June 2008 June 2008 | ||

|

Food Outlook | |

| Global Market Analysis | ||

|

OILSEEDS, OILS AND MEALS1/

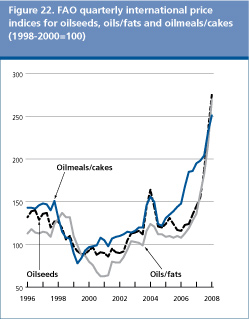

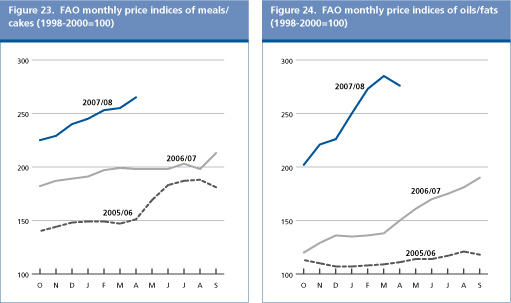

The steady rise in international prices of oilseeds, oils and meals that started in 2006 has continued during the first half of the current season (October 2007-September 2008). In January-March 2008, corresponding to the second quarter of the 2007/08 season, prices climbed to new record levels: on average, the FAO price index for meals/cakes rose 29 percent and 70 percent from the 2006/07 and 2005/06 corresponding values, respectively. For oilseeds and oils/fats the gain was even larger, with the index up or 94 percent compared with last year and 140 percent from 2006.

The lingering price strength since the beginning of 2007/08 reflects a tighter global supply and demand outlook for oilseeds and derived products as well as spill-over effects from world grain markets. In 2007/08, a decline in world oilseed production is leading to reduced growth in global oils/fats supplies and to an unprecedented fall in meal supplies. Combined with further expansion in global oil and meal demand for food, feed and energy uses, a steep reduction in inventories (especially of oilmeals) has become inevitable, and critically low stock-to-use ratios for both oils and meals have propelled international prices upward. In the last few months, international prices have also been particularly volatile as the market responded sharply to unexpected weather developments and sudden trade policy adjustments in a number of exporting and importing countries. Also, the spikes and erratic price movements have caused import flows of countries like China and India to be less regular and predictable, thereby adding further instability to world markets.

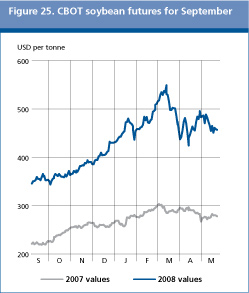

With current forecasts for the next marketing year pointing toward a marked recovery in global oilseed plantings and thus production, in 2008/09, total oil and meal output would be sufficient to meet demand. As a result, prices for oilseeds and derived products could stabilize and possibly weaken during the remainder of this season and in early 2008/09, assuming the projected rise in plantings materializes and weather conditions develop normally. The futures market seems to point to the same direction: after rising steadily, last March, soybean futures prices (CBOT September 2008 contract) began to falter and, at the beginning of May, futures were traded at similar levels to those four months earlier, i.e. around USD 460 per tonne, nearly USD 100 below the peak recorded in March. However, considering that the anticipated production increases would only allow for a partial recovery of global stocks and stocks-to-use ratios, prices are expected to remain well above the corresponding values of last year. In fact, in early May 2008, CBOT soybean contracts were traded at about USD 180 (or over 60 percent) higher than in early May 2007. Moreover, a prolonged and more substantial fall in prices is unlikely because a first easing of prices can be expected to revive demand for vegetable oils as a biofuel feedstock (provided mineral oil prices remain at their current, record-high level). On the other hand, should some key consuming countries decide to adjust downward their national, mandatory, biofuel consumption targets, a significant weakening of vegetable oil prices could ensue. Considering that oilseed markets are likely to remain relatively tight, price volatility is expected to remain high in the coming months. Any surprises, such as adverse weather conditions in northern hemisphere countries (and the related changes in planting decisions and crop developments) would strongly affect world market prices. Uncertainty regarding future government policies on biofuels and on trade will also contribute to market instability.

Global oilseed output is forecast to drop 3 percent, mainly on account of lower soybean production. Compared with 2006/07, soybean production is expected to decline by 6 percent, while sunflowerseed output is poised to fall 5 percent. The anticipated expansion in global rapeseed, groundnut, palm kernel and copra production will not be sufficient to offset crop declines envisaged for soybean and sunflower. The drop in total oilseed output is largely driven by increased competition from grains, notably in the United States but also in China and in CIS countries, and by unfavourable weather conditions in key growing regions. With regard to soybeans, plantings in the United States have fallen by 16 percent, as farmers shifted land to maize. Consequently, output dropped to 70 million tonnes, about 18 percent below the average of the last three seasons. Similarly, in China, production has declined by 12 percent year-on-year, due to a contraction in area and yields. In response to these reductions, soybean growers in South America, where the 2007/08 crop is currently being harvested, have raised plantings substantially. Nevertheless, the region's aggregate output is estimated to increase by only 3 percent due to only limited or no improvements in yields following unfavourable weather conditions. As for sunflowerseed, this season's drop in global production is confirmed, largely reflecting poor harvests in the European Union, the Russian Federation and Ukraine and in spite of a record crop recently harvested in Argentina. World rapeseed production is confirmed to rise slightly. Strong demand and high prices stimulated an increase in rapeseed area in several countries (expect China and India), but adverse weather conditions depressed yields in most growing regions. Also world groundnut production is estimated to have risen, mainly due to India's improved performance. Table 5. World production of major oilseeds

Source: FAO.

Note: The split years bring together northern hemisphere annual crops harvested in the latter part of the first year shown, with southern hemisphere annual crops harvested in the early part of the second year shown. For tree crops, which are produced throughout the year, calendar year production for the second year shown is used.

The 2007/08 crop estimates translate into an increase in global oil/fat production of less than 2 percent, similar to last season but markedly below the gains witnessed in the three preceding seasons. Palm, palm kernel, copra and groundnut oil are all expected to record sizeable increases, but the marked fall in soybean and sunflowerseed oil and stagnating rapeseed oil output is depressing overall growth. Soybean oil production alone is forecast to fall by nearly 6 percent to 36 million tonnes. By contrast, prospects for tropical oils are positive: palm oil is expected to resume expansion, with overall output climbing to a record 42 million tonnes, as outputs in Malaysia and Indonesia are forecast to rise by 9 and 11 percent, respectively. In Malaysia, growth is mostly sustained by yield improvements, whereas in Indonesia a further rise in mature area is driving expansion. As for global supplies of oils/fats (i.e. 2007/08 opening stocks plus production), these are estimated to increase by only 2 percent, as opposed to the 5 percent annual average growth recorded in recent years.

Under the influence of record-high prices, year-on-year expansion in global oil/fat consumption is expected to slow down to 3 percent in 2007/08, as opposed to about 5 percent in recent years. Less dynamic demand in developed countries and lower non-food usage seem to underlie this slowdown. In the European Union, annual growth is estimated at 2 percent, compared with an average rise of 7 percent in the past three seasons, whereas in the United States' consumption growth will be down to zero. By contrast, China's marked expansion in consumption is expected to continue, propelled by strong and steady growth in incomes and population. Also in India and other countries in Asia, consumption should continue to rise, albeit at a reduced rate compared with recent years, as consumers are struggling with rising domestic prices. Palm oil should account for about two-thirds of this season's global consumption expansion, and its share in total oil utilization is expected to rise to 26 percent. Table 6. World oilseeds and products markets at a glance

Source: FAO

Note: Refer to footnote 3 in the text for further explanations regarding definitions and coverage.

1 Includes oils and fats of vegetable and animal origin.

2 Production plus opening stocks.

3 Residual of the balance.

4 Trade data refer to exports based on a common October/September marketing season.

5 All meal figures are expressed in protein equivalent; meals include all meals and cakes derived from oilcrops as well as fish meal.

* Jan-April 2008

Although global consumption of biofuels is expected to increase further in 2007/08, the market for vegetable oil-based biodiesel is poised to grow at a reduced rate as surging feedstock prices are significantly curtailing profit margins in biodiesel production. In the European Union, reduced national incentives for biofuel consumption in some countries (in particular in Germany) and growing importation of biodiesel from overseas are slowing down the demand for vegetable oil by local processors. Expansion of the European Union biodiesel industry has temporarily come to a halt and existing biodiesel plants are reported to be operating well below capacity. Utilization of rapeseed oil by biodiesel producers in the European Union is anticipated to remain unchanged or to fall slightly during 2007/08. In the United States, where utilization of soyoil for biodiesel production almost doubled in 2006/07, demand is estimated to grow by only 5-6 percent this season. While the rise in vegetable oil prices is also affecting biodiesel industries in developing countries (for example in Argentina and Malaysia), growth prospects there seem to be better, given higher profit margins and because biodiesel is produced for both the domestic and export markets. Globally, further growth in utilization of vegetable oils as feedstock for biofuel is expected to be associated with an expansion of world trade in biodiesel.

Latest estimates for 2007/08 confirm that global oil/fat production should fall short of global consumption. The shortfall is expected to result in a 10 percent drawdown in global stocks. This drop mainly reflects the situation in the United States, where the cut in total soyoil inventories (i.e. oil inventories plus the oil contained in stored seeds) needed to compensate for this season's crop contraction is estimated at 2.1 million tonnes, or half of this season's opening stocks. Sizeable cuts in inventories are also predicted for Argentina (soybeans and their oil), Canada, China and India (rapeseed/oil) and the European Union and the Russian Federation (sunflowerseed/oil). By contrast, Asian palm oil inventories are anticipated to approach 5 million tonnes, up 16 percent from the previous season. Overall, these estimates imply a drop in the global stocks-to-utilization ratio by almost two percentage points, which explains the recent strengthening in international prices of vegetable oil.

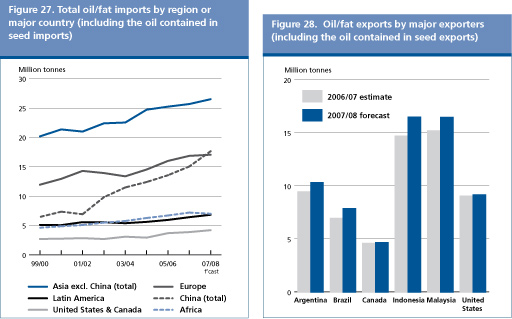

In 2007/08, the total volume of oil/fat shipments is anticipated to exceed 80 million tonnes (in terms of oils/fats plus the oil contained in oilseeds traded), which implies an about average year-on-year increase of 5-6 percent. Palm oil will account for the bulk of the anticipated expansion, while soy oil should play a less important role than usual. A significant drop in global shipments is expected for sunflower oil, due to supply shortages in the Russian Federation and Ukraine. While trade in vegetable oils destined for biofuel production is not expected to change much, shipments of the end-product, vegetable oil-based biodiesel, appears to be gaining in importance. Reportedly, the European Union alone may import 1.5 million tonnes of biodiesel in 2008. As already anticipated, developing countries in Asia, notably China, will account for most of the expected rise in global imports. In China, domestic crop shortfalls have accentuated the country's supply deficit, raising import requirements by 18 percent or 2.6 million tonnes. Purchases by the rest of Asia are set to increase around 3 percent. In several developing, import-dependent countries, notably India, imports have been affected by government trade policy measures aimed at reducing their consumers' exposure to high prices. In the European Union, imports are anticipated to remain similar to last year, implying that the rise in consumption will have to be satisfied mainly through a drawdown of inventories and a cut in exports.

With regard to global exports, reliance on South American supplies is estimated to intensify. Record shipments of soybeans are expected from Brazil. Shipments from Argentina should also rise, although flows have recently been disrupted by strikes against the introduction of higher export taxes. In the United States, exporters should be in a position to maintain last season's shipment levels thanks to the substantial release of soybeans from stocks. Meanwhile, the country's vegetable oil imports are expected to grow further, in order to satisfy rising demand from biodiesel producers. Global sunflower oil shipments should drop sharply, as some governments, notably in Ukraine, imposed export restrictions to avert domestic market shortages. Regarding palm oil, global export growth is estimated to accelerate, with shipments from Indonesia and Malaysia exceeding, respectively, 14 million and 15 million tonnes. The combined share of palm and soy in global trade (referring to oils/fats plus the oil contained in oilseeds traded) is estimated to reach 72 percent in 2007/08.

The current negative prospects for 2007/08 oilseed crops, and in particular the pronounced decline of soybean production in the United States, are expected to translate into an unprecedented 4 percent, or 9 million tonnes drop in global meal/cake output. The United States is behind the expected 10 million tonnes or 6 percent drop in global soybean meal output. Also, sunflowerseed meal output may fall sizeably, whereas moderate gains are predicted for most other meals/cakes. The drop in total meal output will be concentrated in China and the United States, offset only in part by higher production in Brazil, India and Paraguay. Global supplies of meals/cakes (i.e. 2007/08 production plus 2006/07 closing stocks) are confirmed to fall, marking a reversal from past trends.

In 2007/08, global meal consumption (expressed in protein equivalent) is estimated to rise by over 5 percent or 5.3 million tonnes. Soybean meal is expected to account for most of the prospective rise in global consumption. Total utilization is anticipated to keep rising in spite of record-high prices, mainly because in Asia, and especially in China, the consumption of livestock products is continuing to expand. The increase in global meal demand also stems from the exceptional worldwide shortage in feed grains and the resulting surge in their prices, which is encouraging the compound feed industry to replace feed grains with other products, notably oilmeals. This situation applies in particular to the European Union, where meal consumption is estimated to grow by about 5 percent.

Due to this season's marked tightening of meal supplies, a major reduction in stocks (referring to both, meals and the meal contained in oilseeds stored) will be needed in order to satisfy demand. Global inventories are estimated to drop by almost 28 percent. This unprecedented decline reflects primarily soybeans and their meal. The main country concerned is the United States, where total inventories are estimated to shrink by close to 75 percent following the release of over 11 million tonnes of soybeans. As a result, the global stocks-to-use ratio is estimated to drop sharply (from 18 to less than 13 percent), thus cancelling out the gains recorded over the past three seasons and explaining the persisting firmness of international meal prices.

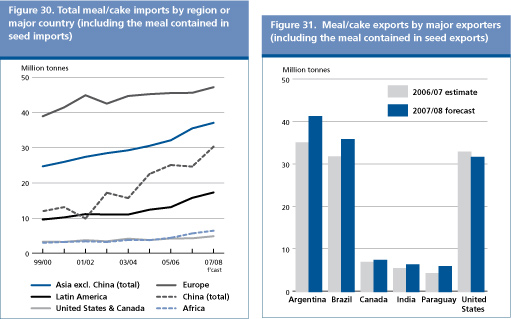

Global trade in meals/cakes (including the meal equivalent of oilseeds traded) is forecast to reach a record 147 million tonnes in 2007/08, implying a year-on-year increase of 9 percent. As in past years, the rise is expected to be mainly on account of soybeans and their meal. As for the other meals, a drop in shipments of sunflowerseed meal is envisaged. Most of the anticipated rise in global imports is expected to occur in Asia. In China alone, where total purchases are estimated to grow by about 5.7 million tonnes, or more than 20 percent from last year. Poor harvests led to a marked reduction in meal output from domestically grown crops, which, combined with steadily rising feed demand, is anticipated to push China's total imports to a record 30 million tonnes. This import level implies that about 60 percent of the country's meal requirements will be sourced abroad, the highest degree of import dependence on record. Other Asian buyers that are expected to raise their purchases include Indonesia, the Republic of Korea and the Philippines. At 44 million tonnes, the European Union is foreseen to remain the world's largest buyer of meals in the international market. The estimated year-on-year increase of 4 percent is mainly attributed to the surge in feed grain prices, which will encourage European Union feed compounders to use more oilmeals.

Regarding exports, the large release of soybeans from stocks will help the United States contain the fall in its meal shipments at less than 4 percent. Meanwhile, world market dependence on South American supplies is expected to deepen. Based on current production estimates, shipments from the region will increase by over 12 million tonnes or 16 percent, with the two main suppliers, Argentina and Brazil accounting for about 6 million and 4 million tonnes respectively. Argentina's export estimate has just been revised downward, following the disruption of export operations during recent strikes in the country. Paraguay, with total shipments approaching 6 million tonnes (compared with about 3 million tonnes until two years ago), is emerging as another important supplier in the region. In 2007/08, almost 60 percent of global export supplies should originate from these three countries. Following abundant crops, India's meal shipments are set to exceed 6 million tonnes (increasing 17 percent year-on-year), driven by the interest of buyers in Asia to import from close-by sources, as international freight rates have gone up considerably.

Farmers are expected to respond to persistently high oilseed prices and prospects of continued growth in demand by substantially expanding the area sown to oilcrops for marketing in 2008/09. The rise in area should be mainly on account of soybeans, which are expected to gain back much of the land lost to grains during the current season. As a result, after this season's unprecedented drop, global oilcrop output could climb to new record levels, assuming normal weather conditions and average yields. Based on first tentative forecasts, global soybean output may exceed 240 million tonnes, up 9-10 percent from the current season and 3 percent above the previous record achieved in 2006/07. The other oilcrops, in particular rapeseed, may also reach all-time highs, while further increases are also expected in mature oil palm areas. Spring plantings of 2008/09 oilcrops will soon come into full swing in the northern hemisphere, whereas, in the southern hemisphere, new season sowings will only begin towards the end of this year. Soybean plantings are tentatively estimated to increase by 18 percent in the United States, mainly at the expense of maize and cotton but also thanks to additional cropland brought into production and a likely expansion of double cropping. As a result, and assuming normal growing conditions, output in the country could increase by about 14 million tonnes (or 20 percent) compared with the current season, still falling 2-3 percent short of the 2006/07 level. In China, soybean production is forecast to grow about 14 percent, but also in this case output would fall short of the country's record. The South American soybean crop, which will be harvested in eqarly 2009, is tentatively forecast to grow by another 3-4 percent or close to 5 million tonnes, assuming normal weather conditions. However, these forecasts are still subject to much uncertainty, concerning, in particular, the impact of future mineral oil prices on production and transportation costs, the future level of export taxation in Argentina, and the launching of new initiatives, for example in Brazil, to reign in the ongoing expansion of soybean plantings for environmental reasons. Similarly, sunflowerseed production in the European Union, the Russian Federation and the Ukraine is anticipated to recover in 2008/09, though not enough to match previous levels. Global cottonseed output could fall, considering that, in the United States, part of the expansion in the soybean area is likely to occur at the expense of cotton. By contrast, record or near record rapeseed crops could be harvested in Canada, the European Union and Eastern Europe. In China, however, rapeseed production is not likely to recover from this season's depressed level. Overall, the above-mentioned forecasts suggest that the current tightness in global markets for oilseeds and derived products could ease as the new marketing season begins. In 2008/09, output of oils and meals should be sufficient to meet consumption. However, low levels of carry-in stocks will likely weigh on the market during 2008/09. During the course of next season, a full recovery in global inventories could be achieved for oils/fats, but this is not likely to be the case for meals. Factoring in projected demand, global stock-to-use ratios are anticipated to improve, while remaining below the levels recorded prior to this season's decline, especially in the case of oilmeals, which, given the likely continued tightness in global maize markets, could remain in high demand. Based on current market prospects for 2008/09, a stabilization of international prices for oilseeds, oils and meals around current levels, or somewhat below the actual level in the case of oils, is envisaged for the remainder of the current season and in early 2008/09. 1. Almost the entire volume of oilcrops harvested worldwide is crushed in order to obtain oils and fats for human nutrition or industrial purposes and cakes and meals used as feed ingredients. Therefore, rather than referring to oilseeds, the analysis of the market situation is mainly undertaken in terms of oils/fats and cakes/meals. Hence, production data for oils (cakes) derived from oilseeds refer to the oil (cake) equivalent of the current production of the relevant oilseeds, and do not reflect the outcome of actual oilseed crushing nor take into account changes in oilseed stocks. Furthermore, the data on trade in and stocks of oils (cakes) refer to the sum of trade in and stocks of oils and cakes plus the oil (cake) equivalent of oilseed trade and stocks. 2. For details on prices and corresponding indices, see appendix Table A-24. 3. This section refers to oils from all origins, which, in addition to products derived from the oil crops discussed under the section on oilseeds, include palm oil, marine oils as well as animal fats. 4. This section refers to meals from all origins, which, in addition to products derived from the oil crops discussed under the section on oilseeds, include fish meal as well as meals of animal origin. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GIEWS | global information and early warning system on food and agriculture |