December 2009 December 2009 | ||

|

Food Outlook | |

| Global Market Analysis | ||

|

SUGAR

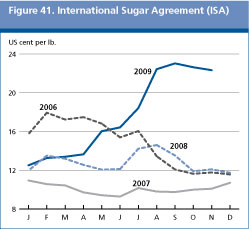

International Sugar Agreement daily prices have risen sharply since late last year, passing from an average of US 11.90 cents per pound in October 2008 to US 16.00 cents per pound in May 2009 and reaching a 28-year high of US 25.18 cents per pound5/ on 31 August 2009. Since then prices have started retreating and, in October, they averaged US 22.00 cents per pound. While a gradual increase in prices in 2009 was to be expected, given the tightening of the global market, the speed and magnitude of the run-up suggest an overreaction of the market to an expected surge of imports by India and to a poor outlook of crops in Brazil in 2009/10. As production prospects started to improve in October, notably for Brazil, international sugar price began to retreat from their highs.

Overall, despite production cuts in 2008/09 and expectations of world sugar production remaining short of global consumption in 2009/10 for the second consecutive year, the sugar market is relatively well supplied. Carry-over stocks in 2008/09 were estimated at 72 million tonnes, equivalent to 45 percent of estimated global utilization, while those in 2009/10 are forecast at 68 million tonnes, still providing a comfortable 42 percent coverage of expected world consumption in 2009/10. Indeed, world sugar utilization is gauged to have grown by 1.6 percent in 2008/09 to 161 million tonnes and is foreseen to expand by a modest 1.1 percent in 2009/10 to 163 million tonnes, below the long-term average trend. Looking ahead, world sugar prices are expected to remain firm but at a lower level than current highs. Table 13. World sugar market at a glance

* Jan-November 2009

Sugar markets are highly regulated by domestic and trade policies and are often subject to prohibitively high tariffs and limited tariff rate quotas that insulate them from international price developments. For example, in Japan and the United States, the sugar subsector is relatively unaffected by international price movements as domestic prices are much higher than world levels. This is also the case in the European Union, even though domestic sugar prices have been on a declining trend since 2006, when a major reform of the sugar market was implemented. In several developing countries, and especially the least developed countries, the predominance of informal trade, which is generally not integrated with international markets, reduces the transmission of high world prices on consumers and producers. However, sugar prices have also increased sharply in key importing countries in Asia and Africa. For example, domestic sugar prices have reportedly increased by 30 percent in China and India since February 2009. On the other hand, high international prices provide an opportunity to boost exports and generate foreign exchange earnings in Brazil, Thailand and a few net-exporting countries in eastern and southern Africa.

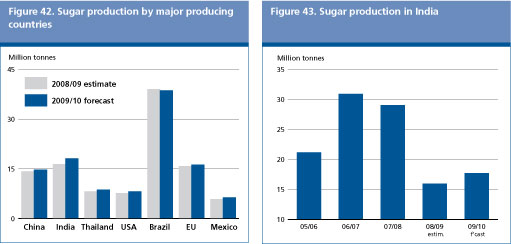

According to the latest FAO forecasts, after falling in 2008/09, world sugar production is expected to recover by 3.3 percent to 159.6 million tonnes in 2009/10. The growth in production is attributed to generally favourable weather conditions and higher prices, which should encourage the use of fertilizers and other inputs. The bulk of the expansion is expected to take place in the developing countries, where production is forecast to grow by 3.7 percent, as opposed to 1.8 percent in the developed countries. Despite a larger world production, this will not be enough to cover the expected global consumption in 2009/10, marking the second consecutive year of a shortfall. The deficit between production and consumption is predicted to hover around 3 million tonnes. In South America, production is forecast to change little, overall. Although the outlook in Brazil has deteriorated recently as a result of heavy rainfall during late summer, which damaged sugar-cane yields and delayed harvesting operations, output is now estimated to remain at last year's level of around 38 million tonnes. Given the relative competitiveness of sugar prices against ethanol returns, it is expected that a larger share of around 43 percent of sugar cane output will be allocated for the processing of sugar instead of ethanol, as opposed to 40 percent in 2008/09. Sugar production is expected to rise in Argentina, reflecting a return to favourable weather conditions and large investments in productive capacity. Increased output is expected in Peru, as large private investment entered the sector to cater for domestic consumption and exports. Sugar output in Colombia should also increase on the back of rising planted areas, as buoyant domestic sugar prices should also favour the transformation into sugar over sugarcane-based ethanol.

Table 14. World sugar production (million tonnes)

In Central America, the sector may undergo a vigorous recovery in 2009/10. Improvements in domestic sugar prices boosted sugar production in Mexico to 5.7 million tonnes, up 10 percent from a reduced output in 2008/09. Last year's decline in production was attributed to difficult growing conditions and delays in cane processing. Sugar supply in 2009/10 should be enough to cover expected domestic consumption and larger exports to the United States, which are being propelled under the North America free trade agreement. Despite less than ideal weather conditions, mainly excessive rainfall, sugar output is to expand in Guatemala. Planted area in the country should be responsive to competitively administered sugar-cane prices by the Guatemala's Sugar Board. Reflecting an anticipated expansion in sugar-cane plantings and more widespread use of inputs, sugar output in Cuba is officially forecast to increase to 1.5 million tonnes in 2009/10, which, if realized, would be 300 000 tonnes more than in 2008/09. This estimate might need to be revised downward in the course of the season to reflect possible losses incurred during the hurricane season. Notwithstanding drought conditions in several sugar producing countries, aggregate sugar production in Africa is set to reach 11.2 million tonnes in 2009/10, 400 000 tonnes or 3.5 percent above the previous year. The increase in output is largely due to area expansion and enhanced processing capacity. Strong domestic consumption growth and improved access to the European Union market under the Everything-But-Arms initiative (EBA) and the Economic Partnership Agreements (EPAs) are fostering large investment efforts in the continent. In South Africa, the largest sugar producer in the region, sugar production is forecast at 2.4 million tonnes in 2009/10, up 3.4 percent from 2008/09, on account of improved crop husbandry, which should sustain yields. Sugar production in Egypt, the second largest sugar producer in Africa, is expected to stay at last year's level (1.9 million tonnes) as many farmers are expected to shift to growing cereals, which offer better returns than sugar. However, sugar production may be boosted over the next three years by government support through large investments and increased sugar-cane prices to farmers. Production in Sudan is forecast to increase to 1.1 million tonnes, which is 21 percent more than 2008/09, given a significant expansion in processing capacity. There are plans to expand production to 10 million tonnes by 2015, with foreign direct investments from Gulf States and joint partnership initiatives with Egypt. Expected gains are also foreseen in Kenya, where production is set to grow by about 4 percent due to near normal rainfall in the western part of the country, where most of the sugar-cane farming takes place. These increases are set to offset declining production in the costal provinces where insufficient rainfall has impeded crop growth. In Mozambique, sugar output is expected to reach 400 000 tonnes, up 24 percent from last season, as planted area is foreseen to expand by 37 percent in 2009/10. The incremental output will be processed by new processing infrastructure undertaken by the four sugar mills in the country. Below-average rainfall and limited input utilization, due to high fertilizer costs, are set to constrain production growth in the United Republic of Tanzania below initial forecasts. The sugar subsector in that country is undergoing structural changes in response to improved market access to the European Union.

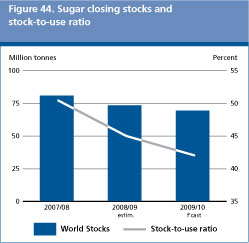

The 2009/10 outlook for sugar production in Asia has improved from last year's season, when significant cuts in India and Pakistan reduced aggregate output in the region by 22 percent from the levels attained in 2007/08. The reduction was attributed to irregular rainfall and a shift of land allocation in favour of grains and oilseeds. Sugar output in India is now expected to reach 17.5 million tonnes, 11 percent more than last year, but below initial forecasts, as prospects were marred by poor monsoon rains during the critical months of June and July. Despite a drop in planted area in the major sugar-cane producing region of Utar Pradesh, production may benefit from the higher statutory minimum price (SMP) paid to growers, which is expected to result in a greater allocation of cane into centrifugal sugar production, at the expense of local non-centrifugal sweeteners namely gur and khandsary. Still, production is anticipated to fall short of expected consumption for the second consecutive year. In Thailand, early official estimates of production in 2009/10 point to 6 percent growth, driven by favourable weather conditions and higher usage of fertilizers. Given current attractive prices, production may increase further in the following season due to larger area under sugar cane. Moderate gains are expected in China, mainly as a result of higher yields that have offset declines in planted areas for both beet and cane sugar, as well as in Indonesia and Turkey. However, production in Pakistan is set to decrease on the back of a decline in area planted and more remunerative prices for short duration crops. In Europe, sugar output in the European Union is expected to expand to 15.6 million tonnes, still well short of the 17.4 million tonnes produced in 2007/08. Favourable weather conditions are likely to result in output surpassing the established quota of 14.5 million tonnes. Similar to last year, the out-of-quota quantities will be absorbed by the chemical and ethanol industries. Sugar output is also expected to increase in Ukraine because of higher sugar content, even though farmers cut area sown to beet and planting instead more grains and sunflower seeds. Production is set to decline in the Russian Federation by 4 percent, as a result of a sharp drop in the area under beet and below average yields. The Government is reportedly planning to provide USD 500 million in subsidies to boost sugar production by 42 percent over the next three years. In the rest of the world , sugar production in the United States is forecast above the 2008/09 level, on account of increased area and use of Genetically Modified Organisms (GMO) seeds. In Australia flooding in Queensland, the main producing region, has impaired cane yields and sugar content, wiping early prospects for a larger sugar output. Production in 2009/10 is now expected to remain around the same level as in 2008/09.

World sugar consumption in 2009/10 is forecast to rise to 162.6 million tonnes, 1.1 percent more than in 2008/09, but 1.4 percentage points below the ten-year trend as relatively high sugar prices are expected to contain consumption growth. Sugar intake in the developing countries is set to expand only moderately to 113 million tonnes, accounting for 69 percent of global consumption. Policy measures to dampen the effect of current high prices, such as temporarily removal of tax or import duties, limits on stock holdings and retail price control, have helped sustain sugar intake in several net-importing developing countries. On average, per caput sugar availability in 2009/10 is estimated to remain around 23 kg per year, the same level as in the previous season. A return of positive economic growth in 2010 together with an easing of international sugar prices should lend some support to industrial sugar usage by the manufacturing and food preparation sectors, including the beverages industries, which is especially sensitive to variations in income.

World sugar imports are forecast to reach 52 million tonnes in 2009/10 (October/September), 5 percent more than in the previous season, driven largely by the need to replenish stocks or/and offset production shortfalls. India will be the major engine for growth in world sugar imports in 2009/10. However, forecasts at this early stage of the season are subject to much uncertainty. For instance, an unexpected easing of world sugar prices or a further depreciation of the United States Dollar against other major currencies could lead to a stronger import demand. Shipments to the European Union are also set to increase, to meet growing domestic utilization. Official imports are estimated to reach 4.5 million tonnes, 12.5 percent, more than last year. Some of these imports will be sourced from the EBA countries, which, as of October 2009, have been granted unlimited and duty-free access to the European Union market. Elsewhere in Europe, imports by the Russian Federation, the third largest sugar importer in 2008/09, are expected to increase by 500 000 tonnes to 3.3 million tonnes, to compensate for lower production. Imports by the country in 2008/09 have been less than in the previous year, owing to an exceptionally high seasonal import duty of USD 165 per tonne, which the Government is now reportedly considering to reduce, in view of the high prices prevailing in world markets. In Asia, purchases by Indonesia and Malaysia, are foreseen to decrease, mainly on account of either higher international sugar prices or better production. Preliminary forecasts indicate that China may purchase about 200 000 tonnes less than last season, as production in the country continues to expand. In the rest of the world, deliveries to the United States are forecast at 2.5 million tonnes, a 9 percent decline over the previous year. Additional imports may be required in the course of the season to rebuild reserves, as the United States' current stock level is relatively low. Similarly, imports by countries in Africa are foreseen to decline by around 2.3 percent to 9 million tonnes, much lower than previously envisaged, as larger availability of locally produced sugar could deter imports. Much of the anticipated rise in global exports in 2009/10 would be on account of Brazil, the world's largest exporter, which is expected to ship 25 million tonnes, up 5 percent from 2008/09, despite lower than expected production. Comfortable stock levels are indeed expected to enable the country to meet the increase in import demand. Brazil will account for nearly half of the global export this season and should be among those to benefit most from the higher prices. Owing to better production prospects and strong import demand by India, sales from Thailand, the world's second largest sugar exporter, are also expected to increase by 3.5 percent to 5.2 millions tonnes. Deliveries from Australia, Cuba, Guatemala and South Africa are foreseen to increase as well, on the back of attractive world prices. A key feature of this year's export market is the fall of exports from India by 81 percent to about 35 000 tonnes. The last year the country exported less than 50 000 tonnes of sugar was 1999. 5. USD 551 per tonne 6. Sugar production figures refer to centrifugal sugar derived from sugar cane or beet, expressed in raw equivalents. Data relate to the October/September season. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GIEWS | global information and early warning system on food and agriculture |