asia is forecast to remain virtually unchanged from last year's good level at 207 million tonnes. Production in China, by far the biggest producer in the region, is expected to remain well above the average of the past five years at 149 million tonnes.

Regarding barley, the second most important coarse grain, output is forecast to increase significantly in 2008 by some 10 percent to nearly 148 million tonnes. In Europe, output is seen to rise sharply by 12 percent, reflecting increased plantings in several countries, but also a recovery of yields after adverse weather in parts last year. In the European Union, as for wheat, the removal of the compulsory set-aside requirement for the current cropping year facilitated an area expansion, concurrent with the significant increase in wheat plantings. In North America, however, the barley area in Canada is expected to decrease at the expense of larger areas dedicated to wheat, but output may increase in the United States. Among the other significant barley producing countries around the world, larger crops are expected also in North Africa, where weather conditions improved after drought last year, and also in Australia, where large plantings are planned if sufficient timely rains arrive.

World sorghum output in 2008 is forecast at some 64 million tonnes, up by 2.4 percent from the previous year's crop. The increase comes from larger crops in most of the significant sorghum producing countries with the exception of the United States, where plantings are expected to decline.

TRADE

|

|

Trade in 2008/09 to contract on smaller world demand for maize and sorghum

|

|

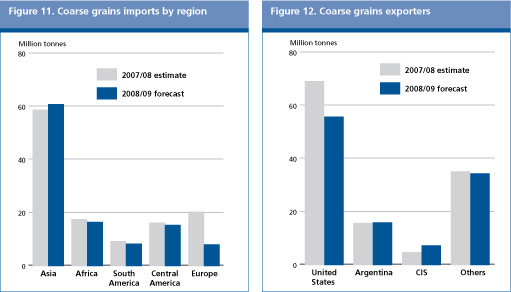

World trade (exports) in coarse grains in 2008/09 (July/June) is forecast to contract sharply, falling to 111.5 million tonnes, down 13 million tonnes, or 9 percent from the estimated exports of 2007/08. This prospect represents a near complete reversal of the situation observed in 2007/08 when higher maize and sorghum exports boosted trade in coarse grains to a record volume. International trade in maize and sorghum is expected to retreat to more normal levels in the new season. The main reason is the European Union: whereas in 2007/08, the European Union resorted to importing a record volume of coarse grains, primarily from Brazil and the United States, to cover the feed grain shortfall caused by the reduction in domestic wheat supplies, the expected recovery in its wheat production this season reduces the need for such large imports in the new season.

World maize trade in 2008/09 is forecast to reach 85 million tonnes, down almost 12.5 million tonnes from the peak in 2007/08. Global trade in sorghum is forecast to drop to roughly 7 million tonnes, down 2 million tonnes from estimated exports in 2007/08. However, trade in barley is seen to increase by almost 3 million tonnes to 16.5 million tonnes. The increase reflects larger export availabilities from Australia, the European Union, the Russian Federation and Ukraine which together are likely to more than offset declines in Canada and Kazakhstan. Trade in oats and rye is expected to change little from last year, remaining at 2 million tonnes and 500 000 tonnes, respectively.

On a regional basis, in Europe, as was already mentioned, imports are forecast to fall sharply, owing to lower purchases by the European Union, to below 8 million tonnes, down from the12 million tonnes peak in 2007/08. Asia is by far the largest market for coarse grains and total imports by countries of the continent are forecast to increase by a further 2 million tonnes to a record volume of over 60 million tonnes in 2008/09, representing nearly 55 percent of global trade. Most of the anticipated increase is expected in the Islamic Republic of Iran, Saudi Arabia and the Syrian Arab Republic, mainly in response to anticipated reductions in domestic production levels in 2008. Larger imports are also forecast for the Republic of Korea due to strong feed demand.

In Africa, total imports are likely to decline by 1 million tonnes, to 16 million tonnes in 2008/09. In Morocco, a recovery in output from last year's drought-reduced barley crop is expected to result in lower imports. In addition, an expectation of bumper maize crops in South Africa is expected to help the country to cut imports and resume its regional position as a major maize exporter. However, in Kenya, a likely decline in this year's maize production could result in a doubling of imports. Little variation is expected in imports by most other countries in Africa.

In Latin America and the Caribbean, aggregate imports are forecast to decline by nearly 2 million tonnes to roughly 23 million tonnes in 2008/09. Maize imports by Mexico are forecast to decline by 1 million tonnes due to the expected increase in domestic production. Imports by Brazil could be halved given the expectation of a record maize crop this year. Imports by most other countries in the region are forecast to remain unchanged from 2007/08.

The anticipated reduction in world import demand is expected to ease the impact of somewhat tighter export supplies. Among the major exporters, the cut in maize production in the United States combined with the expected expansion in domestic utilization would result roughly in a 13 million tonnes drop in exports. Exports from Argentina are also forecast to decline mostly as a result of the decline in production. But shipments from Australia and Ukraine are forecast to double due to bigger crops while larger export supplies are also expected in South Africa. Brazil will again be among the world's largest maize exporters in the new season. Maize exports from China (Mainland) are forecast to remain unchanged from the estimated level in 2007/08.

UTILIZATION

|

|

Total utilization to increase in 2008/09 primarily on higher industrial use

|

|

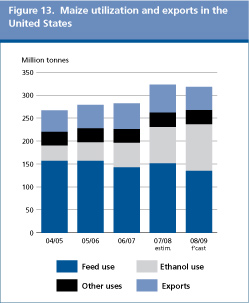

World utilization of coarse grains in 2008/09 is forecast to reach 1 096 million tonnes, up 2.3 percent, or roughly 24 million tonnes, from the previous season and above the ten-year trend for the second consecutive season. This expansion will be driven primarily by strong growth in industrial use. As in previous seasons, the expanding use of maize for ethanol production is behind the surge in industrial usage of all grains and most of that expansion is taking place in the United States. Total utilization of grains for production of ethanol in 2007/08 is estimated at roughly 98 million tonnes, up 27 million tonnes, or 40 percent, from the previous season. Maize accounts for most of this use, at nearly 92 million tonnes, of which some 79 million tonnes are used in the United States alone. Based on the latest forecast (9 May 2008) from the United States Department of Agriculture (USDA), the maize use for production of ethanol in the United States will increase to 101.6 million tonnes in 2008/09, nearly 25 million tonnes more than in 2007/08 and almost twice as much as in 2006/07.

Total feed use of coarse grains is forecast to decrease slightly from the estimated record in 2007/08, to around 630 million tonnes. Larger volumes of wheat, especially in the European Union, and growing supplies of distillers' dried grains (DDG) in the United States are likely to compensate for the lower availability of coarse grains such as maize in feed rations. Global food consumption of coarse grains is forecast to reach 185 million tonnes, up 1.4 percent, or 2.5 million tonnes, from 2007/08 and close to trend. The bulk of the increase is anticipated in Africa, most notably in Malawi and Nigeria, but food consumption of coarse grains is also expected to increase in a few countries in Asia and South America.

STOCKS

|

|

Stocks to decline sharply on utilization exceeding production

|

|

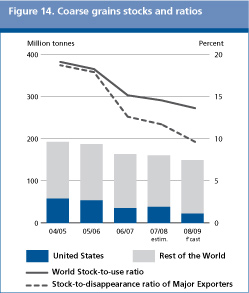

Based on the preliminary forecasts for production in 2008 and utilization in 2008/09, world coarse grain stocks by the close of seasons in 2009 could fall by as much as 7 percent, or 11 million tonnes, from their reduced opening level, to 148 million tonnes. At this level, the world stocks-to-use ratio for coarse grains is expected to fall to a new low of just 13.6 percent, roughly one percentage point below its previous low in 2007/08. The reduction in total world inventory in 2008/09 and the drop in stocks-to-use ratio both stem mainly from the supply and demand of maize in the United States. While maize production in the United States is expected to decline by 24 million tonnes in 2008, total domestic utilization is increasing. Although exports from the United States are expected to decline in 2008/09, stocks would still have to be drawn down considerably to meet the anticipated demand. Total coarse grains stocks in the United States are forecast to fall to around 23 million tonnes, down 16 million tonnes from their opening level and the smallest level since the mid-1990s when they were at just over 14 million tonnes.

The anticipated decline in reserves held in the United States is likely to be only partially offset by increases in stocks held in other major exporting countries. Slightly higher inventories are currently forecast for Argentina, Australia and the European Union while a forecast reduction in maize production in Canada is expected to result in lower stocks in that country. Further, major exporter's stocks-to-disappearance ratio (i.e. domestic consumption plus exports) is expected to decline in the new season, to 9.6 percent, down 2 percentage points from 2007/08 and well below the 15 percent during the early years of this decade. Elsewhere, favourable crop prospects in Brazil, South Africa and Ukraine are expected to boost stock levels in those countries. Stocks in China are also forecast to increase should the anticipated production be realized.

|

June 2008

June 2008