CASSAVA

PRICES

|

|

International quotations retreat from record highs

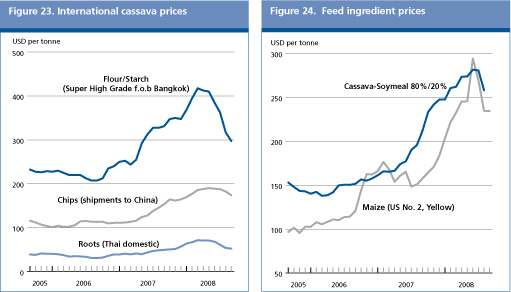

The pervasive trend in falling commodity prices that began in mid 2008 and accelerated thereafter has not spared cassava. Among the most heavily affected products are cassava flour and starch, the prices of which averaged USD 298 per tonne (f.o.b. Bangkok) by September 2008, representing a loss of almost 30percent from their peak value in March 2008.Quotations for Thai cassava chips (destined for China) have been under less downward pressure, falling to USD 174, around 9percent below the May2008 high.

Prices of chips and pellets are heavily influenced by developments in international feed markets, as cassava blended with protein rich-meals becomes an effective substitute for coarse grains and wheat. The recovery in feed grain supplies in Thailand’s principal export markets, notably China and the European Union, has strained the competitiveness of imported cassava chips and pellets, especially when soaring freight costs over much of the year are taken into account. The demand-led fall in prices of cassava chips and pellets, has been further aggravated by developments in the energy sector. Cassava chip products increasingly feature as a feedstock for ethanol distilleries in Asia, but poor ethanol returns, combined with lower crude oil prices in recent months, have depressed cassava utilization in energy production, thereby accelerating the general price decline.

International cassava starch quotations are also driven by developments in international grain markets. Demand too has deteriorated in recent months as the availability of cheaper substitutes, such as maize starch, has increased in major export destinations in Asia, resulting in a sharp drop in cassava starch import demand.

Price outlook

Prospects for cassava product prices in the short term remain bleak. A record harvest is expected in Thailand and the conditions behind the current faltering demand for cassava products are likely to prevail well into next year. Cassava product prices will have to fall considerably from current levels to enable them to regain competitiveness, barring negative supply shocks to international grain markets, resulting in rebounding grain prices.

|

|

2006

|

2007

estim

|

2008

f’cast

|

Change: 2008 over 2007

|

|

|

million tonnes fresh root equiv.

|

%

|

|

WORLD BALANCE

|

|

|

|

|

|

Production

|

222.6

|

228.1

|

238.5

|

4.5

|

|

Trade

|

38.4

|

39.6

|

30.1

|

-24.0

|

|

|

|

|

|

|

|

SUPPLY AND DEMAND INDICATORS

|

|

|

Per caput food consumption:

|

|

|

|

|

|

World

|

kg/year

|

18.1

|

18.3

|

19.1

|

4.1

|

|

Developing

|

kg/year

|

23.0

|

23.3

|

24.2

|

3.8

|

|

LDC

|

kg/year

|

62.9

|

61.1

|

62.8

|

2.8

|

|

Sub Saharan Africa

|

kg/year

|

106.1

|

103.5

|

106.4

|

2.8

|

|

Trade share of prod.

|

%

|

17.3

|

17.4

|

12.6

|

-27.6

|

|

|

|

|

|

|

|

|

Cassava Prices*

|

|

2006

|

2007

|

2008

|

Change:

Jan-Sep 2008

|

|

|

|

USD/mt

|

over

Jan-Sep 2007

|

|

|

|

|

|

%

|

|

Chips (shipments to China)

|

|

108.88

|

136.02

|

182.69

|

29.8

|

|

Starch (f.o.b. Bangkok)

|

|

221.46

|

303.13

|

374.03

|

44.0

|

|

Thai domestic root prices

|

|

89.54

|

45.68

|

58.09

|

49.1

|

* Source: Thai Tapioca Trade Association

PRODUCTION

|

|

Food and energy security endeavours could drive global production to an all-time high in 2008

Global cassava production in 2008 is forecast as 238.5million tonnes, 5percent above the record of the previous year.

Soaring prices of traded food staples, especially cereals, witnessed over much of the last 24months have led farmers in many vulnerable countries to turn to indigenous crops as an alternative source to more expensive cereals. Among these crops, cassava has been at the forefront. As a ‘crisis crop’ cassava roots can be left in the ground for well over a year and harvested when food shortages arise or when prices of preferred cereals become prohibitive. This attribute could give rise to a marked expansion in output in Africa, of about 5percent, or some 6million tonnes. Government support for the commercialization of cassava as a food crop also underpins the continent’s positive prospects. Such support often takes the form of diffusing high yielding and disease resistant planting material, improving the availability and provision of inputs, as well as measures to strengthen the cassava value chain, notably food processing.Production in Nigeria, the world largest producer, for instance, could reach 49million tonnes, up 7percent from 2007, while in Ghanait is expected to surpass 10million tonnes for the first time.

Cassava production is anticipated to record strong growth in Asia, much on account of Thailand, where, according to the annual planting survey, a 15percent rise in production is forecast in 2008 to a record 29.15million tonnes. Earlier in the year, Thai officials approved a plan to increase cassava yields by around 30percent over the next five years and to stabilize the country’s cassava area. International demand for Thai cassava products has traditionally been the main growth driver for the country’s crop, and hitherto had attracted strong government support for the sector through a price intervention scheme. Very attractive domestic root market prices in the planting season, however, have led to a suspension of the scheme this year. Prospects of high producer returns, which induced a shift away from sugar cane cultivation, combined with expected robust demand for the crop as a feedstock for ethanol in domestic and regional distilleries are principally behind record cassava plantings in the country. Since then, however, producer prices have slumped by a third, as demand at home and abroad for energy production and for feed have fallen well short of expectations, prompting fears of large cassava surpluses and calls for the resurrection of the government intervention scheme.

Among the region’s other major cassava producers, Viet Nam could register yet another bumper crop, as farmers are reported to have shifted land towards cultivation of the more remunerative cassava, mainly at the expense of cotton and sugarcane. In the Philippines, public-private sector efforts to develop a competitive domestic feed industry through the commercialization of cassava could pave the way for a record cassava output. An expansion of cassava cultivation at the expense of coffee could also lead to higher production in Indonesia in 2008. In all three countries, energy crop programmes that utilize cassava as a feedstock for ethanol production have constituted an important driver behind the expansion in production over the past two years. Biofuel initiatives have benefited from official support, such as the allocation of additional land for cassava and mandatory ethanol-gasoline blending requirements. They have also attracted foreign direct investment, mainly from mainland China. But China has also initiated large scale investments within its own borders to expand the cassava crop for ethanol production. Expectations now point to a record cassava output of some 4.5million tonnes this year. The moratorium on new grain-based ethanol plants, that is still in place, has led to roughly one half of China’s ethanol output being derived from root crops in the form of cassava and sweet potatoes. Smaller cassava producing countries in the region, such as the Lao Democratic People’s Republic, have also been recipients of capital inflows from China to expand cassava cultivation for energy feedstock production and from the Republic of Korea for starch production.

The 2008 production outlook for Latin America and the Caribbean points to a small contraction, reflecting an anticipated lower harvested area in Brazil, the region’s largest producer. In spite of a sustained increase in producer prices over the past two years, Brazil’s output is expected to fall short of the 30-year high reached in 2007. As for Paraguay and Colombia, the region’s other major cassava producing countries, little is known about the current situation, but both countries have experienced firm growth in cassava production in recent years.

|

|

2005

|

2006

|

2007

|

2008

|

|

|

Thousand tonnes

|

|

World

|

207 437

|

222 559

|

228 138

|

238 450

|

|

Africa

|

114 602

|

118 078

|

117 888

|

124 000

|

|

Nigeria

|

41 565

|

45 721

|

45750

|

49 000

|

|

Congo, Dem. Rep. of

|

14 974

|

14 989

|

15 000

|

15 300

|

|

Ghana

|

9 567

|

9 638

|

9 650

|

10 300

|

|

Angola

|

8 606

|

8 810

|

8 800

|

9 000

|

|

Mozambique

|

6 500

|

7 500

|

7 350

|

7 750

|

|

Tanzania, United Rep. of

|

7 000

|

6 500

|

6 600

|

7 000

|

|

Uganda

|

5 576

|

4 926

|

4 456

|

4 000

|

|

Latin America

|

|

|

|

|

|

Brazil

|

25 872

|

26 639

|

27 313

|

26 300

|

|

Paraguay

|

4 785

|

4 800

|

5 100

|

5 300

|

|

Colombia

|

2 050

|

2 000

|

2 100

|

2 200

|

|

Asia

|

55 917

|

67 190

|

70 745

|

76 650

|

|

Thailand

|

16 938

|

22 584

|

25 348

|

29 150

|

|

Indonesia

|

19 321

|

19 928

|

19 610

|

20 000

|

|

Viet Nam

|

6 646

|

7 714

|

8 900

|

10 000

|

|

India

|

5 855

|

7 620

|

7 600

|

7 700

|

|

China, Mainland

|

4 000

|

4 300

|

4 350

|

4 500

|

|

Cambodia

|

536

|

2 182

|

2 000

|

2 100

|

|

Philippines

|

1 678

|

1 757

|

1 829

|

2 000

|

* Forecast

Outlook for 2009

Prospects for 2009 appear mixed. On the one hand, rising commercialization through public and private support of the crop could provide an impetus for larger plantings, but on the other, falling international prices of cereals and energy will likely thwart any expansion in cassava cultivation. The current financial crisis also casts doubt on production prospects, since any meaningful expansion of cassava cultivation, particularly in relation to end use such as flour processing and ethanol production, will necessarily rely on access to credit markets which afford investors reasonable returns.

TRADE

|

|

Considerable contraction set for global cassava trade in 2008

Global trade in cassava products in the current year is likely to fall to an eight year low of 7.5 million tonnes (pellet equivalent). The forecast is based on a significant decline in the competitiveness of cassava feedstuffs and starch relative to grain based products, combined with lower international demand for cassava as a feedstock for ethanol production. This expectation is in line with a weaker pace of cassava shipments by Thailand to date, by far the world’s largest international supplier. Overall, the country is anticipated to ship just over 7 million tonnes (pellet equivalent) of cassava chips, pellets and starch in 2008, down almost a quarter in volume from the previous year.

Countries in Asia are once again expected to be the major destination of internationally traded cassava products in aggregate. The implementation of the free-trade zone between China and Thailand, which resulted in the abolishment of a 6 percent tariff levied on Thai cassava products, has provided a boost to cassava trade between the two countries in recent years, and in doing so, firmly established China as the world’s leading importer of cassava products. However, 2008 marks a shift in China’s status, especially in the context of chips and pellets imports. While Thailand is foreseen to export 40 percent less than what it did in 2007, China’s share in that market is expected to fall to 35 percent in 2008 from a high of 90 percent in 2006. Ample supplies of cheaper domestic grain based feedstuffs and home grown cassava for China’s ethanol industry are likely to depress cassava inflows into the country. A permanent retreat from the import market of the European Union, once the major destination of international cassava shipments (mainly for animal feed), appears to have come to an end. Thailand is preparing to ship as much as 1.4 million tonnes of pellets to the community, similar to the level last year but four times the volume delivered in 2006. The European Union has emerged as the main destination for pellets in the current year. However, the momentum in European Union purchases has slowed in the past few months, coinciding with the increased availability of feedstuffs among member states following the recent grain harvest.

As for cassava starch and flour, global trade is again expected to contract, but not to the same degree foreseen in the chips and pellets market. The fall in trade would similarly reflect the price advantage that grain based starch is forecast to maintain over cassava. Japan appears likely to overtake China as the principal starch buyer, with Indonesia, the Chinese Province of Taiwan and Malaysia all engaging in significant international purchases during the course of the year.

Regarding other international suppliers, Vietnam and Indonesia could export as much as 0.5 million tonnes of cassava, mainly in the form of chips for ethanol usage in China.

|

|

2005

|

2006

|

2007

|

2008

|

|

|

Thousand tonnes

|

|

Total

|

6 240

|

8 964

|

9 240

|

7 026

|

|

Flour and starch

|

|

|

|

|

|

Total

|

3 212

|

4 616

|

4 416

|

4 132

|

|

Japan

|

622

|

694

|

729

|

921

|

|

China

|

525

|

723

|

694

|

586

|

|

Chinese Prov of Taiwan

|

502

|

676

|

548

|

482

|

|

Indonesia

|

348

|

968

|

667

|

450

|

|

Malaysia

|

229

|

312

|

256

|

353

|

|

Others

|

986

|

1 244

|

1 523

|

1 341

|

|

Chips and pellets

|

|

|

|

|

|

Total

|

3 028

|

4 348

|

4 824

|

2 894

|

|

China

|

2 766

|

3 963

|

3 127

|

1 032

|

|

EU

|

246

|

341

|

1 436

|

1 392

|

|

Others

|

16

|

44

|

261

|

470

|

Source: TTTA, FAO

1 In product weight of chips and pellets

Outlook for 2009

Prospects for trade in 2009 are dominated by uncertainty. Much will depend on whether the cassava-grain relative price falls, thus stimulating greater international demand for cassava products, but all current indications point to a sustained recovery in international grain supplies, barring adverse weather and the absence of any spillover effects from the global financial crisis. Another factor concerns the degree of capacity utilization and expansion in cassava-based ethanol industries in Asia, especially China, which in turn will depend on the margin of ethanol returns, and the ethanol price relative to petroleum. Higher (lower) demand for cassava as an energy feedstock could trigger greater (smaller) regional trade flows. Finally, exceptionally high freight rates witnessed over much of the past 24 months have also had a detrimental effect on the relative competitiveness between cassava import prices and domestic grain product prices, and hence import demand in 2008. However, recent sharp falls in freight quotations if sustained, could pave the way for an expansion of trade next year.

UTILIZATION

|

|

Food and ethanol drive cassava utilization in 2008

Domestic cassava utilization growth is very much in line with changes in domestic production, given the fact very few countries are involved in sizeable trade and proper cassava stocks are held only in relatively modest quantities and in dried form.

Regarding food utilization, high and protracted prices of cereals and other traded staples throughout the year have led many vulnerable consumers in countries where cassava is grown, to turn to the root crop to sustain dietary needs. This is particularly evident in sub-Saharan Africa, where consumption of cassava is mostly in the form of fresh roots and processed products. However, strengthening demand for the indigenous crop has resulted in domestic prices of cassava to surge in recent months in many localities, especially in urban centres and areas remote from production. Nevertheless, the overall production gain in the region is expected to outpace growth in population, bringing about an increase in per caput food availability. Measures to promote cassava flour ahead of imported cereals, either through direct consumption or through blending, are gathering momentum across the world and constitute an important driver for higher cassava food consumption. For instance, Mozambique could follow Brazil and Nigeria, which already mandate the inclusion of 10 percent cassava flour in wheat flour. Several countries in the Caribbean have also promoted this initiative.

The demand for cassava by bioenergy sectors has also emerged as a significant driver in the expansion of cassava utilization. A typical production system can produce about 280 litres (222 kg) of 96 percent pure ethanol from a tonne of cassava with 30 percent starch content.

China is forecast to produce around 1 million tonnes of ethanol from cassava in 2008. The country is also looking towards agreements with several neighbouring countries to supply its ethanol industry with the feedstock. In Thailand, an ethanol plant with a capacity to produce up to 0.5 million litres of ethanol per day came on line in 2008. Indonesia is currently gearing up cassava based ethanol production in preparation for mandatory gasoline blends containing up to 5 percent ethanol beginning next year. Plant construction is reported to be underway in the Lao Democratic People’s Republic, Papua New Guinea, Fiji Islands and pilot research for ethanol production underway in Nigeria, Colombia and Uganda. However, high cassava prices have restrained the expansion of the crop’s use as an energy feedstock. This is especially true in Thailand, where industry sources report that for ethanol production to be commercially viable, root prices should not exceed Baht 1 500 (USD 44) per tonne. Throughout much of the year, market prices have hovered well above this ceiling. Furthermore, the expansion of a major ethanol plant in China was recently suspended owing to insufficient quantities of domestic cassava and unprofitable procurement of the feedstock from the regional marketplace, namely Thailand and Viet Nam.

Utilization of cassava as animal feed, in the form of dried chips and pellets, is mostly concentrated in Brazil and Colombia in Latin America and the Caribbean, Nigeria in Africa, China in Asia and the Netherlands and Spain in Europe. Little is known how feed usage has fared in the former two regions, but the demand for cassava feed ingredients in Asia has plummeted and remains flat in Europe.

|

November 2008

November 2008